Apple Stock: Wedbush Remains Bullish, Even After Lowering Price Target

Table of Contents

Wedbush's Lowered Price Target and Rationale

Wedbush previously held a higher price target for Apple stock. However, their latest report adjusted this target downward. While the exact figures are subject to change and should be verified through official Wedbush publications, the reduction reflects a cautious approach to current market conditions. This adjustment isn't necessarily a bearish signal; rather, it acknowledges certain challenges impacting the broader tech sector and Apple specifically.

The reasons behind this price target adjustment include:

- Macroeconomic Factors: Global economic uncertainty, inflation, and potential recessionary pressures can dampen consumer spending and impact demand for Apple products.

- Supply Chain Concerns: Ongoing disruptions to global supply chains can affect Apple's production and delivery timelines, potentially impacting sales figures.

- Increased Competition: The competitive landscape in the tech industry remains fierce, with rivals constantly innovating and vying for market share.

Keywords: Apple stock price prediction, price target adjustment, Apple stock forecast, macroeconomic factors, supply chain issues.

Maintaining a Bullish Outlook: Why Wedbush Remains Positive

Despite lowering their price target, Wedbush maintains a bullish outlook on Apple's long-term prospects. This positive sentiment stems from several key factors:

Robust iPhone Demand and Sales

Despite economic headwinds, iPhone sales remain remarkably strong. The iPhone continues to be a flagship product for Apple, driving a substantial portion of its revenue. This consistent demand demonstrates the brand's loyalty and the enduring appeal of the product. Factors contributing to this strength include:

- Strong brand loyalty: Apple users often exhibit high brand loyalty, leading to repeat purchases and upgrades.

- Innovative features: Apple consistently introduces innovative features and technologies, keeping its products competitive.

- Robust ecosystem: The integration of the iPhone with other Apple products and services creates a powerful ecosystem that encourages user loyalty.

Growth in Apple Services

Apple's services segment, encompassing offerings like Apple Music, iCloud, Apple TV+, and the App Store, continues to exhibit impressive growth. This segment provides a recurring revenue stream, adding stability and predictability to Apple's financial performance. Key factors driving this growth include:

- Expanding service offerings: Apple constantly expands its service offerings, attracting new subscribers and increasing engagement.

- Subscription model: The subscription-based nature of many Apple services ensures consistent revenue streams.

- Integration with hardware: The seamless integration of services with Apple hardware enhances user experience and drives adoption.

Innovation and Future Product Launches

Apple's history of groundbreaking innovation remains a key driver of its long-term success. Anticipation for upcoming product releases, including new iPhones, Apple Watches, and potential advancements in augmented reality (AR) and virtual reality (VR), fuels investor confidence. This ongoing innovation cycle ensures Apple remains at the forefront of technological advancements.

Keywords: Apple iPhone sales, Apple services revenue, Apple innovation, future product releases, long-term growth, Apple stock outlook.

Analyzing Market Reactions to Wedbush's Report

The market's reaction to Wedbush's report has been varied. While the price target adjustment initially caused some stock price volatility, the overall response reflects a nuanced understanding of the situation. Many investors seem to share Wedbush's long-term optimism, viewing the price target revision as a short-term adjustment rather than a fundamental shift in Apple's prospects.

Analyzing investor sentiment and subsequent trading activity reveals a mixture of cautious optimism. While some investors might have trimmed their positions, others likely see this as a buying opportunity, particularly given Wedbush's continued bullish outlook. This suggests that the market is factoring in both the short-term challenges and the long-term growth potential of Apple.

Keywords: Apple stock market reaction, investor sentiment, stock price volatility, trading analysis, market impact.

Conclusion: Apple Stock: A Bullish Future Despite Short-Term Adjustments

Wedbush's revised price target for Apple stock, while lower than previously anticipated, doesn't signal a bearish shift in their overall outlook. The adjustment reflects realistic consideration of macroeconomic and supply chain factors. However, their continued bullish sentiment is grounded in the robust demand for iPhones, the consistent growth of Apple Services, and the company's enduring commitment to innovation. These key drivers point to a strong potential for long-term growth.

Stay informed on the latest Apple stock updates and market analysis to make informed investment decisions. Continue researching Apple stock to better understand its potential for growth. Keywords: Apple stock investment, Apple stock analysis, Apple stock future, long-term investment, stock market insights.

Featured Posts

-

Frank Sinatras Marital History Wives Relationships And Legacy

May 25, 2025

Frank Sinatras Marital History Wives Relationships And Legacy

May 25, 2025 -

The Future Of Gucci Under Demna Gvasalias Creative Leadership

May 25, 2025

The Future Of Gucci Under Demna Gvasalias Creative Leadership

May 25, 2025 -

K 100 Letiyu Innokentiya Smoktunovskogo Menya Vela Kakaya To Sila

May 25, 2025

K 100 Letiyu Innokentiya Smoktunovskogo Menya Vela Kakaya To Sila

May 25, 2025 -

Office365 Data Breach Millions Made From Executive Inboxes Fbi Investigation Reveals

May 25, 2025

Office365 Data Breach Millions Made From Executive Inboxes Fbi Investigation Reveals

