Analyzing The Fiscal Impact Of Election Promises: Deficit Projections And Economic Slowdown Concerns

Table of Contents

Assessing the Cost of Election Promises

This section delves into the methodologies used to estimate the financial implications of each election promise. Accurately predicting the fiscal impact requires rigorous analysis and reliable data. Failing to do so can lead to unforeseen economic consequences down the line.

Data Collection and Analysis

Estimating the true cost of election promises requires a multi-faceted approach to data collection and analysis. Sources include government budgets, independent economic forecasts from organizations like the Congressional Budget Office (or equivalent national institutions), and academic research. Analytical techniques employed often include cost-benefit analysis, econometric modeling, and scenario planning to account for various economic conditions.

For example, analyzing tax cut proposals involves estimating the revenue loss based on factors like the tax rate reduction, the affected income brackets, and the potential for behavioral changes (e.g., increased tax avoidance). Similarly, evaluating increased spending on social programs requires detailed projections of program participation rates, service costs, and administrative overhead. Proposed regulatory changes demand a careful assessment of compliance costs for businesses and their potential impact on economic activity.

- Analysis of tax cut proposals and their revenue implications: Tax cuts can stimulate economic growth but also reduce government revenue, potentially increasing the budget deficit. The extent of this impact depends heavily on the size and scope of the tax cuts, as well as the overall economic climate.

- Evaluation of increased spending on social programs and infrastructure: Increased spending on social programs, such as healthcare or education, and infrastructure projects, can boost economic activity in the short-term through job creation and increased consumer demand. However, sustained long-term funding is crucial for such promises to truly benefit the economy.

- Assessment of the cost of proposed regulatory changes: New regulations can impose costs on businesses, potentially leading to reduced investment and job creation. The analysis needs to weigh the potential benefits (e.g., improved environmental protection or consumer safety) against these economic costs.

Deficit Projections and Their Implications

The promises made during election campaigns often lead to projected increases in government debt. It is crucial to analyze both the immediate and long-term effects of these increases.

Short-term vs. Long-term Effects

Increased government spending and tax cuts without corresponding revenue increases directly impact the budget, potentially leading to a widening budget deficit in the short term. This can manifest as increased borrowing by the government, potentially putting upward pressure on interest rates. In the long term, accumulating debt can have severe repercussions.

- Increased interest payments on national debt: A larger national debt necessitates higher interest payments, further straining government finances and potentially reducing funds available for essential public services.

- Potential for credit rating downgrades: A consistently high level of public debt can trigger credit rating downgrades, increasing the cost of borrowing for the government and potentially impacting investor confidence in the national economy.

- Crowding out of private investment: Increased government borrowing can compete with private sector borrowing for available capital, potentially leading to higher interest rates and reduced private investment, hindering long-term economic growth.

Economic Slowdown Concerns

Fiscal policies stemming from election promises can have significant negative effects on economic growth, manifesting in various forms.

Inflationary Pressures

Increased government spending, particularly when the economy is near full employment, can create demand-pull inflation, driving up prices for goods and services. Similarly, cost-push inflation can result from increased taxes or stringent regulations that raise production costs.

- Demand-pull inflation due to increased government spending: When government spending outpaces the economy's capacity to produce goods and services, demand outstrips supply, leading to price increases.

- Cost-push inflation due to increased taxes or regulations: Higher taxes on businesses or stricter regulations can increase production costs, which are then passed on to consumers in the form of higher prices.

Impact on Investment and Employment

Fiscal policies can significantly impact private sector investment and employment. High government borrowing can lead to higher interest rates, reducing the attractiveness of private investment projects. New regulations, while potentially beneficial in some areas, can lead to job losses in affected sectors.

- Reduced private investment due to higher interest rates: Higher interest rates increase the cost of borrowing for businesses, making investment projects less profitable and potentially leading to reduced investment and economic growth.

- Potential job losses in sectors affected by new regulations: Stricter regulations can increase the cost of compliance for businesses, potentially leading to reduced output, job cuts, or business closures.

Conclusion

This article has explored the crucial need to critically analyze the fiscal impact of election promises. Understanding the potential for increased deficits and economic slowdown is paramount for informed voting and responsible governance. The methodologies used to estimate the cost of these promises, along with the projected effects on government debt and economic growth, highlight the importance of realistic and sustainable policy planning. We must demand transparency and detailed analysis from all political parties regarding the financial implications of their platforms. Only through a careful assessment of the fiscal impact of election promises can we ensure a stable and prosperous future. Make your voice heard; demand responsible fiscal planning from your elected officials – and hold them accountable for the fiscal impact of their election promises.

