Analyzing The Potential Merger Of Canadian Tire And Hudson's Bay

Table of Contents

Synergies and Potential Benefits of a Canadian Tire Hudson's Bay Merger

A merger between these retail behemoths could unlock significant synergies and advantages. Let's examine the key potential benefits.

Enhanced Retail Footprint and Market Reach

A combined Canadian Tire and Hudson's Bay would boast a dramatically expanded retail footprint across Canada. This translates to:

- Increased store locations: Access to a significantly larger network of physical stores, reaching more customers nationwide.

- Expansion into new geographic areas: Opportunities to penetrate underserved markets and increase overall market presence.

- Greater brand awareness: Combined marketing efforts could amplify brand recognition and reach a broader consumer base.

The geographic overlap between existing Canadian Tire and Hudson's Bay locations presents opportunities for strategic consolidation and expansion into new, potentially lucrative markets. Analyzing market share data reveals significant potential for growth through this enhanced reach, particularly in smaller towns and cities currently underserved by either brand. This expanded presence could significantly impact the Canadian Tire Hudson's Bay merger's success.

Operational Efficiencies and Cost Savings

Consolidation of operations offers substantial opportunities for cost reduction through economies of scale. This includes:

- Reduced overhead costs: Combining administrative functions, streamlining processes, and eliminating redundancies.

- Improved supply chain efficiency: Optimizing logistics, warehousing, and distribution networks to lower costs and improve delivery times.

- Streamlined logistics: Integrating purchasing and inventory management systems for greater efficiency and reduced waste.

For example, consolidating their respective supply chains could lead to significant savings in transportation and warehousing costs. Similarly, merging marketing departments could lead to more efficient campaigns and reduced advertising spend. A comprehensive analysis suggests potential annual cost savings in the hundreds of millions of dollars, a key factor in the financial viability of a Canadian Tire Hudson's Bay merger.

Cross-selling Opportunities and Diversification

The diverse product offerings of Canadian Tire (hardware, sporting goods, automotive) and Hudson's Bay (apparel, home goods, luxury items) present exciting cross-selling opportunities. This includes:

- Increased customer engagement: Expanding the product range available to existing customer bases, encouraging repeat purchases.

- Expanded product portfolio: Attracting new customer segments by offering a more comprehensive range of goods and services.

- Loyalty program integration: Creating a unified loyalty program to enhance customer retention and drive sales across both brands.

Imagine a customer purchasing a new BBQ at Canadian Tire and being offered complementary outdoor furniture or apparel from Hudson's Bay through targeted promotions. This kind of cross-selling potential is immense, driving revenue growth and customer loyalty. However, successfully integrating these different brand identities and customer bases will be crucial to realize these opportunities.

Challenges and Potential Risks of a Canadian Tire Hudson's Bay Merger

While the potential benefits are substantial, several challenges and risks must be carefully considered.

Integration Difficulties and Cultural Conflicts

Merging two large organizations with distinct cultures and operational systems is complex and can lead to:

- Potential employee layoffs: Redundancies in certain roles are inevitable, leading to potential workforce disruption and morale issues.

- System incompatibility: Integrating disparate IT systems, supply chain management platforms, and retail operations can be costly and time-consuming.

- Brand dilution concerns: Maintaining the distinct brand identities of Canadian Tire and Hudson's Bay while integrating their operations requires a delicate balancing act.

Effective change management strategies are crucial to mitigate these risks. A phased integration approach, careful communication with employees, and a clear vision for the combined entity are essential for a successful merger. Ignoring these aspects could significantly hinder the success of the Canadian Tire Hudson's Bay merger.

Regulatory Scrutiny and Antitrust Concerns

The Competition Bureau of Canada would meticulously scrutinize the merger, assessing its potential impact on competition. This involves:

- Potential for antitrust challenges: The merger could be challenged if it is deemed to create excessive market concentration, harming competition.

- Lengthy regulatory approval process: Obtaining regulatory approval could be a protracted process, delaying the realization of synergies.

- Conditions imposed by regulators: The Bureau might impose conditions, such as divestitures or behavioral remedies, to address competition concerns.

Similar past merger cases in the Canadian retail sector provide valuable precedents. Studying these cases offers insights into potential regulatory challenges and strategies for navigating the approval process. Understanding the regulatory landscape is critical for the success of a Canadian Tire Hudson's Bay merger.

Financial Risks and Debt Burden

Financing the merger would likely involve significant debt, creating financial risks including:

- Increased financial risk: High levels of debt can make the combined entity vulnerable to economic downturns and interest rate hikes.

