Analyzing XRP (Ripple) At Under $3: A Buyer's Guide

Table of Contents

Understanding XRP's Current Market Position

Recent Price Movements and Volatility

XRP's price has experienced significant volatility in recent months. Understanding these fluctuations is crucial for any potential investor. Factors influencing XRP's price include overall cryptocurrency market sentiment, regulatory news, and adoption rates.

- Example of recent news impacting XRP price: The ongoing SEC lawsuit against Ripple Labs has significantly impacted XRP's price, creating periods of both sharp drops and surprising rallies. Positive developments in the case can lead to price surges, while negative updates often cause dips. Analyzing news sources and legal updates is crucial to understanding these price swings.

- XRP price chart analysis: Examining the XRP price chart reveals periods of high volatility. Observing trading volume alongside price movements provides further insight into market sentiment and potential buying or selling pressures. Tools like TradingView offer detailed XRP price charts and technical indicators.

- Keyword integration: Analyzing the XRP price chart reveals the interplay between XRP market cap and overall crypto market volatility. Understanding this relationship is key to informed decision-making.

Analyzing the Fundamentals of Ripple

Beyond price fluctuations, understanding Ripple's underlying technology and its real-world applications is vital. RippleNet, Ripple's payment network, offers a unique proposition in the financial sector.

- Key features of RippleNet: RippleNet facilitates faster, cheaper, and more transparent cross-border payments for financial institutions. Its scalability and efficiency are key selling points.

- Partnerships with financial institutions: Ripple has partnered with numerous banks and financial institutions globally, signaling growing adoption and validating its technology. These partnerships significantly influence the long-term viability of XRP.

- Advantages over other cryptocurrencies: Compared to Bitcoin or Ethereum, XRP focuses specifically on payment processing, providing a potential advantage in this niche market. Its speed and low transaction fees are significant advantages.

- Keyword integration: Ripple technology, RippleNet, and XRP use cases are integral to assessing the long-term potential of XRP as an investment. Investigating these factors is critical for informed investment decisions.

Assessing the Risks and Rewards of Investing in XRP at Under $3

Potential Risks

Investing in XRP, or any cryptocurrency, carries inherent risks. It's crucial to understand these before committing your capital.

- The ongoing SEC lawsuit: The SEC lawsuit against Ripple remains a significant uncertainty. A negative outcome could severely impact XRP's price and future.

- Potential for technological disruption: The cryptocurrency landscape is constantly evolving. New technologies or competing payment solutions could challenge Ripple's market position.

- Competition from other payment solutions: Other payment platforms, both traditional and crypto-based, are competing for market share, creating pressure on XRP's adoption.

- Keyword integration: Understanding the risks associated with XRP regulation, particularly concerning the SEC lawsuit Ripple, is paramount. Recognizing the broader cryptocurrency risks is essential for responsible investing.

Potential Rewards

Despite the risks, XRP also presents significant potential rewards.

- XRP price prediction scenarios (with disclaimers): While predicting future prices is impossible, analyzing various factors like adoption rates and regulatory outcomes can lead to potential scenarios. It's crucial to remember that these are only speculative and not financial advice.

- Potential for increased institutional adoption: Further adoption by financial institutions could significantly boost XRP's price and market capitalization.

- Technological improvements: Continuous improvements and development within Ripple's technology could enhance its competitive advantage and attract further adoption.

- Keyword integration: A positive resolution to the SEC lawsuit could drastically influence XRP future price and enhance its investment potential. Analyzing XRP price prediction 2024 and beyond requires careful consideration of several factors.

Developing a Sound Investment Strategy for XRP

Risk Tolerance and Diversification

Before investing in XRP, carefully assess your risk tolerance. Cryptocurrency investments are highly volatile.

- Strategies for risk management: Never invest more than you can afford to lose. Consider dollar-cost averaging (DCA) to mitigate risk by spreading investments over time.

- Importance of not investing more than you can afford to lose: This is a crucial principle of responsible investing in any asset class, especially volatile cryptocurrencies.

- Keyword integration: Proper cryptocurrency risk management and investment diversification are vital to protect your capital. A safe cryptocurrency investment strategy prioritizes risk mitigation.

Setting Realistic Investment Goals

Define clear, achievable investment goals and timeframes.

- Short-term vs. long-term investment strategies: Short-term trading strategies aim for quick profits but carry higher risk. Long-term investing offers potential for greater returns but requires patience.

- Defining clear objectives: What are your investment goals? Are you aiming for short-term gains or long-term growth? Setting clear objectives guides your investment decisions.

- Keyword integration: A long-term cryptocurrency investment strategy often involves holding assets for extended periods, aiming to benefit from potential price appreciation. Short-term cryptocurrency trading involves more frequent buying and selling. A crypto investment strategy should align with your personal financial goals.

Choosing the Right Exchange

Selecting a reputable and secure cryptocurrency exchange is crucial.

- Factors to consider when selecting an exchange: Security features, transaction fees, user interface, customer support, and regulatory compliance are important factors.

- Examples of exchanges (without endorsement): Research different exchanges like Coinbase, Kraken, Binance etc., but always perform your due diligence before choosing one.

