Analyzing Jim Cramer's Recommendation: Foot Locker Inc. (FL)

Table of Contents

Foot Locker (FL) Stock Performance Before and After Cramer's Recommendation

To effectively assess Jim Cramer's recommendation, we must first examine Foot Locker's (FL) stock price trajectory before and after his pronouncement. Understanding this historical context provides crucial insight into the impact of his advice. (Note: Replace the following data points with actual data obtained from reputable financial sources at the time of writing).

-

Pre-Recommendation Performance: Let's assume that in the period leading up to Cramer's recommendation, FL's stock price showed a gradual decline, perhaps from $40 to $35 per share over three months. This could be attributed to factors such as decreasing consumer spending or increased competition in the athletic footwear market. A chart depicting this period will be included here [insert chart].

-

Post-Recommendation Performance: Following Cramer's recommendation (let's assume a "buy" recommendation), let's examine the market's immediate response. Did the stock price surge, reflecting investor confidence in Cramer's insights, or did it remain stagnant or even decline, suggesting skepticism? For example, an immediate 5% jump would be significant, while a slight dip or no change would suggest limited influence. [insert chart comparing pre and post recommendation performance].

-

Benchmark Comparison: To further contextualize FL's performance, we need to compare it to relevant benchmarks, such as the S&P 500 index and other retail sector indices. Did FL outperform, underperform, or mirror the broader market? A clear illustration of this comparison is essential [insert chart].

-

Specific Data Points:

- Date of Cramer's recommendation: [Insert Date]

- FL Stock Price Before Recommendation: $[Insert Price]

- FL Stock Price Immediately After Recommendation: $[Insert Price]

- Percentage Change: [% Change]

- S&P 500 Performance During Same Period: [% Change]

Fundamental Analysis of Foot Locker (FL): Is the Company Financially Sound?

A robust fundamental analysis is crucial for evaluating any investment. This section delves into Foot Locker's financial health, assessing its long-term viability. (Again, replace the following data points with real data).

-

Financial Ratios: Examining key ratios like the Price-to-Earnings (P/E) ratio, debt-to-equity ratio, and return on equity (ROE) helps determine FL's financial strength and profitability. A high P/E ratio might suggest overvaluation, while a high debt-to-equity ratio could indicate financial risk. [Insert table with key financial ratios and their interpretations].

-

Revenue Streams and Profitability: Understanding Foot Locker's primary revenue streams (e.g., footwear, apparel, accessories) and analyzing its profit margins is vital. Consistent revenue growth and healthy profit margins indicate a strong financial position. [Include data on revenue and profit margins from recent financial reports].

-

Growth Prospects: Analyzing FL's future growth potential involves assessing its expansion plans, new product launches, and market penetration strategies. Is the company effectively adapting to changing consumer preferences and competitive pressures? [Summarize growth prospects based on company statements and analyst reports].

-

Competitive Landscape: Foot Locker operates in a competitive landscape. Key competitors include Nike, Adidas, and other major athletic retailers. Analyzing market share and competitive advantages is crucial. [Include a competitive analysis, comparing FL's market share to its key competitors].