- Potential credit rating downgrades: Increased debt could lead to lower credit ratings, making it more expensive to borrow money in the future.

- Impact on shareholder value: A poorly executed merger can significantly diminish shareholder value, potentially leading to investor dissatisfaction.

Careful financial planning and a well-defined capital structure are crucial to mitigate these risks. Exploring alternative financing options, such as equity financing, could reduce reliance on debt and strengthen the financial position of the merged entity. A robust financial model is essential for assessing the feasibility of a Canadian Tire Hudson's Bay merger.

Strategic Implications and Future Outlook for the Canadian Retail Landscape

The Canadian Tire Hudson's Bay merger would have far-reaching implications for the Canadian retail landscape.

Impact on Competitors

The merger would significantly alter the competitive landscape, potentially impacting major players such as:

- Increased market concentration: The combined entity would control a substantial market share, potentially leading to increased bargaining power with suppliers.

- Potential for price wars: Competitors might respond with aggressive pricing strategies to defend their market share.

- Shifts in market share: The merger could trigger significant shifts in market share among major retailers in Canada.

Analyzing the competitive dynamics and market share data of major Canadian retailers is critical to understanding the potential impact of a Canadian Tire Hudson's Bay merger.

Long-term Viability and Sustainability

The long-term viability of the combined entity depends on its ability to address ongoing challenges in the retail sector:

- E-commerce strategies: Developing robust e-commerce platforms and omnichannel strategies is crucial to compete effectively.

- Omnichannel integration: Seamlessly integrating online and offline shopping experiences is key to enhancing customer satisfaction.

- Sustainability initiatives: Implementing sustainable business practices is essential to attract environmentally conscious consumers.

The merged entity would need to invest significantly in technology, logistics, and marketing to compete effectively in the digital age and meet the evolving expectations of Canadian consumers. A clear strategic vision that incorporates sustainable business practices will be key to the long-term success of a Canadian Tire Hudson's Bay merger.

Conclusion

The potential merger of Canadian Tire and Hudson's Bay presents both significant opportunities and considerable challenges. While synergies in operations, retail reach, and cross-selling are clear advantages, integration difficulties, regulatory hurdles, and financial risks must be carefully considered. The long-term success of a hypothetical Canadian Tire Hudson's Bay merger hinges on effective integration, proactive risk management, and a clear strategic vision for navigating the evolving Canadian retail market. Further analysis and due diligence are necessary to fully assess the feasibility and long-term implications of such a major business combination. To stay informed about the future of these retail giants and the potential for a Canadian Tire Hudson's Bay merger, continue to follow industry news and expert analyses.

