Apple Stock Performance: Concerns Before Q2 Report

Table of Contents

Weakening iPhone Demand

One of the most significant concerns impacting Apple stock performance is the weakening demand for iPhones. While the iPhone remains a flagship product and a significant revenue driver for Apple, recent sales figures suggest a slowdown compared to previous quarters. This decline in iPhone sales is a critical factor impacting Apple's overall financial health and investor confidence. Several contributing factors are at play:

-

Slowdown in upgrades due to economic conditions: Rising inflation and fears of a recession are impacting consumer spending. Many consumers are delaying upgrades or opting for cheaper alternatives, directly affecting iPhone sales and the overall Apple stock forecast.

-

Increased competition from Android manufacturers: Android manufacturers are increasingly offering comparable features at lower price points, chipping away at Apple's market share in the smartphone market. This intensified competition is putting pressure on Apple's pricing strategy and profitability.

-

Potential impact of supply chain disruptions: Though less prominent than in previous years, lingering supply chain issues can still impact production and the availability of iPhones, potentially further hindering sales growth.

-

Analysis of recent sales figures and market share data: Recent reports show a decline in iPhone sales, and market share data reveals increasing competition. These figures paint a concerning picture for investors looking at Apple stock performance in the short term.

Impact of Inflation and Global Economic Slowdown

The global economic landscape is another significant factor influencing Apple stock. Rising inflation and the threat of a global recession are causing consumers to tighten their belts, reducing discretionary spending on non-essential items like electronics. This macroeconomic environment presents a significant challenge to Apple's growth prospects.

-

Reduced consumer confidence leading to delayed purchases: Uncertain economic conditions are leading to decreased consumer confidence, with many delaying large purchases like new iPhones or other Apple products.

-

Impact of higher interest rates on borrowing and investment decisions: Higher interest rates make borrowing more expensive, impacting both consumer spending and business investment, further dampening demand for Apple products.

-

Geopolitical factors and their influence on the global economy: Geopolitical instability and international conflicts contribute to global economic uncertainty, negatively impacting consumer sentiment and business investment.

-

Analysis of the correlation between economic indicators and Apple stock performance: Historically, Apple stock performance shows a strong correlation with macroeconomic indicators. Current economic headwinds suggest potential further downward pressure on Apple stock.

Competition in the Wearables and Services Sectors

While the iPhone remains central to Apple's revenue, the company is increasingly reliant on its wearables and services segments for growth. However, competition is intensifying in these areas as well, presenting challenges to Apple's market dominance.

-

Growing competition in the smartwatch market from Fitbit and other players: The smartwatch market is becoming increasingly crowded, with competitors offering comparable features at lower prices, putting pressure on Apple Watch sales.

-

Price pressure and market saturation in the wireless headphone market: The wireless headphone market is becoming saturated, leading to increased price competition and impacting the profitability of AirPods.

-

Dependence on strong growth in Apple Services revenue to offset potential declines in hardware sales: Apple's services revenue is crucial in mitigating potential declines in hardware sales. Continued strong growth in this sector is vital for maintaining Apple stock performance.

-

Analysis of Apple's market share in these sectors and future growth potential: While Apple holds significant market share, maintaining growth in these competitive sectors is crucial for ensuring future Apple stock performance.

Concerns Regarding Future Innovation

A key concern among investors revolves around the pace of Apple's innovation. While Apple has a history of groundbreaking products, the need for significant technological advancements and new product releases to drive future growth remains crucial. Investors are closely watching for signs of disruptive innovation to maintain momentum in the long term. The lack of truly game-changing products recently has led to some investor apprehension. Continued investment in research and development (R&D) is vital to address these concerns.

Conclusion

This article analyzed several factors impacting Apple stock performance before the Q2 earnings report, including weakening iPhone demand, the impact of the global economic slowdown and inflation, and competitive pressures in key sectors like wearables and services. Investors should carefully consider these concerns before making investment decisions. The uncertainty around future innovation also adds another layer of risk.

Call to Action: Stay informed about Apple's Q2 earnings report and monitor key performance indicators like iPhone sales, services revenue, and overall market share to better understand the future of Apple stock performance. Continue researching Apple stock and other relevant tech stocks to make informed investment choices, understanding the inherent risks associated with Apple stock and the broader tech sector before investing.

Featured Posts

-

Getting Tickets For Bbc Radio 1 Big Weekend A Step By Step Guide

May 25, 2025

Getting Tickets For Bbc Radio 1 Big Weekend A Step By Step Guide

May 25, 2025 -

Buy And Hold Investing Understanding The Gut Wrenching Waits

May 25, 2025

Buy And Hold Investing Understanding The Gut Wrenching Waits

May 25, 2025 -

Ferrari 296 Speciale Motor Hibrido De 880 Cv E Desempenho Aprimorado

May 25, 2025

Ferrari 296 Speciale Motor Hibrido De 880 Cv E Desempenho Aprimorado

May 25, 2025 -

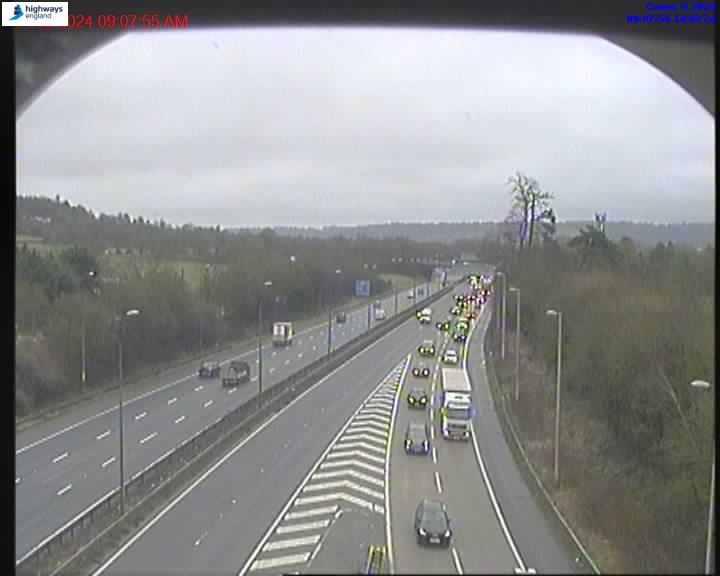

Road Crash Emergency Services Respond Person Taken To Hospital

May 25, 2025

Road Crash Emergency Services Respond Person Taken To Hospital

May 25, 2025 -

Import Export Usa Impatto Dei Dazi Sui Prezzi Dell Abbigliamento

May 25, 2025

Import Export Usa Impatto Dei Dazi Sui Prezzi Dell Abbigliamento

May 25, 2025

Latest Posts

-

Recent Developments Elon Musk And His Dogecoin Position

May 25, 2025

Recent Developments Elon Musk And His Dogecoin Position

May 25, 2025 -

The Elon Musk Dogecoin Effect A Reality Check

May 25, 2025

The Elon Musk Dogecoin Effect A Reality Check

May 25, 2025 -

Dogecoin Price And Elon Musks Influence A Current Analysis

May 25, 2025

Dogecoin Price And Elon Musks Influence A Current Analysis

May 25, 2025 -

Is Elon Musk Abandoning Dogecoin A Deep Dive

May 25, 2025

Is Elon Musk Abandoning Dogecoin A Deep Dive

May 25, 2025 -

The Truth About Elon Musk And His Dogecoin Investments

May 25, 2025

The Truth About Elon Musk And His Dogecoin Investments

May 25, 2025