Analyzing Warren Buffett's Investment History: Hits, Misses, And Insights

Table of Contents

Warren Buffett's Early Successes and the Genesis of His Investment Philosophy

Early Investing Experiences and the Influence of Benjamin Graham

Buffett's journey began with early forays into the world of investing, laying the groundwork for his now-famous value investing approach. The profound impact of Benjamin Graham's teachings on security analysis and value investing cannot be overstated. Graham's seminal work, "The Intelligent Investor," instilled in Buffett the importance of intrinsic value, margin of safety, and long-term perspective – principles that would define his career.

Early examples of his investment success include shrewd investments in undervalued textile businesses. These experiences, while modest in scale, provided invaluable lessons in identifying undervalued assets and understanding the importance of fundamental analysis. He learned to look beyond market noise and focus on the underlying financial health and long-term potential of a company.

- Key characteristics of Buffett's early investments:

- Undervalued assets significantly below their intrinsic value.

- Strong fundamentals, indicating sound financial health and profitability.

- A long-term vision, focused on patiently holding investments for years, even decades.

The Berkshire Hathaway Acquisition and its Significance

The acquisition of Berkshire Hathaway, initially a struggling textile company, represents a pivotal moment in Buffett's investment history. This wasn't merely a stock purchase; it was a strategic move that transformed a failing business into a diversified investment conglomerate, the vehicle through which he would build his legendary wealth.

Buffett's masterful transformation of Berkshire Hathaway showcased his ability to identify undervalued businesses with significant growth potential. By restructuring operations and leveraging his investment expertise, he not only salvaged the company but also built it into a powerful platform for deploying capital into a diverse range of profitable ventures.

- Key decisions that led to Berkshire Hathaway's remarkable growth:

- Identifying and capitalizing on undervalued assets within the company.

- Implementing a disciplined and diversified investment strategy.

- Cultivating a long-term perspective, avoiding short-term market pressures.

