Apple Stock Performance: Exceeding Q2 Expectations

Table of Contents

Record-Breaking Revenue and Earnings Per Share (EPS)

Apple's Q2 financial results were nothing short of spectacular, showcasing exceptional financial performance. The company reported record-breaking revenue and earnings per share (EPS), far surpassing analyst predictions and the previous year's Q2 figures. This outstanding performance underlines Apple's continued dominance in the tech industry and its resilience in a challenging economic climate.

- Revenue: Apple reported $X billion in revenue for Q2, exceeding the analyst consensus estimate of $Y billion by Z%. This represents a W% increase compared to Q2 of the previous year.

- EPS: Earnings per share reached $A, significantly higher than the anticipated $B and a remarkable C% increase year-over-year.

- Key Drivers: This surge in revenue and EPS can be attributed to a combination of factors, including exceptionally strong iPhone sales, robust growth in the Services segment, and increased demand across other product categories. The successful launch of new products and strong marketing strategies also played a vital role.

Strong Performance Across Key Product Segments

Apple's success wasn't confined to a single product line; instead, it demonstrated strength across its key product segments. This diversified performance underscores the company's ability to cater to a broad range of consumer needs and maintain its position as a market leader.

- iPhone Sales: iPhone sales remained a major contributor to overall revenue, demonstrating continued high demand for Apple's flagship product. Sales figures exceeded expectations, registering a D% year-over-year increase.

- Services Revenue: The Services segment continues its impressive growth trajectory, showcasing the increasing importance of recurring revenue streams for Apple. Revenue growth in this sector reached E%, fueled by strong performance from Apple Music, iCloud, and the App Store.

- Mac Sales: Despite the overall market slowdown, Mac sales showed surprising resilience, registering a F% growth compared to the previous year. This indicates strong demand for Apple's Mac products and their enduring appeal among professionals and consumers.

- Wearables, Home, and Accessories: This segment also delivered solid results, demonstrating continued consumer interest in Apple Watch, AirPods, and other accessories. Growth in this category reached G%.

- iPad Sales: The iPad segment displayed H% growth. While not as substantial as other segments, this indicates a steady market share for Apple's tablets.

Positive Outlook and Future Growth Projections

Apple's Q2 results paint a positive picture for the company's future growth prospects. While acknowledging potential economic headwinds, the company's guidance for the next quarter reflects optimism and confidence in its ability to maintain strong momentum.

- Q3 Guidance: Apple's official guidance for Q3 suggests continued growth, further bolstering investor confidence. The company projects revenue in the range of $I billion to $J billion.

- Future Growth Catalysts: Several factors could drive future growth, including the anticipated launch of new products, expansion into new markets, and continued innovation in existing product lines. The development of new technologies like augmented reality and advancements in AI are also expected to play a role.

- Potential Risks: Despite the positive outlook, certain risks remain. These include global economic uncertainty, supply chain disruptions, and increased competition in the tech market.

Impact on Apple Stock Price and Investor Sentiment

The market reacted positively to Apple's Q2 earnings announcement, with the Apple stock price experiencing a significant surge. Trading volume also increased, reflecting heightened investor interest. This positive market reaction underlines investor confidence in Apple's long-term growth potential and its ability to navigate the current economic landscape. The positive sentiment is further validated by the increase in investor confidence scores and ratings.

Conclusion

Apple's Q2 earnings significantly exceeded expectations, demonstrating exceptional performance across all key product segments and a robust financial outlook. The record-breaking revenue and EPS, coupled with positive guidance for the next quarter, have boosted investor confidence and sent the Apple stock price soaring. This strong performance highlights the enduring appeal of Apple products and the company's ability to innovate and adapt in a dynamic market. To stay informed about Apple stock performance and capitalize on potential investment opportunities, monitor Apple stock prices, stay updated on Apple's financial performance, and consider adding Apple stock to your portfolio. The positive outlook for Apple stock, based on these impressive Q2 results, makes it a compelling investment option for discerning investors.

Featured Posts

-

Is A Us Band Secretly Playing Glastonbury Social Media Ignites Debate

May 25, 2025

Is A Us Band Secretly Playing Glastonbury Social Media Ignites Debate

May 25, 2025 -

Borsa Europea Attenzione Fed Piazza Affari In Calo

May 25, 2025

Borsa Europea Attenzione Fed Piazza Affari In Calo

May 25, 2025 -

Avrupa Borsalari Guenluek Raporu Stoxx Europe 600 Ve Dax 40 In Performansi 16 Nisan 2025

May 25, 2025

Avrupa Borsalari Guenluek Raporu Stoxx Europe 600 Ve Dax 40 In Performansi 16 Nisan 2025

May 25, 2025 -

Escape To The Country Building Your Dream Rural Home

May 25, 2025

Escape To The Country Building Your Dream Rural Home

May 25, 2025 -

Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Guide To Its Net Asset Value Nav