Featured Posts

-

France Eurovision 2024 Devoilement De La Chanson De Louane

May 20, 2025

France Eurovision 2024 Devoilement De La Chanson De Louane

May 20, 2025 -

Aktrisata Dzhenifr Lorns E Mayka Za Vtori Pt

May 20, 2025

Aktrisata Dzhenifr Lorns E Mayka Za Vtori Pt

May 20, 2025 -

Deux Matchs Cles En Pro D2 Colomiers Recoit Oyonnax Montauban Affronte Brive

May 20, 2025

Deux Matchs Cles En Pro D2 Colomiers Recoit Oyonnax Montauban Affronte Brive

May 20, 2025 -

Hunter Biden Recordings Assessing President Bidens Mental Fitness

May 20, 2025

Hunter Biden Recordings Assessing President Bidens Mental Fitness

May 20, 2025 -

Bournemouth Vs Fulham Free Live Stream Details Tv Channel And Time 14 04 25

May 20, 2025

Bournemouth Vs Fulham Free Live Stream Details Tv Channel And Time 14 04 25

May 20, 2025

Latest Posts

-

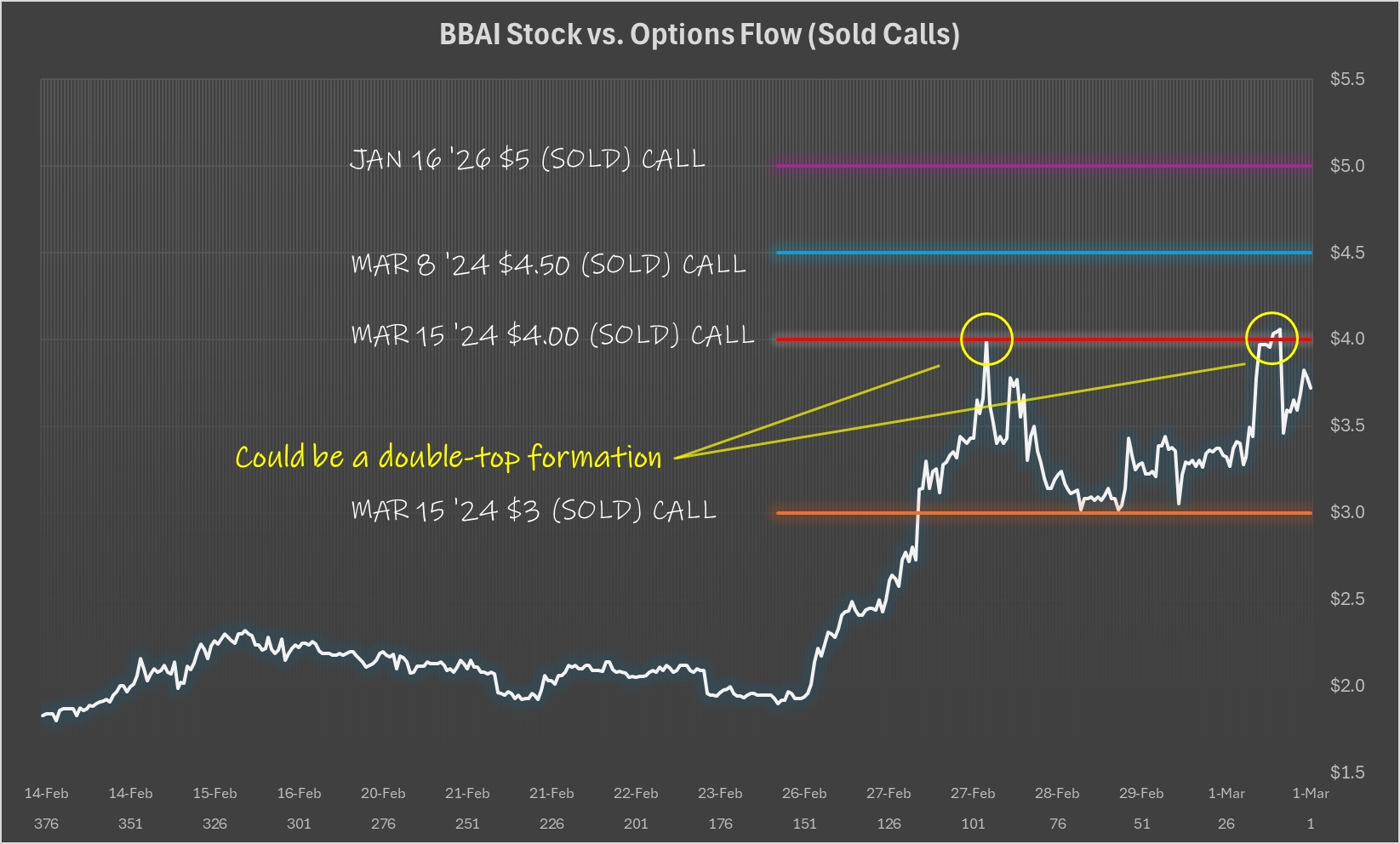

