Analyzing The Treasury Market's Performance On April 8th

Table of Contents

The Treasury market, a cornerstone of global finance, experienced significant shifts on April 8th. Understanding the intricacies of its performance on this particular day is crucial for investors, economists, and anyone seeking to decipher the broader economic landscape. This article aims to analyze the key performance indicators of the Treasury market on April 8th, providing insights into yield curve movements, auction results, the impact of economic indicators, and overall market volatility.

Yield Curve Movements on April 8th

The yield curve, a graphical representation of the yields of government bonds across different maturities, serves as a vital economic indicator. Its shape reflects investor sentiment and expectations regarding future interest rates and economic growth. On April 8th, the yield curve exhibited a [Insert actual observation: e.g., slight steepening, noticeable flattening, or inversion].

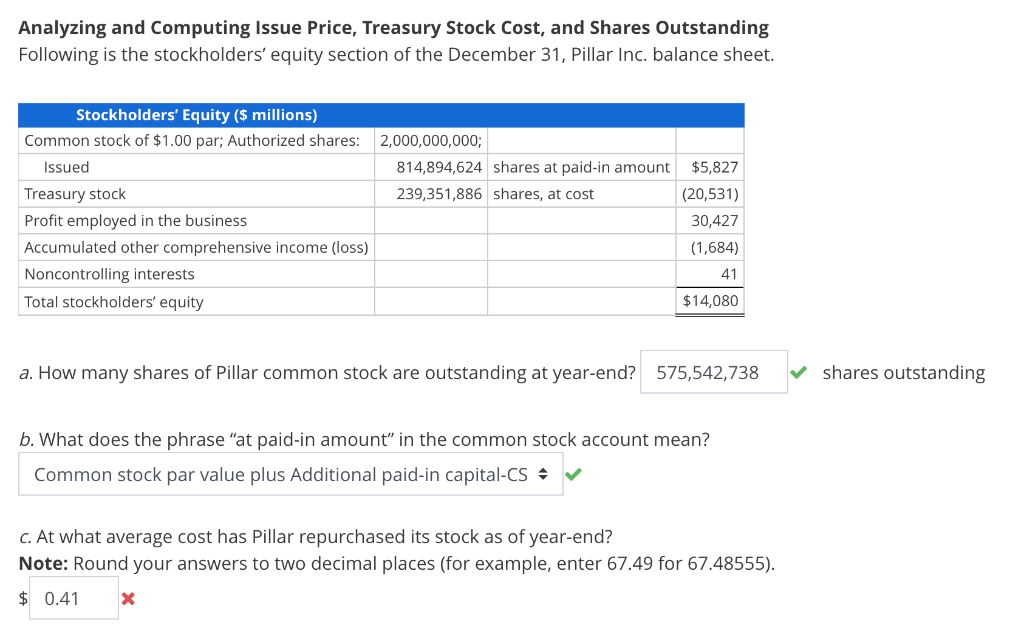

- Specific yield changes: The 2-year Treasury yield [Insert percentage change], the 5-year yield [Insert percentage change], the 10-year yield [Insert percentage change], and the 30-year yield [Insert percentage change]. [Include a chart here with alt text: "Treasury Yield Curve April 8th showing changes in 2, 5, 10, and 30-year yields."]

- Unusual movements: [Describe any unusual movements or anomalies observed, e.g., a significant jump in the 10-year yield, an unexpected flattening of the curve at a specific maturity.]

- Implications: This [Describe the shape of the yield curve observed and its implications. E.g., steepening curve might suggest expectations of strong economic growth, while an inversion could signal recessionary fears.]

Treasury Auction Results and Market Reaction

April 8th witnessed [Specify the type and amount of Treasury auctions held, e.g., a $30 billion 10-year note auction and a $20 billion 30-year bond auction.] The results provided valuable insights into investor demand for government debt.

- Auction results: The bid-to-cover ratio for the 10-year note auction was [Insert data], indicating [Interpret the bid-to-cover ratio, e.g., strong or weak demand]. The high yield was [Insert data]. Similar data for the 30-year bond should also be included. [Insert table here with alt text: "Treasury Auction Results April 8th showing bid-to-cover ratio and high yield for 10-year and 30-year bonds."]

- Market reaction: The market reacted [Describe the market's reaction: positive, negative, or neutral. Provide evidence for your assessment, such as price movements immediately following the auction.] to these results. This suggests [Explain the implied investor sentiment based on market reaction.]

- Broader market trends: The auction results aligned with [Relate the auction outcome to prevailing market trends, e.g., a flight to safety, increased risk aversion, or renewed confidence in the economy.]

Impact of Economic Indicators on Treasury Market Performance

Several key economic indicators released around April 8th significantly impacted Treasury market performance. [Specify the indicators, e.g., inflation data (CPI or PPI), employment figures (nonfarm payrolls), consumer confidence index.]

