Apple Stock: Analyzing The Pre-Q2 Report Dip

Table of Contents

Macroeconomic Factors Influencing Apple Stock

The recent decline in Apple stock isn't solely attributable to company-specific issues; broader macroeconomic factors played a significant role.

Global Inflation and Recessionary Fears

Rising inflation and growing recessionary fears globally have dampened consumer spending and negatively impacted investor confidence. This uncertainty directly affects discretionary purchases like iPhones and other Apple products.

- Decreased consumer confidence: The current economic climate has led to decreased consumer confidence, making people less likely to make large purchases like new smartphones.

- Potential impact on iPhone sales: A slowdown in iPhone sales is a direct consequence of reduced consumer spending, impacting Apple's overall revenue.

- Reduced discretionary spending: Consumers are prioritizing essential spending, leading to a reduction in discretionary purchases like Apple's premium products.

These macroeconomic concerns are impacting investor sentiment towards tech stocks in general. The question many investors are asking is: are tech stocks like Apple truly "recession proof stocks" in this environment? The impact of inflation on tech stocks is a key area of concern for analysts.

Geopolitical Uncertainty and Supply Chain Disruptions

The ongoing war in Ukraine and persistent geopolitical instability have further complicated the situation. These factors contribute to supply chain disruptions and increased manufacturing costs, putting pressure on Apple's profitability.

- Impact on component sourcing: The war in Ukraine and other geopolitical events have disrupted the supply of crucial components for Apple's products, impacting production.

- Potential production delays: These disruptions can cause delays in the production and release of new products, affecting sales projections.

- Increased manufacturing costs: The instability leads to higher costs for raw materials and logistics, squeezing Apple's profit margins.

Supply chain resilience is a critical factor influencing Apple's ability to navigate these challenges and maintain its production output. Understanding the geopolitical risk associated with Apple's global manufacturing operations is essential for any thorough analysis of its stock performance.

Apple-Specific Concerns Preceding Q2 Earnings

Beyond macroeconomic headwinds, several Apple-specific concerns contributed to the pre-Q2 dip.

Slowing iPhone Sales Growth

While iPhones remain a dominant force in the smartphone market, signs of slowing sales growth have emerged. This could be attributed to several factors.

