Analyzing Uber's Stock Performance Amidst Recessionary Fears

Table of Contents

Impact of Inflation and Reduced Consumer Spending on Uber's Revenue

Inflation and reduced consumer spending are directly impacting Uber's revenue streams. As disposable income shrinks, consumers are cutting back on discretionary spending, leading to a decrease in ride-hailing demand. This is further exacerbated by a shift in consumer behavior towards cheaper transportation alternatives, such as public transport or carpooling.

- Decreased discretionary spending leading to fewer rides: With less money available, people are opting for fewer Uber rides, impacting revenue directly.

- Shift in consumer behavior towards cheaper alternatives: Budget-conscious consumers are actively seeking more affordable transportation options, impacting Uber's market share.

- Impact on Uber Eats demand due to reduced restaurant spending: Inflation is also impacting restaurant spending, resulting in a decline in Uber Eats orders. Consumers are either cooking more at home or choosing cheaper dining options.

- Analysis of Uber's pricing strategies during inflationary periods: Uber's pricing strategies during this period will be critical. Maintaining high prices could further decrease demand, while lowering prices might negatively impact profit margins. Finding the right balance is key to navigating this economic challenge.

Charts illustrating the correlation between inflation rates, consumer spending, and Uber's ride volume and Uber Eats order numbers would provide a clearer picture of the impact.

Uber's Strategic Responses to Recessionary Pressures

To mitigate the negative impacts of the recession, Uber is implementing several strategic responses. These are crucial in determining Uber's stock performance and the company's ability to weather the economic storm.

- Cost-cutting measures (e.g., layoffs, reduced marketing spending): To improve profitability, Uber has undertaken cost-cutting measures, including layoffs and reduced marketing expenditure.

- Focus on profitability over growth: The company's focus has shifted from aggressive growth to prioritizing profitability, reflected in its financial reporting and strategic decisions.

- Expansion into new markets or service offerings: Diversification into new markets and service offerings can help to mitigate the risks associated with reliance on a single sector. Expansion into areas less sensitive to economic downturns is a key strategy.

- Investment in technology to improve efficiency: Investments in technology aimed at increasing efficiency and reducing operational costs are essential for long-term sustainability. This includes advancements in ride-matching algorithms and delivery optimization.

The effectiveness of these strategies will significantly influence Uber's future stock performance and its ability to maintain a strong market position.

