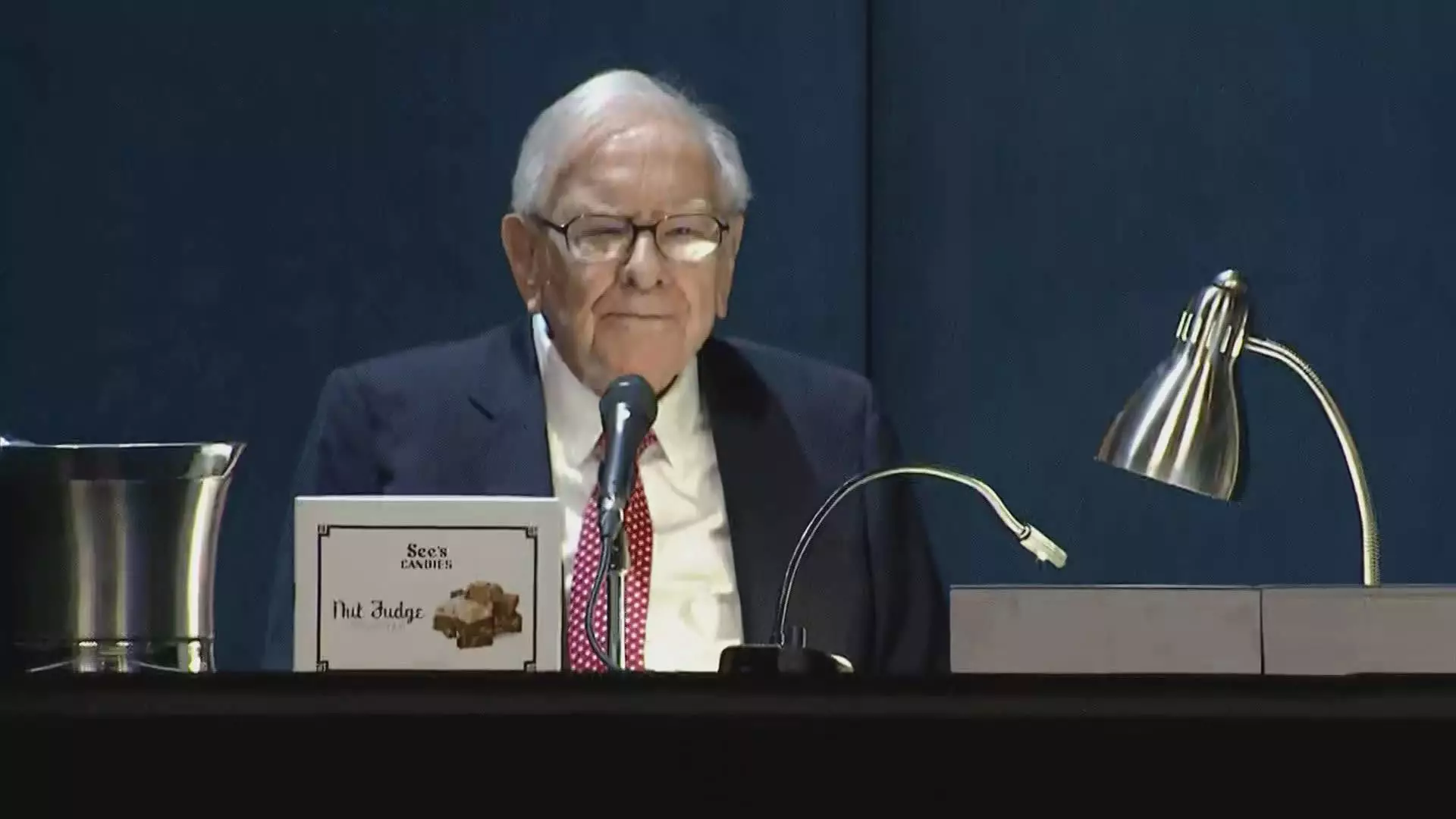

Analyzing Warren Buffett's Apple Strategy: Key Insights For Investors

Table of Contents

The Rationale Behind Buffett's Apple Investment

Buffett's investment in Apple wasn't a spur-of-the-moment decision; it was a calculated move based on a thorough understanding of the company's strengths and long-term potential. Several key factors contributed to his decision, offering valuable lessons for discerning investors.

Apple's Brand Strength and Consumer Loyalty

Apple boasts exceptional brand recognition and a cult-like following globally. This translates into incredibly high customer retention rates and unwavering brand loyalty, a cornerstone of sustainable business success. This loyalty isn't just anecdotal; it's reflected in market share data and consistently high customer satisfaction surveys.

- Exceptional brand recognition globally. Apple's logo is instantly recognizable worldwide, signifying quality, innovation, and a premium experience.

- High customer loyalty leading to repeat purchases. Apple users frequently remain within the Apple ecosystem, upgrading devices and purchasing complementary products.

- Strong ecosystem locking in customers. The seamless integration of Apple devices, software, and services creates a powerful network effect that makes switching brands difficult and expensive. This powerful ecosystem is a key factor in Apple’s sustained success and high customer retention.

Apple's Recurring Revenue Streams

Beyond hardware sales, Apple generates significant and increasingly important recurring revenue through its services business. This predictable income stream, fueled by subscription models, contributes significantly to the company's long-term stability and growth prospects. This is a key aspect that often goes unnoticed when evaluating a company's potential.

- Growing revenue from services like iCloud and Apple Music. These subscription services provide a steady flow of cash, less susceptible to the cyclical nature of hardware sales.

- App Store as a major revenue driver. The App Store generates billions in revenue annually through app sales, in-app purchases, and developer fees.

