Apple Stock Price Target: Should You Buy AAPL At $200 Based On $254 Prediction?

Table of Contents

Analyzing the $254 Apple Stock Price Prediction

Several factors contribute to the optimistic $254 Apple stock price prediction. Understanding these, alongside potential risks, is crucial for informed decision-making.

Factors Supporting the $254 Prediction

Several positive factors support the bullish $254 Apple stock price prediction:

- Strong iPhone Sales: Despite economic headwinds, iPhone sales remain robust, demonstrating enduring brand loyalty and consistent demand. [Link to a recent Apple earnings report showing iPhone sales figures].

- Growth in Services Revenue: Apple's services segment (Apple Music, iCloud, Apple TV+, etc.) continues to experience significant growth, providing a recurring revenue stream and boosting profitability. [Link to an article detailing Apple's services revenue growth].

- Innovative Product Pipeline: Apple's history of innovation continues with anticipated launches, such as the highly anticipated AR/VR headset and new Mac models, potentially driving future growth. [Link to an article discussing Apple's upcoming product releases].

- Expanding Market Share in Wearables: Apple Watch and AirPods maintain strong market positions and continue to expand their market share in the rapidly growing wearables sector. [Link to a market research report on the wearables market].

- Strong Brand Loyalty: Apple boasts unparalleled brand loyalty, ensuring a consistent customer base for its products and services.

The methodology behind the $254 prediction likely involves a combination of fundamental analysis (examining Apple's financial health and future prospects) and technical analysis (using charts and historical data to predict future price movements). Different analysts may utilize varying models, leading to differing predictions.

Potential Risks and Headwinds

While the outlook is positive, several headwinds could impact the accuracy of the $254 Apple stock price prediction:

- Global Economic Slowdown: A global recession could dampen consumer spending, impacting demand for Apple's premium products.

- Increased Competition: Intense competition from Android smartphone manufacturers and other tech companies poses a challenge to Apple's market dominance.

- Supply Chain Disruptions: Geopolitical instability and unexpected events can disrupt Apple's supply chain, impacting production and sales.

- Currency Fluctuations: Changes in foreign exchange rates can affect Apple's profitability and stock price.

- Regulatory Challenges: Increasing regulatory scrutiny in various markets could lead to increased costs and potential fines.

Negative analyst reports often cite concerns about these risks, suggesting a more conservative price target than $254. [Link to a bearish analyst report on AAPL].

Evaluating AAPL Stock at the $200 Price Point

Determining whether $200 is a good entry point requires analyzing AAPL's current valuation and financial performance.

Current Valuation and Financial Performance

AAPL's current valuation, considering metrics like its Price-to-Earnings (P/E) ratio and Price-to-Sales (P/S) ratio, should be compared to its historical performance and competitors. [Link to a financial analysis website showing AAPL's key financial metrics]. Recent quarterly earnings reports provide insights into the company's financial health and future prospects. [Link to Apple's latest earnings report]. Comparing the current valuation to the $254 prediction helps gauge the potential upside and risk.

Risk Tolerance and Investment Strategy

Investment decisions must align with individual risk tolerance and investment goals. A long-term investor with a high-risk tolerance might view the $200 price point as an attractive entry point, considering the potential upside to $254. A short-term investor, however, might prefer a less volatile investment. Diversification is key – don't put all your eggs in one basket.

Alternative Investment Options

While AAPL offers significant potential, considering alternative tech stocks or investment options is wise. For example, investing in a diversified tech ETF or exploring other promising tech companies provides balance. [Link to a resource comparing different tech stocks].

Conclusion

Buying AAPL at $200 based on a $254 Apple stock price target presents both potential rewards and risks. The positive factors supporting the prediction are strong, but significant headwinds exist. Conduct thorough research, carefully consider your risk tolerance and investment strategy, and understand the potential downsides before investing. Make an informed decision about the Apple Stock Price Target – conduct your own research and consider the potential risks and rewards before investing in AAPL. Remember to consult with a financial advisor before making any investment decisions.