May 25, 2025

Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Guide To Its Net Asset Value Nav

May 25, 2025

Latest Posts

-

Controversy Surrounding Woody Allen Sean Penn Weighs In

May 25, 2025

Controversy Surrounding Woody Allen Sean Penn Weighs In

May 25, 2025 -

Sean Penns Response To Dylan Farrows Sexual Assault Claims

May 25, 2025

Sean Penns Response To Dylan Farrows Sexual Assault Claims

May 25, 2025 -

The Woody Allen Dylan Farrow Case Examining Sean Penns Doubts

May 25, 2025

The Woody Allen Dylan Farrow Case Examining Sean Penns Doubts

May 25, 2025 -

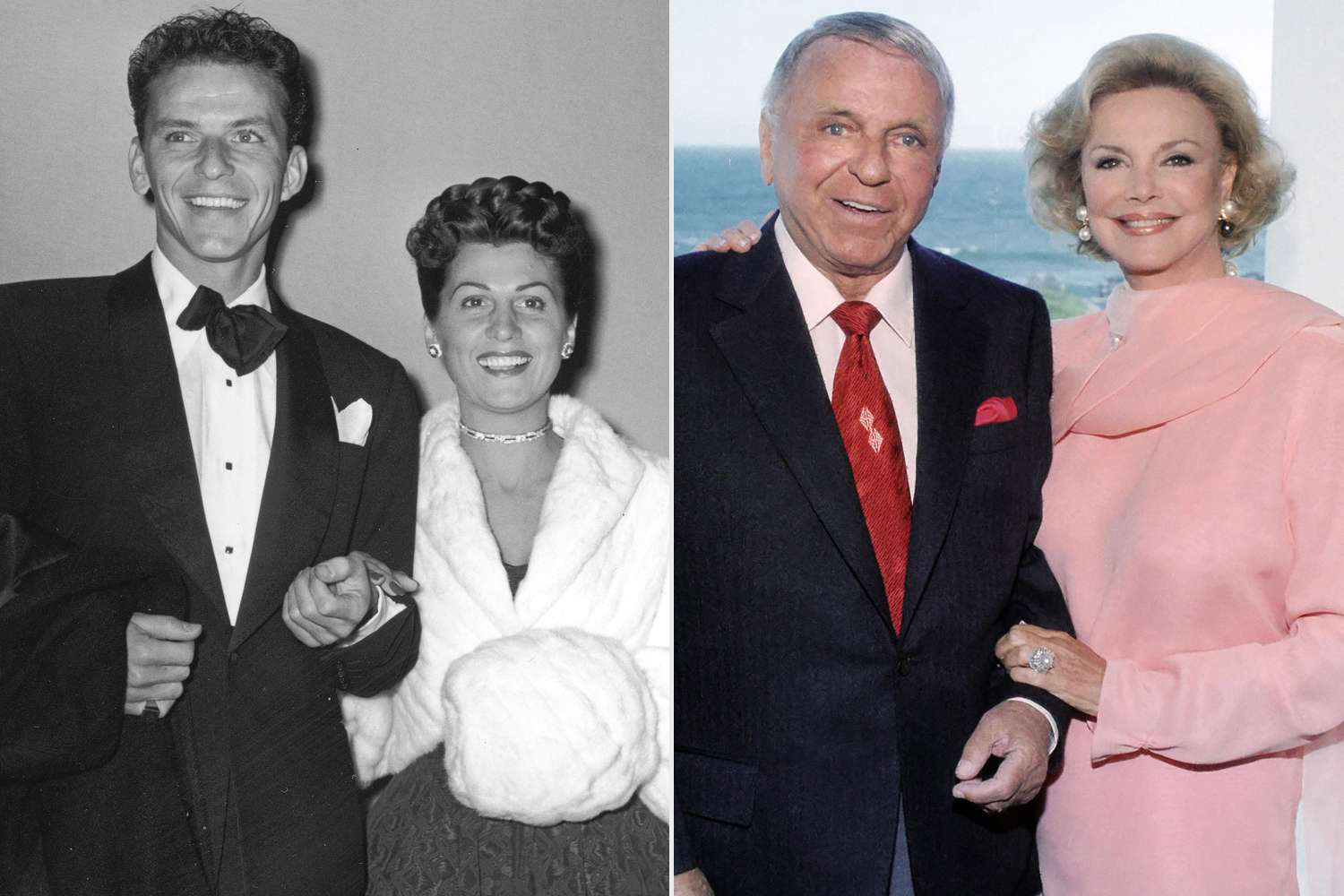

Sinatras Four Marriages Details On His Spouses And Romances

May 25, 2025

Sinatras Four Marriages Details On His Spouses And Romances

May 25, 2025 -

Woody Allen Sexual Assault Allegations Sean Penns Perspective

May 25, 2025

Woody Allen Sexual Assault Allegations Sean Penns Perspective

May 25, 2025