Apple Stock Takes A Hit From Projected $900 Million Tariff

Table of Contents

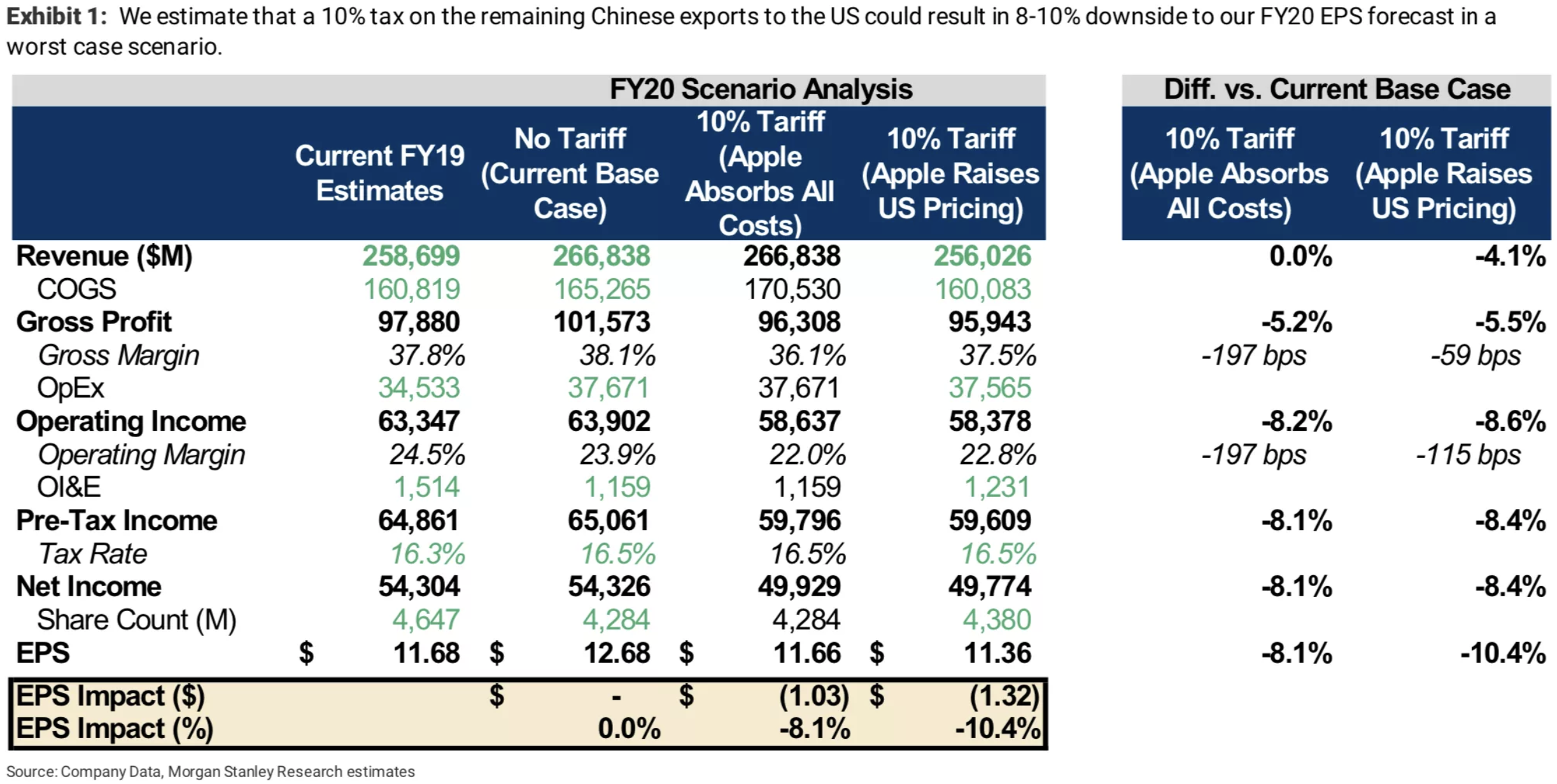

The Impact of the $900 Million Tariff on Apple's Financials

The projected $900 million tariff will undoubtedly impact Apple's financial performance. This translates to decreased profit margins, potentially forcing price increases for consumers and eroding investor confidence. The tariff's effect will vary across different product lines.

- iPhones: A significant portion of iPhones are manufactured in China, making them particularly vulnerable to the tariff. This could lead to an estimated 2-3% decrease in iPhone profit margins, depending on the specific tariff rates applied.

- Macs: Similar to iPhones, Macs assembled in China will face increased production costs, potentially affecting their pricing and competitiveness in the market.

- Apple Watch and AirPods: These products, also largely manufactured in China, will likely experience similar price pressures, potentially reducing their profitability.

The impact extends beyond direct product costs. The $900 million tariff also threatens to disrupt Apple's finely-tuned supply chain, leading to potential delays in product launches and increased logistical complexities. Any significant disruption could further reduce profit margins and damage Apple’s reputation for timely product delivery. Reliable sources indicate that Apple's overall profit margin could see a decline of up to 1.5% – a substantial hit for a company of its size. This financial impact will be closely watched by investors and analysts in the coming quarters. The long-term effects of these Apple tariffs and their effects on the Apple financial impact remain to be seen.

Market Reaction and Investor Sentiment

The market reacted swiftly to the $900 million tariff projection. Apple stock experienced immediate volatility, with a noticeable drop in its share price shortly after the news broke. Trading volume spiked significantly, indicating increased investor activity and concern. Analyst ratings have been adjusted downward, reflecting a more cautious outlook on Apple's near-term prospects.

