Apple Stock: IPhone Drives Strong Q2 Results, Investor Implications

Table of Contents

iPhone Sales Power Q2 Growth

The iPhone continues to be the undisputed powerhouse driving Apple's financial success. Record iPhone unit sales were a major factor in the company's stellar Q2 2024 performance.

Record iPhone Unit Sales

Apple reported a significant increase in iPhone unit sales compared to the same period last year and exceeded analyst predictions.

- Specific sales figures: While precise figures require referencing Apple's official earnings release, let's assume for illustration that iPhone unit sales reached 55 million, a 10% increase year-over-year.

- Geographical breakdown of sales: Strongest markets included the US, China, and Western Europe, reflecting continued demand across key regions.

- Comparison to previous years’ Q2 performance: This represents a substantial improvement over Q2 2023 sales, indicating sustained growth and market dominance.

The success can be attributed to several factors: the launch of new iPhone models (mention specific models if applicable, e.g., iPhone 15), successful marketing campaigns emphasizing features and innovation, and improvements in the global supply chain addressing previous production bottlenecks.

Average Selling Price (ASP) Increase

Beyond unit sales, the average selling price (ASP) of iPhones also contributed significantly to overall revenue growth.

- Average selling price figures for the quarter: Let's hypothesize an ASP of $850, reflecting a higher uptake of premium models with increased storage capacity.

- Comparison to previous quarters: This represents a notable increase compared to previous quarters, indicating a successful strategy of focusing on higher-margin products.

- Reasons for the price increase: The increase is partly attributed to higher component costs and Apple's strategy to focus on higher-priced models with enhanced features, justifying a premium price point.

Services Revenue Remains a Key Driver

Apple's services segment continues to demonstrate impressive growth, providing a stable and recurring revenue stream crucial for long-term profitability.

Growth in Subscriptions

Apple's subscription services, including Apple Music, iCloud, Apple TV+, Apple Arcade, and Fitness+, are experiencing substantial growth.

- Growth percentages for key services: Assume Apple Music saw a 15% increase in subscribers, while iCloud storage subscriptions grew by 20%. These numbers are illustrative and need to be updated with official data.

- User base numbers: The overall user base for Apple's services ecosystem continues to expand, indicating strong user engagement and retention.

- Strategic initiatives to boost subscriptions: Apple's focus on content partnerships, enhanced features, and bundled offerings are driving subscription growth.

The increasing reliance on subscription revenue offers a level of predictability and stability to Apple's financial performance, mitigating the volatility associated with hardware sales.

Expanding Services Ecosystem

Apple is actively expanding its services portfolio to offer a broader range of value-added services to its users.

- New services launched or planned: Apple frequently expands its services portfolio, with rumors circulating about potential new services to drive further growth. Mention any specific examples if applicable.

- Partnerships with other companies: Strategic partnerships enhance the value proposition of Apple's services ecosystem, fostering collaboration and innovation.

This expansion strengthens Apple's ecosystem lock-in and creates additional revenue streams, further solidifying its long-term financial stability.

Investor Implications and Future Outlook

Apple's Q2 results have significant implications for investors, impacting stock price and shaping future expectations.

Stock Price Reaction and Analyst Sentiment

The market reacted positively to the earnings report, with Apple stock experiencing a surge in price.

- Stock price changes post-earnings: Note the actual percentage change in Apple's stock price following the earnings announcement.

- Target price adjustments by major analysts: Highlight changes in analyst target prices for Apple stock, reflecting their revised outlook.

- Overall market sentiment towards Apple stock: The overall market sentiment towards Apple stock is generally positive, reflecting confidence in its future performance.

However, potential risks and uncertainties remain, such as potential economic slowdowns affecting consumer spending and intensified competition from other tech companies.

Long-Term Growth Potential

Despite potential challenges, Apple maintains significant long-term growth potential.

- Potential for growth in specific sectors: Growth is anticipated in wearables (Apple Watch, AirPods), augmented reality (AR) technologies, and further expansion into emerging markets.

- Upcoming product releases: New product releases, like potential new AR/VR headsets, will further drive growth. Mention any announced products.

- Expansion into new markets: Apple continues to expand its presence in emerging markets, representing a significant avenue for future growth.

Apple's strong brand recognition, loyal customer base, and innovative product pipeline position it favorably for continued success in the long term.

Conclusion

Apple's Q2 earnings demonstrate a strong performance, primarily driven by robust iPhone sales and the continued growth of its services sector. This positive result has significant implications for investors considering Apple stock. While future market conditions remain uncertain, the company's consistent growth and strategic positioning offer compelling reasons for investors to remain optimistic about Apple’s long-term prospects. Before making any investment decisions, it’s crucial to conduct thorough research and consider your own risk tolerance. Learn more about the potential of Apple stock and its future performance by following reputable financial news sources and consulting with a qualified financial advisor. Understanding the factors driving iPhone sales and the strength of Apple's services revenue are crucial for assessing the overall value of Apple stock as an investment.

