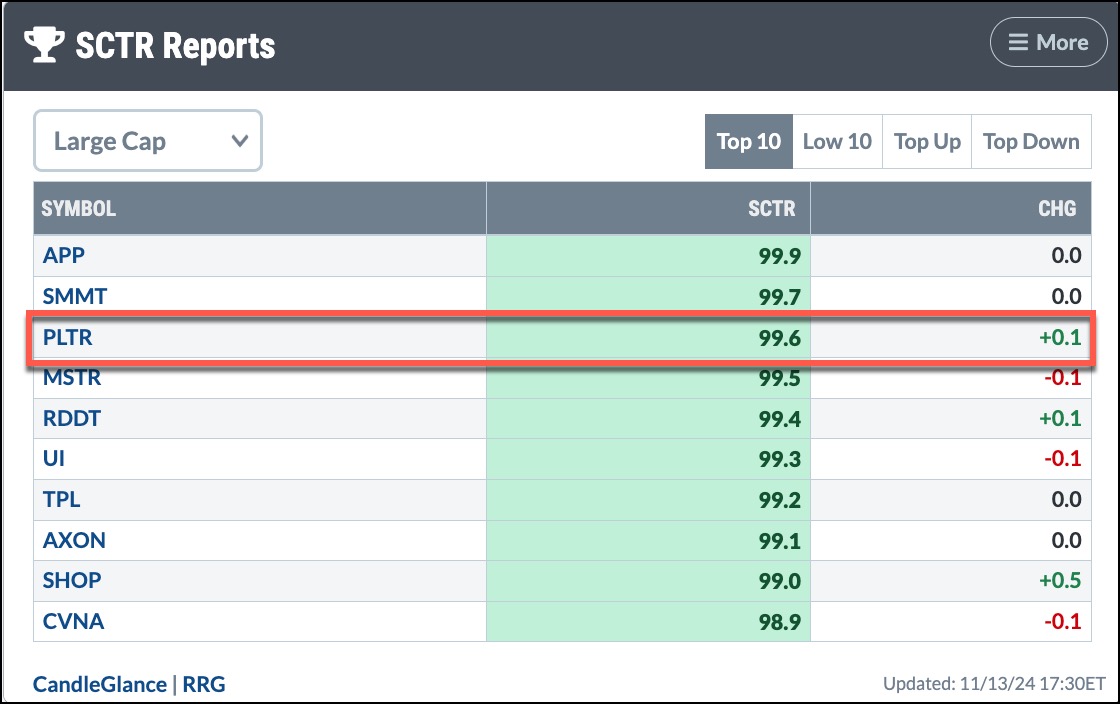

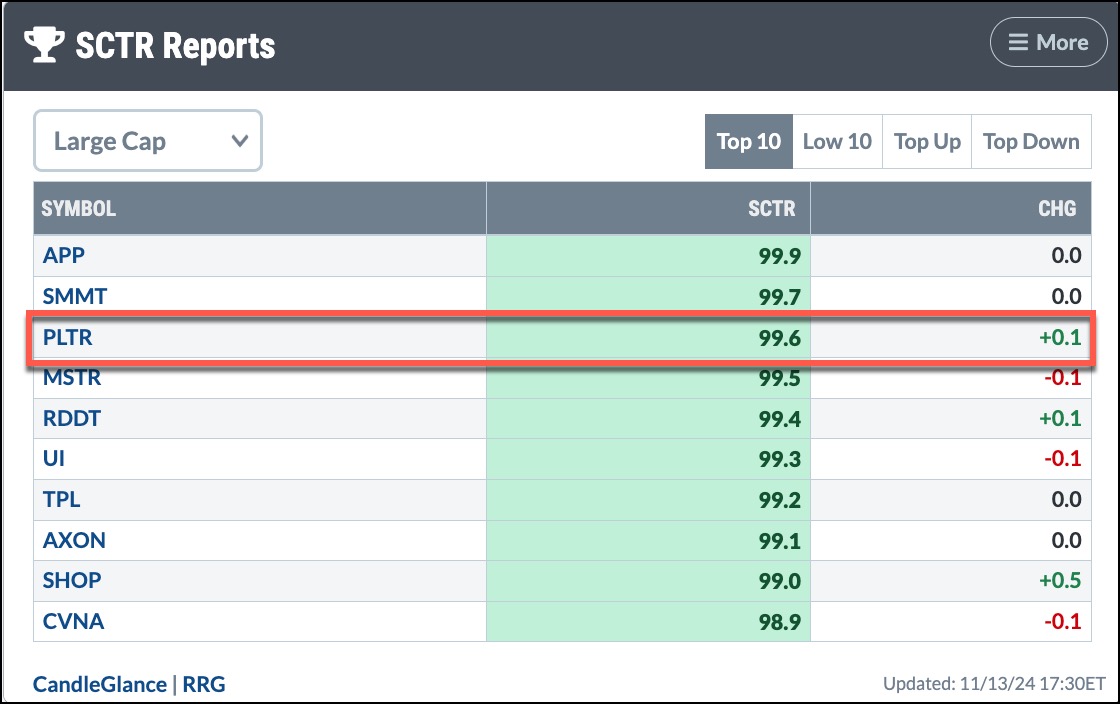

Analyzing Palantir Stock: Risks And Rewards

Table of Contents

Palantir Technologies (PLTR) has captivated investors with its cutting-edge data analytics platform and lucrative government contracts. However, analyzing Palantir stock requires a careful assessment of both its significant potential rewards and inherent risks. This article delves into the key factors to consider before investing in PLTR, helping you make an informed decision about this intriguing data analytics stock.

Understanding Palantir's Business Model and Revenue Streams

Palantir's revenue streams are multifaceted, presenting both opportunities and challenges for potential investors. Understanding these streams is crucial for a comprehensive Palantir stock analysis.

Government Contracts: A Foundation of Stability

A significant portion of Palantir's revenue is derived from government contracts, both domestically (like the US intelligence community) and internationally. This provides a degree of stability, but also introduces several risks.

- Dependence on large government contracts: A substantial portion of revenue hinges on these contracts, creating vulnerability if they aren't renewed or reduced.

- Potential for contract renewal challenges: The competitive bidding process for government contracts can be intense, introducing uncertainty regarding future revenue streams.

- Exposure to shifting government priorities and budget constraints: Changes in government policy or budget cuts can directly impact Palantir's revenue from this sector.

- Opportunities for growth in international government markets: Expansion into new international government markets presents significant growth potential for PLTR stock.

Commercial Partnerships: Diversification and Competition

Palantir is actively expanding its commercial partnerships with private sector companies in finance, healthcare, and other industries. This diversification strategy aims to reduce reliance on government contracts, but also introduces new competitive pressures.

- Growing market share in commercial sectors like finance and healthcare: This demonstrates Palantir's ability to adapt and succeed beyond the government sector, a vital factor in a Palantir stock analysis.

- Competition from established players in the data analytics market: Companies like Microsoft, Google, and Amazon pose significant competition in this space.

- Need for continued innovation to maintain a competitive edge: Palantir must constantly innovate to stay ahead of its competitors and justify its high valuation.

- Potential for higher growth margins in the commercial sector: While more competitive, successful commercial partnerships often offer higher profit margins compared to government contracts.