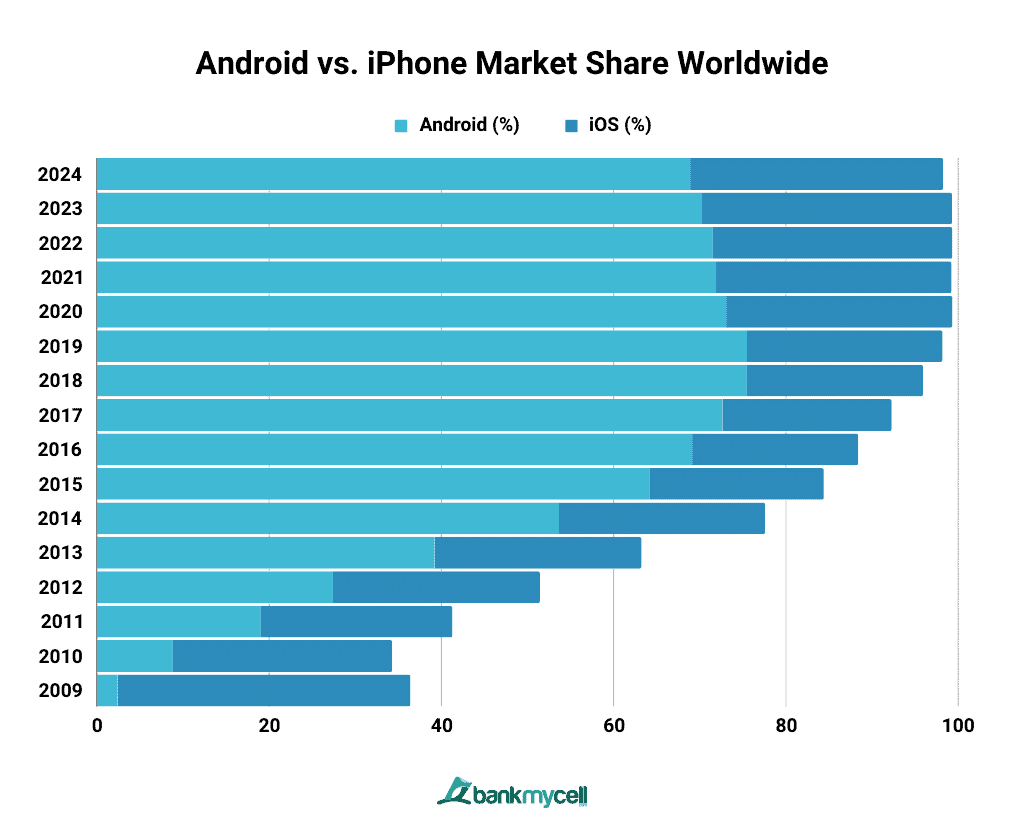

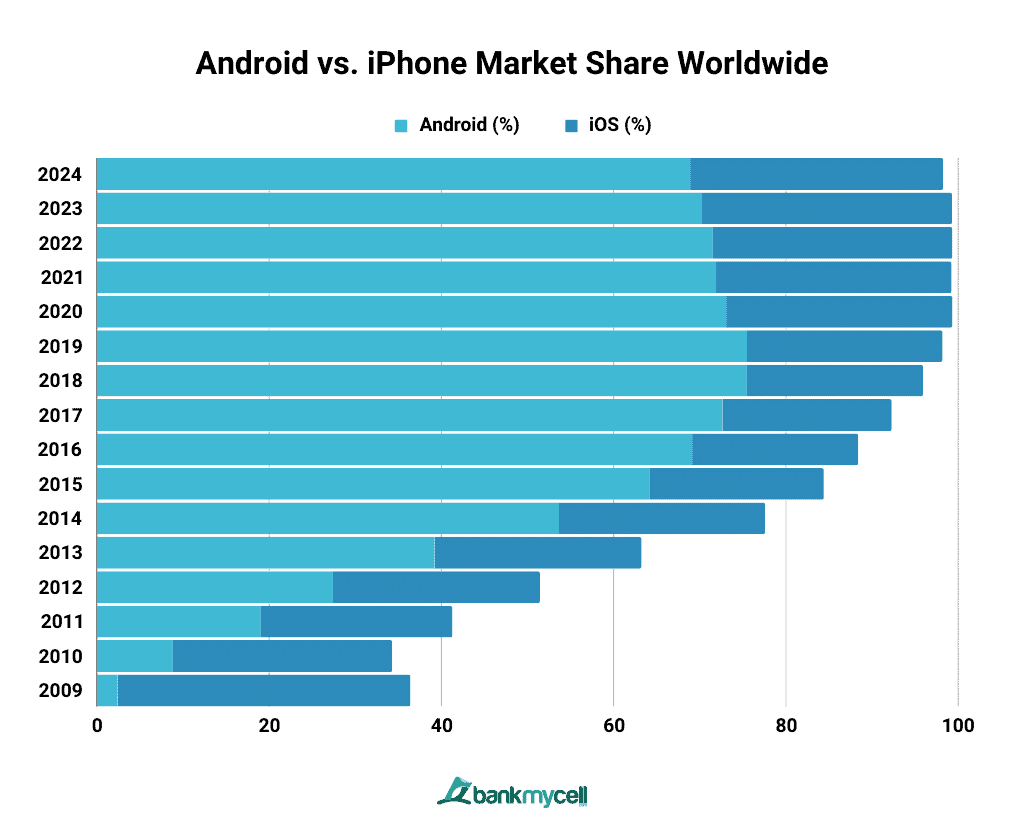

- Competition from Android manufacturers: Intense competition from Android manufacturers, offering increasingly sophisticated and affordable alternatives, is putting pressure on Apple's market share.

- Upgrade cycle lengthening: Consumers are holding onto their iPhones for longer periods, extending the upgrade cycle and impacting demand for new models.

- Pricing concerns: The high price point of iPhones can be a barrier for some consumers, particularly during economic uncertainty.

Analyzing iPhone sales figures and the overall smartphone market share is crucial for understanding the current dynamics. Apple's competition is becoming fiercer, demanding a deeper dive into the competitive landscape.

Concerns Regarding Other Product Lines

Concerns extend beyond iPhone sales. Pre-existing anxieties about other Apple product lines also played a part.

