Analyzing The Effectiveness Of Minnesota's Film Tax Credit Program

Table of Contents

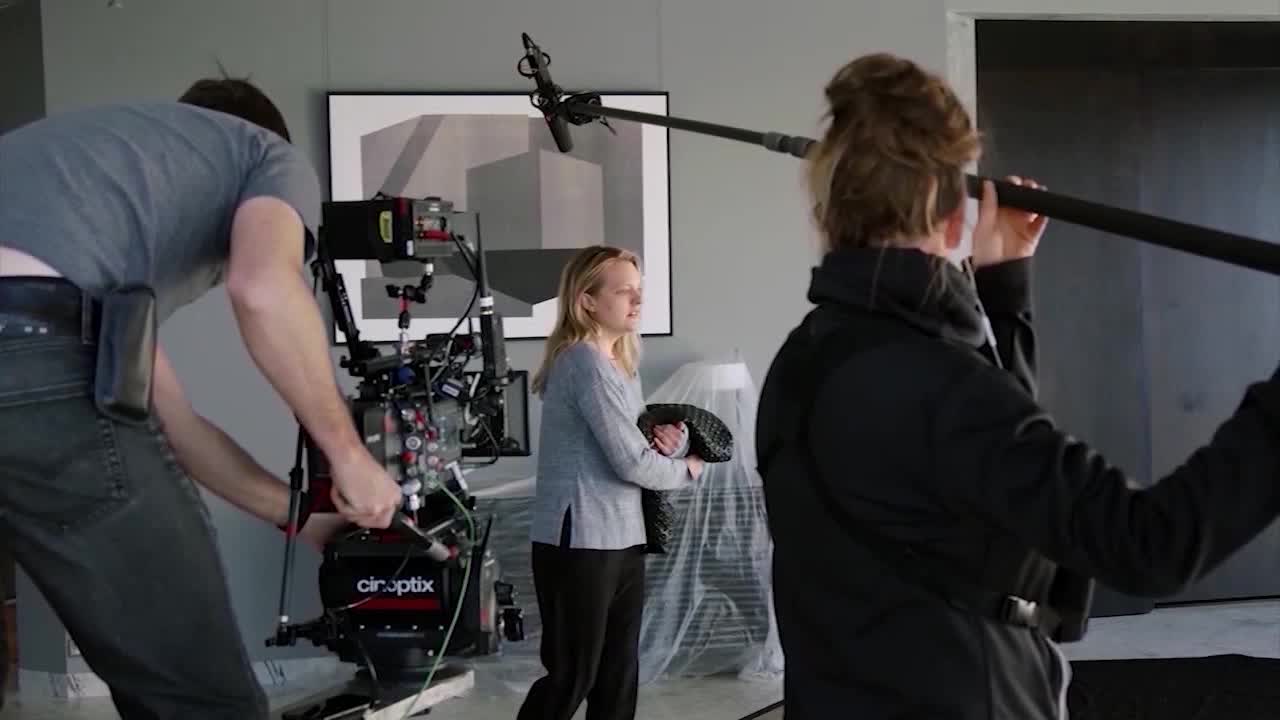

Economic Impact of Minnesota's Film Tax Credit Program

The Minnesota film tax credit program generates significant direct and indirect economic benefits. Film productions inject capital into the local economy through spending on various goods and services. This "economic impact Minnesota film" extends beyond the immediate production costs.

- Increased spending in local businesses: Productions spend heavily on local businesses, including restaurants, hotels, equipment rentals, and transportation services. This boosts revenue for these businesses and creates a ripple effect throughout the community.

- Creation of jobs in various sectors: The film industry isn't just about actors and directors; it creates jobs in numerous sectors, including production, post-production, catering, transportation, and more. This "job creation film industry" effect significantly impacts employment figures.

- Revenue generation for the state: While the program offers tax credits, it also generates revenue for the state through taxes on film production activities, including sales tax, income tax from employed individuals, and other related taxes.

- Attracting film productions to the state, boosting tourism: Successful film productions can showcase Minnesota's landscapes and locations, attracting tourists and further stimulating the economy. This positive impact on tourism is an often overlooked benefit of film production in the state.

Quantifying the precise economic impact requires detailed studies. While comprehensive data on the total "film production spending" in Minnesota attributable to the tax credit isn't readily available in a single, easily accessible source, various reports from organizations like the Minnesota Film Office and economic development agencies provide insights into the program's positive influence on the state's economy.

Job Creation and Workforce Development through Film Incentives

The Minnesota film tax credit program significantly contributes to job creation and workforce development. Analyzing the program reveals a substantial impact on employment within the state.

- Number of jobs created (both temporary and permanent): While many positions are temporary, the influx of productions creates numerous short-term jobs, and some productions lead to the creation of permanent positions within the state's film industry.

- Types of jobs created (e.g., crew positions, acting roles, support staff): The program fosters diverse job opportunities, benefiting individuals with various skill sets. This includes highly skilled professionals and those seeking entry-level positions in the growing "Minnesota film jobs" sector.

- Skills development initiatives associated with the tax credit program: The program can indirectly support workforce development by encouraging the growth of training programs and educational initiatives related to film production.

- Impact on local workforce training programs: The demand created by film productions might stimulate partnerships between educational institutions and the film industry, resulting in improved workforce training programs specializing in film and related fields, strengthening the "workforce development film" pipeline.