Assessing the Risks of Investing in Palantir Stock

While Palantir offers exciting potential, investors must carefully weigh the inherent risks before investing in PLTR stock.

Valuation Concerns: A High Price Tag

Palantir's high valuation relative to its current earnings is a significant concern for many. While impressive growth is anticipated, it must meet these high expectations to justify the current Palantir stock price.

- Price-to-earnings ratio (P/E) compared to industry peers: A comparison with competitors reveals whether Palantir's valuation is justified or inflated.

- Projected future earnings growth and its impact on valuation: Accurate projections of future growth are crucial for determining if the current stock price is sustainable.

- Potential for stock price correction if growth expectations aren't met: Failure to meet projected growth could lead to a significant drop in the Palantir stock price.

Dependence on a Few Key Clients: Concentration Risk

Despite diversification efforts, a substantial portion of Palantir's revenue still comes from a relatively small number of large clients. This creates significant risk.

- Identifying key clients and their contributions to revenue: Understanding which clients contribute the most revenue helps assess the impact of losing one.

- Risk mitigation strategies to reduce client concentration: Analyzing Palantir's strategies to diversify its client base is crucial.

- Analysis of potential impact if a key client relationship is lost: Quantifying the potential negative impact is a key part of any thorough Palantir analysis.

Intense Competition: A Crowded Marketplace

The data analytics market is fiercely competitive, with both established tech giants and nimble startups constantly vying for market share.

- Analysis of key competitors and their market share: Identifying and evaluating the competitive landscape is vital for a proper Palantir investment analysis.

- Palantir's competitive advantages and differentiators: Understanding Palantir's unique strengths is crucial for assessing its long-term prospects.

- Strategies to maintain a competitive position in the long term: Analyzing Palantir's strategies for future growth and competitiveness is essential.

Evaluating the Rewards of Investing in Palantir Stock

Despite the risks, Palantir presents several compelling reasons for investors to consider its stock.

Growth Potential: Riding the Data Wave

Palantir operates in a rapidly expanding market for data analytics and artificial intelligence. This presents significant long-term growth opportunities.

- Market size and growth projections for data analytics: The immense growth of the data analytics market fuels the potential for Palantir's expansion.