Analyzing Key Financial Metrics of Uber's Stock Performance

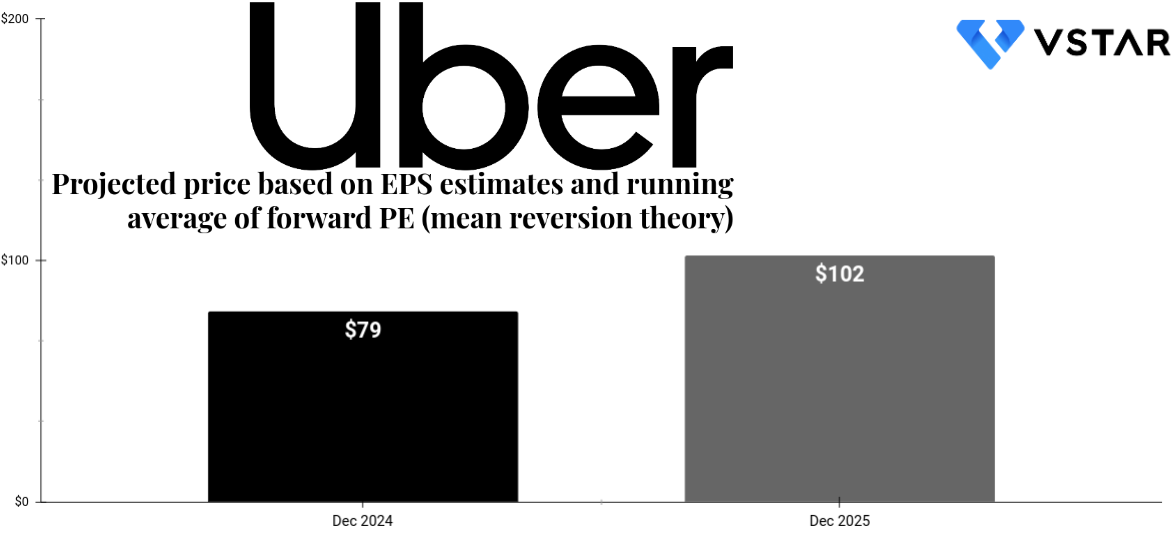

Analyzing Uber's financial performance involves a deep dive into key metrics. This includes examining revenue growth, earnings per share (EPS), price-to-earnings ratio (P/E), and market capitalization. Comparing these metrics to those of competitors like Lyft provides valuable insights into Uber's relative position within the industry. Charts and graphs illustrating these metrics over time would provide a visual representation of Uber's stock performance against the backdrop of the economic downturn. Analyzing revenue growth in both its ride-sharing and food delivery segments separately is crucial to understanding the impact of the recession on each business line.

Investor Sentiment and Future Predictions for Uber's Stock

Investor sentiment toward Uber's stock is a crucial indicator of its future performance. Analyst ratings, predictions, and news coverage influence investor decisions. Analyzing short-term versus long-term stock outlooks will provide a comprehensive understanding.

- Short-term vs. long-term stock outlook: While short-term predictions may be pessimistic due to immediate economic pressures, long-term forecasts might be more optimistic, considering Uber's potential for growth and market dominance.

- Risk assessment for investors: Investing in Uber during a recession carries inherent risks, including potential further declines in stock price due to decreased demand and increased competition.

- Potential catalysts for stock price appreciation or depreciation: Positive catalysts could include successful cost-cutting measures, the expansion into new profitable markets, and improvements in operational efficiency. Negative catalysts could include an extended recession, increased competition, or regulatory changes.

Considering expert opinions and market analyses is crucial in gauging investor sentiment and forecasting potential movements in Uber's stock price.

Conclusion: Uber's Stock Performance: A Recessionary Outlook and Investment Considerations

In conclusion, analyzing Uber's stock performance during this period of recessionary fears requires a multifaceted approach. The impact of inflation and reduced consumer spending on Uber's revenue is undeniable. However, the company's strategic responses, including cost-cutting and a focus on profitability, are attempts to mitigate these challenges. Analyzing key financial metrics and investor sentiment provides a clearer picture of the current situation and potential future outcomes.

While uncertainty remains, a thorough understanding of Uber's stock performance and its relationship to broader economic factors is vital for investors. It's crucial to conduct further research, stay updated on the latest news and analyses of Uber's stock and the overall economic climate, and make informed investment decisions based on a comprehensive understanding of the risks and opportunities. Understanding Uber's stock performance requires continuous monitoring of these factors and a nuanced approach to investment strategies.

Featured Posts

-

Bueckers Open Invitation Which Mavericks Star Will Attend A Wings Game

May 19, 2025

Bueckers Open Invitation Which Mavericks Star Will Attend A Wings Game

May 19, 2025 -

Kibris Ta Yeni Bir Baslangic Stefanos Stefanu Nun Rolue

May 19, 2025

Kibris Ta Yeni Bir Baslangic Stefanos Stefanu Nun Rolue

May 19, 2025 -

Cellcom Network Outage Lengthy Recovery Expected For Users

May 19, 2025

Cellcom Network Outage Lengthy Recovery Expected For Users

May 19, 2025 -

I Anastasi Toy Lazaroy Sta Ierosolyma Gegonota And Symvola

May 19, 2025

I Anastasi Toy Lazaroy Sta Ierosolyma Gegonota And Symvola

May 19, 2025 -

Cooke Maroney And Jennifer Lawrence Couple Steps Out Following Second Child Speculation

May 19, 2025

Cooke Maroney And Jennifer Lawrence Couple Steps Out Following Second Child Speculation

May 19, 2025