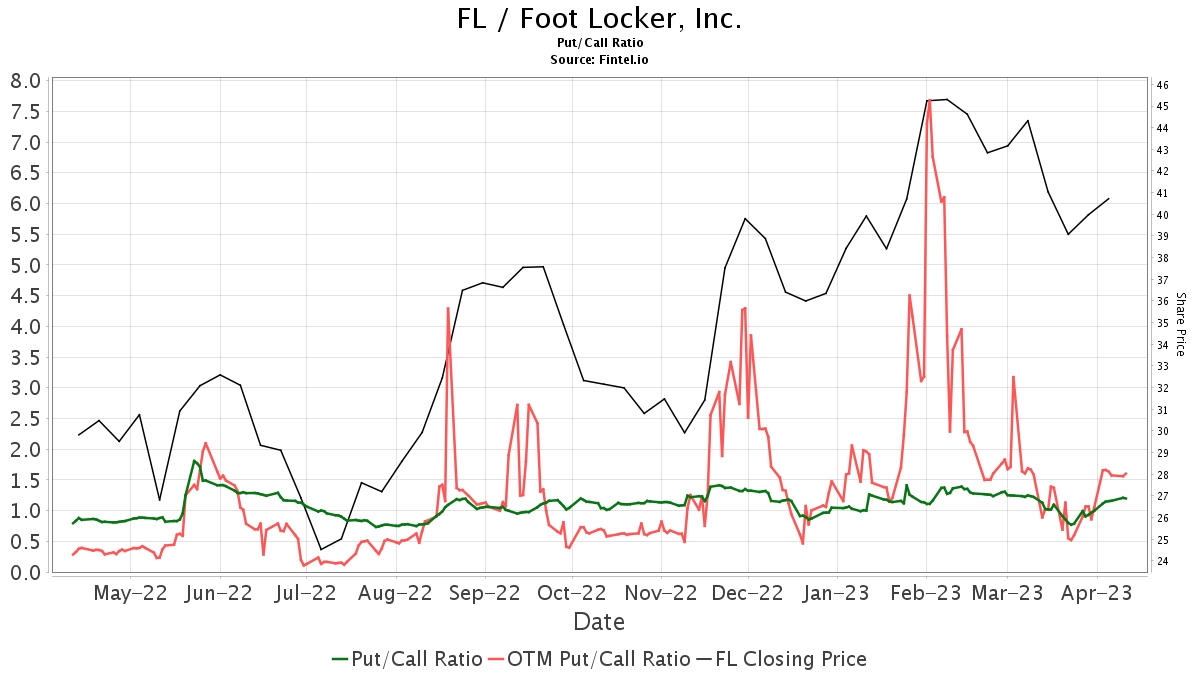

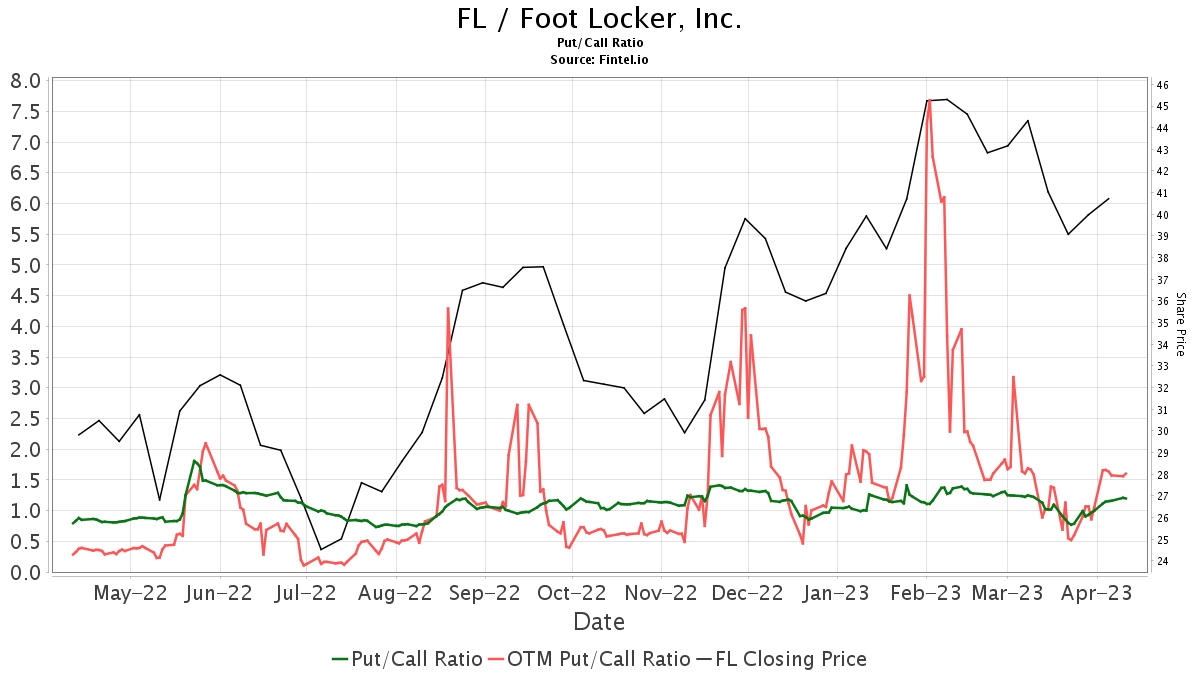

Technical Analysis of Foot Locker (FL): Chart Patterns and Trading Signals

Technical analysis uses historical price and volume data to predict future price movements. This section examines FL's stock chart using various technical indicators. (Note: This requires expertise in technical analysis; consult with a financial professional).