- Palantir's market penetration and potential for expansion: Assessing Palantir's current market share and potential for further expansion is critical.

- Potential for disruptive innovation and new product launches: Palantir's innovative capacity is a significant driver of potential future growth.

Strong Government Relationships: A Stable Foundation

Palantir's established relationships with government agencies provide a stable revenue base and the potential for securing future contracts.

- Analysis of current and potential future government contracts: Understanding Palantir's government contract pipeline is crucial for assessing future revenue streams.

- Geopolitical risks and their impact on government contracts: Assessing potential geopolitical risks is important for realistic Palantir stock price predictions.

- Long-term prospects for government partnerships: The long-term viability of these partnerships is a key factor to consider.

First-Mover Advantage: Establishing Dominance

Palantir's early entry into the big data analytics market for government and enterprise gives it a significant first-mover advantage and considerable brand recognition.

- Advantages gained from early market entry: This early entry has allowed Palantir to establish itself as a leader in the field.

- Brand recognition and reputation in the industry: Palantir's strong brand reputation provides a competitive edge.

- Potential for continued leadership in the market: Maintaining its leadership position is vital for the continued success of PLTR stock.

Conclusion: Making Informed Decisions About Palantir Stock

Analyzing Palantir stock requires a thorough understanding of its potential and inherent risks. While its innovative technology and strong government relationships offer significant rewards, investors must carefully consider the high valuation, competition, and dependence on key clients. Ultimately, the decision to invest in Palantir stock should be based on a comprehensive assessment of these factors and your own risk tolerance. Conduct your own due diligence and consider consulting a financial advisor before making any investment. Remember, carefully analyzing Palantir stock is crucial for making informed investment decisions.

Featured Posts

-

Vintervaer I Sor Norge Sno Og Vanskelige Kjoreforhold I Fjellet

May 09, 2025

Vintervaer I Sor Norge Sno Og Vanskelige Kjoreforhold I Fjellet

May 09, 2025 -

Elon Musk Still Worlds Richest Despite 100 Billion Net Worth Loss Hurun Global Rich List 2025

May 09, 2025

Elon Musk Still Worlds Richest Despite 100 Billion Net Worth Loss Hurun Global Rich List 2025

May 09, 2025 -

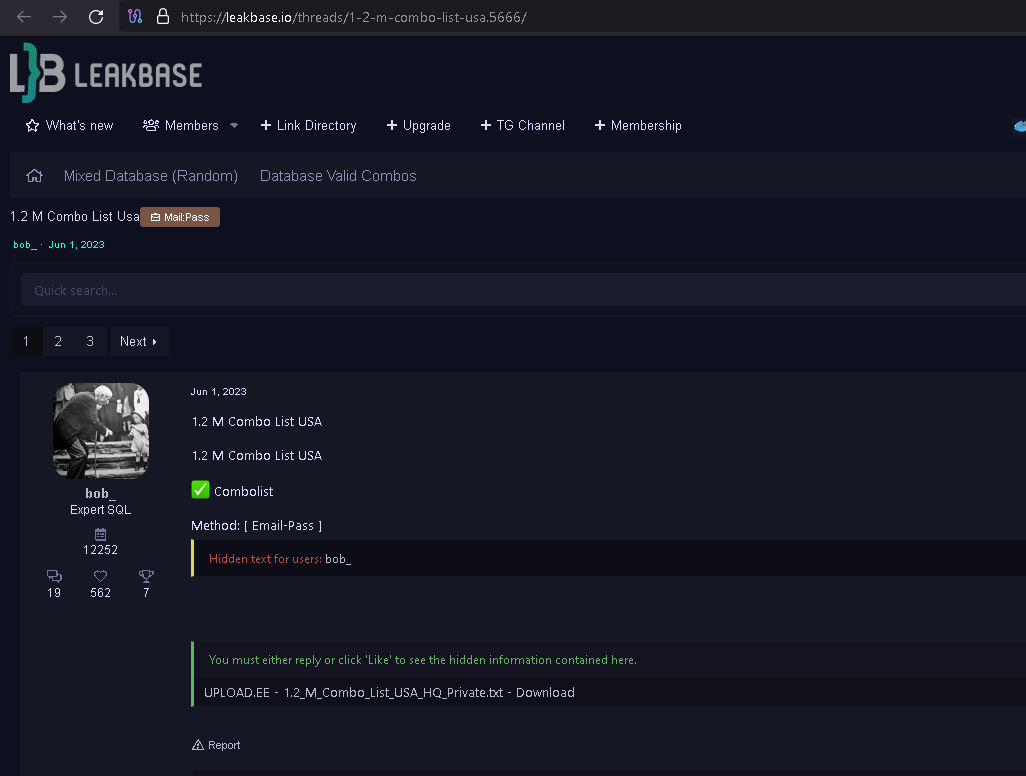

Massive Office365 Data Breach Millions Lost Criminal Charged

May 09, 2025

Massive Office365 Data Breach Millions Lost Criminal Charged

May 09, 2025 -

Tech Billionaires Losses 194 Billion In 100 Days Post Trump Inauguration Donation

