Analyzing Nicolai Tangen's Approach To Trump's Tariffs

Table of Contents

The Impact of Trump's Tariffs on Global Markets

Trump's tariffs, implemented between 2018 and 2020, significantly disrupted global trade and investment. These protectionist measures aimed to reshape international commerce, leading to considerable repercussions:

- Disruption of global supply chains: Tariffs forced companies to reconsider sourcing strategies, leading to delays, increased costs, and logistical nightmares. This complexity directly impacted the efficiency and profitability of numerous global businesses.

- Increased costs for imported goods: The tariffs themselves added directly to the price of imported goods, leading to inflation and reduced consumer purchasing power in many countries. This impacted businesses relying on imported materials and components.

- Market uncertainty and volatility: The unpredictable nature of the tariff announcements and retaliatory measures from other countries created significant uncertainty, leading to market volatility and impacting investor confidence. This environment necessitated nimble and adaptive investment strategies.

- Sector-specific impacts: Certain sectors, particularly technology and manufacturing, were disproportionately affected. The imposition of tariffs on specific goods created winners and losers across various industries, necessitating careful portfolio adjustments.

- Geopolitical implications: The trade war exacerbated existing geopolitical tensions, impacting relationships between countries and complicating the global economic landscape. This increased the complexities of international investment.

These broad impacts directly influenced NBIM's investment strategy, forcing a reassessment of risk and opportunity across its vast portfolio.

Tangen's Strategic Response to Tariff Uncertainty

Tangen's approach to managing the risks posed by the tariffs was characterized by prudence and a focus on long-term value creation. His strategy involved:

- Diversification strategies: NBIM likely increased its diversification across geographies and asset classes to mitigate the impact of sector-specific shocks stemming from the tariffs. This reduced exposure to any single region or industry heavily affected by trade disputes.

- Emphasis on long-term investment horizons: NBIM's long-term investment mandate allowed it to weather the short-term volatility caused by the tariffs, focusing on fundamental value rather than short-term market fluctuations. This approach minimized impulsive reactions to market noise.

- Portfolio allocation adjustments: NBIM likely adjusted its portfolio allocations, potentially reducing exposure to sectors particularly vulnerable to tariffs while increasing investment in more resilient sectors. Specific examples of these shifts would require access to NBIM’s internal investment data.

- Engagement with companies: NBIM likely engaged with portfolio companies affected by the tariffs, providing support and guidance to navigate the challenges and potentially influencing corporate strategies to mitigate negative impacts. This proactive engagement ensured alignment with portfolio companies.

- Lobbying efforts (potential): While not publicly confirmed, NBIM may have engaged in behind-the-scenes lobbying efforts to influence trade policy, advocating for outcomes favorable to its investments and the global economy. This indirect influence is a common feature of large investors' strategies.

Tangen's public statements during this period (if available) would provide further insights into his specific actions and rationale.

Risk Management Strategies within NBIM

NBIM, given its mandate, employs sophisticated risk management techniques. In response to Trump's tariffs, these likely included:

- Stress testing and scenario planning: NBIM almost certainly conducted extensive stress testing and scenario planning to assess the potential impact of various tariff scenarios on its portfolio. This approach allowed for proactive risk mitigation and contingency planning.

- Hedging strategies: NBIM likely utilized hedging strategies to protect against currency fluctuations and other market risks exacerbated by the tariffs. This minimized losses caused by unforeseen shifts in exchange rates.

- Enhanced due diligence and monitoring: NBIM likely intensified its due diligence processes and monitoring of portfolio companies to identify and address emerging risks related to the tariffs. This reinforced oversight of portfolio companies.

- Collaboration with external experts: NBIM likely collaborated with external experts in economics, trade, and geopolitical analysis to gain insights and inform its investment decisions. This broadened perspective and minimized blind spots.

These strategies worked in concert to ensure the resilience of NBIM's portfolio during this turbulent period.

The Long-Term Implications for NBIM's Investment Strategy

The experience of navigating Trump's tariffs had lasting implications for NBIM's investment philosophy:

- Increased focus on geographic diversification: The experience likely reinforced the importance of geographic diversification, reducing reliance on any single region susceptible to protectionist policies. This ensured wider distribution of risk.

- Changes to industry allocation: NBIM likely refined its industry allocation strategies, factoring in potential vulnerabilities to future trade disputes. This approach refined risk assessment to incorporate political factors.

- Enhanced geopolitical risk assessment: The tariffs highlighted the significance of geopolitical risk assessment in investment decision-making. NBIM likely incorporated more robust geopolitical considerations into its future strategies.

- Lessons learned and adjustments: The experience provided valuable lessons in navigating global economic uncertainty. NBIM likely incorporated these lessons into its future investment strategies.

