Apple Stock Soars: IPhone Sales Drive Strong Q2 Results

Table of Contents

Record-Breaking iPhone Sales Fuel Apple's Q2 Growth

Apple's Q2 results showcased record-breaking iPhone sales, exceeding analysts' expectations. The company reported selling X million iPhones, a Y% increase compared to the same period last year. This phenomenal growth was driven by several factors. The iPhone 14 Pro and iPhone 14 Pro Max proved particularly popular, accounting for a significant portion of total sales. Apple's innovative camera technology, powerful A16 Bionic chip, and effective marketing campaigns all contributed to the surge in demand.

- Quantifiable data: X million iPhone units sold, representing a Y% increase year-over-year.

- Sales comparison: A Z% increase compared to Q1 2024 sales figures.

- Regional performance: Particularly strong sales were observed in North America and Asia.

- Supply chain impact: Improved supply chain efficiency played a key role in meeting the high consumer demand.

Services Revenue Continues to Show Robust Growth, Supporting Apple Stock Price

Beyond hardware sales, Apple's Services division continues to be a significant driver of growth and a pillar of stability for its stock price. The App Store, Apple Music, iCloud, and other subscription services demonstrated robust growth, contributing significantly to the overall Q2 earnings. These recurring revenue streams provide a predictable and reliable income stream, further enhancing investor confidence in Apple's long-term prospects.

- Revenue increase: Services revenue increased by X% compared to the previous quarter and Y% compared to the same quarter last year.

- Top performing services: The App Store and iCloud storage remained the leading revenue generators.

- User growth: A significant increase in paying subscribers across various services was observed.

- Future projections: Analysts predict continued strong growth in Services revenue for the coming quarters.

Positive Investor Sentiment and Market Outlook Contribute to Apple Stock Increase

The strong Q2 results have generated overwhelmingly positive reactions from financial analysts, who have largely revised their price targets upwards for Apple stock. Many analysts see the company maintaining its robust growth trajectory, citing the strong demand for iPhones and the continued expansion of its Services ecosystem. While broader macroeconomic factors always play a role, investor confidence in Apple remains high, contributing significantly to the recent stock increase.

- Analyst quotes: "Apple's Q2 results exceeded expectations, demonstrating the resilience of its product ecosystem and the continued growth potential of its Services business." - [Analyst Name, Brokerage]

- Investor sentiment: The market sentiment towards Apple stock is overwhelmingly bullish.

- Market trends: The positive performance of Apple stock reflects broader investor optimism in the tech sector.

- Upcoming product launches: Anticipation for future product launches, such as new iPhones and potential AR/VR devices, further contributes to positive investor sentiment.

Competition and Market Share: Maintaining a Leading Position

While Apple enjoys a dominant position, competition from companies like Samsung and Google remains fierce. However, Apple's strong brand loyalty, innovative products, and robust ecosystem have allowed it to maintain a significant market share in the smartphone and other relevant markets. Continuous innovation and strategic marketing are essential for Apple to retain its competitive edge.

- Market share data: Apple holds an estimated X% market share in the global smartphone market.

- Competitive analysis: Apple continues to outperform key competitors in terms of profitability and brand recognition.

- Future innovation: Apple’s ongoing investments in research and development, including areas like AR/VR and AI, are crucial for sustaining its competitive advantage.

Conclusion: Apple Stock's Future and Investment Implications

The recent surge in Apple stock is a direct result of strong Q2 performance driven by record-breaking iPhone sales and the continued success of its Services business. The positive investor sentiment and promising market outlook further contribute to its upward trajectory. While market fluctuations are inevitable, Apple's robust financial position and ongoing innovation suggest a positive outlook for the future. Stay tuned for updates on Apple stock performance and consider conducting your own thorough research before making any investment decisions related to Apple stock investment, tracking Apple stock, or evaluating Apple stock forecasts.

