Analyzing The Canadian Tire-Hudson's Bay Merger: Opportunities And Challenges

Table of Contents

Canadian Tire, a powerhouse in automotive parts, home improvement, and sporting goods, holds a significant market share. Hudson's Bay, a venerable department store chain known for apparel, home furnishings, and luxury goods, also commands substantial market presence. A merger would combine these strengths, creating a truly formidable entity.

Synergies and Opportunities of a Canadian Tire-Hudson's Bay Merger

A Canadian Tire-Hudson's Bay merger presents numerous synergistic opportunities for growth and profitability.

Expanded Product Portfolio and Market Reach

The complementary nature of their product offerings is a key advantage. Canadian Tire's focus on practical goods contrasts beautifully with Hudson's Bay's more fashion-focused and luxury lines. This combined portfolio would appeal to a broader demographic, increasing market penetration. A merger could also facilitate expansion into new market segments, potentially leveraging existing brand recognition to introduce new product categories.

- Increased brand recognition: The combined entity would enjoy significantly enhanced brand awareness and recall.

- Cross-selling opportunities: Customers browsing for home improvement supplies at Canadian Tire could be easily targeted with offers for related home furnishings from Hudson's Bay, and vice versa.

- Potential for loyalty program integration: Combining loyalty programs could create a powerful incentive for customers to shop across both brands, boosting customer retention and spending.

Enhanced Supply Chain and Logistics

A Canadian Tire-Hudson's Bay merger offers significant potential for streamlining supply chain operations. Combining warehousing, distribution, and transportation networks would lead to substantial cost reductions. Improved inventory management and efficiency would minimize waste and optimize stock levels.

- Reduced operational costs: Economies of scale would significantly lower operating expenses.

- Improved delivery times: A more efficient supply chain would allow for faster and more reliable delivery to customers.

- Optimized supply chain management: Advanced technologies and integrated systems would enhance supply chain visibility and responsiveness.

Leveraging Digital Channels and E-commerce

The combined strengths of Canadian Tire and Hudson's Bay in the digital realm would allow for a stronger online presence and enhanced customer experience. By integrating online and offline retail channels, the merged entity could offer a seamless omnichannel shopping journey.

- Strengthened online presence: A combined website with improved functionality and broader product offerings would attract more online customers.

- Enhanced customer experience: Improved customer service, personalized recommendations, and a more intuitive online shopping experience would increase customer satisfaction.

- Omnichannel integration: Seamless integration between online and offline shopping channels would provide customers with greater flexibility and convenience.

Challenges and Risks Associated with a Canadian Tire-Hudson's Bay Merger

Despite the substantial opportunities, a Canadian Tire-Hudson's Bay merger would also present significant challenges.

Integration Difficulties and Cultural Conflicts

Merging two distinct corporate cultures with differing operational styles and IT systems would be a complex undertaking. Integration costs could be substantial, and employee resistance to change is a realistic concern. Careful planning and execution are crucial to mitigate these risks.

- Potential for employee resistance: Cultural clashes and job security concerns could lead to decreased employee morale and productivity.

- Integration costs: The costs associated with merging IT systems, supply chains, and other operational aspects could be significant.

- Disruption to existing operations: Integration processes could disrupt existing operations, potentially leading to short-term losses in revenue and customer satisfaction.

Regulatory Scrutiny and Antitrust Concerns

A merger of this magnitude would undoubtedly attract significant regulatory scrutiny. Antitrust concerns regarding market dominance would require careful consideration. The approval process could be lengthy and uncertain, potentially leading to delays or even a blocked merger.

- Potential for delayed or blocked merger: Regulatory hurdles and antitrust investigations could significantly delay or even prevent the merger from proceeding.

- Fines and penalties: Failure to comply with regulatory requirements could result in substantial fines and penalties.

- Divestitures: Regulators may require the merged entity to divest certain assets or business units to address antitrust concerns.

Brand Dilution and Customer Confusion

Maintaining the distinct brand identities of Canadian Tire and Hudson's Bay while integrating their operations would be challenging. A poorly managed merger could lead to brand dilution, customer confusion, and even a loss of customer loyalty.

- Negative impact on brand image: A poorly executed merger could damage the reputation of both brands.

- Loss of customer loyalty: Customers may be hesitant to embrace a merged entity, leading to a decrease in customer loyalty.

- Difficulties in marketing the combined entity: Communicating the value proposition of the merged entity to consumers would require a clear and effective marketing strategy.

