Analyzing Trump's Oil Price Outlook: Goldman Sachs' Social Media Scrutiny

Table of Contents

Trump's Energy Policies and Their Impact on Oil Prices

Trump's energy policies significantly impacted global oil markets. His administration's approach focused heavily on deregulation and boosting domestic production.

Deregulation and Increased Domestic Production

Trump's approach to deregulation included championing projects like the Keystone XL pipeline and easing environmental regulations on drilling and extraction. This led to a noticeable increase in US oil production. Data from the EIA (Energy Information Administration) shows a substantial rise in US crude oil production from approximately 9 million barrels per day (bpd) in early 2017 to over 12 million bpd by late 2019. This increased supply contributed to lower global oil prices, although the exact correlation is complex and influenced by various other factors. However, this surge in production came at a cost, with critics pointing to increased environmental concerns and potential long-term damage to ecosystems.

- Keystone XL Pipeline: Approval signaled a shift towards increased reliance on fossil fuels.

- Environmental Regulation Rollbacks: These actions eased restrictions on drilling and fracking, boosting domestic production.

- Impact on Prices: Increased supply generally exerts downward pressure on prices, though geopolitical factors often offset this.

OPEC Relations and Global Oil Market Dynamics

Trump's administration engaged with OPEC (Organization of the Petroleum Exporting Countries) in a dynamic and often unpredictable manner. While there were periods of cooperation, aimed at stabilizing oil prices, there were also instances of tension, particularly regarding Iran sanctions which impacted global supply. These sanctions, while aimed at curbing Iran's nuclear ambitions, contributed to oil price volatility. Trump’s unpredictable foreign policy approach added to market uncertainty, making it harder to predict oil price trends solely based on production levels.

- Iran Sanctions: Significantly impacted global oil supply and contributed to price fluctuations.

- OPEC Negotiations: The US's role in these negotiations often shifted, creating uncertainty in the market.

- Geopolitical Instability: Events in the Middle East consistently influenced both supply and demand, making predictions challenging.

Impact of the COVID-19 Pandemic

The COVID-19 pandemic dramatically impacted global oil demand. Lockdowns and travel restrictions caused an unprecedented drop in oil consumption, leading to a sharp decline in prices—a phenomenon that even Trump’s policies could not fully counteract. The initial response focused primarily on economic stimulus packages aimed at cushioning the broader economic impact rather than direct intervention in the oil market. The subsequent recovery in oil prices, starting in mid-2020, was gradual and uneven, reflecting the uneven nature of the global economic rebound.

- Demand Shock: The pandemic triggered an unprecedented decrease in global oil demand.

- Price Crash: Oil prices plummeted to historically low levels.

- Recovery: The post-pandemic recovery in oil prices was gradual and influenced by vaccination rates and economic recovery.

Goldman Sachs' Social Media Strategy and Oil Market Commentary

Goldman Sachs, a leading investment bank, utilizes social media extensively to disseminate its market analysis, including commentary on oil prices. Their strategy aims to influence market sentiment and build their brand as a thought leader.

Dissemination of Market Analysis

Goldman Sachs uses platforms like Twitter and LinkedIn to share its oil price forecasts, research reports, and expert opinions. Their posts often feature concise summaries of market trends, technical analyses, and projections for future price movements. The tone varies, from cautiously optimistic to overtly bearish depending on market conditions.

- Twitter: Used for quick updates, market commentary, and engagement with followers.

- LinkedIn: Used for longer-form content, research reports, and professional networking.

- Influence: Goldman Sachs' substantial online following translates to significant reach and potential impact on market sentiment.

Public Perception and Market Reactions

Goldman Sachs' social media commentary can significantly influence investor behavior. Positive forecasts might lead to increased buying pressure, while negative predictions can trigger selling. Public reaction is highly diverse, with some investors closely following their recommendations, while others remain skeptical or view the commentary as self-serving marketing. The bank's substantial influence necessitates careful scrutiny of their statements.

- Investor Behavior: Market participants often consider Goldman Sachs' analysis when making investment decisions.

- Public Opinion: Public perception of Goldman Sachs' commentary is influenced by the accuracy of past predictions.

- Controversies: Occasional controversies arise regarding the objectivity of their analysis and potential conflicts of interest.

Comparison with other Financial Institutions

Goldman Sachs' social media strategy is comparable to other major financial institutions, though specific approaches differ. Some institutions favor a more academic and data-driven approach, while others adopt a more populist and engaging tone. The effectiveness of each strategy is subjective, and often depends on the specific target audience. The overall trend shows increased use of social media by financial institutions to reach a broader audience.

Analyzing the Correlation Between Trump's Policies and Goldman Sachs' Analysis

Analyzing the correlation between Trump's policies and Goldman Sachs' analysis requires a careful examination of their predictions and the subsequent market outcomes.

Alignment of Predictions and Actual Outcomes

Comparing Goldman Sachs' predictions on oil prices with the actual market performance during Trump's presidency reveals varying degrees of accuracy. While they correctly predicted some general trends (e.g., the initial price drop caused by the pandemic), their specific price targets sometimes deviated from the actual outcomes. This discrepancy highlights the inherent difficulty in accurately predicting oil prices, impacted by numerous interconnected factors.

- Accuracy: Analyzing the accuracy of Goldman Sachs' predictions requires evaluating both the timing and magnitude of price changes.

- Bias: Scrutinizing potential biases in their analysis is crucial for objective evaluation.

- Limitations: Recognizing limitations imposed by the complexity of the oil market is essential.

