Apple Stock: Long-Term Bullish Despite Price Cut? Wedbush's Take

Table of Contents

Wedbush's Rationale for a Bullish Outlook on Apple Stock

Wedbush's bullish stance on Apple stock is underpinned by several key factors, suggesting a strong long-term growth trajectory despite short-term market fluctuations. Their analysis points to a company well-positioned for continued success. Key reasons for their optimism include:

-

Strong iPhone Sales: Despite persistent economic headwinds and concerns about a potential recession, iPhone sales remain robust. This demonstrates the enduring appeal and brand loyalty associated with Apple products. The Apple stock price, while volatile, reflects this underlying strength.

-

Growth in Services: Apple's services sector, encompassing the App Store, iCloud, Apple Music, and other subscription services, is a significant driver of revenue growth and profitability. This recurring revenue stream provides a stable foundation for Apple's financial performance, a key factor in Wedbush's Apple prediction. This diversification reduces reliance on hardware sales alone, improving the Apple stock forecast.

-

Expansion into New Markets and Products: Apple continues to invest heavily in research and development, expanding into promising new areas like augmented reality (AR) and virtual reality (VR). These ventures represent significant growth opportunities, further bolstering the long-term Apple investment thesis.

-

Resilient Brand and Customer Loyalty: Apple enjoys unparalleled brand recognition and customer loyalty, fostering a strong ecosystem that encourages repeat purchases and upgrades. This inherent strength contributes significantly to the company's resilience in the face of economic uncertainty and competitive pressures.

-

Strategic Price Adjustments: Wedbush views the recent price cuts not as a sign of weakness, but rather as strategic moves to gain market share and stimulate demand, particularly in the face of increased competition. This is a key component of their Apple stock price analysis.

Analyzing the Impact of Recent Apple Price Cuts

Apple's recent price reductions, impacting various products, have sparked debate about their long-term effects. While short-term profit margins may be affected, the potential long-term benefits are significant. Several factors contribute to the price cuts:

-

Increased Competition: The smartphone market is increasingly competitive, necessitating price adjustments to remain attractive.

-

Component Costs: Fluctuations in component costs can influence pricing strategies.

-

Market Saturation: In mature markets, price reductions can stimulate demand and encourage upgrades.

The impact of these cuts can be viewed in two phases:

-

Short-Term Impact: Reduced profit margins are a likely consequence in the short term.

-

Long-Term Impact: Increased market share, boosted customer acquisition, and potentially higher overall revenue due to increased volume are anticipated long-term positive effects. These are critical factors in understanding the overall Apple sales strategy and the broader Apple competitive landscape.

Counterarguments and Potential Risks to the Bullish Apple Stock Prediction

While Wedbush maintains a bullish outlook, it's essential to acknowledge potential counterarguments and risks:

-

Global Economic Uncertainty: Recessionary fears and global economic instability could dampen consumer spending, impacting Apple's sales.

-

Increased Competition: Intense competition from other tech giants, particularly in the smartphone and services markets, poses a considerable threat.