May 25, 2025 -

Nightcliff Stabbing Teenager Charged With Murder In Darwin

May 25, 2025

Nightcliff Stabbing Teenager Charged With Murder In Darwin

May 25, 2025

Latest Posts

-

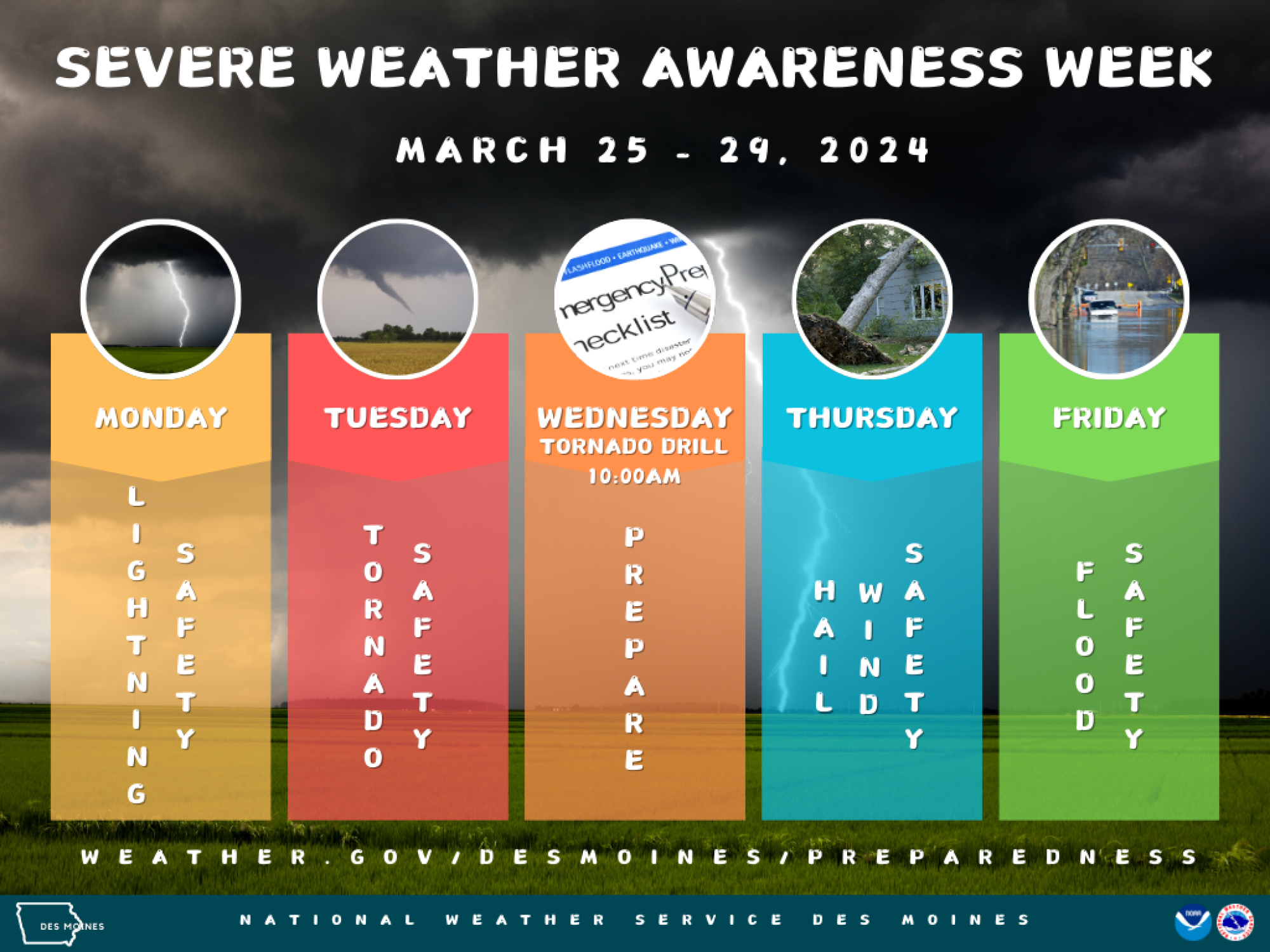

Severe Weather Awareness Week Day 5 Focus On Flood Safety

May 25, 2025

Severe Weather Awareness Week Day 5 Focus On Flood Safety

May 25, 2025 -

Extreme V Mware Price Increase At And T Details 1 050 Cost Surge From Broadcom

May 25, 2025

Extreme V Mware Price Increase At And T Details 1 050 Cost Surge From Broadcom

May 25, 2025 -

Protecting Yourself And Your Family From Floods Severe Weather Awareness Week

May 25, 2025

Protecting Yourself And Your Family From Floods Severe Weather Awareness Week

May 25, 2025 -

Severe Weather Report April 2nd Tornado Activity And Current Flash Flood Warnings April 4th 2025

May 25, 2025

Severe Weather Report April 2nd Tornado Activity And Current Flash Flood Warnings April 4th 2025

May 25, 2025 -

1 050 Price Hike At And T Sounds Alarm On Broadcoms V Mware Deal

May 25, 2025

1 050 Price Hike At And T Sounds Alarm On Broadcoms V Mware Deal

May 25, 2025