- Correlation between indicators and yield movements: The release of [Specify economic indicator] showing [State the result of the indicator e.g., higher-than-expected inflation] led to [Explain the effect on Treasury yields, e.g., a rise in yields as investors anticipated further interest rate hikes.]

- Investor expectations: This data reinforced investor expectations of [Describe what the economic data implied for the future, e.g., continued monetary tightening by the central bank.]

- Unexpected news: [Discuss any unexpected economic news and its subsequent impact on Treasury yields and market sentiment. For example: "The unexpected drop in consumer confidence led to a temporary flight to safety, pushing Treasury yields slightly lower."]

Trading Volume and Volatility on April 8th

Trading volume in the Treasury market on April 8th was [State the volume level – high, low, or average. Compare to recent historical averages.]. Price volatility was [Describe the volatility level – high, low, or average. Compare to recent historical averages.].

- Comparison to historical averages: [Provide details comparing volume and volatility to recent historical data to offer context.]

- Potential causes: The [high/low] volume and volatility could be attributed to [Offer potential reasons, e.g., anticipation of an upcoming policy announcement, reaction to specific news events, or changes in investor risk appetite.]

- Impact on investor strategies: The increased/decreased volatility may have influenced investor strategies, prompting [Explain the potential impact on investor decision-making, e.g., some investors might have adopted more cautious strategies during periods of high volatility.]

Conclusion

Analyzing the Treasury market's performance on April 8th reveals a complex interplay of factors. Yield curve movements, auction results, economic indicators, and trading volume all contributed to the overall market dynamics. The [summarize the overall market trend observed on April 8th, e.g., slight increase in yields driven by inflation concerns, or a period of relative stability despite economic uncertainty] highlights the importance of continuous monitoring and informed decision-making in the Treasury market. Stay informed about daily Treasury market performance by subscribing to our newsletter! For in-depth analysis of Treasury market trends, contact our financial experts today!