-

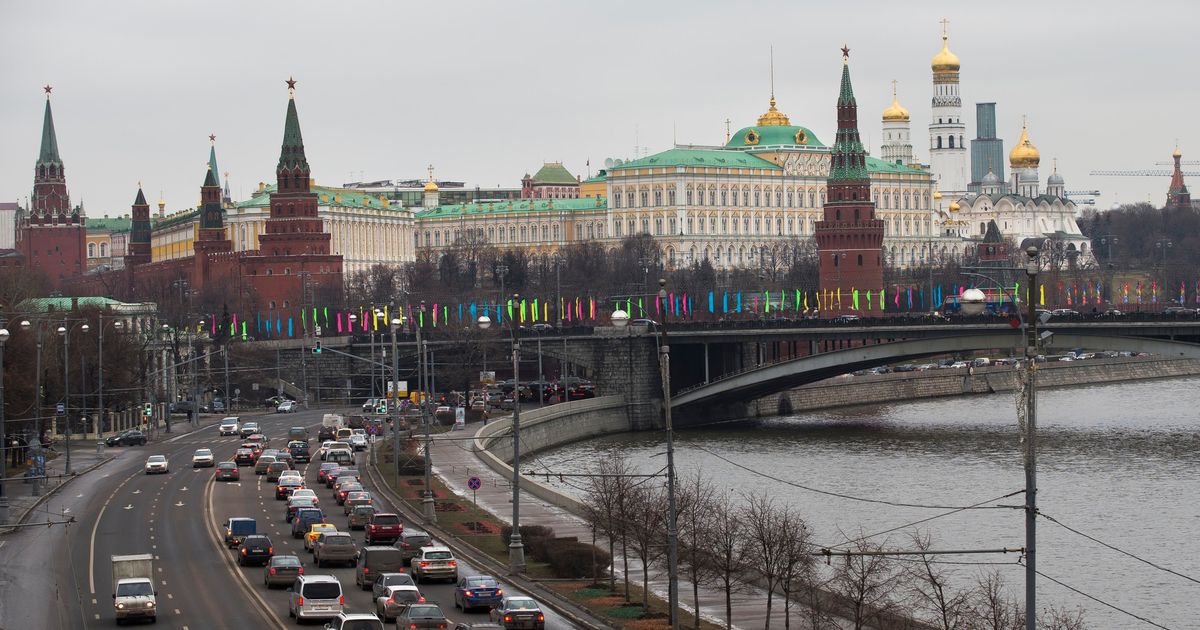

Supply Chain Disruptions: Geopolitical events and unforeseen circumstances can disrupt Apple's supply chain, affecting production and delivery.

-

Negative Publicity or Regulatory Issues: Negative press or regulatory scrutiny can damage Apple's reputation and impact its stock performance.

Diversification within the Apple Ecosystem

A crucial factor mitigating some of these risks is Apple's diversified product and service portfolio. The strength of the Apple ecosystem, where devices and services are seamlessly integrated, ensures sustained revenue streams and reduces reliance on any single product category. This diversification is a key buffer against potential market downturns and competitive pressures.

Investing in Apple Stock – A Long-Term Perspective

Wedbush's bullish prediction for Apple stock is founded on a strong belief in the company's long-term growth potential, supported by strong iPhone sales, a thriving services sector, expansion into new markets, and a resilient brand. While risks, such as global economic uncertainty and increased competition, exist, the potential for long-term growth remains significant. This balanced perspective highlights both the compelling upside and potential challenges of Apple Stock. Therefore, potential investors should conduct thorough research and consider their individual risk tolerance and financial goals before making investment decisions. Learn more about Apple Stock's potential and make informed investment decisions.

Featured Posts

-

Europese Aandelenmarkt Analyse Van De Recente Koerswijziging Ten Opzichte Van Wall Street

May 25, 2025

Europese Aandelenmarkt Analyse Van De Recente Koerswijziging Ten Opzichte Van Wall Street

