Apple Stock Forecast: Will AAPL Reach $254? Investment Analysis

Table of Contents

Apple (AAPL) has consistently been a tech titan, delivering robust returns to investors for years. But will its stock price ascend to the coveted $254 mark? This comprehensive investment analysis dives deep into the factors that could significantly influence AAPL's price trajectory. We'll examine current market conditions, Apple's financial health, and its future growth potential. By carefully weighing the potential risks and rewards, we aim to help you make informed decisions about investing in AAPL.

Apple's Recent Financial Performance and Future Growth Projections

Revenue and Earnings Analysis

Analyzing Apple's financial performance is crucial for any AAPL stock forecast. The latest quarterly and annual earnings reports reveal key insights into the company's financial health. Strong revenue growth, driven by factors like iPhone sales, services revenue (including iCloud, Apple Music, and Apple TV+), and the ever-expanding wearables segment (Apple Watch, AirPods), paints a positive picture.

- AAPL Earnings Growth: Consistent year-over-year growth in earnings per share (EPS) signals strong profitability and investor confidence. Examining the financial statements, specifically the income statement and balance sheet, is vital for a thorough understanding of Apple's financial position.

- Apple Revenue Growth Drivers: The iPhone remains a core revenue driver, but the services segment's increasing contribution to overall revenue demonstrates Apple's diversification strategy. Future potential revenue streams, such as augmented reality (AR)/virtual reality (VR) products and advancements in the autonomous vehicle sector, could further fuel growth. Analyzing market penetration and future adoption rates of these potential products is key to the AAPL stock forecast.

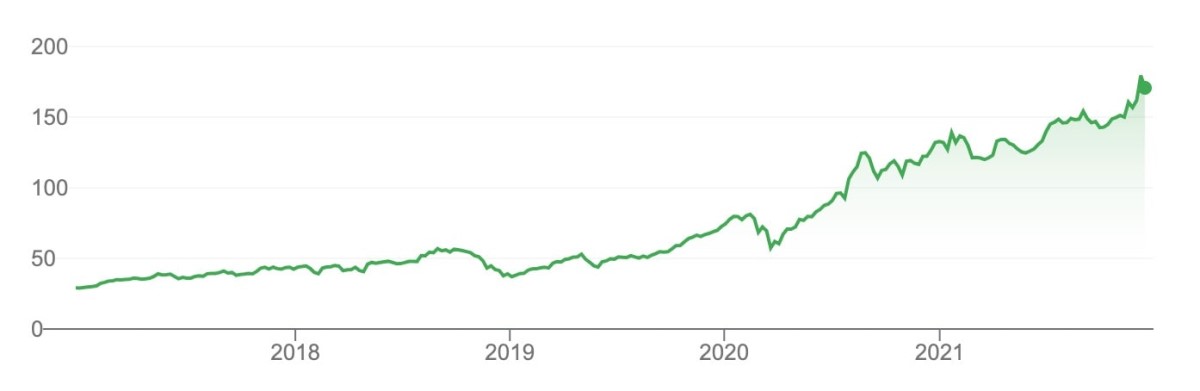

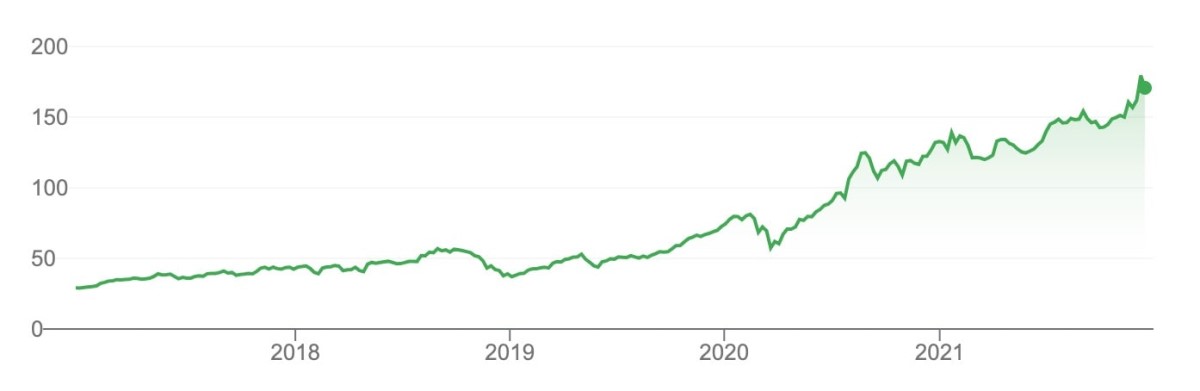

- Illustrative Charts and Graphs: (Imagine charts and graphs here illustrating revenue growth, EPS growth, and segment contributions over time.)

