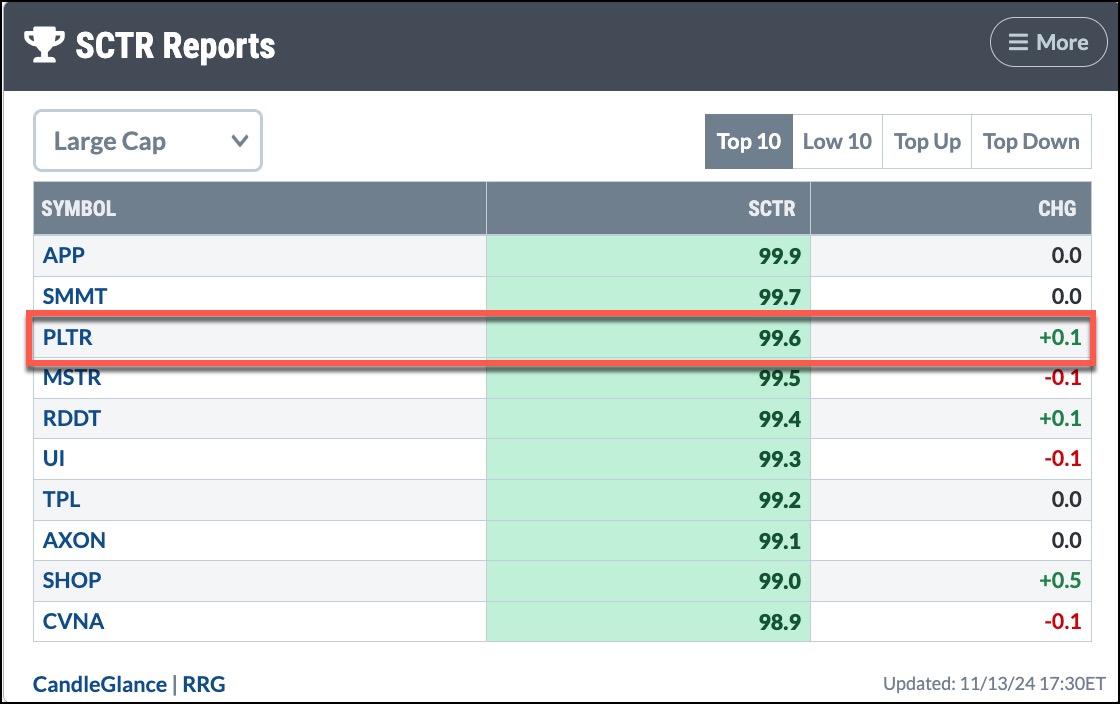

Analyzing Palantir Stock Before May 5th: A Practical Approach

Table of Contents

Fundamental Analysis of Palantir's Financial Performance

Understanding Palantir's financial health is crucial for any Palantir stock analysis. We'll examine key metrics to assess its current standing and future potential.

Revenue Growth and Projections

Analyzing Palantir's revenue growth is paramount. We need to look beyond simple year-over-year increases and delve into the composition of that growth.

- Government Contracts: Palantir heavily relies on government contracts. Analyzing the size and renewal rates of these contracts is crucial for predicting future revenue. A decrease in government spending could significantly impact Palantir's bottom line.

- Commercial Growth: The expansion into the commercial sector is vital for Palantir's long-term sustainability. Tracking the growth rate and profitability of this segment is key to a comprehensive Palantir stock analysis.

- Revenue Diversification: A diversified revenue stream mitigates risk. Examining the balance between government and commercial clients reveals the company's resilience to market fluctuations. A heavily concentrated client base presents higher risk.

Recent reports show [insert relevant data and chart illustrating revenue growth]. While growth has been [positive/negative], analysts project [insert projected figures and source]. This projection hinges on [mention key factors driving or hindering projected growth].

Profitability and Margins

Profitability is a critical indicator of a company's financial health. Examining Palantir's gross and operating margins provides insight into its efficiency and pricing power.

- Gross Margin: This shows the profitability of Palantir's products and services. A declining gross margin might indicate increased competition or rising input costs.

- Operating Margin: This reflects the efficiency of Palantir's operations, considering expenses beyond the cost of goods sold.

- R&D Spending: High R&D investment suggests a commitment to innovation, but it can also negatively impact short-term profitability. Balancing innovation with profitability is key.

[Insert relevant data and charts illustrating gross and operating margins, comparing them to industry benchmarks]. The current margins suggest [positive/negative] trends, potentially influenced by [mention key factors influencing profitability].

Debt and Cash Flow

A company's debt levels and cash flow are vital for assessing its long-term financial stability.