Influence of Political Factors on Market Predictions

Trump's policies undoubtedly influenced Goldman Sachs' predictions. Changes in regulations, geopolitical stances, and trade agreements directly impacted the bank’s analysis. While determining if Goldman Sachs demonstrated a pro- or anti-Trump bias is complex and requires extensive analysis, identifying their reactions to significant policy shifts is vital in understanding the correlation between political action and market prediction.

- Policy Impact: Trump's actions significantly altered the variables considered in Goldman Sachs' forecasting models.

- Bias Detection: Determining any underlying political bias in their analysis requires further investigation.

- Market Sensitivity: The speed and nature of market response to political shifts indicate the interplay between policy and prediction.

Conclusion: Understanding the Interplay of Politics, Finance, and Social Media in Shaping Trump's Oil Price Outlook

This analysis reveals a complex interplay between Trump's energy policies, Goldman Sachs' social media commentary, and the resulting oil price movements. While Trump's deregulation efforts led to increased domestic production, the impact on global prices was influenced by other factors, including OPEC relations, geopolitical events, and the unprecedented demand shock caused by the COVID-19 pandemic. Goldman Sachs' social media strategy played a role in shaping public perception, influencing investor behavior through the dissemination of their market analysis, though the accuracy and potential bias of their predictions require ongoing scrutiny. Understanding “Trump's oil price outlook” necessitates a critical assessment of the interplay between political decisions, financial analysis, and the power of social media in shaping market sentiment. Further research is needed to fully explore the long-term impacts of Trump's energy policies on global oil markets and the evolving role of social media in financial market analysis. Continue researching “Trump's oil price outlook” and critically analyze information from diverse sources to gain a more comprehensive understanding of this complex topic.

Featured Posts

-

Golden State Warriors Triumph Jimmy Butlers Impact Against Houston Rockets

May 15, 2025

Golden State Warriors Triumph Jimmy Butlers Impact Against Houston Rockets

May 15, 2025 -

Ver Roma Monza En Directo Online Y Gratis

May 15, 2025

Ver Roma Monza En Directo Online Y Gratis

May 15, 2025 -

The Luka Doncic Trade Vs Jalen Brunson Leaving Dallas A Mavericks Perspective

May 15, 2025

The Luka Doncic Trade Vs Jalen Brunson Leaving Dallas A Mavericks Perspective

May 15, 2025 -

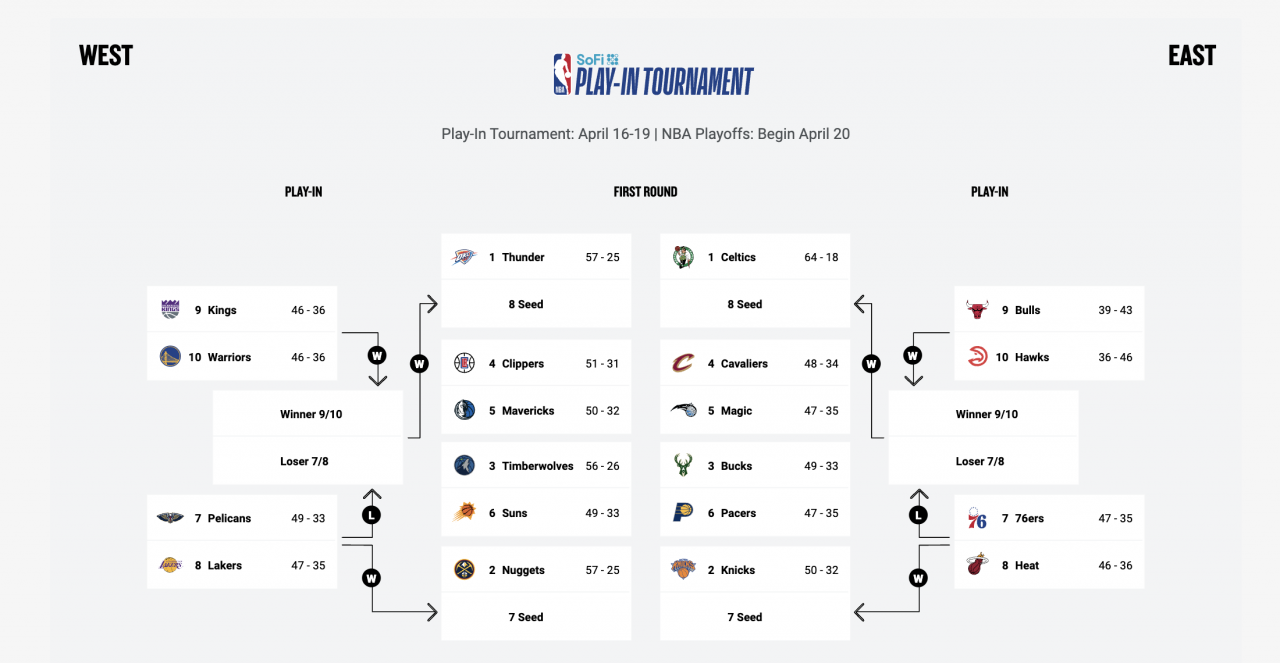

Nba Play In Warriors Grizzlies Matchup Preview

May 15, 2025

Nba Play In Warriors Grizzlies Matchup Preview

May 15, 2025 -

Tarim Kredi Koop Ciftci Marketleri 2 4 Mayis 2025 Indirim Guenleri

May 15, 2025

Tarim Kredi Koop Ciftci Marketleri 2 4 Mayis 2025 Indirim Guenleri

May 15, 2025