These adjustments informed Tangen's subsequent investment decisions, demonstrating the lasting impact of the Trump tariff era.

Conclusion

This analysis reveals Nicolai Tangen's proactive and pragmatic approach to managing the challenges posed by Trump's tariffs. His strategy, characterized by diversification, a long-term perspective, and sophisticated risk management, enabled NBIM to navigate this volatile period effectively. Understanding Tangen's response is crucial for both investors and policymakers, offering insights into managing similar economic uncertainties in the future. Further research into the impact of trade policies on sovereign wealth funds like NBIM, and a deeper analysis of Nicolai Tangen's Trump Tariffs approach can provide valuable insights for navigating future economic uncertainties. Continue exploring the intricacies of Nicolai Tangen's approach to Trump's tariffs and the broader implications for global investment.

Featured Posts

-

Cuomos 3 Million In Undisclosed Nuclear Stock Options Investigation Needed

May 05, 2025

Cuomos 3 Million In Undisclosed Nuclear Stock Options Investigation Needed

May 05, 2025 -

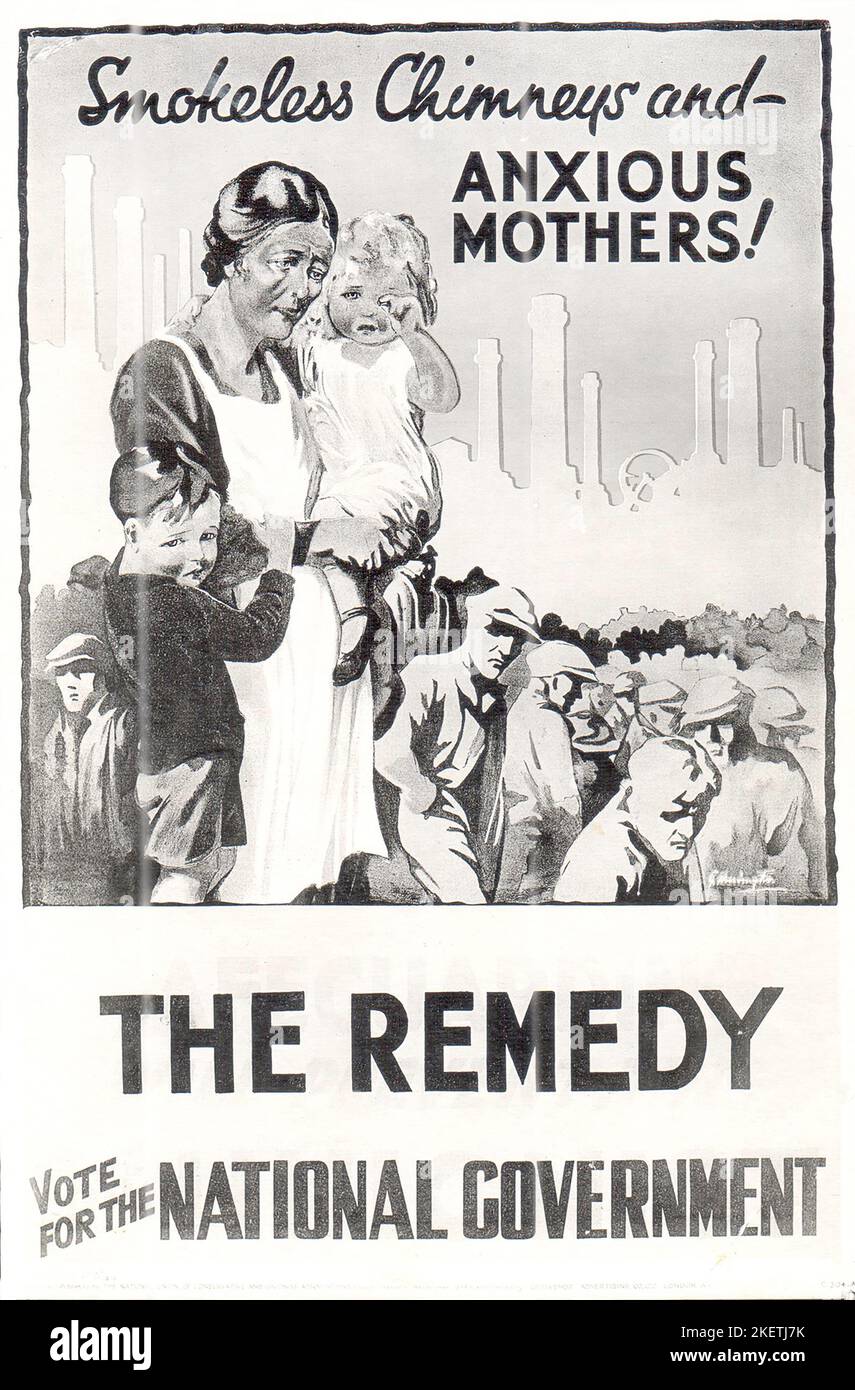

Labours Hardened Approach To Migration Is It Enough To Counter Farage

May 05, 2025

Labours Hardened Approach To Migration Is It Enough To Counter Farage

May 05, 2025 -