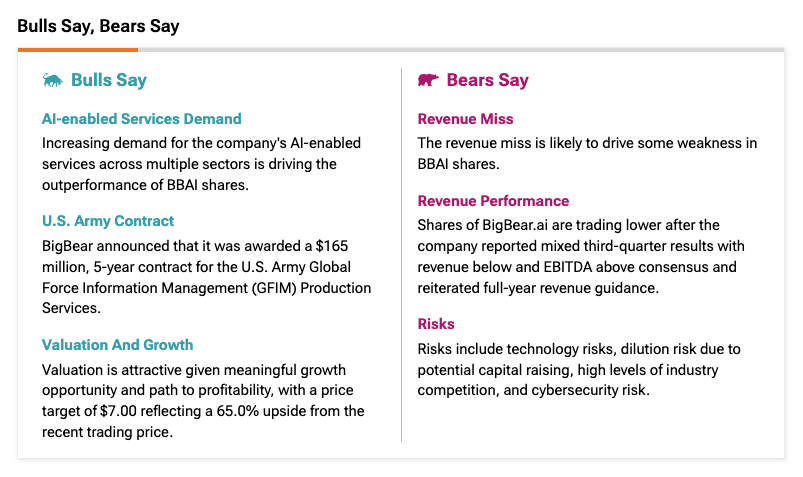

Big Bear Ai Bbai Stock Losses Legal Options For Investors

May 20, 2025

Big Bear Ai Bbai Stock Losses Legal Options For Investors

May 20, 2025 -

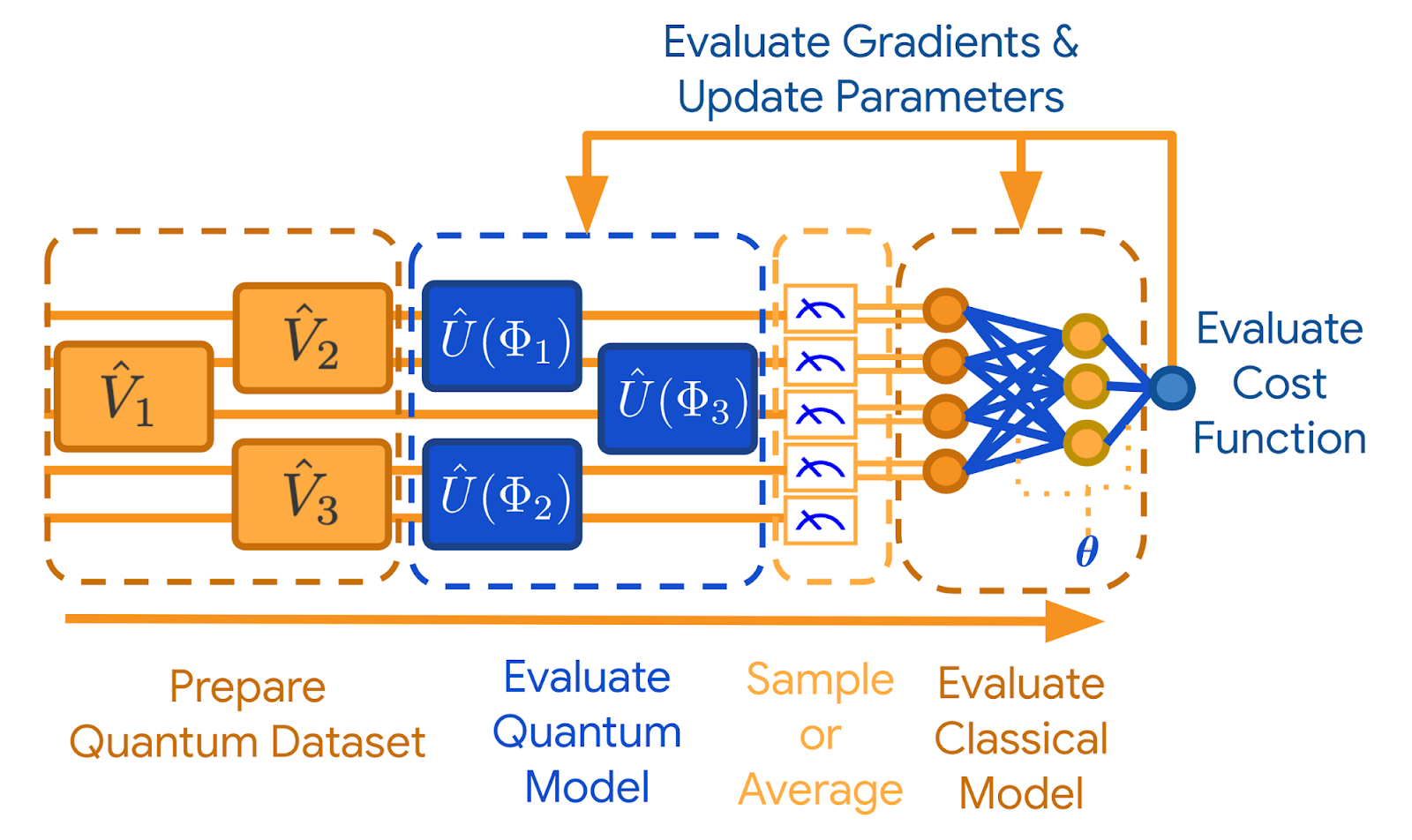

Ai Quantum Computing Stock Dip A Buying Opportunity

May 20, 2025

Ai Quantum Computing Stock Dip A Buying Opportunity

May 20, 2025 -

Gross Law Firm Representing Investors In Big Bear Ai Bbai Stock

May 20, 2025

Gross Law Firm Representing Investors In Big Bear Ai Bbai Stock

May 20, 2025 -

This Ai Quantum Computing Stock A Dip Buying Opportunity

May 20, 2025

This Ai Quantum Computing Stock A Dip Buying Opportunity

May 20, 2025 -

Protect Your Rights Big Bear Ai Bbai Investors Urged To Contact Gross Law Firm

May 20, 2025

Protect Your Rights Big Bear Ai Bbai Investors Urged To Contact Gross Law Firm

May 20, 2025