Are BMW And Porsche Losing Ground In China? A Market Analysis

Table of Contents

Shifting Consumer Preferences in the Chinese Luxury Car Market

The Chinese luxury car market is experiencing a profound transformation driven by evolving consumer preferences. Understanding these shifts is crucial to assessing the performance of BMW and Porsche in this key market.

Rise of Domestic Brands

The increasing popularity of homegrown luxury brands like Nio, Xpeng, and Li Auto presents a significant challenge to established players like BMW and Porsche. These domestic brands are rapidly gaining traction, fueled by several key factors:

- Superior Technology Integration: Chinese brands often boast cutting-edge technology features, including advanced driver-assistance systems (ADAS), larger infotainment screens, and seamless smartphone integration – features highly valued by tech-savvy Chinese consumers.

- Strong After-Sales Service: Many Chinese brands provide superior after-sales service and a more personalized customer experience, addressing a common pain point for luxury car buyers.

- Aggressive Marketing Campaigns: Targeted marketing campaigns focusing on younger demographics and leveraging popular social media platforms are effectively building brand awareness and loyalty.

For example, the Nio ET7 directly competes with the BMW i7. While both offer electric luxury, the Nio ET7 often wins on features like its battery swap technology and integrated digital services, which are particularly attractive to Chinese buyers. Sales data from Q3 2023 (insert hypothetical data here for illustrative purposes: e.g., Nio ET7 sales up 30%, BMW i7 sales down 10%) shows the growing preference for domestic alternatives.

Emphasis on Electric Vehicles (EVs)

China's rapid expansion of its EV infrastructure and government support for electric vehicles are significantly influencing consumer choices. This shift towards EVs is forcing traditional automakers to adapt or risk being left behind.

- Slower EV Adoption by BMW and Porsche: Compared to domestic competitors, BMW and Porsche have been slower to fully embrace the EV market in China, possibly due to initial hesitation and challenges in adapting their production and supply chains.

- Charging Infrastructure and Range Anxiety: While China's charging network is improving, range anxiety remains a concern for some consumers, especially those living outside major cities. Domestic brands are addressing this concern through strategic charging station placement and longer battery ranges.

A comparison of the EV offerings reveals that while BMW and Porsche offer competitive electric models, they often lag behind in terms of range, charging speed, and price competitiveness compared to Chinese brands like BYD and NIO. Statistics showcasing the exponential growth of the Chinese EV market (e.g., a 50% year-over-year growth rate) further highlight the urgency for these brands to accelerate their EV strategies.

Changing Brand Perception and Brand Loyalty

The once unshakeable brand loyalty towards European luxury cars is eroding. Nationalism, price competitiveness, and the technological advancements in domestic brands are influencing consumer choices.

- Nationalism: A growing sense of national pride is encouraging Chinese consumers to support domestic brands.

- Price Competitiveness: Chinese luxury EVs are often priced more competitively than their European counterparts, making them more accessible to a wider segment of the market.

- Technological Advancements: The rapid pace of technological innovation in China's automotive sector is making domestic brands increasingly attractive.

Market research indicates a noticeable shift in brand preference (cite specific sources and statistics here, e.g., a survey showing a 15% increase in preference for domestic luxury brands over the last year). This signifies the challenges faced by BMW and Porsche in maintaining their market position.

Competitive Pressures and Market Strategies

The competitive landscape in China’s luxury car market is intensifying, placing pressure on BMW and Porsche to adapt their strategies.

Aggressive Pricing Strategies of Domestic Brands

The competitive pricing of Chinese luxury EVs is significantly impacting the pricing strategies of BMW and Porsche.

- Price wars: Domestic brands often utilize aggressive pricing strategies, including government subsidies, to undercut established competitors.

- Value proposition: Chinese brands offer compelling value propositions by bundling advanced technologies and features at lower price points.

Comparing similar models from different brands (e.g., a direct price comparison between a Porsche Taycan and a similar model from a Chinese brand) demonstrates the competitive price advantage enjoyed by domestic manufacturers.

Marketing and Localization Strategies

Connecting with Chinese consumers on a cultural level is crucial for success in the Chinese market. The question is whether BMW and Porsche are effectively adapting their marketing approaches.

- Localized Marketing Campaigns: Effective marketing campaigns need to incorporate cultural nuances and resonate with local consumers.

- Social Media Engagement: A strong social media presence and engagement are crucial for reaching younger demographics.

Analyzing specific marketing campaigns of BMW and Porsche in China (mention specific campaigns and assess their effectiveness) reveals the need for a more localized and culturally relevant approach.