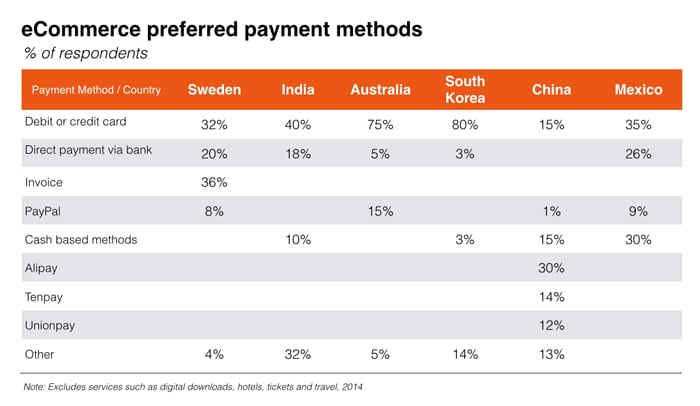

Spotify On I Phone Choose Your Preferred Payment Method

May 05, 2025

Spotify On I Phone Choose Your Preferred Payment Method

May 05, 2025 -

Australia Votes National Election Reflects Global Political Trends

May 05, 2025

Australia Votes National Election Reflects Global Political Trends

May 05, 2025 -

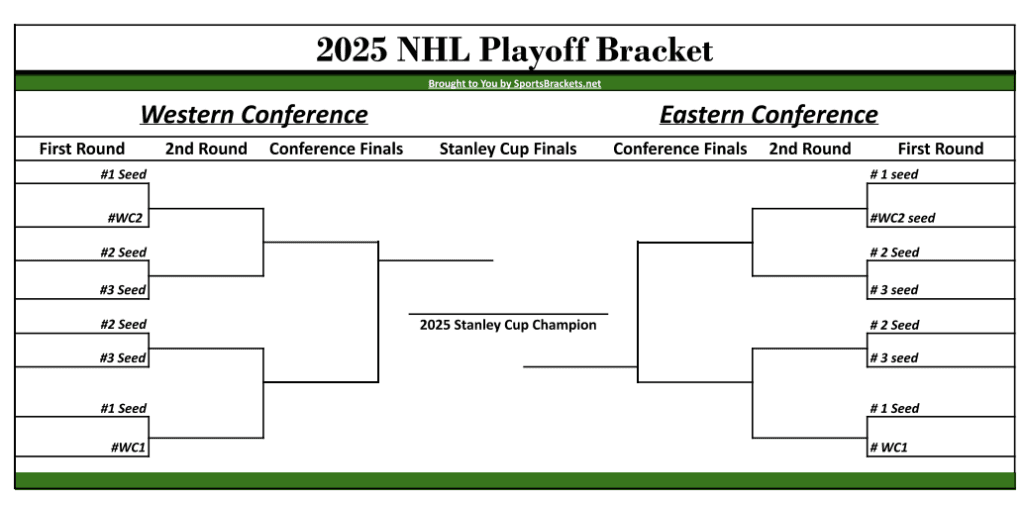

Showdown Saturday Nhl Playoffs Crucial Games And Standings Update

May 05, 2025

Showdown Saturday Nhl Playoffs Crucial Games And Standings Update

May 05, 2025

Latest Posts

-

Will The Oilers Rebound Against The Canadiens A Morning Coffee Preview

May 05, 2025

Will The Oilers Rebound Against The Canadiens A Morning Coffee Preview

May 05, 2025 -

Oilers Vs Canadiens Morning Coffee Predictions And Bounce Back Potential

May 05, 2025

Oilers Vs Canadiens Morning Coffee Predictions And Bounce Back Potential

May 05, 2025 -

Nhl Highlights Avalanche Defeat Panthers Despite Late Comeback

May 05, 2025

Nhl Highlights Avalanche Defeat Panthers Despite Late Comeback

May 05, 2025 -

Johnston And Rantanen Power Avalanche To Victory Over Panthers

May 05, 2025

Johnston And Rantanen Power Avalanche To Victory Over Panthers

May 05, 2025 -

First Round Nhl Playoffs Key Factors And Predictions

May 05, 2025

First Round Nhl Playoffs Key Factors And Predictions

May 05, 2025