Analyzing Bitcoin's Rebound: Potential For Future Growth

Table of Contents

Factors Contributing to Bitcoin's Rebound

Several key factors have converged to fuel Bitcoin's recent rebound. Understanding these elements is crucial to forecasting its future trajectory.

Institutional Investment: A Growing Force in the Bitcoin Market

Institutional investors are increasingly embracing Bitcoin, signifying a major shift in market maturity and stability. This influx of capital significantly impacts price stability and reduces volatility.

- MicroStrategy's massive Bitcoin holdings have demonstrated a long-term commitment to the cryptocurrency.

- Tesla's initial investment, though later partially liquidated, highlighted the potential for large corporations to hold Bitcoin as a reserve asset.

- The growing interest from hedge funds and other institutional investors signifies a move towards Bitcoin's acceptance as a legitimate asset class. This increased institutional adoption is fostering greater price stability and reducing the susceptibility to rapid, unpredictable swings. Bitcoin investment strategies are becoming increasingly sophisticated, reflecting this growing institutional interest.

Regulatory Clarity (or Lack Thereof): Navigating the Regulatory Landscape

Regulatory developments, or the lack thereof, significantly influence investor sentiment and market stability. While complete clarity remains elusive in many jurisdictions, some developments have had a positive impact.

- Positive regulatory news, such as the clarification of certain regulatory frameworks in specific countries, can boost investor confidence.

- Negative regulatory news, such as stricter regulations or outright bans, can cause significant price drops and create uncertainty.

- The ongoing debate surrounding Bitcoin regulation globally underscores the need for clear, consistent, and internationally harmonized policies to foster long-term growth and stability in the cryptocurrency market. The ongoing uncertainty surrounding Bitcoin regulation continues to be a key factor in shaping investor sentiment.

Technological Advancements: Enhancing Bitcoin's Capabilities

Technological advancements within the Bitcoin network itself continue to enhance its capabilities and appeal. These upgrades address scalability issues and improve the overall user experience.

- The Lightning Network provides faster and cheaper transaction capabilities, overcoming one of Bitcoin's historical limitations.

- The Taproot upgrade improved privacy and efficiency, making transactions more secure and cost-effective.

- Advances in mining efficiency reduce the environmental impact and increase the overall sustainability of Bitcoin's operation. These Bitcoin technology improvements contribute to increased adoption and long-term viability.

Macroeconomic Factors: The Global Context of Bitcoin's Price

Global economic conditions play a significant role in Bitcoin's price movements. It's often seen as a hedge against inflation and economic uncertainty.

- High inflationary pressures often drive investors towards Bitcoin as a store of value.

- Changes in interest rates can influence the attractiveness of Bitcoin relative to other investment options.

- Geopolitical events and economic instability can also lead to increased demand for Bitcoin as a safe haven asset. Understanding these macroeconomic indicators is crucial for analyzing Bitcoin's price correlation with broader economic trends. Bitcoin's role as a hedge against inflation is frequently cited as a key driver of its price.

Assessing the Potential for Future Growth

While Bitcoin's rebound is encouraging, several factors must be considered when assessing its future potential.

Market Sentiment and Predictions: Gauging the Future

Market sentiment towards Bitcoin is currently mixed, with predictions varying widely. Analyzing market trends and expert opinions provides a valuable perspective.

- Market analysis from reputable firms provides insights into current trends and potential future scenarios.

- Expert predictions offer varying forecasts, reflecting the inherent uncertainty in the cryptocurrency market. These Bitcoin price predictions offer a spectrum of possibilities. Careful review of the methodology behind these predictions is vital for making informed decisions.

Challenges and Risks: Navigating the Potential Headwinds

Several challenges and risks could hinder Bitcoin's growth. Understanding these is critical for informed investment decisions.

- Regulatory crackdowns in various jurisdictions pose a significant threat to Bitcoin's price.

- Competition from altcoins presents a constant challenge, as new cryptocurrencies with innovative features emerge.

- Environmental concerns related to Bitcoin mining remain a persistent issue that needs addressing.

- Market volatility continues to be a defining characteristic of Bitcoin, presenting risks to investors. Managing Bitcoin volatility is a key skill for investors.

Long-Term Growth Potential: A Balanced Perspective

Despite the challenges, Bitcoin's long-term growth potential remains significant based on several factors.

- The increasing adoption rate suggests a growing acceptance of Bitcoin as a viable asset and payment method.

- Ongoing technological advancements will continue to improve Bitcoin's functionality and efficiency.

- The increasing market maturity and institutional involvement point towards a more stable and sustainable future for Bitcoin. This signifies a shift towards a more established and less volatile asset. A long-term Bitcoin investment strategy should consider these factors.

Analyzing Bitcoin's Rebound: A Look Ahead

Bitcoin's recent rebound is a result of several converging factors, including increased institutional investment, technological improvements, and macroeconomic conditions. While challenges remain, the potential for continued growth is significant, driven by increasing adoption, technological advancements, and potential long-term value. Understanding Bitcoin's rebound is crucial for navigating the evolving cryptocurrency market. Continue your research into Bitcoin's potential and make informed decisions about your investment strategy. Further analysis of Bitcoin's rebound and its implications for the future of cryptocurrency is essential.