May 25, 2025 -

17 Celebrity Falls From Grace Overnight Reputation Ruins

May 25, 2025

17 Celebrity Falls From Grace Overnight Reputation Ruins

May 25, 2025 -

13 Vuotias Kuljettaja Ferrarille Taessae On Nimi Jonka Kannattaa Muistaa

May 25, 2025

13 Vuotias Kuljettaja Ferrarille Taessae On Nimi Jonka Kannattaa Muistaa

May 25, 2025 -

H Nonline Sk Tisice Prepustenych V Nemecku Reakcia Na Hospodarsky Pokles

May 25, 2025

H Nonline Sk Tisice Prepustenych V Nemecku Reakcia Na Hospodarsky Pokles

May 25, 2025 -

Canada Post Strike Will Customer Loyalty Suffer

May 25, 2025

Canada Post Strike Will Customer Loyalty Suffer

May 25, 2025

Latest Posts

-

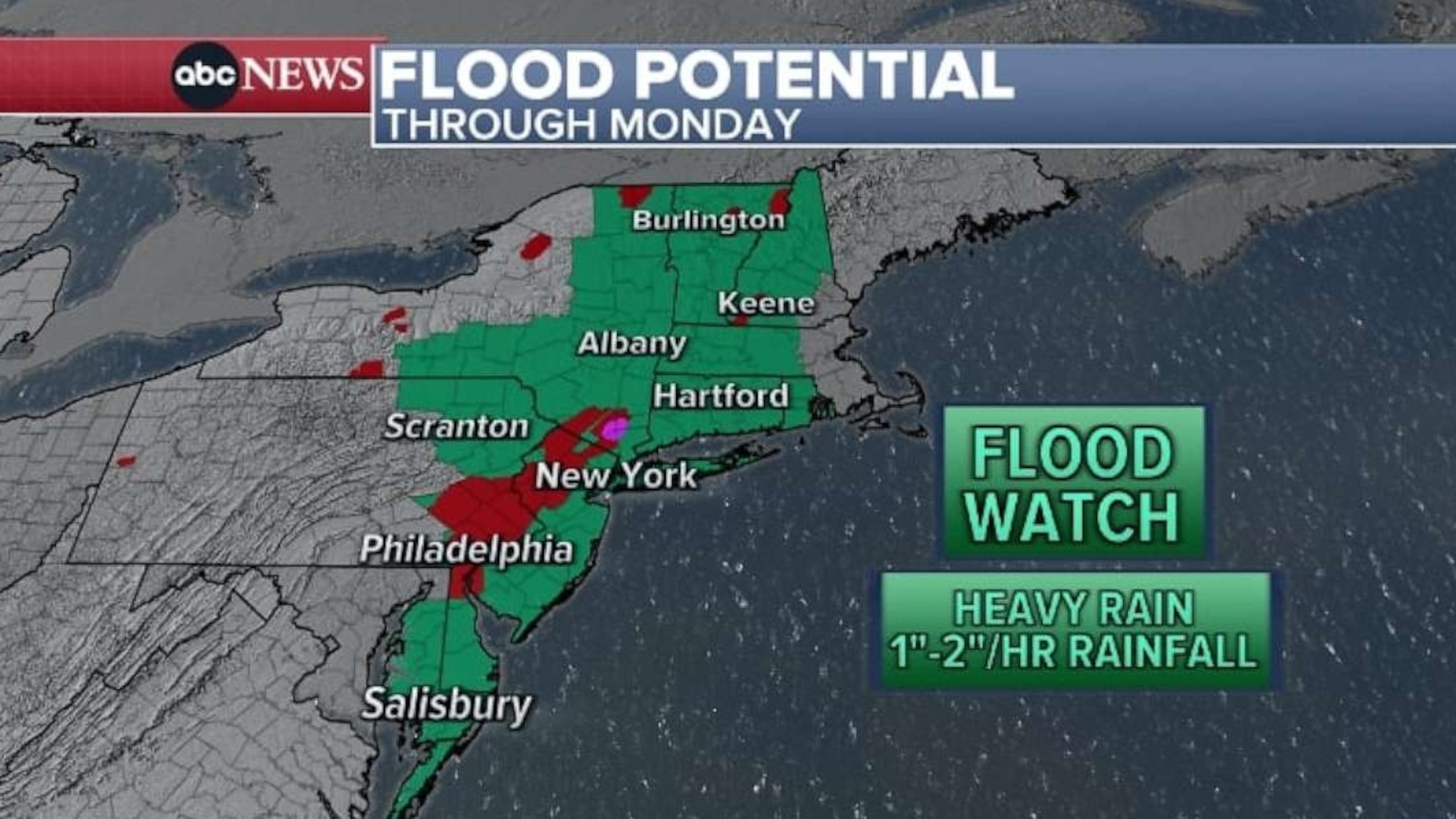

Flash Flood Warning Cayuga County Under Alert Until Tuesday Night

May 25, 2025

Flash Flood Warning Cayuga County Under Alert Until Tuesday Night

May 25, 2025 -

North Myrtle Beachs Water Crisis Understanding The Public Safety Implications

May 25, 2025

North Myrtle Beachs Water Crisis Understanding The Public Safety Implications

May 25, 2025 -

Public Safety Issues In North Myrtle Beach Due To Excess Water Consumption

May 25, 2025

Public Safety Issues In North Myrtle Beach Due To Excess Water Consumption

May 25, 2025 -

North Myrtle Beach Excessive Water Use A Public Safety Risk

May 25, 2025

North Myrtle Beach Excessive Water Use A Public Safety Risk

May 25, 2025 -

Flash Flood Emergency What To Know And How To Respond

May 25, 2025

Flash Flood Emergency What To Know And How To Respond

May 25, 2025