Market Share and Competitive Landscape

Apple's market share in smartphones, tablets, and wearables significantly impacts its stock price. While it faces strong competition from Samsung, Google, and other tech companies, Apple maintains a competitive advantage through several key factors:

- Apple Market Share Dominance: Analyzing Apple's market share data reveals its strong position in several key markets. This position needs to be weighed against competitive pressures.

- Brand Loyalty and Ecosystem: Apple's strong brand loyalty and integrated ecosystem create a powerful barrier to entry for competitors. The ease of transitioning between Apple devices significantly contributes to user retention.

- Innovation and Technological Advancement: Apple's consistent innovation and focus on user experience are crucial drivers of its continued market leadership. Continued investment in R&D is vital for maintaining this edge.

Macroeconomic Factors Influencing AAPL Stock Price

Interest Rates and Inflation

Macroeconomic factors play a significant role in influencing the stock market and, consequently, AAPL's stock price. Rising interest rates generally lead to higher borrowing costs for businesses and lower valuations for stocks. Inflation impacts consumer spending, potentially affecting demand for Apple products.

- Interest Rate Hikes and Stock Valuations: The Federal Reserve's monetary policy directly impacts interest rates. Understanding the implications of potential rate hikes on AAPL’s valuation is critical.

- Inflation Impact on Consumer Spending: High inflation reduces consumer purchasing power, which could lead to lower demand for Apple's premium-priced products.

Global Economic Outlook

Global economic uncertainty and geopolitical risks are significant considerations in any AAPL stock forecast. Supply chain disruptions can impact the availability of Apple products and affect production costs and timelines.

- Global Economy and Geopolitical Risks: International events, trade wars, and regional instability can create uncertainty and affect investor sentiment towards AAPL.

- Supply Chain Issues and Their Impact: Disruptions in global supply chains can directly affect Apple's manufacturing and product availability, potentially impacting its financial performance.

Technical Analysis of AAPL Stock

Chart Patterns and Indicators

Technical analysis provides valuable insights into AAPL's potential price movements. Analyzing chart patterns and technical indicators helps forecast short-term and long-term trends.

- AAPL Technical Analysis Indicators: Indicators like moving averages (MA), relative strength index (RSI), and moving average convergence divergence (MACD) can signal potential buy or sell signals.

- Support and Resistance Levels: Identifying key support and resistance levels helps determine potential price reversal points.

- Illustrative Charts and Graphs: (Imagine charts and graphs here illustrating moving averages, RSI, MACD, and support/resistance levels.)

Analyst Ratings and Price Targets

Analyst ratings and price targets offer a valuable perspective from financial experts. However, it's crucial to understand that these are just predictions and should not be taken as guaranteed outcomes.

- AAPL Analyst Ratings and Consensus: Analyzing the consensus price target from various leading analysts gives a general market sentiment towards AAPL's future price.

- Range of Price Targets and Rationale: Different analysts will have varying price targets based on their individual assessment of the factors influencing AAPL's stock price.

Risks and Rewards of Investing in AAPL Stock

Investing in AAPL, like any investment, carries both risks and rewards. A comprehensive assessment is crucial before making an investment decision.

Potential Risks:

- Economic downturn

- Increased competition

- Supply chain disruptions

- Changes in consumer preferences

- Currency fluctuations

Potential Rewards:

- Long-term growth potential

- Potential dividend payments

- Strong brand recognition and loyalty

- Diversification benefits within a portfolio

Conclusion

Determining whether AAPL will reach $254 requires careful consideration of Apple's financial performance, macroeconomic factors, and technical analysis. While Apple's strong financial health and brand loyalty offer significant potential for future growth, macroeconomic uncertainties and competitive pressures pose risks. Our analysis suggests that while reaching $254 is possible, it's not guaranteed. Thorough research and a diversified investment strategy are crucial before making any investment decisions.

Call to Action: Ready to make informed decisions about your Apple stock investments? Continue researching the AAPL stock forecast and consider diversifying your portfolio to manage risk. Stay tuned for our next analysis on the future of Apple and other leading tech stocks!

