Apple Stock (AAPL): Important Price Levels And Their Implications

Table of Contents

Understanding Support and Resistance Levels in AAPL

Support and resistance levels are crucial concepts in technical analysis. Support levels represent prices where buying pressure is strong enough to prevent a further price decline. Conversely, resistance levels indicate prices where selling pressure halts upward momentum. These levels are often identified using candlestick charts, which visually represent price movements over time. By examining past price action, we can identify areas where the price has previously bounced or stalled.

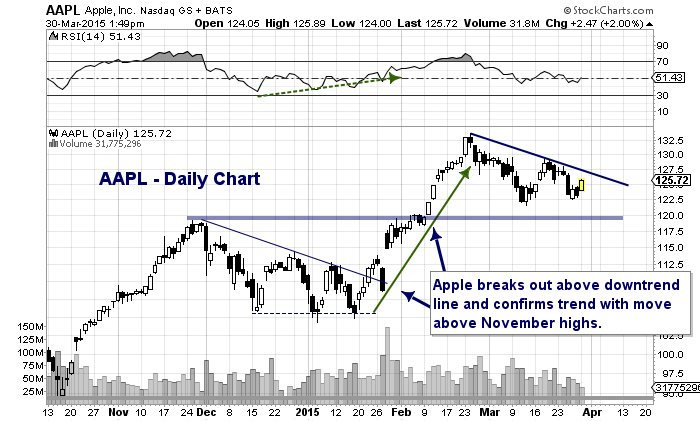

For example, looking at historical Apple stock charts, we can see numerous instances where the price found support around specific levels, only to bounce back up. Similarly, we can identify resistance levels where the price struggled to break through, repeatedly encountering selling pressure.

-

Breakouts: A break above a resistance level often signals a bullish trend, suggesting further upward price movement. Conversely, a break below a support level can trigger a bearish trend, indicating potential for further price decline.

-

Psychological Impact: These levels hold significant psychological weight for traders. The anticipation of reaching a key support or resistance level can influence trading decisions, leading to increased buying or selling pressure near these points.

-

Identifying Support and Resistance: Tools like moving averages can assist in identifying potential support and resistance levels. Moving averages smooth out price fluctuations, making it easier to identify trends and potential turning points.

Key AAPL Price Levels to Watch

Identifying key price levels for AAPL requires analyzing historical data, technical indicators, and market sentiment. Here are a few significant price levels to monitor:

1. $150: This level has historically acted as a strong support level for AAPL. A break below this level could signal further downside potential, while a sustained price above it could indicate a bullish trend.

- Potential Upward Target: $175

- Potential Downward Target: $130

- Trading Strategy: Buy on dips near $150, consider selling if it breaks below $145.

- Risk Assessment: Moderate to high, depending on overall market conditions.

2. $175: This level represents a significant psychological barrier and has acted as both support and resistance in the past. Breaking above this level could suggest a strong bullish trend, while failure to do so might indicate a consolidation phase.

- Potential Upward Target: $200

- Potential Downward Target: $150

- Trading Strategy: Buy on confirmation above $175, consider taking profits near $190.

- Risk Assessment: Moderate.

3. $200: This level represents a major psychological resistance level and a significant hurdle for AAPL. A break above this level would signify a very strong bullish sentiment.

- Potential Upward Target: $225+

- Potential Downward Target: $175

- Trading Strategy: Buy on confirmation above $200, use stop-loss orders to protect profits.

- Risk Assessment: High, but potential rewards are also high.

Note: These price levels are subject to change based on market dynamics and fundamental factors. Always conduct your own thorough research before making any investment decisions. The charts included (in a real article, you'd include relevant charts here) visually represent these levels and their historical context.

Factors Influencing AAPL Price Levels

Numerous factors influence AAPL's price, broadly categorized into macroeconomic and company-specific influences.