- Debt Levels: High debt can increase financial risk, especially during economic downturns. Analyzing Palantir's debt-to-equity ratio provides a picture of its financial leverage.

- Cash Reserves: Sufficient cash reserves provide a buffer against unexpected events. Examining Palantir's cash on hand and its cash flow from operations reveals its liquidity position.

- Free Cash Flow (FCF): FCF represents the cash generated by the company's operations after accounting for capital expenditures. Positive and growing FCF indicates strong financial health.

Palantir's current debt levels are [insert data]. Their cash reserves stand at [insert data], suggesting [positive/negative assessment]. The company's free cash flow shows [insert data and analysis].

Assessing Palantir's Competitive Landscape and Market Position

A comprehensive Palantir stock analysis must consider its competitive position and future growth prospects.

Competition and Market Share

Palantir operates in a competitive landscape. Understanding its competitive advantages is vital.

- Key Competitors: Identifying and analyzing competitors like [mention key competitors] is essential. Comparing Palantir's strengths and weaknesses against its rivals provides valuable context.

- Market Share: Assessing Palantir's market share provides insight into its dominance and potential for future growth. A growing market share signals success in the competitive market.

- Competitive Advantages: Palantir’s unique technology, government relationships, and strong data security protocols could be key differentiators.

Palantir's market share in [relevant market segment] is currently [insert data]. Its key competitive advantages include [list key advantages], while key challenges include [list key challenges].

Technological Innovation and Future Growth

Innovation is crucial for long-term success in the data analytics sector.

- R&D Efforts: Palantir's investment in research and development is a leading indicator of its future innovation capabilities.

- New Products and Services: The development of new products and services shows Palantir's ability to adapt to evolving market demands and maintain a competitive edge.

- Disruptive Technologies: The potential impact of disruptive technologies on Palantir's business model should also be considered.

Palantir's recent advancements in [mention specific technologies] indicate a commitment to innovation. The success of its new offerings will significantly impact future revenue growth.

Evaluating External Factors Influencing Palantir Stock

External factors can significantly influence Palantir's stock price.

Geopolitical Factors

Geopolitical events significantly impact government contracts and international expansion.

- Government Contracts: Changes in government policy or international relations can affect the awarding and renewal of government contracts.

- International Expansion: Political instability or sanctions can hinder Palantir's ability to expand into new international markets.

[Discuss specific geopolitical events and their potential impact on Palantir’s business and stock price].

Economic Conditions and Market Sentiment

Broader economic conditions and market sentiment significantly influence stock prices.

- Macroeconomic Factors: Inflation, interest rates, and economic growth rates all play a role in shaping investor sentiment towards Palantir.

- Market Sentiment: News events, analyst reports, and general market trends can impact investor confidence and the stock's valuation.

[Analyze the correlation between macroeconomic factors and Palantir’s stock performance. Discuss how current market sentiment impacts the stock's value].

Conclusion

This practical approach to analyzing Palantir stock before May 5th highlighted key financial metrics, competitive landscape assessments, and external factors influencing the company's performance. By carefully considering these aspects, investors can make more informed decisions about their Palantir investments.

Continue your diligent Palantir stock analysis beyond May 5th. Stay updated on the latest financial reports and news impacting the company to refine your investment strategy and potentially capitalize on future opportunities in the Palantir market. Remember to conduct thorough research and consider seeking professional financial advice before making any investment decisions. Remember, this is not financial advice. Conduct your own thorough due diligence before making any investment decisions.

Featured Posts

-

Rio Ferdinands Bold Champions League Prediction Before Arsenal Vs Psg

May 09, 2025

Rio Ferdinands Bold Champions League Prediction Before Arsenal Vs Psg

May 09, 2025 -

Dakota Johnson Melanie Griffith And Siblings Attend Materialist Screening

May 09, 2025

Dakota Johnson Melanie Griffith And Siblings Attend Materialist Screening

May 09, 2025 -

If The Monkey Is 2025s Worst Stephen King Adaptation It Still Means A Great Year For King

May 09, 2025

If The Monkey Is 2025s Worst Stephen King Adaptation It Still Means A Great Year For King

May 09, 2025 -

Addressing The Controversy Benson Boone And The Harry Styles Comparisons

May 09, 2025

Addressing The Controversy Benson Boone And The Harry Styles Comparisons

May 09, 2025 -

Jysws Wflamnghw Alshmrany Yelq Ela Alsfqt Almrtqbt Fydyw Hsry

May 09, 2025

Jysws Wflamnghw Alshmrany Yelq Ela Alsfqt Almrtqbt Fydyw Hsry

May 09, 2025