- Subscription model creates predictable future cash flow. Recurring revenue reduces the uncertainty inherent in many businesses, making financial forecasting easier and more reliable. This predictability is highly valuable for long-term investors.

Undervaluation and Long-Term Growth Potential

At the time of Buffett's initial investment, many analysts considered Apple to be undervalued relative to its intrinsic value—a key tenet of Buffett's value investing philosophy. He recognized Apple's potential for continued long-term growth across various markets, including wearables, services, and emerging markets. This vision extended beyond the current market sentiment and focused on the company’s fundamental strength.

- Initially perceived as undervalued by the market. Buffett recognized that the market's short-term focus was overlooking Apple's long-term potential.

- Significant growth potential in emerging markets. Apple still has substantial untapped growth potential in rapidly developing economies.

- Consistent innovation driving future growth. Apple's continuous investment in research and development ensures a pipeline of innovative products and services.

Key Benefits of Buffett's Apple Strategy

Buffett's Apple investment has yielded exceptional returns and significant benefits for Berkshire Hathaway's portfolio. These gains illustrate the power of long-term investing and strategic diversification.

Exceptional Returns on Investment

Berkshire Hathaway's Apple investment has generated substantial capital appreciation, significantly outperforming broader market benchmarks over the long term. This underscores the potential rewards of identifying and holding onto high-quality companies for the long haul.

- Significant capital appreciation. The value of Berkshire Hathaway's Apple holdings has increased dramatically since the initial investment.

- Outperformance compared to market benchmarks. The Apple investment has delivered returns far exceeding those of many other investments and market indices.

- Example of long-term investment success. This investment stands as a prime example of the rewards of patient, long-term investing.

Portfolio Diversification and Risk Mitigation

Apple's consistent revenue streams and strong brand contribute significantly to Berkshire Hathaway's overall portfolio diversification, reducing overall risk. This showcases the importance of balancing risk and reward in a diversified investment portfolio.

- Reduced portfolio volatility. Apple's relatively stable performance helps offset the volatility of other, riskier investments within the portfolio.

- Lower overall investment risk. Diversification across different asset classes and sectors mitigates the impact of individual investment losses.

- Counterbalances riskier investments. Apple acts as a ballast in the portfolio, reducing overall risk exposure.

Lessons for Investors from Buffett's Apple Strategy

Buffett's Apple investment provides several critical lessons for individual investors seeking to build a successful portfolio.

The Importance of Long-Term Investing

Buffett's success with Apple underscores the importance of adopting a long-term investment horizon, focusing on fundamental value and disregarding short-term market noise. Patience and discipline are paramount for long-term investment success.

- Avoid short-term market fluctuations. Focus on the underlying value of the company, rather than reacting to daily price changes.

- Focus on long-term growth potential. Identify companies with strong fundamentals and a clear path to sustained growth.

- Patience is crucial for investment success. Long-term investing requires discipline and the ability to withstand temporary market downturns.

Identifying Undervalued Companies with Strong Fundamentals

Buffett's approach emphasizes the importance of thorough fundamental analysis to identify companies trading below their intrinsic value. This requires looking beyond short-term market sentiment and focusing on the company's financial health, competitive advantages, and future growth prospects.

- Thorough due diligence before investment. Conduct comprehensive research to understand a company's business model, financial performance, and competitive landscape.

- Focus on strong financials and competitive moat. Identify companies with healthy balance sheets, robust cash flow, and sustainable competitive advantages.

- Understanding a company’s business model. A thorough understanding of how a company generates revenue and profit is crucial for evaluating its long-term potential.

The Power of Recurring Revenue Streams

The lesson from Apple's recurring revenue model is clear: identifying companies with predictable, recurring revenue sources is crucial for building a stable and growing portfolio. These streams provide greater predictability and higher valuations.

- Predictable future cash flows. Recurring revenue provides a more reliable foundation for future growth and earnings.

- Higher valuation multiples. Companies with strong recurring revenue tend to command higher valuations in the market.

- Greater investor confidence. Predictable cash flow increases investor confidence and reduces uncertainty.

Conclusion

Analyzing Warren Buffett's Apple strategy reveals several invaluable lessons for investors. His focus on strong brands, recurring revenue streams, and long-term growth potential highlights the importance of fundamental analysis and patient investing. By understanding these key insights and applying them to your own investment decisions, you can improve your chances of building a more robust and profitable portfolio. Learn from the Oracle of Omaha and start building your own successful investment strategy focusing on identifying undervalued companies with strong fundamentals and recurring revenue streams. Remember to always conduct thorough research and seek professional financial advice when necessary. Start analyzing potential investments today!

Featured Posts

-

Stiven King Novi Zayavi Pro Trampa Ta Maska

May 06, 2025

Stiven King Novi Zayavi Pro Trampa Ta Maska

May 06, 2025 -

Wembanyama Rend Hommage A Son Mentor Gregg Popovich

May 06, 2025

Wembanyama Rend Hommage A Son Mentor Gregg Popovich

May 06, 2025 -

Are You A True Stephen King Fan Test Your Knowledge With These 5 Books

May 06, 2025

Are You A True Stephen King Fan Test Your Knowledge With These 5 Books

May 06, 2025 -

71 Yasindaki Guelsen Bubikoglu Nun Sosyal Medya Paylasimi Bueyuek Ses Getirdi

May 06, 2025

71 Yasindaki Guelsen Bubikoglu Nun Sosyal Medya Paylasimi Bueyuek Ses Getirdi

May 06, 2025 -

Bollywood Outsider Madhu Chopra Discusses Priyanka Chopras Early Career Hardships

May 06, 2025

Bollywood Outsider Madhu Chopra Discusses Priyanka Chopras Early Career Hardships

May 06, 2025