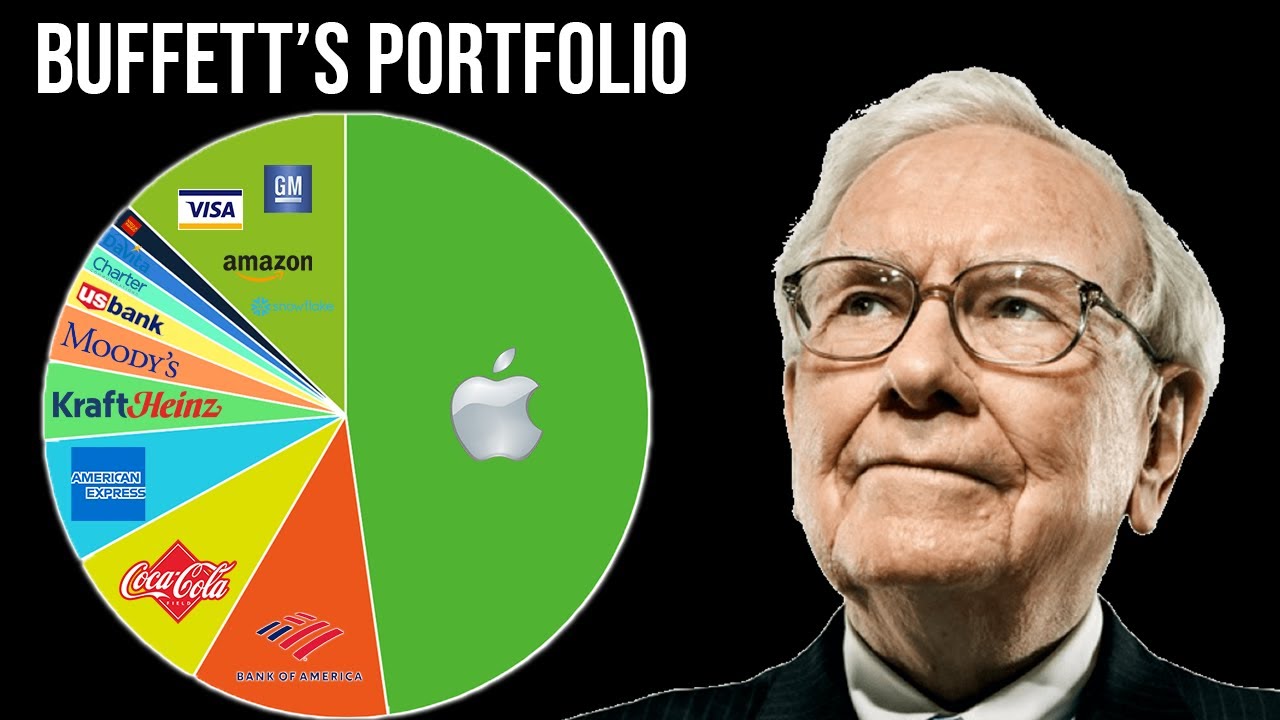

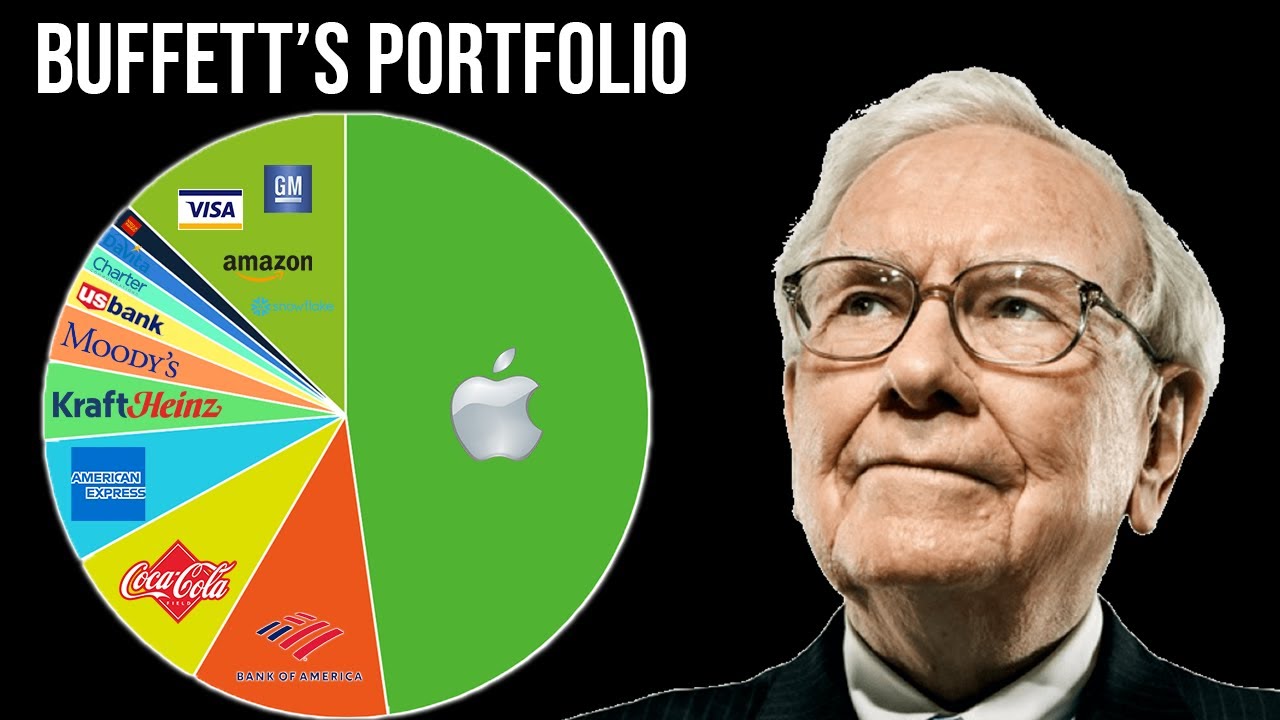

Notable Investments and Case Studies

Successful Investments (Coca-Cola, American Express):

Two of Buffett's most celebrated investments are Coca-Cola and American Express. These weren't fleeting opportunities; they were strategic acquisitions reflecting his understanding of strong brands, durable competitive advantages, and consistent profitability. Buffett's deep understanding of the business models and management quality played a significant role in the success of these investments. He recognized the enduring power of these brands and the strength of their respective management teams.

- Key characteristics of these successful investments:

- Strong brands with widespread recognition and consumer loyalty.

