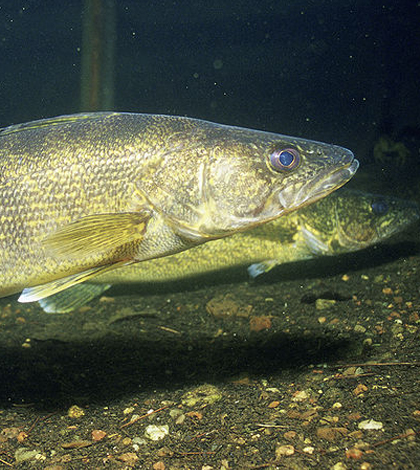

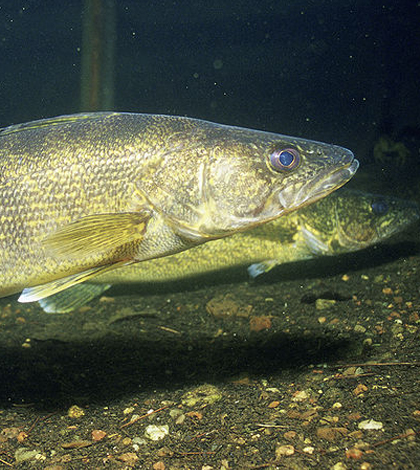

Analyzing The Walleye Credit Cut: Realigning Commodities Teams With Core Group Priorities

Table of Contents

Understanding the Impact of the Walleye Credit Cut on Commodities Trading

The Walleye Credit Cut has had a profound and multifaceted impact on commodities trading, creating significant challenges and altering the dynamics of the market. Understanding these consequences is the first step towards effective adaptation.

Reduced Trading Capacity

The credit cut directly limits the capacity of commodities trading firms. This is manifested in several ways:

- Reduced access to credit lines: Many firms relied on readily available credit lines to finance large trades. The cut significantly reduces this access, limiting their ability to engage in high-volume trading.

- Increased margin requirements: Brokers and exchanges have responded to the credit crunch by increasing margin requirements, meaning traders need to tie up more capital for each trade, further reducing their trading capacity.

- Difficulty securing financing for large trades: Securing financing for substantial commodity transactions has become considerably more challenging, impacting the ability to participate in major deals and potentially leading to missed opportunities.

Increased Risk and Volatility

The Walleye Credit Cut has increased risk and volatility in the commodities market. This heightened uncertainty necessitates a more cautious and strategic approach:

- Higher potential for losses: Reduced trading capacity and increased margin requirements directly increase the potential for losses, especially during periods of market volatility.

- Need for more robust risk management strategies: Firms must implement or strengthen their risk management strategies to mitigate the increased exposure to loss. This includes more sophisticated hedging techniques and closer monitoring of market movements.

- Increased scrutiny from regulatory bodies: Regulatory bodies are likely to increase scrutiny of trading activities in the wake of the credit cut, demanding greater transparency and stricter adherence to compliance regulations.

Shifts in Market Dynamics

The credit cut has fundamentally altered the competitive landscape of the commodities market:

- Smaller players forced out: Firms with limited capital or weaker risk management strategies may be forced out of the market entirely, unable to withstand the increased pressure.

- Consolidation among larger firms: Larger, more financially stable firms are likely to consolidate their market share, acquiring smaller players or benefiting from the exit of competitors.

- Changing pricing dynamics: The reduced trading capacity and increased risk can lead to fluctuations in pricing, creating both challenges and opportunities for traders who can effectively navigate this new environment.

Realigning Commodities Teams for Enhanced Efficiency and Focus

Adapting to the post-Walleye Credit Cut environment requires a strategic realignment of commodities teams to maximize efficiency and focus on core competencies.

Prioritizing Core Competencies

Identifying and focusing on core competencies is paramount for survival and growth:

- Identifying most profitable commodities: Companies need to analyze their performance data and identify which commodities offer the highest profit margins, focusing resources on these areas.

- Streamlining operations: Inefficient processes and unnecessary expenses need to be eliminated to improve profitability and reduce vulnerability.

- Eliminating non-core activities: Non-core activities that drain resources without generating significant returns should be outsourced or discontinued.

Optimizing Team Structure and Roles

Restructuring teams to improve efficiency is crucial:

- Reassigning personnel to key areas: Personnel should be strategically reassigned to focus on high-priority areas, such as risk management and core commodity trading.

- Creating specialized teams: Creating specialized teams focused on specific commodities or trading strategies can improve expertise and efficiency.

- Leveraging technology for automation: Utilizing automation tools can streamline processes, reduce manual labor, and improve accuracy.

Implementing Robust Risk Management Strategies

Mitigating risk is more crucial than ever:

- Strengthening risk assessment processes: Companies must enhance their risk assessment processes to better identify and manage potential threats.

- Implementing stricter credit controls: More stringent credit controls are necessary to limit exposure to counterparty risk.

- Diversifying trading portfolios: Diversifying trading portfolios across different commodities can help mitigate risk associated with individual market fluctuations.

Leveraging Technology and Data Analytics in the Post-Walleye Credit Cut Environment

Technology and data analytics play a critical role in adapting to the new market reality.

Enhanced Data Analytics for Improved Decision-Making

Data-driven decision-making is crucial for success:

- Predictive modeling for risk assessment: Using advanced analytics to predict potential risks and develop strategies to mitigate them.

- Market trend analysis: Leveraging data analytics to identify emerging market trends and opportunities.

- Optimizing trading strategies: Using data-driven insights to refine trading strategies and improve profitability.

Utilizing Automated Trading Systems

Automation can improve efficiency and reduce risk:

- Algorithmic trading: Implementing algorithms to execute trades automatically, based on predefined parameters.

- High-frequency trading: Leveraging high-frequency trading systems to capitalize on short-term market fluctuations.

- Automated risk management systems: Using automated systems to monitor and manage risk in real-time.

Implementing Advanced Communication and Collaboration Tools

Effective communication is vital:

- Real-time data sharing: Providing team members with access to real-time data to improve decision-making.

- Improved team coordination: Utilizing collaborative tools to improve communication and coordination among team members.

- Enhanced client communication: Maintaining clear and effective communication with clients to build and maintain trust.

Conclusion

The "Walleye Credit Cut" presents significant challenges to commodities teams, necessitating a strategic realignment of priorities and operational structures. By prioritizing core competencies, leveraging technology, and implementing robust risk management strategies, companies can navigate this new landscape effectively. Understanding the implications of the Walleye Credit Cut is vital for long-term success in the commodities market. Take proactive steps to analyze your current strategies and implement the necessary changes to ensure your team's continued profitability and resilience in this evolving environment. Don't wait – start analyzing the impact of the Walleye Credit Cut on your operations today.

Featured Posts

-

Rookies Strong Performance Threatens Veteran Roster Spots

May 13, 2025

Rookies Strong Performance Threatens Veteran Roster Spots

May 13, 2025 -

Byds Global Ambitions Half Its Car Sales Outside China By 2030

May 13, 2025

Byds Global Ambitions Half Its Car Sales Outside China By 2030

May 13, 2025 -

Top Efl Highlights Must See Goals And Matches

May 13, 2025

Top Efl Highlights Must See Goals And Matches

May 13, 2025 -

La And Orange County Face Record Breaking Heat Safety Tips And Precautions

May 13, 2025

La And Orange County Face Record Breaking Heat Safety Tips And Precautions

May 13, 2025 -

Doom Eternal Soundtrack A Waiting Room Playlist For The Dark Ages

May 13, 2025

Doom Eternal Soundtrack A Waiting Room Playlist For The Dark Ages

May 13, 2025