Featured Posts

-

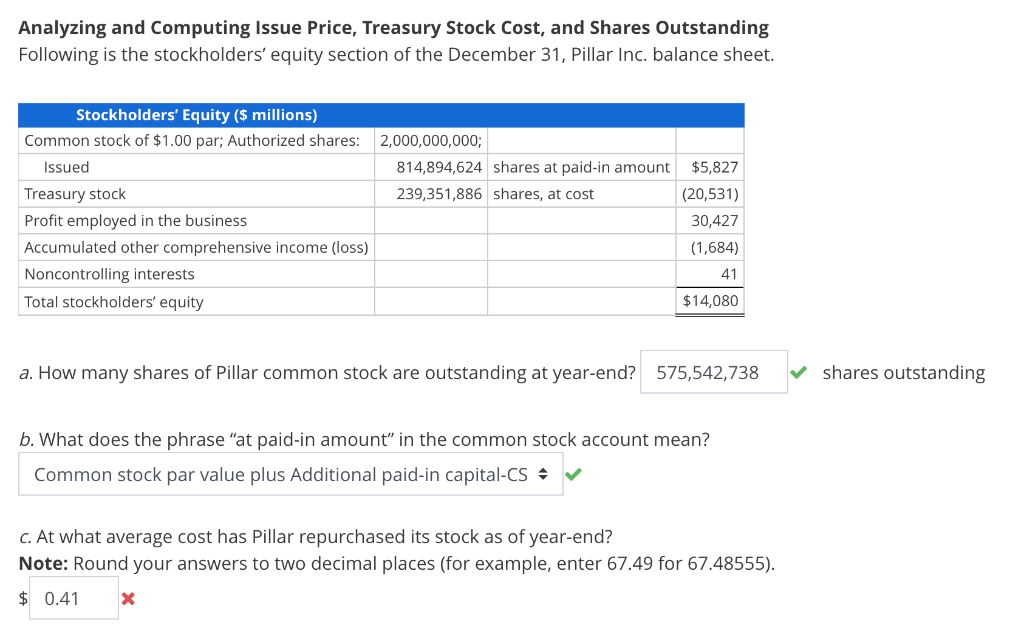

Shedeur Sanders Prank Call Son Of Falcons Defensive Coordinator Apologizes

Apr 29, 2025

Shedeur Sanders Prank Call Son Of Falcons Defensive Coordinator Apologizes

Apr 29, 2025 -

How To Have A Happy Day February 20 2025

Apr 29, 2025

How To Have A Happy Day February 20 2025

Apr 29, 2025 -

Chicago Office Market Meltdown The Rise Of Zombie Buildings

Apr 29, 2025

Chicago Office Market Meltdown The Rise Of Zombie Buildings

Apr 29, 2025 -

Top Universities Unite A Private Resistance To Trumps Agenda

Apr 29, 2025

Top Universities Unite A Private Resistance To Trumps Agenda

Apr 29, 2025 -

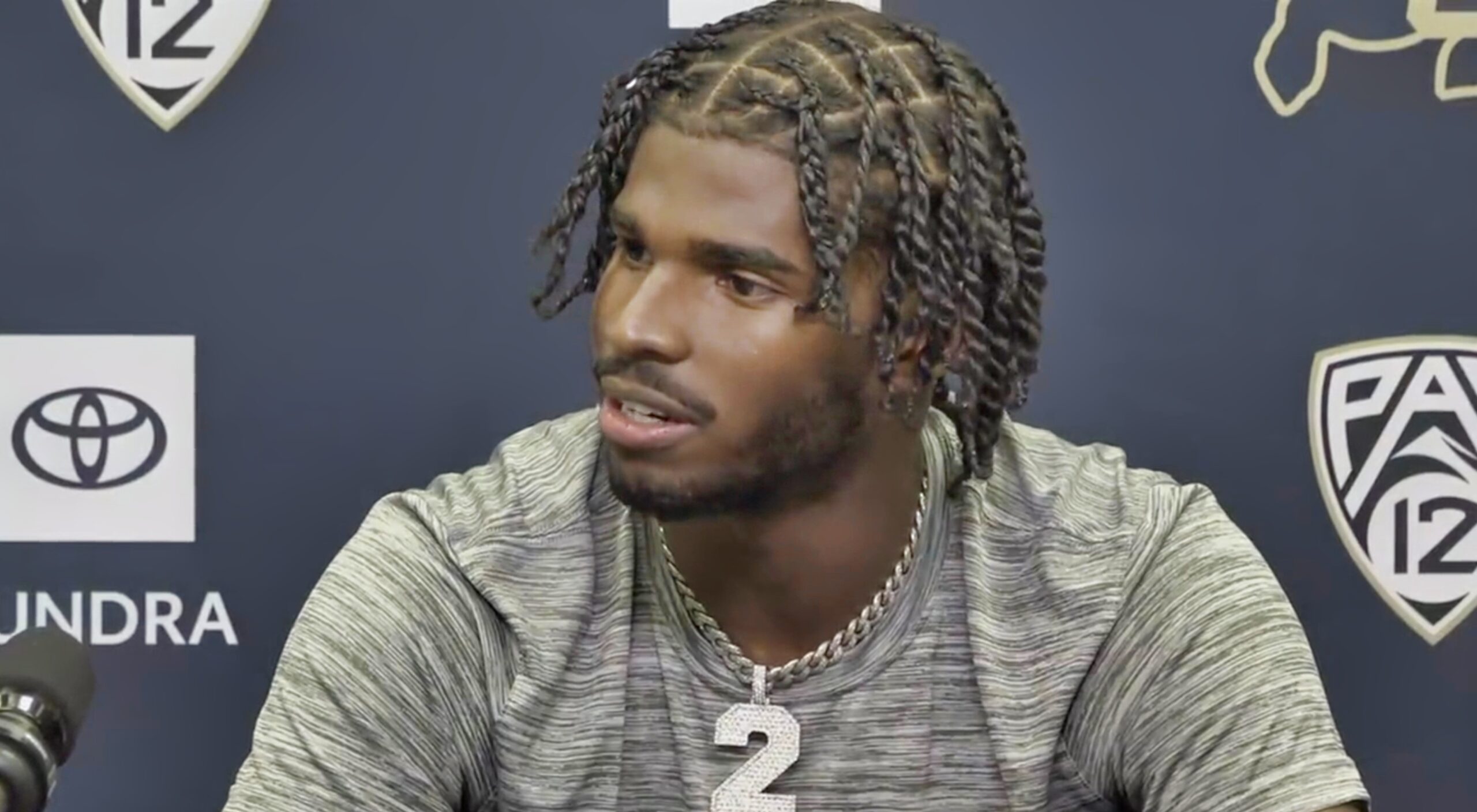

Fatal Wichita Black Hawk Crash Nyt Investigates Pilots Last Actions

Apr 29, 2025

Fatal Wichita Black Hawk Crash Nyt Investigates Pilots Last Actions

Apr 29, 2025

Latest Posts

-

Convicted Cardinal Claims Right To Participate In Papal Conclave

Apr 29, 2025

Convicted Cardinal Claims Right To Participate In Papal Conclave

Apr 29, 2025 -

Debate Ensues Can A Convicted Cardinal Vote In The Next Papal Conclave

Apr 29, 2025

Debate Ensues Can A Convicted Cardinal Vote In The Next Papal Conclave

Apr 29, 2025 -

Papal Conclave Convicted Cardinals Voting Eligibility Questioned

Apr 29, 2025

Papal Conclave Convicted Cardinals Voting Eligibility Questioned

Apr 29, 2025 -

Reaching A Mature Audience You Tubes Expanding Viewership Npr

Apr 29, 2025

Reaching A Mature Audience You Tubes Expanding Viewership Npr

Apr 29, 2025 -

You Tubes Senior Surge Demographics And Engagement Strategies Npr

Apr 29, 2025

You Tubes Senior Surge Demographics And Engagement Strategies Npr

Apr 29, 2025