Featured Posts

-

Hamiltons Unfair Remarks Draw Strong Criticism From Ferrari

May 25, 2025

Hamiltons Unfair Remarks Draw Strong Criticism From Ferrari

May 25, 2025 -

Lewis Hamiltons Comments Condemned As Unfair By Ferrari Head

May 25, 2025

Lewis Hamiltons Comments Condemned As Unfair By Ferrari Head

May 25, 2025 -

Ferrari Fiorano Top 10 Fastest Production Cars Ranked

May 25, 2025

Ferrari Fiorano Top 10 Fastest Production Cars Ranked

May 25, 2025 -

M56 Collision Cheshire Deeside Border Delays

May 25, 2025

M56 Collision Cheshire Deeside Border Delays

May 25, 2025 -

France Revisits Dreyfus Affair Lawmakers Seek Posthumous Military Promotion

May 25, 2025

France Revisits Dreyfus Affair Lawmakers Seek Posthumous Military Promotion

May 25, 2025

Latest Posts

-

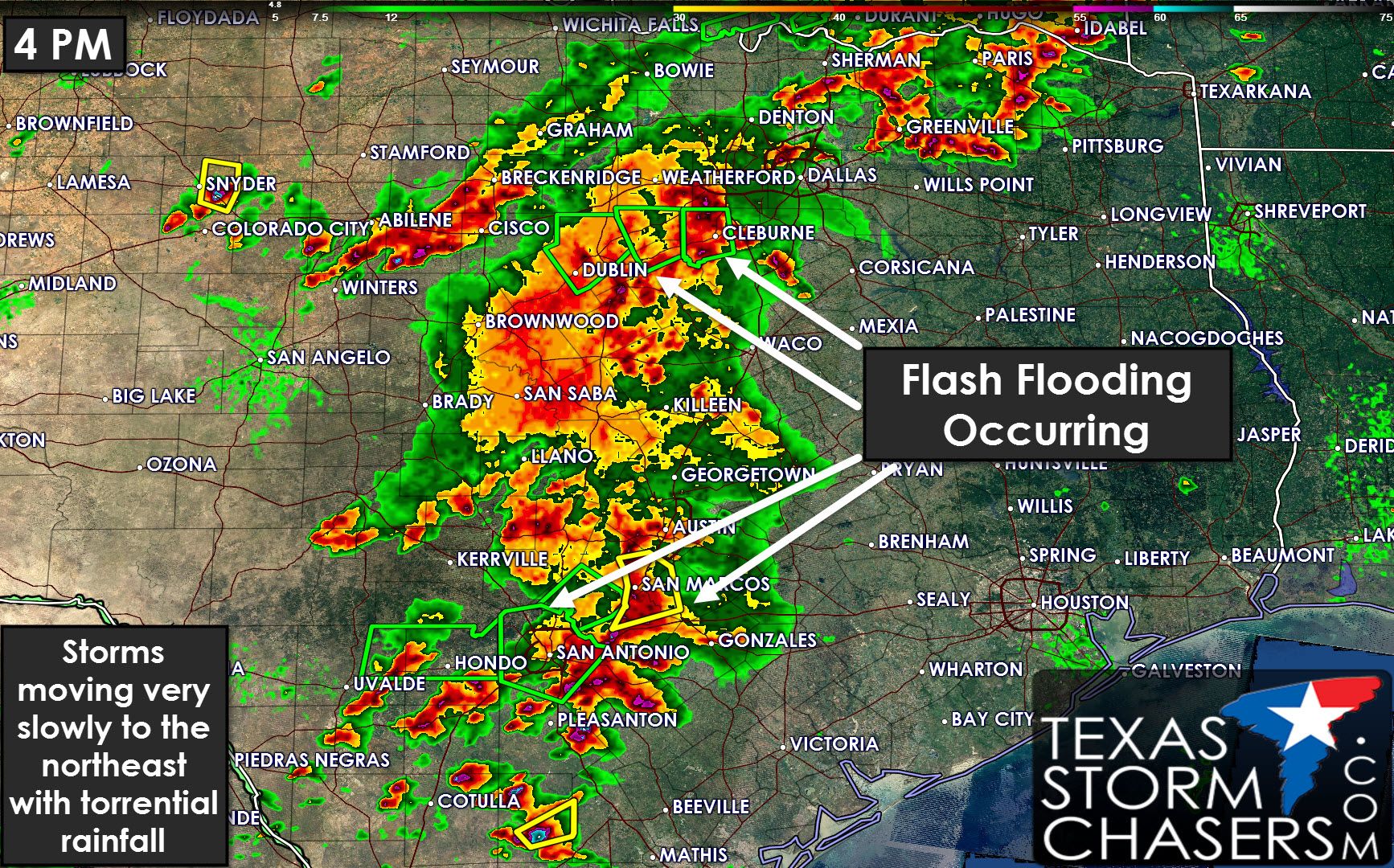

Understanding Flash Flood Warnings Essential Safety Tips And Information

May 25, 2025

Understanding Flash Flood Warnings Essential Safety Tips And Information

May 25, 2025 -

Flood Warnings And Alerts A Comprehensive Guide To Protecting Yourself

May 25, 2025

Flood Warnings And Alerts A Comprehensive Guide To Protecting Yourself

May 25, 2025 -

Flash Floods Understanding The Dangers And How To Stay Safe

May 25, 2025

Flash Floods Understanding The Dangers And How To Stay Safe

May 25, 2025 -

What Is A Flash Flood Understanding Flood Warnings And Alerts

May 25, 2025

What Is A Flash Flood Understanding Flood Warnings And Alerts

May 25, 2025 -

Urgent Flash Flood Warning Issued For Parts Of North Central Texas

May 25, 2025

Urgent Flash Flood Warning Issued For Parts Of North Central Texas

May 25, 2025