- Keyword integration: Finding the best cryptocurrency exchanges involves careful comparison and consideration of various factors. A secure cryptocurrency exchange prioritizes user funds and security measures. Consider which XRP exchange best suits your needs.

Conclusion: Making Informed Decisions about Analyzing XRP (Ripple) at Under $3

This buyer's guide has explored key aspects of analyzing XRP (Ripple) at its current price point, highlighting both the potential rewards and significant risks. Remember that predicting XRP's future price is speculative. The ongoing SEC lawsuit, market volatility, and technological competition create uncertainty. However, Ripple's technology, partnerships, and potential for wider adoption offer potential for future growth.

Recap Key Considerations: Thorough research is paramount. Assess your risk tolerance honestly, and diversify your portfolio accordingly. Develop a well-defined investment strategy aligned with your financial goals and timeframe. Remember, never invest more than you can afford to lose.

Call to Action: While this buyer's guide provides valuable insights into analyzing XRP (Ripple) at under $3, remember to conduct your own thorough research before making any investment decisions. Understanding the risks and rewards involved is crucial for successful cryptocurrency investment. Don't rely solely on this guide; analyze XRP independently and make informed decisions about your investment strategy.

Featured Posts

-

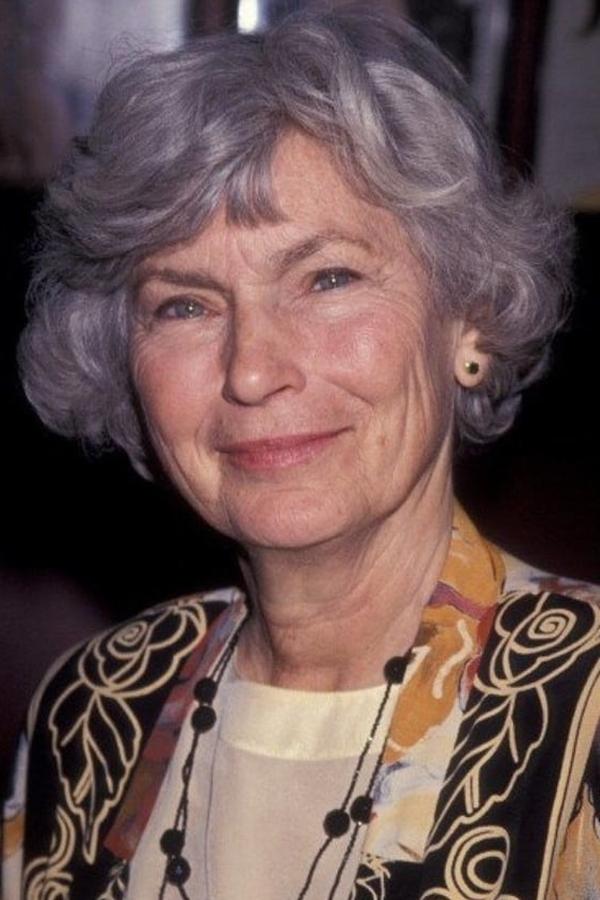

Priscilla Pointer Dies Remembering The Dallas And Carrie Star

May 01, 2025

Priscilla Pointer Dies Remembering The Dallas And Carrie Star

May 01, 2025 -

Frances Rugby Triumph Duponts Masterful Performance Against Italy

May 01, 2025

Frances Rugby Triumph Duponts Masterful Performance Against Italy

May 01, 2025 -

Neispricana Prica O Prvoj Ljubavi Zdravka Colica

May 01, 2025

Neispricana Prica O Prvoj Ljubavi Zdravka Colica

May 01, 2025 -

Remembering Priscilla Pointer Amy Irvings Mother Deceased At 100

May 01, 2025

Remembering Priscilla Pointer Amy Irvings Mother Deceased At 100

May 01, 2025 -

Michael Sheen Pays Off 1 Million Debt For 900 People

May 01, 2025

Michael Sheen Pays Off 1 Million Debt For 900 People

May 01, 2025

Latest Posts

-

The Future Of Luxury Cars In China Challenges And Opportunities For Bmw Porsche And Competitors

May 01, 2025

The Future Of Luxury Cars In China Challenges And Opportunities For Bmw Porsche And Competitors

May 01, 2025 -

Los Angeles Wildfires A New Frontier For Disaster Related Gambling

May 01, 2025

Los Angeles Wildfires A New Frontier For Disaster Related Gambling

May 01, 2025 -

La Landlord Price Gouging After Fires A Selling Sunset Star Speaks Out

May 01, 2025

La Landlord Price Gouging After Fires A Selling Sunset Star Speaks Out

May 01, 2025 -

Are Bmw And Porsche Losing Ground In China A Look At Market Trends And Challenges

May 01, 2025

Are Bmw And Porsche Losing Ground In China A Look At Market Trends And Challenges

May 01, 2025 -

Selling Sunsets Stars Name Condemns Post Fire Price Gouging In La

May 01, 2025

Selling Sunsets Stars Name Condemns Post Fire Price Gouging In La

May 01, 2025