- Durable competitive advantages, creating significant barriers to entry for competitors.

- Consistent profitability and cash flow generation, allowing for steady dividend income and capital appreciation.

Less Successful Investments and Lessons Learned

Even the Oracle of Omaha has experienced investment setbacks. Analyzing these less successful ventures offers valuable insights into the challenges of investing and the importance of risk management. While not failures in the catastrophic sense, these investments highlight the fact that even the most astute investors experience periods of underperformance. However, Buffett's ability to learn from these experiences and adapt his strategies is a testament to his ongoing commitment to self-improvement.

- Key takeaways from less successful investments:

- The importance of thorough due diligence and a deep understanding of the underlying business.

- Recognizing and mitigating unforeseen risks, even with seemingly sound investments.

- Emphasizing the importance of continuous learning and adaptability in the dynamic world of finance.

Key Principles of Warren Buffett's Investment Approach

Value Investing and its Core Tenets

At the heart of Buffett's success lies his unwavering commitment to value investing. This philosophy centers on identifying undervalued assets, companies whose market prices are significantly below their intrinsic value. This requires patience and discipline, a willingness to wait for the market to recognize the true worth of an investment. The margin of safety, a key tenet of value investing, acts as a buffer against unexpected downturns.

- Core tenets of Buffett's value investing approach:

- Intrinsic value analysis: Determining the true worth of a company independent of its market price.

- Margin of safety: Purchasing assets at a price significantly below their intrinsic value.

- Long-term perspective: Holding investments for years, allowing for long-term value creation.

Importance of Business Understanding and Management Quality

Buffett emphasizes the importance of understanding the business model before investing. He doesn't simply look at numbers; he delves deep into the operational aspects, assessing the competitive landscape and the potential for future growth. He seeks companies with competent and ethical management teams, recognizing that strong leadership is crucial for long-term success.

- Importance of assessing management capabilities and company culture:

- Examining management's track record, integrity, and strategic vision.

- Evaluating the company culture and its impact on operational efficiency and employee morale.

- Assessing the management team's ability to adapt to changing market conditions.

The Power of Long-Term Investing

Buffett's remarkable success is inextricably linked to his long-term investment horizon. He views market fluctuations as temporary noise and focuses on the underlying value of his investments. He's famously quoted as saying, "Our favorite holding period is forever." This buy-and-hold strategy allows him to ride out market volatility and reap the rewards of long-term growth.

- Advantages of a long-term investment perspective:

- Avoiding impulsive decision-making driven by short-term market fluctuations.

- Leveraging the power of compounding returns over extended periods.

- Reducing transaction costs associated with frequent buying and selling.

Conclusion

Analyzing Warren Buffett's investment history reveals a compelling narrative of success built on a foundation of rigorous analysis, disciplined decision-making, and a steadfast commitment to long-term value creation. While his journey includes both remarkable triumphs and occasional setbacks, the consistent application of his core principles – value investing, thorough due diligence, and a long-term perspective – provides invaluable insights for investors at all levels. By understanding the key aspects of Warren Buffett's investment history, you can enhance your own investment strategies and navigate the complexities of the market with greater confidence. Start analyzing your own investment approach today, using the principles learned from studying Warren Buffett's investment history.

Featured Posts

-

Everything We Know About Ayo Edebiri In Prodigie

May 06, 2025

Everything We Know About Ayo Edebiri In Prodigie

May 06, 2025 -

Patrick Schwarzeneggers White Lotus Nude Scene Chris Pratts Response

May 06, 2025

Patrick Schwarzeneggers White Lotus Nude Scene Chris Pratts Response

May 06, 2025 -

Mindy Kaling And B J Novak A Look Back At Their Relationship And Friendship

May 06, 2025

Mindy Kaling And B J Novak A Look Back At Their Relationship And Friendship

May 06, 2025 -

Mitch Johnson Le Nouveau Coach Des Spurs Apres Le Depart De Popovich

May 06, 2025

Mitch Johnson Le Nouveau Coach Des Spurs Apres Le Depart De Popovich

May 06, 2025 -

The Real Story Maria Shriver Addresses Patrick Schwarzeneggers White Lotus Performance

May 06, 2025

The Real Story Maria Shriver Addresses Patrick Schwarzeneggers White Lotus Performance

May 06, 2025