Analyzing CoreWeave Stock: Trends And Predictions

Table of Contents

CoreWeave's Business Model and Competitive Advantage

CoreWeave's core strength lies in its specialization in GPU cloud computing. This focus allows them to cater specifically to the needs of industries heavily reliant on high-performance computing, including artificial intelligence (AI), machine learning (ML), and high-performance computing (HPC) applications.

GPU-focused Cloud Computing

CoreWeave's business model centers around providing scalable, high-performance GPU resources via the cloud. This contrasts with general-purpose cloud providers like AWS, Google Cloud, and Azure, which offer a broader range of services but may not specialize in the same level of GPU optimization.

- High-Performance GPUs: CoreWeave utilizes cutting-edge GPUs, offering clients unparalleled processing power for demanding workloads. This is a significant advantage in the race for AI and ML development.

- Cost-Effectiveness: By specializing in GPU resources, CoreWeave can often offer competitive pricing compared to the broader services of larger cloud providers, making it an attractive option for budget-conscious businesses.

- Scalability: CoreWeave's infrastructure is designed for scalability, allowing clients to easily adjust their computing resources to meet fluctuating demands. This adaptability is crucial for AI and ML projects that can require significant bursts of processing power.

- Strategic Partnerships: CoreWeave's strategic partnerships with hardware vendors and software developers further enhance its offerings and competitive position within the GPU cloud computing market. These partnerships ensure access to the latest technologies and streamlined integration for clients.

Recent Financial Performance and Key Metrics

While CoreWeave is a privately held company, analyzing publicly available information – including news releases, investor presentations, and industry reports – provides insight into its financial performance.

Revenue Growth and Profitability

Although precise financial statements are not publicly available, industry reports suggest strong revenue growth driven by increasing adoption of GPU cloud computing. This is particularly fueled by the expansion of the AI and ML sectors. Key performance indicators (KPIs) such as customer acquisition rates and average revenue per user (ARPU) will be crucial factors in assessing future growth potential.

- Revenue Streams: CoreWeave's revenue is likely derived from subscription-based access to its GPU cloud resources and potential add-on services.

- Profitability Margins: Given the significant investment in high-end hardware, optimizing profitability margins will be a key focus for CoreWeave's long-term success.

- Investments and Acquisitions: Any future investments in infrastructure or acquisitions of complementary technologies would significantly impact CoreWeave's financial performance and future growth trajectory.

Market Trends and Industry Outlook

The future of CoreWeave stock is intrinsically linked to the growth of the broader GPU cloud computing market.

Growth of AI and Machine Learning

The explosive growth of AI and ML is a major driver of demand for GPU-powered cloud computing. AI models require immense computational resources for training and inference, making CoreWeave's specialized services increasingly crucial.

Competition and Market Share

While CoreWeave faces competition from established cloud giants, its niche focus on high-performance computing offers a significant competitive advantage. Analyzing its ability to capture market share within this specialized segment is critical to assessing its future success.

- Market Size and Growth Projections: The market for GPU cloud computing is projected to experience substantial growth in the coming years, presenting significant opportunities for CoreWeave.

- Key Competitors: Analyzing the strengths and weaknesses of competitors like AWS, Google Cloud, and Azure in the GPU cloud computing space is essential to understanding CoreWeave's position.

- Market Disruptions: Potential regulatory changes or technological disruptions could impact CoreWeave's growth trajectory. Maintaining agility and adaptability will be crucial.

CoreWeave Stock Price Prediction and Valuation

Predicting the future price of any stock is inherently speculative. However, by combining fundamental and (optionally) technical analysis, we can formulate a reasoned outlook on CoreWeave stock price.

Fundamental Analysis

Based on the preceding analysis of CoreWeave's business model, financial performance, and market position, its future stock performance is expected to be significantly influenced by factors such as:

- Revenue growth: Continued strong revenue growth, fueled by the expansion of the AI and ML markets, is a key driver of positive stock performance.

- Market share gains: Successfully capturing market share within the specialized GPU cloud computing segment will be crucial.

- Strategic partnerships: Strategic alliances with technology leaders will strengthen its competitive position.

- Economic conditions: Macroeconomic factors, such as a potential recession, could negatively impact investor sentiment and stock prices.

Potential Price Targets (Disclaimer: These are speculative and should not be considered financial advice.)

Given the uncertainties involved, providing specific price targets for CoreWeave stock would be irresponsible. However, a positive outlook is warranted based on the potential of the company and the industry.

Conclusion

Analyzing CoreWeave stock reveals a company well-positioned within a rapidly expanding market. Its focus on GPU-powered cloud computing, coupled with the burgeoning demand for AI and ML, presents significant growth potential. While inherent risks exist in any stock market investment, the fundamental aspects of CoreWeave's business model suggest a promising outlook. However, it's crucial to remember that investing in CoreWeave stock, or any stock, involves risk. Conduct thorough research and consider your own risk tolerance before making any investment decisions. Consider exploring further resources on CoreWeave stock analysis and the CoreWeave stock outlook to make informed choices regarding investing in CoreWeave stock. This information is for educational purposes only and does not constitute financial advice.

