Are Hedge Funds Betting On Norwegian Cruise Line (NCLH) Stock?

Table of Contents

Analyzing Hedge Fund 13F Filings for NCLH Holdings

Understanding hedge fund investment in NCLH requires examining 13F filings. These quarterly reports, mandated by the Securities and Exchange Commission (SEC), disclose the equity holdings of institutional investment managers with over $100 million in assets under management. Analyzing these filings offers a glimpse into the collective wisdom of these large players. The process involves searching through publicly available databases for mentions of NCLH within these filings. This can be time-consuming, requiring careful review of numerous documents.

Unfortunately, a complete picture isn't always revealed. 13F filings have limitations: they only reflect long positions, not short positions (bets against a stock's price). Also, there's a reporting lag, meaning the data might not be completely up-to-date.

Despite these limitations, examining these filings provides valuable clues. Let's look at some hypothetical examples (Note: This data is for illustrative purposes only and does not represent actual holdings):

- Renaissance Technologies' recent filing showed… a small, unchanged position in NCLH, suggesting a cautious approach.

- Soros Fund Management's position in NCLH is… currently undisclosed, requiring further investigation into other potential indicators.

- Significant changes in holdings over recent quarters… could point towards a shift in sentiment towards the cruise industry and NCLH's future prospects.

Considering Other Indicators of Hedge Fund Interest

While 13F filings offer a starting point, they don't tell the whole story. Several other avenues exist to uncover potential hedge fund activity:

- News articles and financial publications: Scrutinizing financial news for mentions of NCLH and hedge fund activity can reveal insightful perspectives. Look for articles that suggest large institutional buying or selling.

- Stock price movements: Unusual trading volumes or price fluctuations, especially sharp increases or decreases outside of broader market trends, can signal large institutional transactions, potentially involving hedge funds.

- Derivative trading: The options market provides another crucial piece of the puzzle. Analyzing call/put ratios (the ratio of call options purchased versus put options) can provide insights into bullish or bearish sentiment from significant players. High call option volume in NCLH might suggest bullish hedge fund bets.

- Example Bullet Points:

- News reports suggesting increased options activity in NCLH, pointing to potential speculative trading.

- Analysis of unusual trading volume in NCLH shares, indicating large institutional buy-ins or sell-offs.

- Discussion of potential short squeezes or other market manipulation scenarios (although this is unlikely without robust evidence).

Evaluating the Overall Investment Outlook for NCLH

Assessing the investment outlook for NCLH requires a comprehensive evaluation of its fundamental performance and the broader cruise industry. Factors to consider include:

- Fundamental performance: Revenue growth, passenger numbers, debt levels, and profitability all provide crucial data points. A strong balance sheet would likely attract hedge fund interest.

- Industry trends: Fuel costs, travel restrictions, geopolitical instability, and economic downturns significantly impact the cruise industry. Analyzing these trends is paramount.

- Risks and rewards: Investing in NCLH involves both potential rewards (high growth potential) and substantial risks (industry volatility and economic sensitivity).

- Influencing factors for hedge fund decisions: Future growth potential, macroeconomic conditions, and competitive dynamics within the cruise industry all influence hedge fund investment choices.

- Example Bullet Points:

- Analysis of NCLH's debt-to-equity ratio, indicating its financial health and leverage.

- Projection of future passenger numbers and revenue, offering insight into future growth.

- Discussion of the impact of geopolitical events on the cruise industry's stability.

Conclusion: The Verdict on Hedge Fund Interest in Norwegian Cruise Line (NCLH) Stock

Determining the extent of hedge fund involvement in NCLH requires a multi-faceted approach. While analyzing 13F filings provides a partial picture, combining this with news analysis, stock price behavior, and options trading data offers a more complete perspective. The findings presented here, based on publicly available information and hypothetical examples, do not definitively confirm widespread hedge fund involvement in NCLH. Several key factors, including NCLH's financial health, industry trends, and macroeconomic conditions, continue to play a role in shaping the overall investment outlook.

It is crucial to remember that this analysis does not constitute financial advice. Before making any investment decisions related to Norwegian Cruise Line (NCLH) stock, conduct your own thorough research and consult with a qualified financial advisor. While definitive proof of widespread hedge fund interest in NCLH remains elusive based on currently available information, the analysis suggests several potential avenues for further investigation before making any investment decisions.