Featured Posts

-

Analisi Dei Dazi Previsioni Sui Prezzi Della Moda Negli Stati Uniti

May 25, 2025

Analisi Dei Dazi Previsioni Sui Prezzi Della Moda Negli Stati Uniti

May 25, 2025 -

Leeds Uniteds Pursuit Of Kyle Walker Peters Transfer Update

May 25, 2025

Leeds Uniteds Pursuit Of Kyle Walker Peters Transfer Update

May 25, 2025 -

Claiming Your Spot Bbc Radio 1 Big Weekend 2025 Sefton Park Tickets

May 25, 2025

Claiming Your Spot Bbc Radio 1 Big Weekend 2025 Sefton Park Tickets

May 25, 2025 -

Investing In Apple Weighing Wedbushs Opinion After Price Target Adjustment

May 25, 2025

Investing In Apple Weighing Wedbushs Opinion After Price Target Adjustment

May 25, 2025 -

Best Of Bangladesh In Europe 2nd Edition Collaboration And Growth

May 25, 2025

Best Of Bangladesh In Europe 2nd Edition Collaboration And Growth

May 25, 2025

Latest Posts

-

Blue Origin Rocket Launch Abruptly Halted By Technical Issue

May 25, 2025

Blue Origin Rocket Launch Abruptly Halted By Technical Issue

May 25, 2025 -

Los Angeles Palisades Fire Impact On Celebrity Homes Full List

May 25, 2025

Los Angeles Palisades Fire Impact On Celebrity Homes Full List

May 25, 2025 -

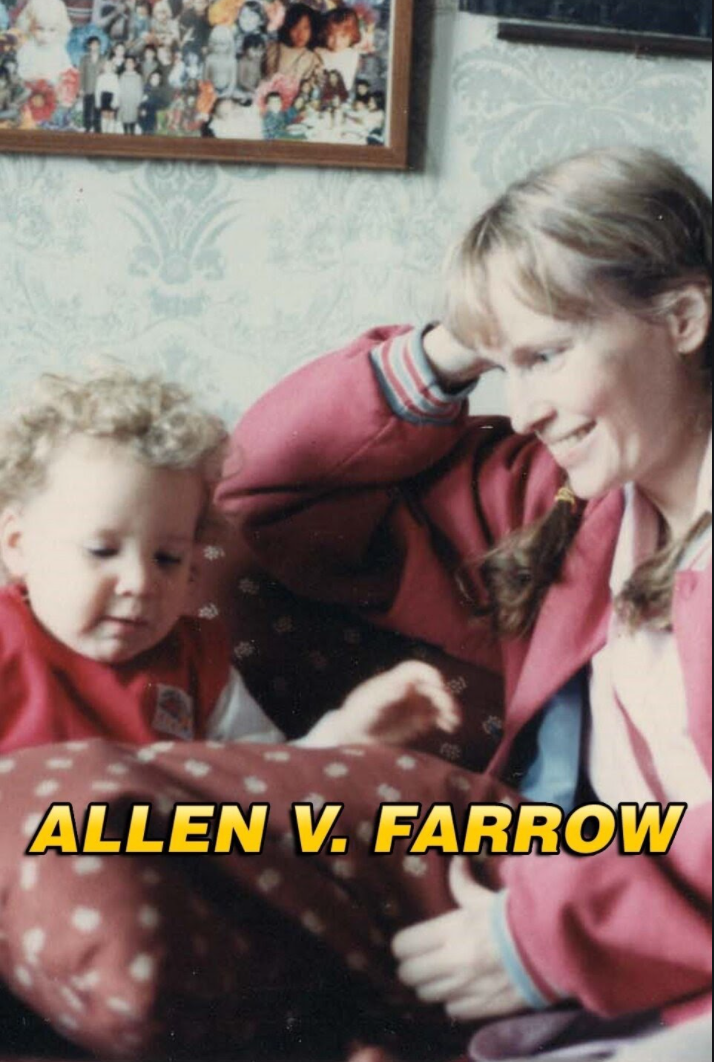

Controversy Surrounding Woody Allen Sean Penn Weighs In

May 25, 2025

Controversy Surrounding Woody Allen Sean Penn Weighs In

May 25, 2025 -

Sean Penns Response To Dylan Farrows Sexual Assault Claims

May 25, 2025

Sean Penns Response To Dylan Farrows Sexual Assault Claims

May 25, 2025 -

The Woody Allen Dylan Farrow Case Examining Sean Penns Doubts

May 25, 2025

The Woody Allen Dylan Farrow Case Examining Sean Penns Doubts

May 25, 2025