Analyzing Uber's Stock Performance During Economic Uncertainty

Table of Contents

Uber's Business Model and Vulnerability to Economic Downturns

Uber's business model relies heavily on discretionary spending. Its core services – ride-hailing and food delivery (Uber Eats) – are considered non-essential for most consumers. This inherent characteristic makes Uber particularly vulnerable to economic downturns. When consumers tighten their belts, they are likely to reduce spending on these services first.

The impact of reduced consumer spending on ride-hailing and delivery services is significant. During periods of economic uncertainty, several factors come into play:

- Decreased demand for rides during recessions: As unemployment rises and disposable income falls, people are less likely to use ride-sharing services, opting for cheaper alternatives like public transport or carpooling.

- Lower restaurant orders impacting Uber Eats revenue: Consumers cut back on dining out and food delivery during economic hardship, directly impacting Uber Eats' revenue stream. This is especially true for higher-priced restaurant options.

- Potential for increased price sensitivity among consumers: During tough economic times, consumers become more price-sensitive. Uber's pricing strategies, and the pricing strategies of restaurants on the Uber Eats platform, will need to be carefully considered to balance profitability with maintaining sufficient demand.

- Impact of inflation on operating costs: Rising inflation increases Uber's operational costs, including fuel prices, driver compensation, and marketing expenses, further squeezing profitability margins.

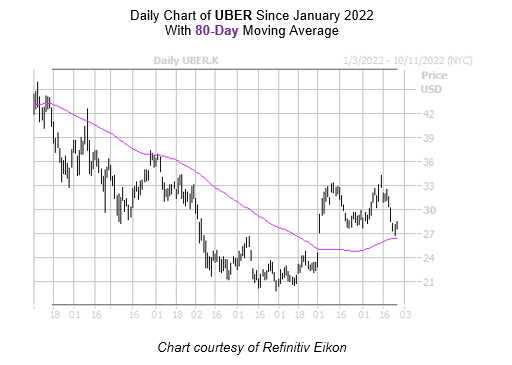

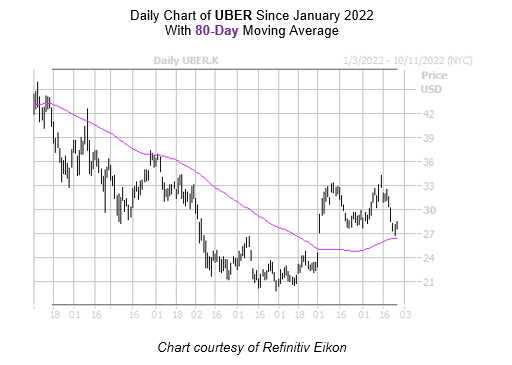

Analyzing Uber's Stock Price Volatility During Past Recessions

Examining Uber's stock performance during previous economic downturns, such as the COVID-19 pandemic, provides valuable insights. The pandemic initially caused a dramatic drop in Uber's stock price due to widespread lockdowns and reduced consumer mobility. However, the subsequent recovery, fueled by the growth of Uber Eats, demonstrated a degree of resilience.

Analyzing historical data reveals correlations between macroeconomic indicators and Uber's stock price. For instance:

- Specific examples of stock price drops during economic crises: Analyzing past data points to specific instances where negative economic news (e.g., a significant increase in unemployment) directly correlated with drops in Uber's stock price.

- Comparison with other transportation and tech stocks: Benchmarking Uber's performance against similar companies within the transportation and technology sectors can help identify industry-specific trends versus company-specific vulnerabilities.

- Analysis of investor sentiment during these periods: Understanding investor sentiment through news articles, social media trends, and analyst reports can provide context for stock price fluctuations.

- Charts and graphs visualizing stock performance vs. economic indicators: Visual representations are crucial for effectively communicating the relationship between Uber's stock price and macroeconomic factors like GDP growth and consumer confidence.

Factors Influencing Uber's Resilience

Despite its vulnerability to economic downturns, Uber has demonstrated some resilience. Several factors contribute to this:

- Expansion into new markets and service offerings: Uber's diversification beyond ride-hailing, including Uber Eats and Uber Freight, provides multiple revenue streams, lessening its dependence on any single sector.