Conclusion

A hypothetical Canadian Tire-Hudson's Bay merger presents both significant opportunities and substantial challenges. While the potential for expanded market reach, enhanced supply chain efficiency, and improved digital capabilities is undeniable, integrating two large corporations with distinct cultures and operational systems would be a complex undertaking. Regulatory scrutiny and the risk of brand dilution also pose substantial hurdles. Successfully navigating these challenges would be critical to realizing the potential benefits of such a major retail consolidation.

What are your predictions for the future of Canadian retail in light of the potential for such a Canadian Tire-Hudson's Bay merger? Share your thoughts and opinions in the comments section below.

Featured Posts

-

To Sygnomi Toy Kanye West Pros Toys Jay Z Kai Beyonce Leptomereies Kai Antidraseis

May 18, 2025

To Sygnomi Toy Kanye West Pros Toys Jay Z Kai Beyonce Leptomereies Kai Antidraseis

May 18, 2025 -

Is Damiano David Joining Eurovision 2025 A Look At The Rumors

May 18, 2025

Is Damiano David Joining Eurovision 2025 A Look At The Rumors

May 18, 2025 -

Reddit Experiencing Widespread Outage Thousands Affected

May 18, 2025

Reddit Experiencing Widespread Outage Thousands Affected

May 18, 2025 -

Arsenal Close To Securing Stuttgart Midfielder

May 18, 2025

Arsenal Close To Securing Stuttgart Midfielder

May 18, 2025 -

Snl Audiences Profanity Filled Reaction To Ego Nwodim Sketch

May 18, 2025

Snl Audiences Profanity Filled Reaction To Ego Nwodim Sketch

May 18, 2025

Latest Posts

-

Southwest Washingtons Economic Future Navigating The Tariff Challenge

May 18, 2025

Southwest Washingtons Economic Future Navigating The Tariff Challenge

May 18, 2025 -

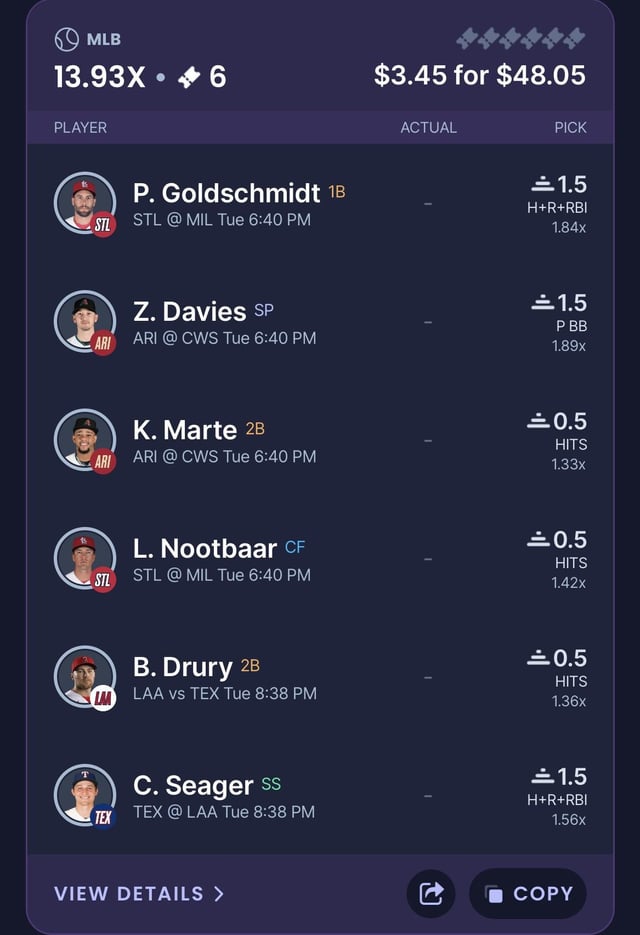

May 8th Mlb Dfs Expert Picks Sleepers And Players To Avoid

May 18, 2025

May 8th Mlb Dfs Expert Picks Sleepers And Players To Avoid

May 18, 2025 -

Another Celebrity Joins Only Fans Amanda Bynes Latest Venture

May 18, 2025

Another Celebrity Joins Only Fans Amanda Bynes Latest Venture

May 18, 2025 -

Southwest Washington Faces Economic Uncertainty Amidst New Tariffs

May 18, 2025

Southwest Washington Faces Economic Uncertainty Amidst New Tariffs

May 18, 2025 -

Unlocking Value Mlb Dfs Sleeper Picks For May 8th

May 18, 2025

Unlocking Value Mlb Dfs Sleeper Picks For May 8th

May 18, 2025