Analyzing XRP's Potential: The Impact Of ETF Decisions And SEC Legal Battles

Table of Contents

The cryptocurrency market is constantly evolving, and few assets have experienced the rollercoaster ride of XRP. This digital asset, created by Ripple Labs, finds itself at a crucial juncture, impacted significantly by ongoing SEC legal battles and the potential approval of XRP ETFs. This analysis delves into the intertwined influences of these factors on XRP's future potential, exploring both the risks and rewards for investors.

The SEC Lawsuit and its Impact on XRP's Price and Adoption

Understanding the Core Allegations

The SEC's lawsuit against Ripple alleges the unregistered sale of XRP as a security. This claim significantly impacts XRP's regulatory status, potentially affecting its trading on exchanges and investor confidence.

- Unregistered securities offering: The SEC argues that Ripple's sales of XRP constituted an unregistered securities offering, violating federal securities laws.

- Impact on exchanges: Several major exchanges delisted XRP following the lawsuit, reducing its accessibility to investors.

- Investor confidence: The uncertainty surrounding the legal outcome has significantly impacted investor confidence in XRP.

The SEC's argument centers on the "Howey Test," which defines an investment contract based on an investment of money in a common enterprise with a reasonable expectation of profit derived from the efforts of others. Ripple, conversely, argues that XRP is a currency, a functional digital asset with utility in its network, and thus not a security. The outcome will set a critical precedent for the entire crypto industry. Partial victories have been seen by both sides, making the ultimate resolution highly uncertain.

Ripple's Defense and its Implications

Ripple's defense rests on the argument that XRP is a decentralized, functional digital asset with utility beyond investment. Their legal strategy focuses on differentiating programmatic sales from investment contracts, highlighting XRP's technology and its use in cross-border payments.

- Programmatic sales vs. investment contracts: Ripple argues that the majority of XRP sales were programmatic and not directed towards investors expecting profits from Ripple's efforts.

- Focus on technology and utility: Ripple emphasizes XRP's utility as a payment solution, aiming to show its function is distinct from a typical security.

- International regulatory landscape: Ripple points to the varying regulatory treatment of XRP internationally, suggesting a lack of consistent classification as a security globally.

Ripple's defense strategy has significantly influenced investor sentiment, with periods of both optimism and pessimism reflected in XRP's price. Expert legal opinions are divided, further underscoring the uncertainty surrounding the outcome.

The Ripple Effect on Exchanges and Trading Volumes

The SEC lawsuit profoundly impacted XRP's availability and trading volume across exchanges.

- Delisting from major exchanges: Several prominent exchanges delisted XRP following the lawsuit, citing regulatory concerns.

- Reduced trading volumes: The delisting and regulatory uncertainty led to a significant reduction in XRP trading volume.

- Impact on liquidity: Decreased trading volume directly impacted XRP's liquidity, making it more challenging to buy or sell large quantities without substantial price movements.

A clear correlation exists between significant legal developments in the case and XRP's price volatility. Positive news tends to lead to price increases, while negative news often results in price drops.

The Potential for XRP ETFs and Their Market Impact

The Appeal and Benefits of XRP ETFs

XRP ETFs offer several benefits for investors compared to directly purchasing XRP.

- Increased accessibility: ETFs provide easier access to XRP for investors who may not be comfortable trading on cryptocurrency exchanges.

- Regulated investment vehicle: ETFs are regulated investment products, offering a layer of security and transparency compared to directly holding XRP.

- Diversification opportunities: XRP ETFs allow investors to diversify their portfolios by adding exposure to the cryptocurrency market.

The potential emergence of XRP ETFs could present a compelling alternative to direct XRP ownership, particularly for institutional investors seeking regulated access to this asset class.

Regulatory Hurdles and Approval Process

The approval of XRP ETFs faces significant hurdles, primarily due to the SEC's ongoing concerns about cryptocurrencies and the Ripple lawsuit.

- SEC's stance on cryptocurrencies: The SEC's overall cautious approach to cryptocurrencies significantly influences its decision-making on ETF applications.

- Regulatory uncertainty: The unclear regulatory landscape for cryptocurrencies adds complexity to the ETF approval process.

- Impact of the Ripple lawsuit: The outcome of the Ripple lawsuit will heavily influence the SEC's decision on XRP ETF applications.

The SEC's approval process is stringent, and the conditions required for XRP ETF approval could include a resolution of the lawsuit favorable to Ripple, or a clear legal definition of XRP that satisfies the SEC's concerns about investor protection.

The Price Impact of ETF Approval (or Rejection)

The approval (or rejection) of XRP ETFs would have a substantial impact on XRP's price.

- Increased demand: ETF approval would likely drive significant demand for XRP, potentially leading to price appreciation.

- Price volatility: The initial period following approval could see increased price volatility as the market adjusts to the increased liquidity and trading volume.

- Institutional investment: ETF approval would likely attract significant institutional investment, further contributing to price increases.

Historical examples of ETF approvals for other cryptocurrencies show a generally positive impact on price, although volatility is common in the short term. Rejection, however, could cause a significant price drop due to reduced investor confidence.

Conclusion

The future of XRP is inextricably linked to the outcome of the SEC lawsuit and the potential approval of XRP ETFs. The regulatory uncertainty surrounding XRP creates significant risks and opportunities for investors. While the SEC lawsuit casts a shadow on XRP's immediate future, the potential for ETF approval offers a pathway towards greater legitimacy and mainstream adoption.

While the future of XRP remains uncertain due to ongoing SEC legal battles and the pending ETF decisions, careful analysis and ongoing monitoring of this evolving situation are crucial for anyone considering investing in XRP. Thorough research and understanding of the inherent risks are paramount before making any investment decisions related to this volatile asset.