Featured Posts

-

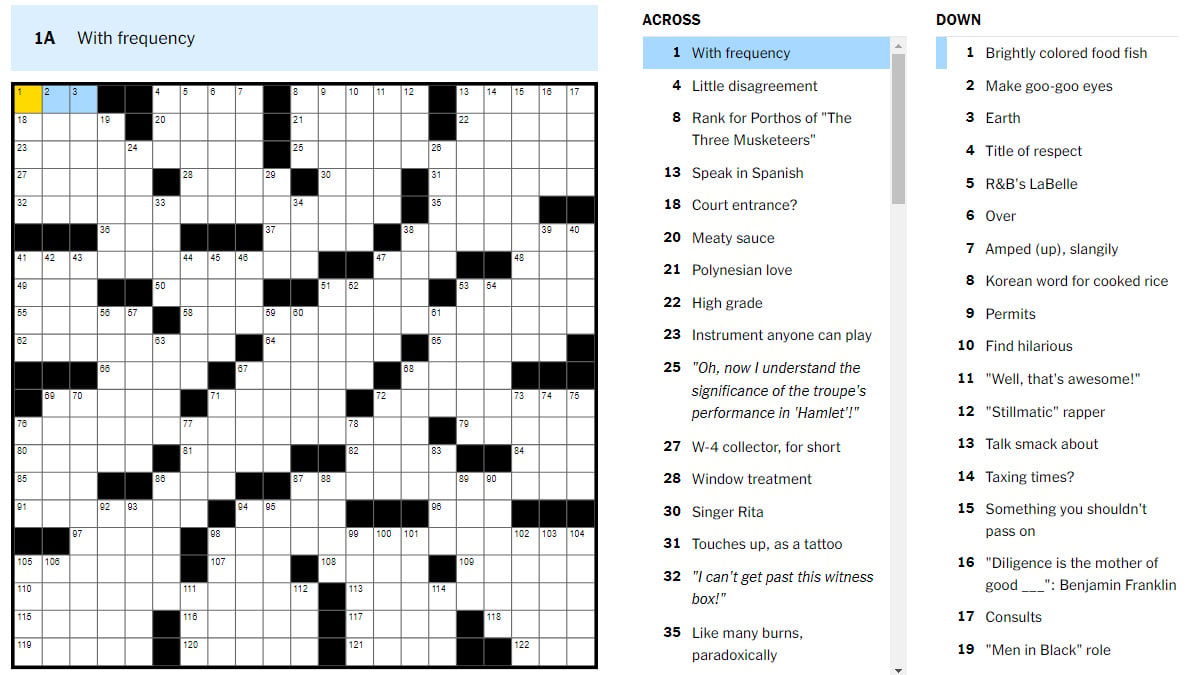

Nyt Mini Crossword March 6 2025 Complete Solution

May 24, 2025

Nyt Mini Crossword March 6 2025 Complete Solution

May 24, 2025 -

When To Fly For Memorial Day Weekend 2025 Avoid The Crowds

May 24, 2025

When To Fly For Memorial Day Weekend 2025 Avoid The Crowds

May 24, 2025 -

Escape To The Country A Realistic Look At Country Living

May 24, 2025

Escape To The Country A Realistic Look At Country Living

May 24, 2025 -

Understanding The Net Asset Value Nav For Amundi Dow Jones Industrial Average Ucits Etf Investors

May 24, 2025

Understanding The Net Asset Value Nav For Amundi Dow Jones Industrial Average Ucits Etf Investors

May 24, 2025 -

Brbs Banco Master Acquisition A Challenge To Brazils Banking Giants

May 24, 2025

Brbs Banco Master Acquisition A Challenge To Brazils Banking Giants

May 24, 2025

Latest Posts

-

Museum Programs Under Threat Examining The Impact Of Federal Funding Cuts

May 24, 2025

Museum Programs Under Threat Examining The Impact Of Federal Funding Cuts

May 24, 2025 -

T Mobile Hit With 16 Million Fine For Repeated Data Breaches

May 24, 2025

T Mobile Hit With 16 Million Fine For Repeated Data Breaches

May 24, 2025 -

The Impact Of Trumps Cuts On Museum Programming And Funding

May 24, 2025

The Impact Of Trumps Cuts On Museum Programming And Funding

May 24, 2025 -

16 Million Fine For T Mobile Details On Three Years Of Data Security Lapses

May 24, 2025

16 Million Fine For T Mobile Details On Three Years Of Data Security Lapses

May 24, 2025 -

Trumps Budget Cuts Threaten Museum Programs A Deep Dive

May 24, 2025

Trumps Budget Cuts Threaten Museum Programs A Deep Dive

May 24, 2025