Analyzing QBTS Stock's Performance Ahead Of Earnings

Table of Contents

The upcoming QBTS earnings announcement has investors on edge. In the volatile world of stock markets, informed decision-making is crucial, and analyzing QBTS stock's performance ahead of earnings is paramount for anyone considering investment. This article aims to provide a comprehensive analysis of QBTS's recent performance and potential future trajectory, helping you navigate this crucial period.

Recent QBTS Stock Performance and Key Financial Indicators

Analyzing QBTS stock requires a deep dive into its recent performance. We'll examine key financial indicators to paint a clear picture of the company's financial health. Recent stock price movements have shown [Insert data on recent stock price trends, highs, and lows – e.g., "a slight upward trend over the past quarter, reaching a high of X and a low of Y"]. This fluctuation likely reflects [Insert reasons for price fluctuations – e.g., "market sentiment regarding the upcoming earnings report and recent industry news"].

Let's examine the key financial metrics:

- Revenue Growth: [Insert data on revenue growth – e.g., "QBTS has reported consistent revenue growth of Z% over the past year"]. This demonstrates [Insert interpretation of revenue growth – e.g., "strong market demand for its products/services"].

- Earnings Per Share (EPS): [Insert data on EPS – e.g., "EPS has increased from A to B over the last two quarters, indicating improved profitability"].

- Profit Margins: [Insert data on profit margins – e.g., "Profit margins remain healthy at C%, showcasing efficient cost management"].

- Debt-to-Equity Ratio: [Insert data on debt-to-equity ratio – e.g., "The debt-to-equity ratio stands at D, suggesting [Insert interpretation of the ratio – e.g., a manageable level of debt]"].

Significant News and Events:

- [Mention any significant news – e.g., "The recent launch of Product X has been met with positive market response."]

- [Mention any competitor actions – e.g., "Competitor Y's recent price cuts may impact QBTS's market share."]

Comparison to Competitors:

- [Compare QBTS to competitors – e.g., "Compared to Competitor Z, QBTS shows higher revenue growth but lower profit margins."]

Factors Influencing QBTS Earnings Expectations

Several factors influence expectations for QBTS's earnings. Analyzing these factors provides a more nuanced understanding of the company's potential.

Market Conditions and Industry Trends:

- [Discuss market conditions – e.g., "The current economic climate presents both opportunities and challenges for QBTS. Rising inflation might impact consumer spending, while increasing demand for [relevant product/service] could boost sales."]

- [Discuss industry trends – e.g., "The growing adoption of [relevant technology] is a positive trend for QBTS, while increasing competition from [competitor type] poses a threat."]

Company Announcements and Investor Statements:

- [Mention recent announcements – e.g., "QBTS's recent press release highlighted strong sales figures for the past quarter, exceeding analyst expectations."]

- [Summarize investor statements – e.g., "Investor presentations have focused on the company's strategic initiatives to expand into new markets."]

Potential Catalysts for Growth or Decline:

- [Discuss potential catalysts for growth – e.g., "The successful integration of a newly acquired company could significantly boost QBTS's revenue."]

- [Discuss potential catalysts for decline – e.g., "Supply chain disruptions could negatively impact production and sales."]

Analyst Predictions:

- [Discuss analyst predictions – e.g., "Analysts' consensus estimates point towards an EPS of E for the upcoming quarter."]

Analyzing QBTS's Competitive Landscape and Market Position

Understanding QBTS's position within its industry is crucial for evaluating its investment potential.

Main Competitors and Performance:

- [List main competitors and their recent performance – e.g., "Competitor A has shown strong growth, while Competitor B is facing challenges."]

Market Share and Competitive Advantages:

- [Discuss QBTS's market share – e.g., "QBTS holds a significant market share of X%, primarily due to its innovative products and strong brand recognition."]

- [Analyze competitive advantages and disadvantages – e.g., "QBTS's strong research and development capabilities are a major advantage, but its reliance on a single supplier poses a risk."]

Strategic Initiatives:

- [Discuss strategic initiatives – e.g., "QBTS's strategic focus on expanding into international markets could drive future growth."]

Risk Assessment and Potential Investment Strategies for QBTS Stock

Investing in QBTS stock involves inherent risks. A thorough risk assessment is crucial before making any investment decisions.

Potential Risks:

- Market Risk: [Explain market risk – e.g., "Overall market downturns can significantly impact QBTS's stock price."]

- Company-Specific Risk: [Explain company-specific risk – e.g., "Failure to launch new products successfully could negatively affect the company's performance."]

Investment Strategies:

- Long-Term Holding: [Explain this strategy – e.g., "A long-term holding strategy is suitable for investors with a higher risk tolerance and a longer time horizon."]