May 09, 2025

Tech Billionaires Losses 194 Billion In 100 Days Post Trump Inauguration Donation

May 09, 2025 -

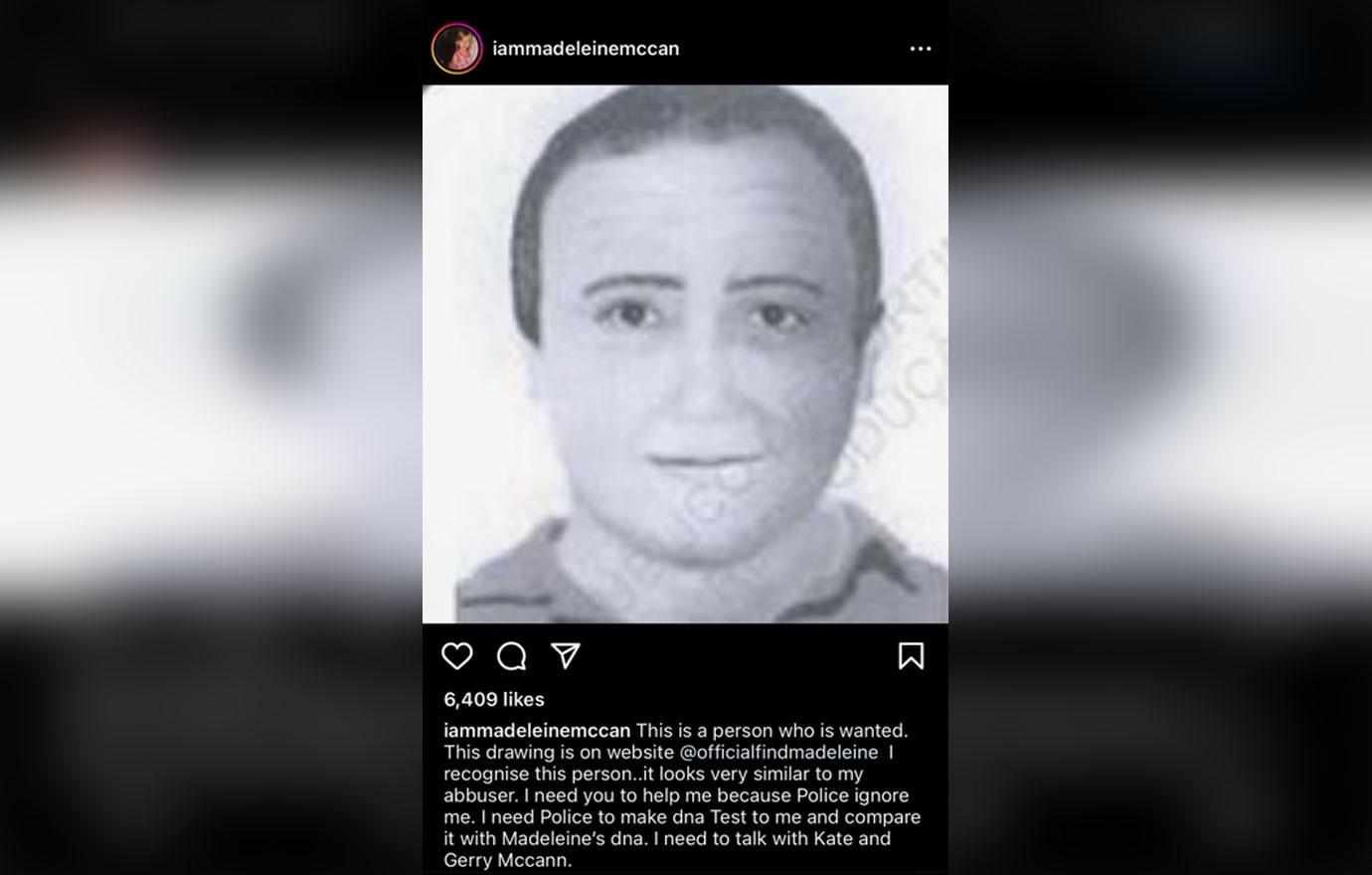

Polish Woman Accused Of Impersonating Madeleine Mc Cann Charged With Stalking

May 09, 2025

Polish Woman Accused Of Impersonating Madeleine Mc Cann Charged With Stalking

May 09, 2025