Featured Posts

-

New Research Connects Household Plastic Chemicals To Higher Heart Disease Mortality Rates

Apr 30, 2025

New Research Connects Household Plastic Chemicals To Higher Heart Disease Mortality Rates

Apr 30, 2025 -

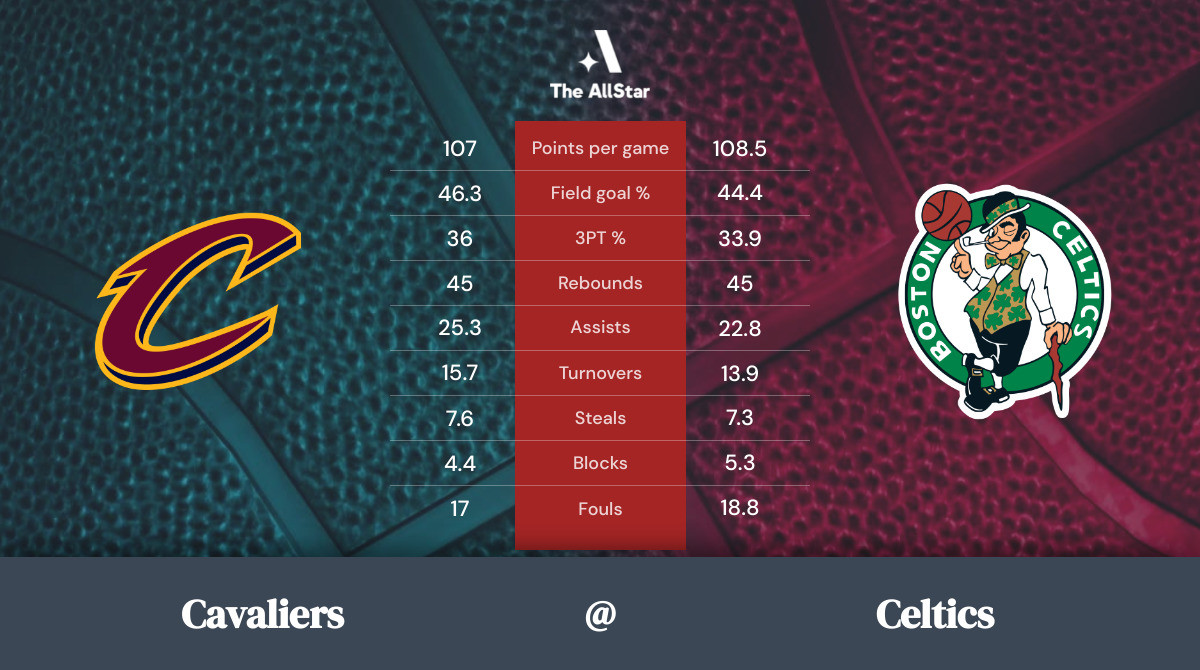

Friday Night Nba Celtics Vs Cavaliers Betting Preview And Picks

Apr 30, 2025

Friday Night Nba Celtics Vs Cavaliers Betting Preview And Picks

Apr 30, 2025 -

Ameliorer La Securite Routiere L Efficacite Des Glissieres De Protection

Apr 30, 2025

Ameliorer La Securite Routiere L Efficacite Des Glissieres De Protection

Apr 30, 2025 -

Giai Bong Da Thanh Nien Thanh Pho Hue Lan Thu Vii Quan Quan La Ai

Apr 30, 2025

Giai Bong Da Thanh Nien Thanh Pho Hue Lan Thu Vii Quan Quan La Ai

