Analyzing The Net Asset Value (NAV) Of The Amundi MSCI All Country World UCITS ETF USD Acc

Table of Contents

Factors Affecting the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc

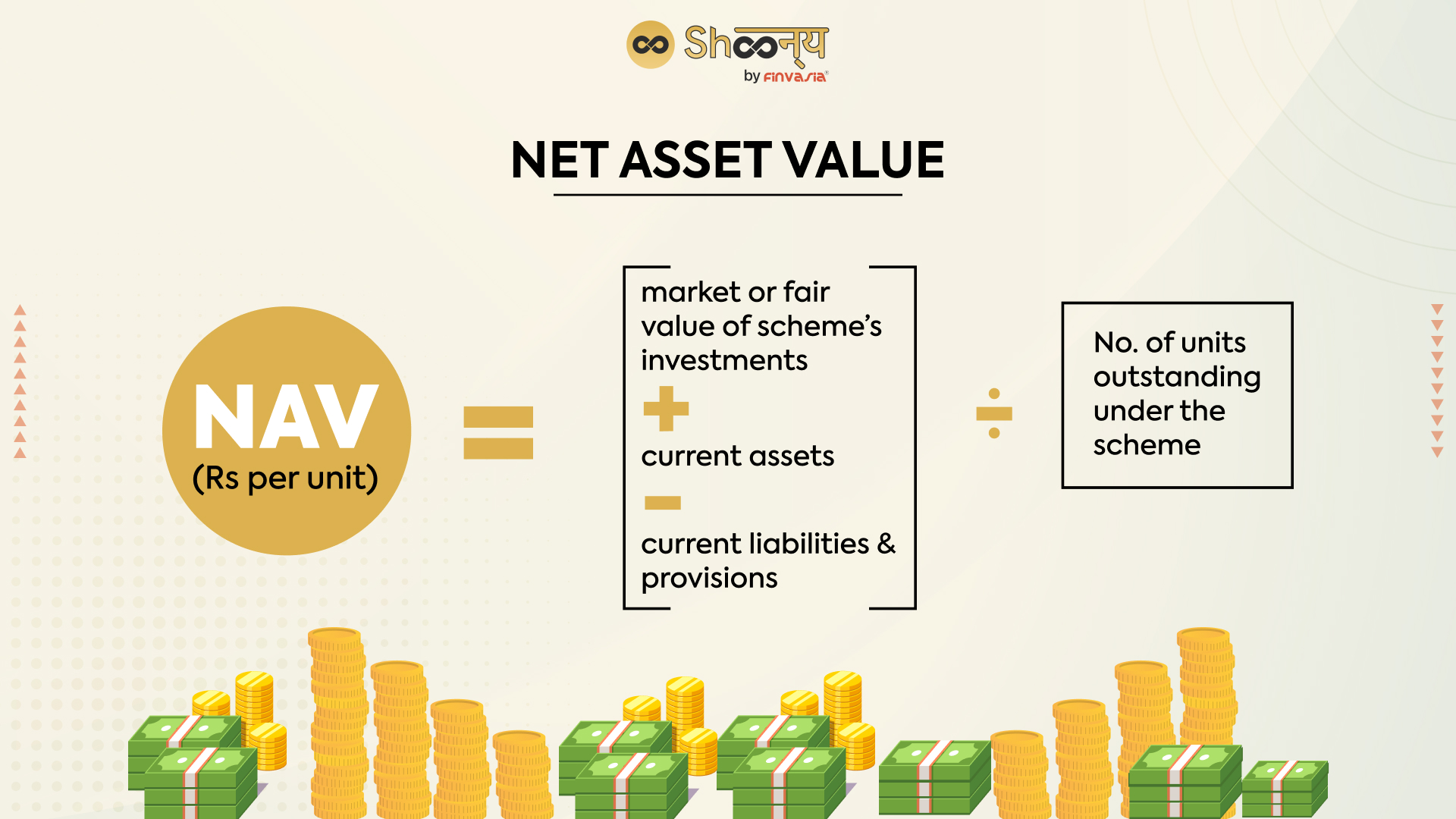

The Net Asset Value (NAV) of the Amundi MSCI All Country World UCITS ETF USD Acc reflects the total value of its underlying assets, primarily determined by the performance of the MSCI All Country World Index. Several factors influence this value:

Underlying Assets and the MSCI All Country World Index

The ETF's NAV is directly tied to the performance of the MSCI All Country World Index. This index tracks a broad range of global equities, providing exposure to developed and emerging markets. Positive performance in the index generally leads to a higher NAV, while negative performance results in a lower NAV. Understanding the index's composition and its constituent companies is essential for comprehending the ETF's NAV movements.

Currency Fluctuations

Because the Amundi MSCI All Country World UCITS ETF USD Acc is denominated in USD, fluctuations in exchange rates between the USD and other currencies represented in the portfolio impact the NAV. A strengthening USD against other currencies will generally reduce the NAV (when converted back to USD), and vice versa.

Market Conditions

Global market trends significantly impact the ETF's NAV. During bull markets, characterized by rising prices, the NAV tends to increase. Conversely, bear markets with falling prices lead to a decrease in the NAV. Factors such as economic growth, interest rates, geopolitical events, and investor sentiment all contribute to these market fluctuations and affect the ETF's NAV.

Dividend Distributions

Dividend payouts from the underlying companies within the MSCI All Country World Index affect the NAV. When companies distribute dividends, the NAV typically decreases by the amount of the dividend paid out to the ETF, reflecting the distribution to shareholders.