Featured Posts

-

Tulsa Storm Damage Reporting Crucial For Nws Impact Assessment

May 02, 2025

Tulsa Storm Damage Reporting Crucial For Nws Impact Assessment

May 02, 2025 -

The Donkey Roundup A Southern California Community Event

May 02, 2025

The Donkey Roundup A Southern California Community Event

May 02, 2025 -

Los Angeles Wildfires The Rise Of Disaster Betting And What It Means

May 02, 2025

Los Angeles Wildfires The Rise Of Disaster Betting And What It Means

May 02, 2025 -

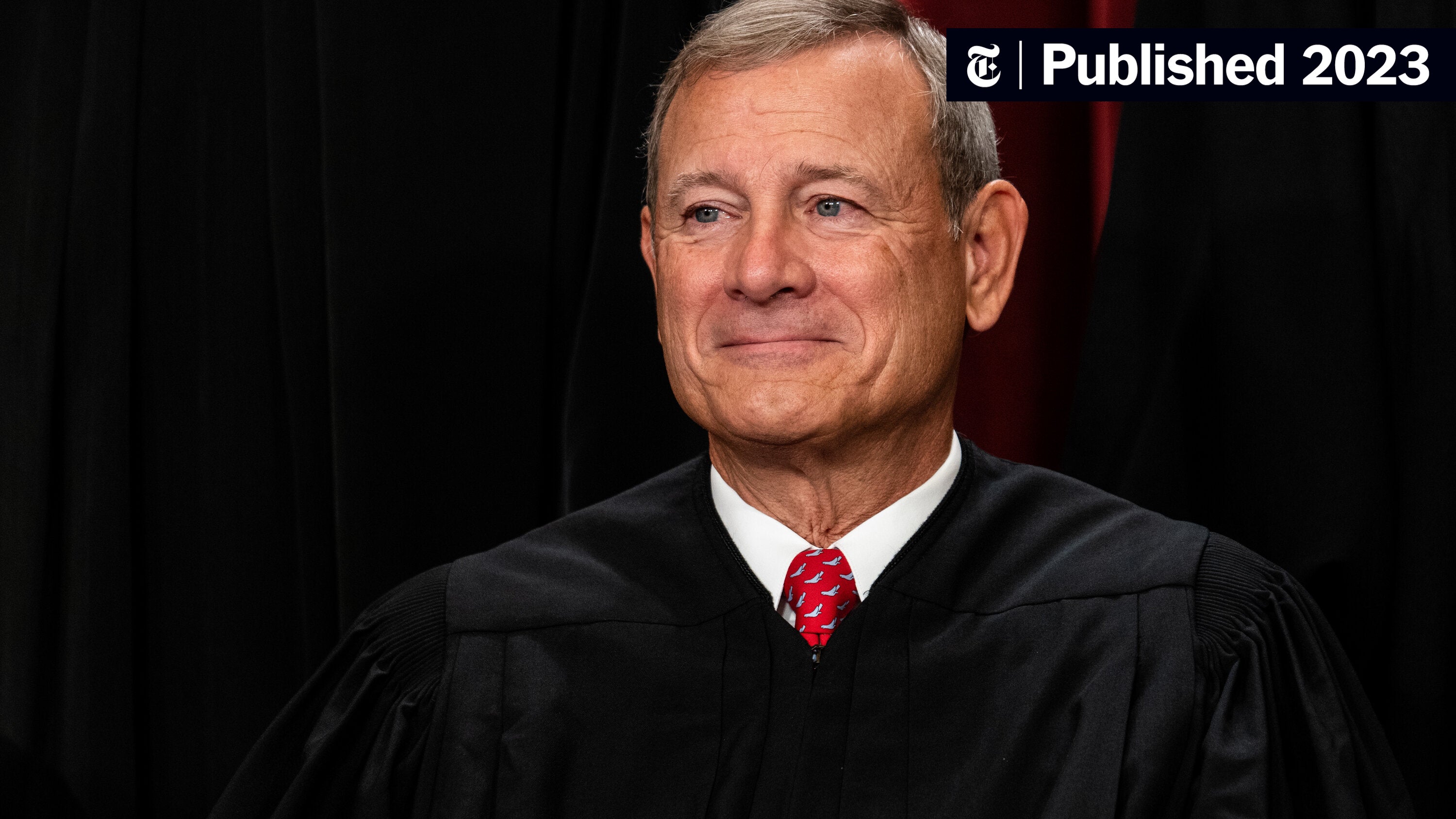

Will Chief Justice Roberts Continue To Weaken The Church State Divide Analyzing Recent Rulings

May 02, 2025

Will Chief Justice Roberts Continue To Weaken The Church State Divide Analyzing Recent Rulings

May 02, 2025 -

Tongas Strong Showing Dashes Samoas Olympic Aspirations

May 02, 2025

Tongas Strong Showing Dashes Samoas Olympic Aspirations

May 02, 2025

Latest Posts

-

School Desegregation The Justice Departments Recent Action And Its Fallout

May 02, 2025

School Desegregation The Justice Departments Recent Action And Its Fallout

May 02, 2025 -

Justice Departments Decision More School Desegregation Orders At Risk

May 02, 2025

Justice Departments Decision More School Desegregation Orders At Risk

May 02, 2025 -

End Of School Desegregation Order Implications For Education

May 02, 2025

End Of School Desegregation Order Implications For Education

May 02, 2025 -

Fortnites Latest Icon Skin Release Date Price And Features

May 02, 2025

Fortnites Latest Icon Skin Release Date Price And Features

May 02, 2025 -

The Justice Departments Decision To End School Desegregation A Deeper Look

May 02, 2025

The Justice Departments Decision To End School Desegregation A Deeper Look

May 02, 2025