- Investor Concerns: Investors are primarily concerned about the potential for reduced profitability, increased pricing pressure, and the overall impact on Apple's long-term growth trajectory.

- Sell-offs and Buy-ins: While significant sell-offs were observed immediately following the announcement, there has also been a degree of buying by investors who see the dip as a buying opportunity.

- Overall Sentiment: The overall investor sentiment is currently leaning towards cautious pessimism, with many analysts waiting to see how Apple responds to the tariff before making any definitive assessments. The volatility of Apple stock in response to this news highlights the significant uncertainty surrounding the issue.

This uncertainty is clearly reflected in the fluctuations of Apple stock price and the cautious approach of numerous investors. The Apple stock price volatility underlines the significance of the situation.

Apple's Response and Potential Mitigation Strategies

Apple has yet to release an official detailed statement directly addressing the $900 million tariff. However, it is expected that the company will actively pursue strategies to mitigate the impact. These may include:

- Lobbying efforts: Apple is likely to intensify its lobbying efforts to influence the government’s tariff policy, potentially working with other affected companies to create a unified front.

- Pricing adjustments: Apple may be forced to adjust prices for some products, though this could alienate consumers. A more likely approach involves absorption of some of the cost increase to maintain market competitiveness.

- Diversification of supply chain: Apple is expected to accelerate efforts to diversify its manufacturing base beyond China, reducing its dependence on a single region for production. This is a long-term strategy that requires significant investment and time to implement effectively.

The effectiveness of these strategies will depend on various factors, including government policies, consumer response to potential price increases, and the overall global economic climate. The Apple response to tariffs will be a key factor in determining the long-term impact of this situation.

Comparison to Previous Tariff Impacts

This situation bears some resemblance to previous instances where tariffs impacted Apple or other tech companies. While the scale of the $900 million figure is substantial, past experience demonstrates that the tech industry can adapt and find ways to mitigate tariff-related challenges. However, the current geopolitical landscape adds a layer of complexity not seen in previous situations. Analyzing these previous Apple tariffs and the history of tech tariffs can inform strategies for overcoming the present challenge.

Long-Term Implications for Apple and the Tech Industry

The $900 million tariff projection carries significant long-term implications for both Apple and the broader tech industry. The long-term impact on Apple is difficult to accurately predict.

- Manufacturing Location Shifts: The tariff could accelerate a shift in Apple's manufacturing operations away from China to other countries with lower tariff burdens or more favorable trade agreements.

- Increased Prices for Consumers: Consumers are likely to face higher prices for Apple products, potentially impacting demand and market share.

- Impact on Innovation and Competition: Increased production costs could stifle innovation and intensify competition within the tech sector, as companies scramble to find ways to mitigate the impact of tariffs.

The consequences of the $900 million tariff extend beyond Apple’s immediate financial performance, impacting the broader tech industry and potentially reshaping the global manufacturing landscape. The future of Apple is closely tied to its ability to navigate these complexities effectively.

Conclusion: Navigating the Uncertainty of Apple Stock After the $900 Million Tariff Projection

The projected $900 million tariff on Apple products presents a significant challenge. The immediate impact on Apple stock is undeniable, along with the potential consequences for its financials, supply chain, and future growth. The market reaction reflects considerable uncertainty, highlighting the complexity and potential long-term effects on Apple and the wider tech industry. Apple's response to these Apple tariffs will be critical in shaping its future. To understand how Apple navigates this $900 million tariff and the subsequent impact on Apple stock, stay tuned for further updates and analysis.

Featured Posts

-

Guccis Massimo Vian Departs Supply Chain Officer Exit Explained

May 25, 2025

Guccis Massimo Vian Departs Supply Chain Officer Exit Explained

May 25, 2025 -

Tathyr Atfaq Aljmark Alamryky Alsyny Ela Mwshr Daks Alalmany Artfae Ila 24 Alf Nqtt

May 25, 2025

Tathyr Atfaq Aljmark Alamryky Alsyny Ela Mwshr Daks Alalmany Artfae Ila 24 Alf Nqtt

May 25, 2025 -

90mph Chase Pair Refuel And Text While Evaded Police Helicopter

May 25, 2025

90mph Chase Pair Refuel And Text While Evaded Police Helicopter

May 25, 2025 -

The M62 Relief Road Burys Unrealized Transport Link

May 25, 2025

The M62 Relief Road Burys Unrealized Transport Link

May 25, 2025 -

The Thames Water Bonus Debate Performance Vs Public Perception

May 25, 2025

The Thames Water Bonus Debate Performance Vs Public Perception

May 25, 2025

Latest Posts

-

Staying Safe During Flash Floods Understanding Alerts And Emergency Procedures

May 25, 2025

Staying Safe During Flash Floods Understanding Alerts And Emergency Procedures

May 25, 2025 -

Flash Flood Safety Recognizing Warnings And Implementing Protective Measures

May 25, 2025

Flash Flood Safety Recognizing Warnings And Implementing Protective Measures

May 25, 2025 -

How To Prepare For Flash Floods Understanding Alerts And Taking Action

May 25, 2025

How To Prepare For Flash Floods Understanding Alerts And Taking Action

May 25, 2025 -

Understanding Flash Flood Warnings Essential Safety Tips And Information

May 25, 2025

Understanding Flash Flood Warnings Essential Safety Tips And Information

May 25, 2025 -

Flood Warnings And Alerts A Comprehensive Guide To Protecting Yourself

May 25, 2025

Flood Warnings And Alerts A Comprehensive Guide To Protecting Yourself

May 25, 2025