- Technological advancements improving operational efficiency: Investments in technology, such as route optimization and dynamic pricing algorithms, improve efficiency and profitability.

- Successful cost reduction initiatives: Uber's ability to implement cost-cutting measures during economic downturns, such as reducing marketing expenses or streamlining operations, is crucial for its survival.

- The role of strategic partnerships and acquisitions: Strategic alliances and acquisitions can provide access to new markets, technologies, or customer bases, helping to buffer against economic headwinds.

Predicting Future Uber Stock Performance

Predicting Uber's future stock performance requires considering current economic forecasts and various potential scenarios. Factors to consider include:

- Long-term growth prospects for the ride-sharing and delivery sectors: The long-term potential of these sectors, particularly in developing economies, remains significant.

- Potential for technological disruption and its impact: Technological advancements, such as autonomous vehicles, could fundamentally change the industry, presenting both opportunities and threats.

- Risks associated with increased competition and regulation: Intense competition and increasing regulatory scrutiny pose ongoing challenges to Uber's profitability.

- Consideration of environmental, social, and governance (ESG) factors: Growing awareness of ESG issues is influencing investor decisions, placing pressure on Uber to improve its sustainability and ethical practices.

Conclusion

This analysis of Uber's stock performance during economic uncertainty reveals a complex interplay between macroeconomic conditions and the company's business model. While vulnerable to downturns, Uber's diversification efforts and cost-cutting measures offer a degree of resilience. Past performance, however, is not indicative of future results. Understanding the factors influencing Uber stock performance during economic uncertainty is crucial for informed investment decisions. Further research and monitoring of key economic indicators are recommended before making any investment choices related to Uber stock. Stay informed about Uber's stock performance and economic uncertainty to make well-informed decisions.

Featured Posts

-

Destino Ranchs Next Gen Media Infrastructure A Strategic Alliance Between Golden Triangle Ventures Lavish Entertainment And Viptio

May 18, 2025

Destino Ranchs Next Gen Media Infrastructure A Strategic Alliance Between Golden Triangle Ventures Lavish Entertainment And Viptio

May 18, 2025 -

Prison Overcrowding Government To Expedite Early Releases Despite Wilders Opposition

May 18, 2025

Prison Overcrowding Government To Expedite Early Releases Despite Wilders Opposition

May 18, 2025 -

5 26 52

May 18, 2025

5 26 52

May 18, 2025 -

Invest In The Future The Countrys Newest Business Hot Spots

May 18, 2025

Invest In The Future The Countrys Newest Business Hot Spots

May 18, 2025 -

Nuoga Bianca Censori Kanye Westo Provokacija

May 18, 2025

Nuoga Bianca Censori Kanye Westo Provokacija

May 18, 2025

Latest Posts

-

Survei Median Dukungan Kuat Rakyat Indonesia Untuk Kedaulatan Palestina

May 18, 2025

Survei Median Dukungan Kuat Rakyat Indonesia Untuk Kedaulatan Palestina

May 18, 2025 -

Daily Lotto April 28 2025 Winning Numbers

May 18, 2025

Daily Lotto April 28 2025 Winning Numbers

May 18, 2025 -

Abd Li Dergi Tuerkiye Israil Catismasinin Artacagina Isaret Etti Erdogan Ve Netanyahu Nun Gelecegi

May 18, 2025

Abd Li Dergi Tuerkiye Israil Catismasinin Artacagina Isaret Etti Erdogan Ve Netanyahu Nun Gelecegi

May 18, 2025 -

Monday April 28 2025 Daily Lotto Numbers

May 18, 2025

Monday April 28 2025 Daily Lotto Numbers

May 18, 2025 -

Suriye Deki Catisma Abd Li Dergi Tuerkiye Ve Israil I Hedef Aliyor Erdogan Netanyahu Gerilimi

May 18, 2025

Suriye Deki Catisma Abd Li Dergi Tuerkiye Ve Israil I Hedef Aliyor Erdogan Netanyahu Gerilimi

May 18, 2025