Further research and data collection are needed to provide precise figures on job creation, but anecdotal evidence and reports from industry professionals strongly suggest a positive impact.

Return on Investment: Assessing the Effectiveness of Minnesota Film Tax Credits

Evaluating the "ROI film tax credits" requires a cost-benefit analysis, comparing the amount of tax revenue forgone due to the credits against the economic benefits generated. This analysis is complex and involves multiple methodologies.

- Total amount of tax credits issued: Tracking the total amount of tax credits issued annually provides a crucial baseline for the analysis.

- Estimated economic impact generated by the tax credits: This requires sophisticated economic modeling to estimate the total economic impact, including both direct and indirect effects.

- Comparison of economic benefits to the cost of the program: Comparing the estimated economic benefits (e.g., increased tax revenue, job creation) to the cost of the tax credits is critical in determining the program’s ROI.

- Discussion of limitations in calculating ROI: Accurately measuring the ROI of film incentives is challenging due to the indirect nature of many economic benefits and the difficulty in attributing specific economic activity solely to the tax credit program. This highlights the need for ongoing evaluation and refinement of analytical methods to better understand the "Minnesota film tax credit effectiveness."

While a precise ROI figure remains elusive due to methodological limitations and data availability, a comprehensive cost-benefit analysis remains crucial for future program assessments and adjustments.

Comparison to Other States' Film Incentive Programs

Benchmarking Minnesota's program against other states' "film tax credit comparison" helps identify best practices and areas for improvement. This comparative analysis allows for a broader understanding of the Minnesota program's strengths and weaknesses.

- Comparison of tax credit rates: Comparing Minnesota's tax credit rates to those offered by other states with successful film incentive programs provides valuable context for evaluating the program's competitiveness.

- Types of productions eligible for tax credits: Analyzing which types of productions are eligible for tax credits in Minnesota and other states helps assess the program's focus and target market.

- Success stories and challenges faced by other states: Learning from the experiences of other states, including their "success stories and challenges faced by other states," can offer valuable insights and lessons for improving the Minnesota program.

- Lessons learned from other states’ experiences: Reviewing other states' successes and failures provides important knowledge for shaping future policy recommendations and making informed decisions about the Minnesota program. Examining successful "state film incentives" programs elsewhere can inspire improvements in Minnesota's approach.

Conclusion: The Future of Minnesota's Film Tax Credit Program

The analysis suggests that Minnesota's film tax credit program has a positive economic impact, creating jobs and stimulating economic activity. However, the precise ROI remains challenging to quantify due to methodological limitations. To maximize the program's effectiveness, ongoing evaluation and refinement are crucial. We need more comprehensive data to accurately measure the "economic impact Minnesota film" and the true "ROI film tax credits."

Recommendations include improving data collection methods to better track economic impact and job creation, exploring adjustments to tax credit rates and eligibility criteria based on a thorough cost-benefit analysis, and focusing on aligning the program with broader economic development strategies for the state. The "Minnesota film industry future" depends on a well-designed and effectively implemented tax credit program.

We encourage readers to engage in further discussion and research on the Minnesota film tax credit program and its impact on the state's economy. Contact your representatives to voice your opinion and advocate for improvements that will maximize the program's effectiveness and ensure the continued growth of Minnesota's thriving film industry. The future of "improving film tax credits" in Minnesota hinges on informed discussion and proactive engagement.

Featured Posts

-

Mlb Game Recap Twins 6 Mets 3

Apr 29, 2025

Mlb Game Recap Twins 6 Mets 3

Apr 29, 2025 -

Mlb Scores Twins Defeat Mets 6 3

Apr 29, 2025

Mlb Scores Twins Defeat Mets 6 3

Apr 29, 2025 -

The Los Angeles Wildfires And The Problem Of Disaster Related Gambling

Apr 29, 2025

The Los Angeles Wildfires And The Problem Of Disaster Related Gambling

Apr 29, 2025 -

Trumps China Tariffs Higher Prices And Empty Shelves The Economic Impact

Apr 29, 2025

Trumps China Tariffs Higher Prices And Empty Shelves The Economic Impact

Apr 29, 2025 -

Celebrities Who Lost Homes In The La Palisades Fires A Complete List

Apr 29, 2025

Celebrities Who Lost Homes In The La Palisades Fires A Complete List

Apr 29, 2025

Latest Posts

-

Israels Gaza Aid Ban Growing Concerns Over Worsening Humanitarian Situation

Apr 29, 2025

Israels Gaza Aid Ban Growing Concerns Over Worsening Humanitarian Situation

Apr 29, 2025 -

Humanitarian Crisis In Gaza Urgent Need For Israel To Lift Aid Restrictions

Apr 29, 2025

Humanitarian Crisis In Gaza Urgent Need For Israel To Lift Aid Restrictions

Apr 29, 2025 -

Food Fuel And Water Crisis In Gaza Calls To End Israels Aid Ban

Apr 29, 2025

Food Fuel And Water Crisis In Gaza Calls To End Israels Aid Ban

Apr 29, 2025 -

Gaza Crisis International Pressure Mounts On Israel To End Aid Blockade

Apr 29, 2025

Gaza Crisis International Pressure Mounts On Israel To End Aid Blockade

Apr 29, 2025 -

Israel Facing Pressure To Lift Gaza Aid Ban Amidst Shortages

Apr 29, 2025

Israel Facing Pressure To Lift Gaza Aid Ban Amidst Shortages

Apr 29, 2025