- Market saturation in specific segments: Certain product categories, such as iPads and MacBooks, might be experiencing market saturation, limiting growth potential.

- Potential for price reductions: To stimulate demand, Apple might need to implement price reductions, impacting profit margins.

- Competition in specific markets: Increased competition in segments like wearables (Apple Watch sales) and services (Apple services revenue) could also be a contributing factor.

Investor Sentiment and Market Speculation

The pre-Q2 dip was also influenced by typical pre-earnings volatility and investor sentiment.

Pre-Earnings Volatility

Stock prices often exhibit heightened volatility in the period leading up to major earnings announcements. This is particularly true for large-cap stocks like Apple.

- Analyst predictions: A wide range of analyst predictions and differing opinions contribute to the market uncertainty.

- Short-selling activity: Short-selling activity can amplify price fluctuations before earnings reports.

- Market sentiment swings: Overall market sentiment can significantly influence investor behavior, impacting Apple stock prices.

Understanding the dynamics of Apple earnings preview and stock market volatility is crucial for interpreting the pre-earnings movements.

Impact of Analyst Ratings and Price Targets

Analyst ratings and price target adjustments further influence investor decisions.

- Impact of positive and negative ratings: Positive ratings and upward price target revisions generally boost investor confidence, while negative ratings have the opposite effect.

- Price target revisions: Changes in price targets by Wall Street analysts reflect their evolving assessments of the company's prospects.

- Consensus forecasts: The consensus forecast from analysts shapes market expectations and can influence trading activity.

Conclusion: Post-Dip Outlook for Apple Stock and Next Steps

The pre-Q2 dip in Apple stock reflects a complex interplay of macroeconomic headwinds, company-specific challenges, and investor sentiment. Global inflation, recessionary fears, geopolitical uncertainty, slowing iPhone sales growth, and concerns about other product lines all contributed to the decline. While risks exist, Apple's strong brand loyalty, innovative products, and robust services business offer potential for future growth.

To stay informed about the evolving situation, continue monitoring Apple Stock performance and stay updated on future earnings reports and market developments. Learn more about the impact of inflation on Apple Stock and other relevant topics discussed in this article to gain a deeper understanding of the factors influencing its price. Stay informed and make informed investment decisions.

Featured Posts

-

Schekotat Nervy Vzglyad Fedora Lavrova Na Pavla I I Zhanr Trillera

May 25, 2025

Schekotat Nervy Vzglyad Fedora Lavrova Na Pavla I I Zhanr Trillera

May 25, 2025 -

Significant Drop In Amsterdam Stock Exchange Aex Index Down Over 4

May 25, 2025

Significant Drop In Amsterdam Stock Exchange Aex Index Down Over 4

May 25, 2025 -

Aex Index Falls Below Key Support Level Years Lowest Point Reached

May 25, 2025

Aex Index Falls Below Key Support Level Years Lowest Point Reached

May 25, 2025 -

Discrepancies Between Former French Pm And Macron Revealed

May 25, 2025

Discrepancies Between Former French Pm And Macron Revealed

May 25, 2025 -

Glastonbury 2025 A Lineup Analysis Charli Xcx Neil Young And The Top Artists To Watch

May 25, 2025

Glastonbury 2025 A Lineup Analysis Charli Xcx Neil Young And The Top Artists To Watch

May 25, 2025

Latest Posts

-

Building Contamination From Ohio Train Derailment A Continuing Health Concern

May 25, 2025

Building Contamination From Ohio Train Derailment A Continuing Health Concern

May 25, 2025 -

Recent Developments Elon Musk And His Dogecoin Position

May 25, 2025

Recent Developments Elon Musk And His Dogecoin Position

May 25, 2025 -

The Elon Musk Dogecoin Effect A Reality Check

May 25, 2025

The Elon Musk Dogecoin Effect A Reality Check

May 25, 2025 -

Dogecoin Price And Elon Musks Influence A Current Analysis

May 25, 2025

Dogecoin Price And Elon Musks Influence A Current Analysis

May 25, 2025 -

Is Elon Musk Abandoning Dogecoin A Deep Dive

May 25, 2025

Is Elon Musk Abandoning Dogecoin A Deep Dive

May 25, 2025