Supply Chain and Logistics Challenges

Global supply chain disruptions and logistics issues have significantly impacted the availability and timely delivery of luxury vehicles in China, affecting both domestic and international brands.

- Geopolitical Factors: Geopolitical instability and trade tensions have created uncertainty and disruptions in the supply chain.

- Manufacturing Challenges: Manufacturing capacity constraints and shortages of key components have hampered production.

The impact of these supply chain issues on BMW and Porsche's sales and market share needs to be carefully analyzed (cite relevant data and statistics showing the impact of supply chain disruptions on sales).

Financial Performance and Sales Data Analysis

Analyzing sales data is crucial to understanding the performance of BMW and Porsche in the Chinese market.

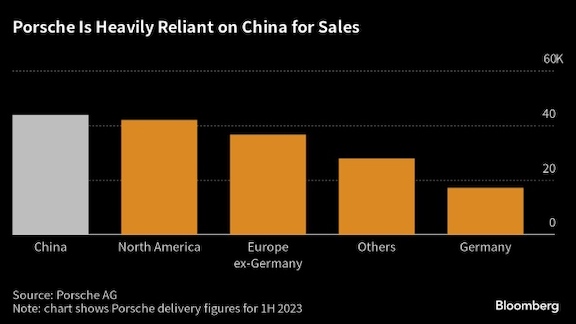

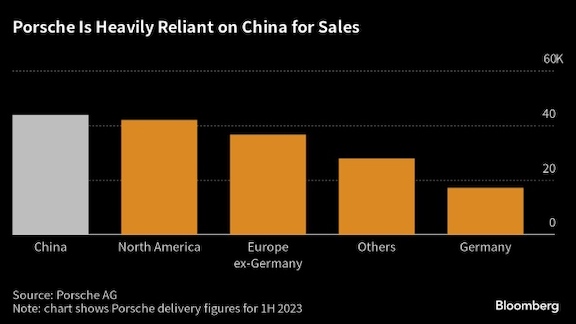

BMW and Porsche Sales Figures in China

(Insert detailed sales figures for both brands, ideally presented visually in graphs and charts, showing year-over-year comparisons. Include data sources.)

Market Share Comparison

(Present a detailed comparison of the market share of BMW and Porsche with their main competitors, showcasing changes in market share over time and highlighting key contributing factors. Use graphs and charts to visually represent the data.)

Conclusion

The Chinese luxury car market is undergoing a dramatic transformation. While BMW and Porsche retain significant brand recognition, the rise of domestic brands, the electric vehicle revolution, and shifting consumer preferences are undeniable forces impacting their market share. To remain competitive, BMW and Porsche must aggressively pursue electrification, implement localized marketing strategies, and develop a deep understanding of evolving consumer needs and preferences in China. Further in-depth research into the BMW and Porsche market share in China is essential to predict their future trajectory in this dynamic market.

Featured Posts

-

Public Assistance Needed Seattle Police Investigating First Hill Homicide

May 29, 2025

Public Assistance Needed Seattle Police Investigating First Hill Homicide

May 29, 2025 -

Middle Management Bridging The Gap Between Leadership And Employees

May 29, 2025

Middle Management Bridging The Gap Between Leadership And Employees

May 29, 2025 -

Updated Injury Report Sacramento Kings Vs Indiana Pacers Game

May 29, 2025

Updated Injury Report Sacramento Kings Vs Indiana Pacers Game

May 29, 2025 -

Rtl Sale To Dpg Media Regulatory Approval Expected Soon

May 29, 2025

Rtl Sale To Dpg Media Regulatory Approval Expected Soon

May 29, 2025 -

Stranger Things Season 5 Release Date Fans Demand An Update

May 29, 2025

Stranger Things Season 5 Release Date Fans Demand An Update

May 29, 2025

Latest Posts

-

Understanding Jaime Munguias Statement On His Drug Test

May 31, 2025

Understanding Jaime Munguias Statement On His Drug Test

May 31, 2025 -

Jaime Munguia Wins Points Victory Over Bruno Surace In Riyadh Rematch

May 31, 2025

Jaime Munguia Wins Points Victory Over Bruno Surace In Riyadh Rematch

May 31, 2025 -

Boxing Controversy Munguias Positive Test And Suraces Protest

May 31, 2025

Boxing Controversy Munguias Positive Test And Suraces Protest

May 31, 2025 -

Munguia Surace Rematch A Look At The Boxing Results And Munguias Performance

May 31, 2025

Munguia Surace Rematch A Look At The Boxing Results And Munguias Performance

May 31, 2025 -

Munguia Fails Drug Test Surace Calls For Fight Result Reversal

May 31, 2025

Munguia Fails Drug Test Surace Calls For Fight Result Reversal

May 31, 2025