Analyzing D-Wave Quantum Inc. (QBTS) As A Quantum Computing Investment

Table of Contents

Understanding D-Wave Quantum's Business Model and Technology

D-Wave's unique approach to quantum computing focuses on quantum annealing, a method particularly well-suited for solving complex optimization problems. Unlike gate-based quantum computers aiming for universal computation, D-Wave's systems excel at finding the lowest energy state of a problem, providing solutions for various applications. This specialized approach allows D-Wave to offer commercially available quantum computers today, focusing on a defined niche market.

D-Wave's primary target market includes industries grappling with optimization challenges:

- Logistics: Optimizing supply chains, delivery routes, and resource allocation.

- Finance: Developing advanced risk management models, optimizing investment portfolios, and fraud detection.

- Materials Science: Discovering new materials with desired properties through simulating molecular interactions.

- Artificial Intelligence: Accelerating machine learning algorithms and improving optimization of AI models.

D-Wave generates revenue through several streams:

- Hardware sales: Direct sales of their quantum computers to research institutions and corporations.

- Software licenses: Providing specialized software tools to facilitate the use of their quantum computers.

- Cloud access: Offering cloud-based access to their quantum computing power through Leap™, their cloud service.

Key clients and collaborations include significant players in various industries, further solidifying D-Wave's position in the market. This is a crucial aspect for evaluating a quantum computing stock like QBTS.

Analyzing QBTS Stock Performance and Valuation

Analyzing QBTS stock requires careful consideration of its historical performance and current valuation. While the quantum computing sector is still nascent, reviewing QBTS's stock price trends and volatility provides insights into market sentiment. It's important to look beyond just the raw stock price and consider key financial metrics:

- Stock price trends and volatility: Tracking QBTS's stock price over time reveals its performance against overall market trends and sector-specific movements in quantum computing stocks.

- Revenue growth and profitability: Assessing the company's revenue growth, profitability, and operating margins is crucial for evaluating its financial health and potential for future growth.

- Price-to-sales ratio (P/S) compared to competitors: Comparing QBTS's P/S ratio to other companies in the quantum computing sector offers a relative valuation metric. This requires examining similar companies with comparable stages of development and revenue generation.

- Debt levels: Evaluating QBTS's debt-to-equity ratio helps assess its financial risk and its ability to finance future operations and growth.

Potential catalysts for future stock growth include successful product launches, securing substantial contracts, and positive advancements in quantum annealing technology. Understanding these factors is vital for making informed investment decisions in QBTS.

Assessing the Risks and Rewards of Investing in QBTS

Investing in QBTS, like any investment in the quantum computing sector, carries inherent risks and rewards. Understanding these factors is critical for building a well-diversified portfolio.

Key Risks:

- Technological challenges: Quantum computing technology is still in its early stages of development. Unforeseen technological hurdles could impact D-Wave's progress and the viability of its technology.

- Competition: The quantum computing landscape is rapidly evolving with significant competition from companies like IBM, Google, and IonQ, each pursuing different approaches. This competitive pressure could impact D-Wave's market share and profitability.

- Market uncertainty: The overall market for quantum computers is still developing. Demand may not meet expectations, influencing the long-term viability of QBTS as a quantum computing stock.

Potential Rewards:

- High growth potential: The quantum computing market is projected to grow exponentially. If D-Wave maintains its technological lead and effectively addresses market demands, QBTS's growth potential is considerable.

- First-mover advantage: As one of the first companies to offer commercially available quantum computers, D-Wave holds a potential first-mover advantage, allowing it to establish a strong customer base and brand recognition.

Diversification is crucial. Quantum computing investments should be part of a broader, diversified portfolio to mitigate risks associated with this emerging technology.

Comparing D-Wave to Competitors in the Quantum Computing Landscape

D-Wave's quantum annealing approach contrasts with other leading companies focused on gate-based quantum computing. While gate-based systems aim for universal quantum computation, D-Wave's specialized focus on optimization problems allows for a different kind of market penetration.

- Gate-based vs. Annealing: IBM, Google, and IonQ are primarily developing gate-based quantum computers, which offer a wider range of computational capabilities but are still in earlier stages of development. D-Wave's annealing approach, while more specialized, is more mature and commercially available.

- Market share analysis: Analyzing the market share of each major player helps understand D-Wave's competitive positioning and potential for future market dominance.

- Strengths and weaknesses: Each competitor possesses unique strengths and weaknesses concerning technology, scalability, and market reach. Comparing these factors allows for a more comprehensive evaluation of D-Wave's competitive position.

Conclusion: Making Informed Investment Decisions about D-Wave Quantum (QBTS)

Investing in D-Wave Quantum (QBTS) presents a high-risk, high-reward opportunity in the burgeoning quantum computing market. D-Wave's unique quantum annealing technology targets specific applications, allowing for earlier commercialization. However, competition, technological challenges, and market uncertainty pose significant risks. Our analysis highlights the need for thorough due diligence before investing in QBTS. Evaluate D-Wave's financial performance, competitive landscape, and technological advancements carefully. Remember to diversify your investments and consider QBTS as part of a well-diversified portfolio within the quantum computing sector. Invest wisely in the future of quantum computing with QBTS, but do your research! Learn more about D-Wave Quantum and its potential for growth before making any investment decisions.

Featured Posts

-

Athlete Eyes Trans Australia Run World Record

May 21, 2025

Athlete Eyes Trans Australia Run World Record

May 21, 2025 -

Decouvrez Hell City La Brasserie Proche Du Hellfest

May 21, 2025

Decouvrez Hell City La Brasserie Proche Du Hellfest

May 21, 2025 -

Fremantle Q1 Financial Results 5 6 Revenue Drop Attributed To Budget Cuts

May 21, 2025

Fremantle Q1 Financial Results 5 6 Revenue Drop Attributed To Budget Cuts

May 21, 2025 -

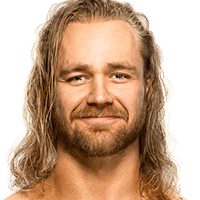

Tyler Bate Returns To Wwe A Look At His Potential Storylines

May 21, 2025

Tyler Bate Returns To Wwe A Look At His Potential Storylines

May 21, 2025 -

Liverpool Fc News Jeremie Frimpong Transfer Update Agreement But No Contact

May 21, 2025

Liverpool Fc News Jeremie Frimpong Transfer Update Agreement But No Contact

May 21, 2025