Expense Ratio

The ETF's expense ratio, which covers operational and management costs, indirectly impacts the NAV. While not directly deducted from the NAV daily, the expense ratio eats into the overall returns, slightly impacting the growth of the NAV over time.

- Underlying Assets: Positive performance increases NAV; negative performance decreases NAV.

- Currency Fluctuations: Strong USD generally lowers NAV; weak USD generally raises NAV.

- Market Conditions: Bull markets increase NAV; bear markets decrease NAV.

- Dividend Distributions: Dividends paid out reduce NAV.

- Expense Ratio: Gradually reduces the overall growth of the NAV.

How to Monitor and Interpret the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc

Monitoring the NAV is crucial for informed investment decisions. Here's how to do it effectively:

Where to Find the NAV

You can find the daily NAV of the Amundi MSCI All Country World UCITS ETF USD Acc on several reliable sources:

- Amundi's Official Website: The ETF provider's website is the most accurate source for this information.

- Financial News Websites: Many reputable financial news sources provide real-time or delayed NAV data for ETFs.

- Brokerage Platforms: If you hold the ETF through a brokerage account, the platform will usually display the current NAV.

Understanding NAV Charts

NAV charts visually represent the ETF's value over time. Analyzing these charts can help identify trends, such as periods of growth or decline. Look for long-term trends to gauge overall performance and short-term fluctuations to understand market volatility.

Comparing NAV to the ETF Price

While the NAV represents the intrinsic value of the ETF's assets, the market price can fluctuate throughout the trading day. A significant difference between the NAV and market price might indicate an arbitrage opportunity or market inefficiencies.

- Track NAV daily: Use reliable sources to monitor daily changes.

- Analyze NAV charts: Identify long-term trends and short-term fluctuations.

- Compare NAV and market price: Understand potential discrepancies and their implications.

Using NAV for Investment Decisions in the Amundi MSCI All Country World UCITS ETF USD Acc

Understanding the NAV empowers you to make better investment choices:

NAV as a Benchmark

The NAV allows you to assess the ETF's performance relative to its benchmark index, the MSCI All Country World Index. Comparing the NAV to the index's performance reveals how well the ETF is tracking its target.

Long-Term versus Short-Term Perspective

While short-term NAV fluctuations are normal, focusing on long-term trends provides a more accurate picture of the ETF's performance and its potential for growth.

Dollar-Cost Averaging

Utilizing the NAV in conjunction with dollar-cost averaging (DCA) strategies can help mitigate the risk associated with market volatility. DCA involves investing a fixed amount of money at regular intervals, regardless of the NAV.

Risk Assessment

Understanding NAV changes helps assess the risk associated with this investment. Large fluctuations might signal higher risk, while more stable NAVs suggest lower risk, though it's still crucial to consider the overall market conditions.

- Use NAV for performance evaluation: Compare it to the benchmark index.

- Prioritize long-term trends: Short-term fluctuations are less significant.

- Implement dollar-cost averaging: Reduce risk by investing regularly.

- Assess risk levels: Understand the volatility indicated by NAV changes.

Conclusion

The Net Asset Value (NAV) of the Amundi MSCI All Country World UCITS ETF USD Acc is a crucial metric for investors seeking global diversification. Understanding the factors influencing the NAV, including the underlying assets, currency fluctuations, market conditions, dividend distributions, and expense ratio, is crucial for making informed investment decisions. Regularly monitoring the NAV and comparing it to the market price and the benchmark index allows for a comprehensive assessment of the ETF's performance and risk profile. By utilizing this information, investors can employ strategies like dollar-cost averaging to optimize their investment strategy. Stay informed about the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc and learn more about using NAV to maximize your Amundi MSCI All Country World UCITS ETF USD Acc investment by visiting the Amundi website [link to Amundi website].

Featured Posts

-

Fastest Ferraris Comparing 10 Production Models At Fiorano

May 25, 2025

Fastest Ferraris Comparing 10 Production Models At Fiorano

May 25, 2025 -

Casualty Treated After Car Overturns On M56

May 25, 2025

Casualty Treated After Car Overturns On M56

May 25, 2025 -

Naujausias Porsche Elektromobiliu Ikrovimo Centras Vieta Ir Galimybes

May 25, 2025

Naujausias Porsche Elektromobiliu Ikrovimo Centras Vieta Ir Galimybes

May 25, 2025 -

Joy Crookes I Know You D Kill Song Release And Details

May 25, 2025

Joy Crookes I Know You D Kill Song Release And Details

May 25, 2025 -

Could Kyle Walker Peters Join Crystal Palace On A Free Transfer

May 25, 2025

Could Kyle Walker Peters Join Crystal Palace On A Free Transfer

May 25, 2025

Latest Posts

-

France Debates Harsher Penalties For Young Criminals

May 25, 2025

France Debates Harsher Penalties For Young Criminals

May 25, 2025 -

Macrons Policies Face Criticism From Former French Pm

May 25, 2025

Macrons Policies Face Criticism From Former French Pm

May 25, 2025 -

The Price Of Progress When Challenging The Status Quo Leads To Punishment

May 25, 2025

The Price Of Progress When Challenging The Status Quo Leads To Punishment

May 25, 2025 -

Lady Gagas Romantic Snl Afterparty Appearance With Fiance Michael Polansky

May 25, 2025

Lady Gagas Romantic Snl Afterparty Appearance With Fiance Michael Polansky

May 25, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Daily Nav Updates And Analysis

May 25, 2025

Amundi Dow Jones Industrial Average Ucits Etf Daily Nav Updates And Analysis

May 25, 2025