Featured Posts

-

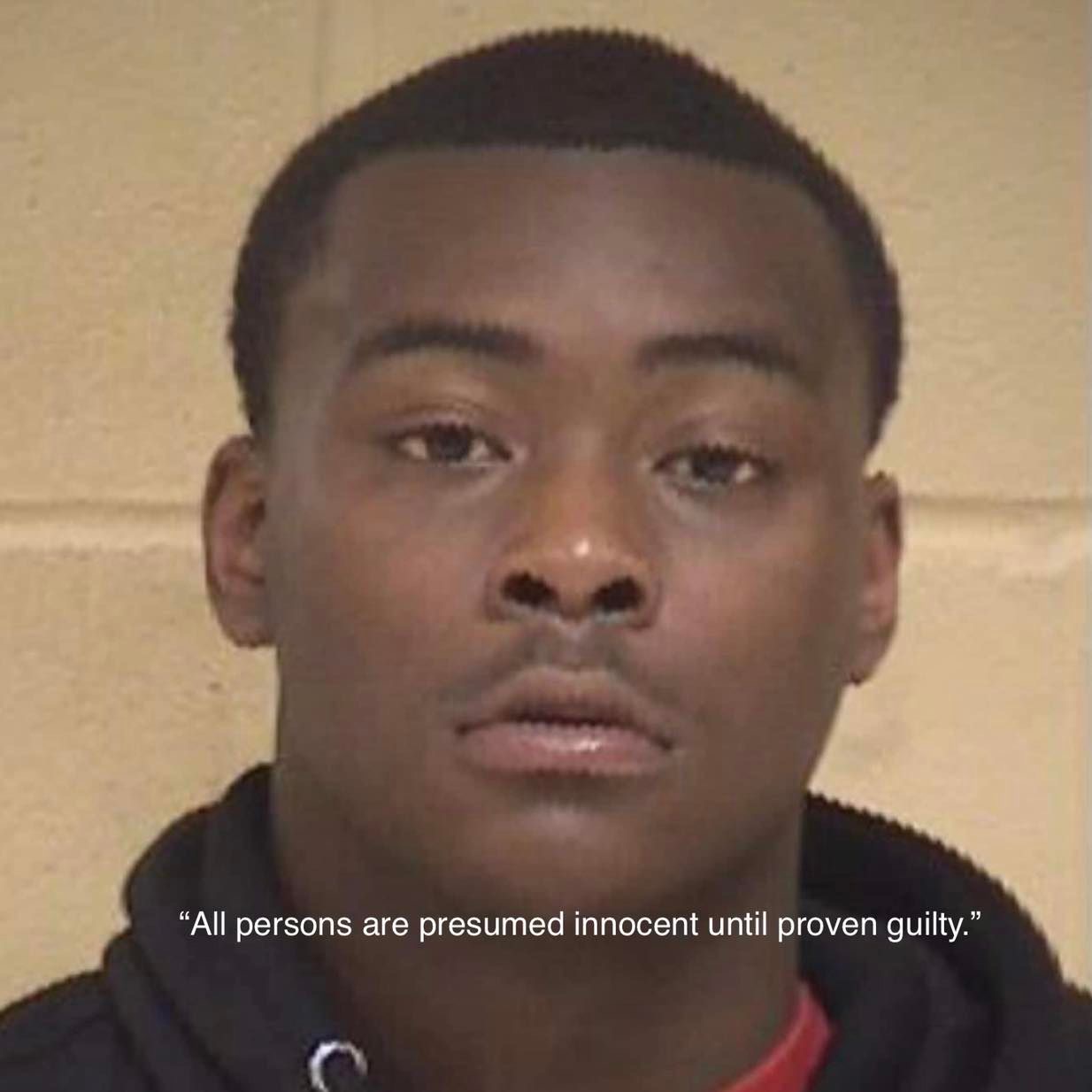

Shreveport Police Make Arrests In Multi Vehicle Theft Case

May 08, 2025

Shreveport Police Make Arrests In Multi Vehicle Theft Case

May 08, 2025 -

Choosing Between Ps 5 And Xbox Series S A Comprehensive Guide

May 08, 2025

Choosing Between Ps 5 And Xbox Series S A Comprehensive Guide

May 08, 2025 -

Champions League Inter Milans Surprise Win Against Bayern

May 08, 2025

Champions League Inter Milans Surprise Win Against Bayern

May 08, 2025 -

Nereden Izlenir Psg Nice Macini Canli Yayinla Takip Edin

May 08, 2025

Nereden Izlenir Psg Nice Macini Canli Yayinla Takip Edin

May 08, 2025 -

Arsenal Psg Macin Hangi Kanalda Ve Saat Kacta Baslayacagini Oegrenin

May 08, 2025

Arsenal Psg Macin Hangi Kanalda Ve Saat Kacta Baslayacagini Oegrenin

May 08, 2025

Latest Posts

-

Kripto Para Yatirimlarinda Duesues Riskler Ve Oenlemler

May 08, 2025

Kripto Para Yatirimlarinda Duesues Riskler Ve Oenlemler

May 08, 2025 -

Yatirimcilarin Kripto Paralardan Cekilmesinin Nedenleri Ve Sonuclari

May 08, 2025

Yatirimcilarin Kripto Paralardan Cekilmesinin Nedenleri Ve Sonuclari

May 08, 2025 -

Kripto Piyasasi Coekuesue Ve Yatirimci Satislari Detayli Analiz

May 08, 2025

Kripto Piyasasi Coekuesue Ve Yatirimci Satislari Detayli Analiz

May 08, 2025 -

The Night Counting Crows Changed Their Snl Performance And Rise To Stardom

May 08, 2025

The Night Counting Crows Changed Their Snl Performance And Rise To Stardom

May 08, 2025 -

Sermaye Piyasasi Kurulu Nun Spk Kripto Varlik Platformlarina Yoenelik Yeni Duezenlemeleri

May 08, 2025

Sermaye Piyasasi Kurulu Nun Spk Kripto Varlik Platformlarina Yoenelik Yeni Duezenlemeleri

May 08, 2025