Featured Posts

-

Naslidki Vidmovi Ukrayini Vid Chlenstva U Nato Otsinka Ekspertiv

May 22, 2025

Naslidki Vidmovi Ukrayini Vid Chlenstva U Nato Otsinka Ekspertiv

May 22, 2025 -

El Regreso De Javier Baez Salud Y Rendimiento En La Mira

May 22, 2025

El Regreso De Javier Baez Salud Y Rendimiento En La Mira

May 22, 2025 -

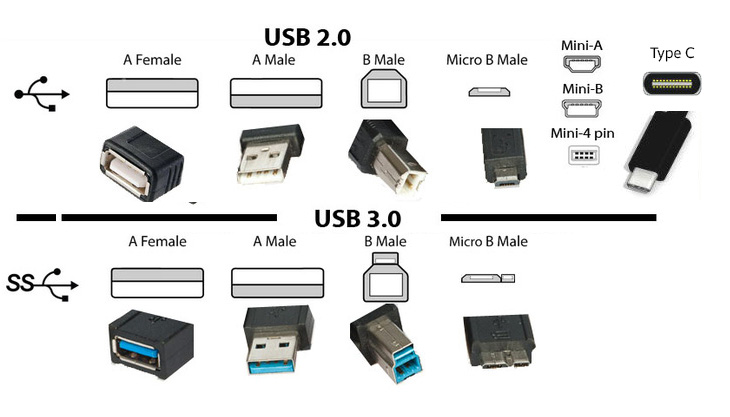

Hai Lo Vuong Tren Dau Noi Usb Chuc Nang Va Giai Dap Thac Mac

May 22, 2025

Hai Lo Vuong Tren Dau Noi Usb Chuc Nang Va Giai Dap Thac Mac

May 22, 2025 -

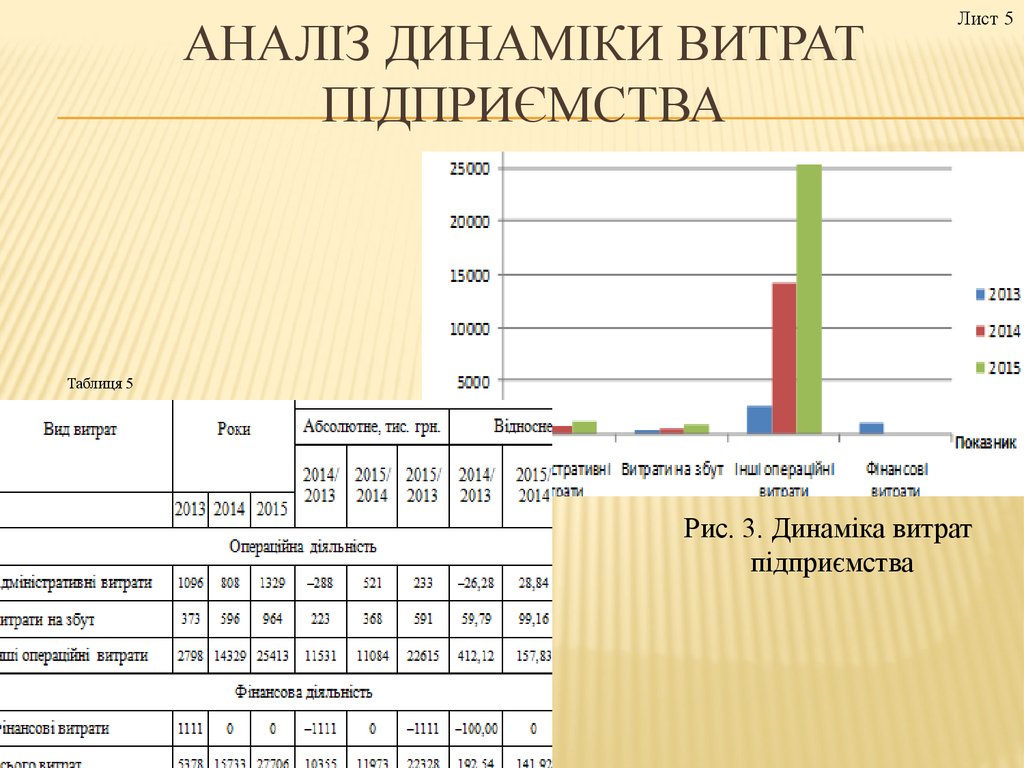

Naybilshi Finansovi Kompaniyi Ukrayini Analiz Dokhodiv Za 2024 Rik

May 22, 2025

Naybilshi Finansovi Kompaniyi Ukrayini Analiz Dokhodiv Za 2024 Rik

May 22, 2025 -

Itineraires Cyclistes En Loire Atlantique Nantes Le Vignoble Et L Estuaire

May 22, 2025

Itineraires Cyclistes En Loire Atlantique Nantes Le Vignoble Et L Estuaire

May 22, 2025