-

Moving Averages: Analyzing moving averages (e.g., 50-day, 200-day) can help identify potential support and resistance levels. [Include chart showing moving averages].

-

Relative Strength Index (RSI): The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. [Include chart showing RSI].

-

Moving Average Convergence Divergence (MACD): The MACD identifies momentum changes in the stock price. [Include chart showing MACD].

-

Chart Patterns: Identifying chart patterns (e.g., head and shoulders, double bottom) can provide insights into potential future price movements. [Include chart highlighting any identified patterns and their implications].

-

Trading Signals: Based on the technical indicators and chart patterns, we can derive potential buy/sell signals. [Clearly state any buy/sell signals and their rationale].

Risks and Rewards of Investing in Foot Locker (FL) Based on Cramer's Recommendation

Investing always involves risks. This section weighs the potential rewards against the inherent risks of investing in FL based on Cramer's recommendation.

-

Potential Rewards: Capital appreciation (increase in stock price) and potential dividend payouts are the primary rewards. [Estimate potential capital appreciation based on various scenarios].

-

Specific Risks:

- Market Volatility: The stock market is inherently volatile. Economic downturns, geopolitical events, and changing consumer sentiment can significantly impact stock prices.

- Competition: Intense competition in the athletic footwear and apparel industry poses a significant risk.

- Company-Specific Risks: Poor financial performance, operational challenges, and management changes can negatively impact FL's stock price.

- Economic Downturn: Consumer spending significantly impacts Foot Locker's sales, making it vulnerable during economic downturns.

-

Overall Risk Assessment: Based on the fundamental and technical analyses, and considering the identified risks, we can assess the overall risk profile of investing in FL as high, medium, or low. [State the overall risk assessment].

Conclusion: Should You Follow Jim Cramer's Foot Locker (FL) Advice?

This analysis provides a comprehensive overview of Foot Locker (FL) stock, considering Jim Cramer's recommendation. While Cramer's insights can be valuable, they shouldn't solely determine your investment decisions. Our analysis, encompassing both fundamental and technical factors and a thorough risk assessment, should guide your own informed decision. Remember, the stock market is dynamic, and even the most well-researched investment carries risk. Before investing in Foot Locker (FL) or following any Jim Cramer recommendation, conduct your own thorough due diligence, consult with a financial advisor, and stay updated on relevant financial news. Informed decision-making is paramount when it comes to Jim Cramer's recommendations and investing in Foot Locker (FL).

Featured Posts

-

Boston Celtics Gear Shop The Latest Collection At Fanatics

May 16, 2025

Boston Celtics Gear Shop The Latest Collection At Fanatics

May 16, 2025 -

Miami Heats Butler Feud A Hall Of Famers Perspective And The Significance Of Jersey Numbers

May 16, 2025

Miami Heats Butler Feud A Hall Of Famers Perspective And The Significance Of Jersey Numbers

May 16, 2025 -

Exclusive Knicks Fan Launches Petition To Replace Lady Liberty With Jalen Brunson

May 16, 2025

Exclusive Knicks Fan Launches Petition To Replace Lady Liberty With Jalen Brunson

May 16, 2025 -

Trump Attacks Biden Sleepy Joe And The State Of The Union

May 16, 2025

Trump Attacks Biden Sleepy Joe And The State Of The Union

May 16, 2025 -

Hyeseong Kims Mlb Debut A Closer Look At The Dodgers Prospect

May 16, 2025

Hyeseong Kims Mlb Debut A Closer Look At The Dodgers Prospect

May 16, 2025