- Short-Term Trading: [Explain this strategy – e.g., "Short-term trading involves buying and selling stock quickly to capitalize on short-term price fluctuations."]

- Options Trading: [Explain this strategy – e.g., "Options trading provides more complex strategies for managing risk and potential gains."]

Return on Investment (ROI):

- [Discuss potential ROI – e.g., "Based on various scenarios, the potential ROI could range from X% to Y%."]

Risk Management:

- [Explain risk management – e.g., "Diversification of investments across different asset classes is important to reduce overall risk."]

Conclusion: Final Thoughts on Analyzing QBTS Stock's Performance Ahead of Earnings

Analyzing QBTS stock requires a holistic approach, considering recent performance, influencing factors, competitive landscape, and potential risks. While QBTS shows [summarize positive aspects], it also faces challenges like [summarize negative aspects]. Remember, all investments carry risk. Before making any investment decisions, it is crucial to conduct thorough due diligence and consider your own risk tolerance. Continue your analysis of QBTS stock, deepen your understanding of QBTS’s performance, and make informed decisions regarding your QBTS stock investments. The information provided here is for informational purposes only and does not constitute financial advice.

Featured Posts

-

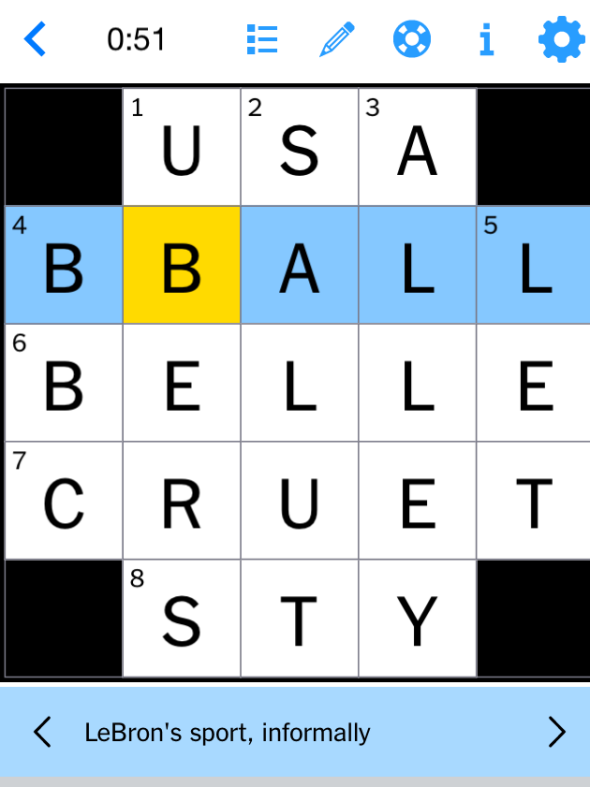

April 13th Nyt Mini Crossword Complete Answers

May 20, 2025

April 13th Nyt Mini Crossword Complete Answers

May 20, 2025 -

Port Autonome D Abidjan Bilan 2022 Et Perspectives

May 20, 2025

Port Autonome D Abidjan Bilan 2022 Et Perspectives

May 20, 2025 -

Beware Of Hmrc Child Benefit Scams Spotting Fake Messages

May 20, 2025

Beware Of Hmrc Child Benefit Scams Spotting Fake Messages

May 20, 2025 -

New Richard Mille Rm 72 01 A Closer Look At The Charles Leclerc Edition

May 20, 2025

New Richard Mille Rm 72 01 A Closer Look At The Charles Leclerc Edition

May 20, 2025 -

Paulina Gretzkys Topless Selfie And Other Unseen Photos

May 20, 2025

Paulina Gretzkys Topless Selfie And Other Unseen Photos

May 20, 2025

Latest Posts

-

Aj Styles Wwe Contract Latest Backstage Updates

May 20, 2025

Aj Styles Wwe Contract Latest Backstage Updates

May 20, 2025 -

Wwe Raw Zoey Stark Suffers Injury Match Cut Short

May 20, 2025

Wwe Raw Zoey Stark Suffers Injury Match Cut Short

May 20, 2025 -

Zoey Stark Injured During Wwe Raw Match Details And Updates

May 20, 2025

Zoey Stark Injured During Wwe Raw Match Details And Updates

May 20, 2025 -

Huuhkajien Alkukokoonpano Naein Se Muuttui

May 20, 2025

Huuhkajien Alkukokoonpano Naein Se Muuttui

May 20, 2025 -

Roxanne Perez And Rhea Ripley Qualify For The 2025 Money In The Bank Ladder Match

May 20, 2025

Roxanne Perez And Rhea Ripley Qualify For The 2025 Money In The Bank Ladder Match

May 20, 2025