Featured Posts

-

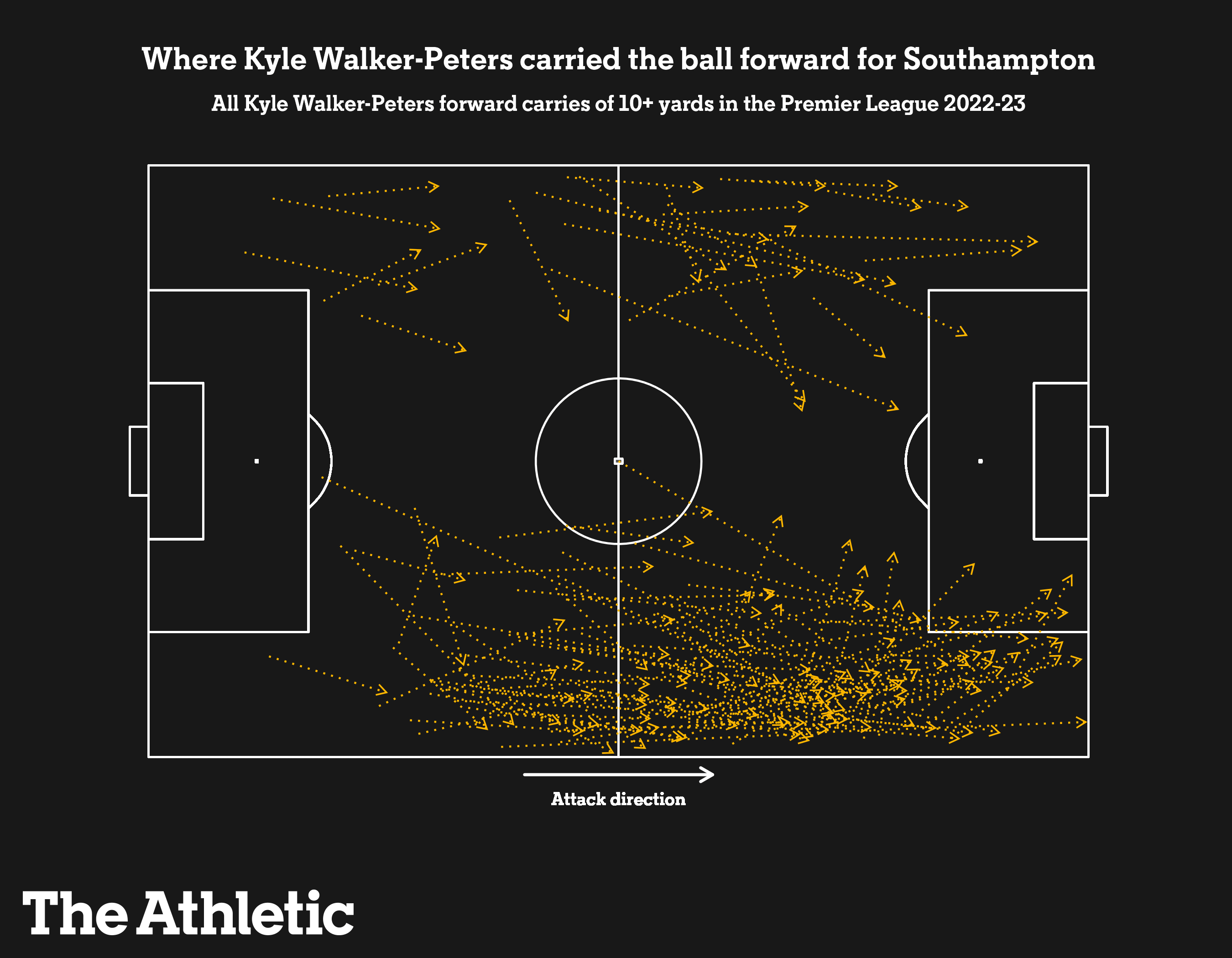

Crystal Palaces Pursuit Of Free Agent Kyle Walker Peters

May 24, 2025

Crystal Palaces Pursuit Of Free Agent Kyle Walker Peters

May 24, 2025 -

80 Millio Forintert Extrazott Porsche 911 Reszletes Bemutatas

May 24, 2025

80 Millio Forintert Extrazott Porsche 911 Reszletes Bemutatas

May 24, 2025 -

The Rumored Open Ai Jony Ive Ai Hardware Deal What We Know

May 24, 2025

The Rumored Open Ai Jony Ive Ai Hardware Deal What We Know

May 24, 2025 -

How To Obtain Bbc Radio 1 Big Weekend 2025 Tickets At Sefton Park

May 24, 2025

How To Obtain Bbc Radio 1 Big Weekend 2025 Tickets At Sefton Park

May 24, 2025 -

Porsche 911 80 Millio Forintert Csak Az Extrak

May 24, 2025

Porsche 911 80 Millio Forintert Csak Az Extrak

May 24, 2025

Latest Posts

-

En Zeki Burclar Dahilik Genleri Ve Akil Yetenekleri

May 24, 2025

En Zeki Burclar Dahilik Genleri Ve Akil Yetenekleri

May 24, 2025 -

Burc Yorumlari Nisan Hangi Burclar Zengin Oluyor

May 24, 2025

Burc Yorumlari Nisan Hangi Burclar Zengin Oluyor

May 24, 2025 -

Seytan Tueyue Gibi En Cekici Burclar Belirlendi

May 24, 2025

Seytan Tueyue Gibi En Cekici Burclar Belirlendi

May 24, 2025 -

Nisan 2024 Para Bereketi Yasayacak Burclar

May 24, 2025

Nisan 2024 Para Bereketi Yasayacak Burclar

May 24, 2025 -

Oefkesini Hemen Cikaran Burclar Ihanetin Bedeli

May 24, 2025

Oefkesini Hemen Cikaran Burclar Ihanetin Bedeli

May 24, 2025