Featured Posts

-

Investment Banking Bbvas Long Term Vision And Strategic Push

Apr 25, 2025

Investment Banking Bbvas Long Term Vision And Strategic Push

Apr 25, 2025 -

Stagecoach 2025 A Guide To The Country Pop And Desert Experiences

Apr 25, 2025

Stagecoach 2025 A Guide To The Country Pop And Desert Experiences

Apr 25, 2025 -

Dope Thief Episode 6 Review Plot Holes And Narrative Concerns

Apr 25, 2025

Dope Thief Episode 6 Review Plot Holes And Narrative Concerns

Apr 25, 2025 -

This Mcu Jean Grey Casting Choice Has Fans Excited

Apr 25, 2025

This Mcu Jean Grey Casting Choice Has Fans Excited

Apr 25, 2025 -

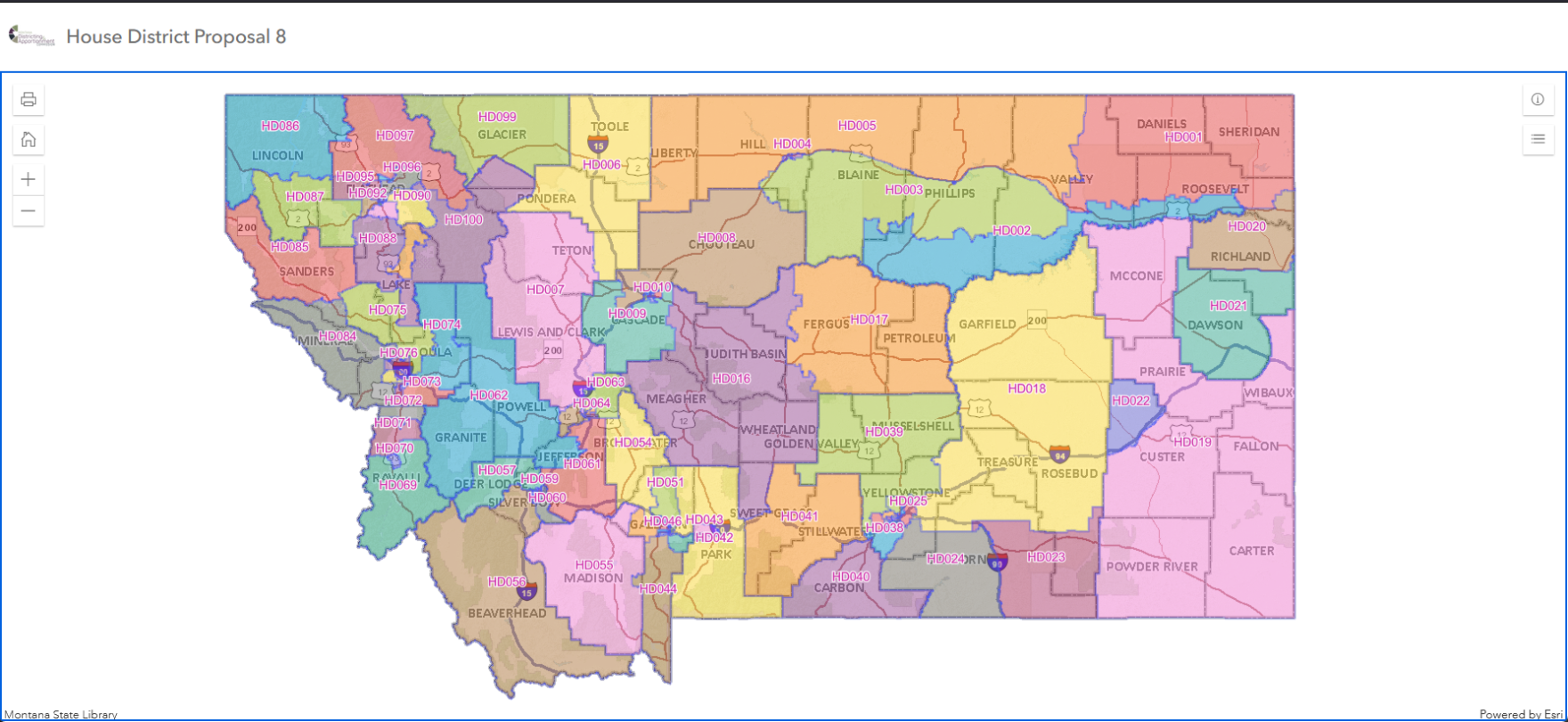

Democrats And Republicans In Montana A Senate Power Struggle

Apr 25, 2025

Democrats And Republicans In Montana A Senate Power Struggle

Apr 25, 2025

Latest Posts

-

Le Realisateur De Black Panther Aux Commandes D Un Reboot De X Files

Apr 30, 2025

Le Realisateur De Black Panther Aux Commandes D Un Reboot De X Files

Apr 30, 2025 -

Ncuti Gatwa Wants Gillian Anderson As Doctor Who Villain

Apr 30, 2025

Ncuti Gatwa Wants Gillian Anderson As Doctor Who Villain

Apr 30, 2025 -

Ryan Coogler Et Le Reboot De X Files Rumeurs Et Analyse

Apr 30, 2025

Ryan Coogler Et Le Reboot De X Files Rumeurs Et Analyse

Apr 30, 2025 -

Ryan Coogler Un Reboot De X Files

Apr 30, 2025

Ryan Coogler Un Reboot De X Files

Apr 30, 2025 -

First Look Teaser Images Revealed For Channel 4s Trespasses

Apr 30, 2025

First Look Teaser Images Revealed For Channel 4s Trespasses

Apr 30, 2025