Macroeconomic Factors: Interest rate hikes, inflation levels, and overall economic growth significantly affect investor sentiment and stock valuations. A strong economy usually supports higher stock prices, while economic downturns often lead to lower valuations.

Company-Specific Factors: Apple's financial performance, new product launches (like iPhones, iPads, Macs, and services), and competitive landscape play a crucial role. Strong earnings reports and successful new product launches typically boost AAPL's price. Conversely, weak financial results or increased competition can negatively impact the stock.

News and Events: Major news events, such as regulatory changes, lawsuits, or geopolitical events, can create significant price swings. For example, negative news about supply chain issues or trade wars can lead to a price drop.

-

Examples: Past instances of negative news impacting AAPL's stock price include concerns over iPhone sales and supply chain disruptions. Positive news, like the launch of a highly anticipated new product, can send the price soaring.

-

Assessing Upcoming Events: Stay informed about upcoming product launches, earnings reports, and other significant events that could impact AAPL's price. This requires continuous monitoring of financial news and Apple's official announcements.

-

Fundamental Analysis: Combining technical analysis (chart patterns and indicators) with fundamental analysis (company financials and industry trends) provides a more comprehensive view of AAPL's prospects.

Conclusion: Mastering Apple Stock (AAPL) Price Levels for Informed Investment Decisions

Understanding key Apple stock (AAPL) price levels, such as support and resistance levels, is paramount for making informed investment decisions. We've explored several significant price levels and the factors influencing their movements. Remember that consistent monitoring of market conditions and news related to Apple is crucial for navigating the volatility of AAPL. The interplay between macroeconomic trends, company performance, and news events significantly shapes the price.

By combining technical and fundamental analysis, you can enhance your understanding of these price levels and their potential implications. Conduct your own thorough research, using the insights provided here to inform your investment strategies. Continue learning about Apple Stock (AAPL) price levels and their implications to refine your trading approach and improve your chances of success in the dynamic Apple stock market. Explore reputable financial resources and consider consulting with a financial advisor before making any investment decisions.

Featured Posts

-

Changes To Italian Citizenship Law Claiming Rights Via Great Grandparents

May 24, 2025

Changes To Italian Citizenship Law Claiming Rights Via Great Grandparents

May 24, 2025 -

Prepad Na Trhu Prace Nemecke Firmy Redukuju Stavy Zamestnancov

May 24, 2025

Prepad Na Trhu Prace Nemecke Firmy Redukuju Stavy Zamestnancov

May 24, 2025 -

M6 Drivers Face Significant Delays Following Van Crash

May 24, 2025

M6 Drivers Face Significant Delays Following Van Crash

May 24, 2025 -

Escape To The Country Dream Homes Under 1 Million

May 24, 2025

Escape To The Country Dream Homes Under 1 Million

May 24, 2025 -

Sean Penn Casts Doubt On Woody Allens Alleged Abuse Of Dylan Farrow

May 24, 2025

Sean Penn Casts Doubt On Woody Allens Alleged Abuse Of Dylan Farrow

May 24, 2025

Latest Posts

-

Dealerships Step Up Opposition To Electric Vehicle Regulations

May 24, 2025

Dealerships Step Up Opposition To Electric Vehicle Regulations

May 24, 2025 -

Toxic Chemical Residue In Buildings Months After Ohio Train Disaster

May 24, 2025

Toxic Chemical Residue In Buildings Months After Ohio Train Disaster

May 24, 2025 -

Resistance To Ev Mandates Grows Among Car Dealerships

May 24, 2025

Resistance To Ev Mandates Grows Among Car Dealerships

May 24, 2025 -

Senate Resolution Highlights Deepening Canada U S Ties

May 24, 2025

Senate Resolution Highlights Deepening Canada U S Ties

May 24, 2025 -

U S Senate Resolution Strengthening The Canada U S Partnership

May 24, 2025

U S Senate Resolution Strengthening The Canada U S Partnership

May 24, 2025