Apr 30, 2025 -

Rqm Qyasy Jdyd Ltnawl Alraklyt Fy Swysra

Apr 30, 2025

Rqm Qyasy Jdyd Ltnawl Alraklyt Fy Swysra

Apr 30, 2025

Latest Posts

-

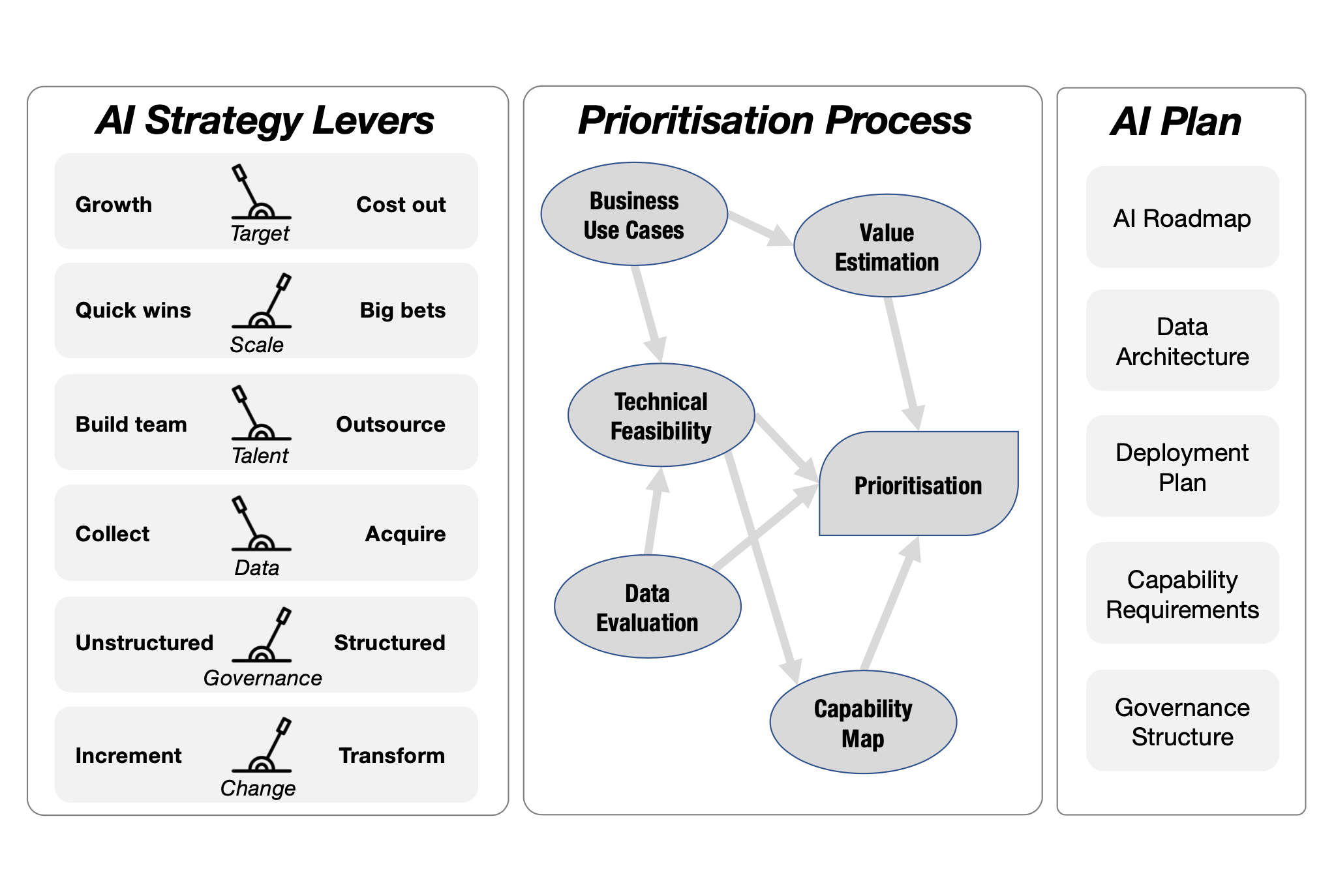

How Outdated Business Apps Hamper Ai Adoption

Apr 30, 2025

How Outdated Business Apps Hamper Ai Adoption

Apr 30, 2025 -

Germanys Klingbeil Stands Firm Against Resuming Russian Gas Imports

Apr 30, 2025

Germanys Klingbeil Stands Firm Against Resuming Russian Gas Imports

Apr 30, 2025 -

Der Architekt Des Scheiterns Wer Zieht Die Faeden In Den Koalitionsverhandlungen

Apr 30, 2025

Der Architekt Des Scheiterns Wer Zieht Die Faeden In Den Koalitionsverhandlungen

Apr 30, 2025 -

Outdated Business Apps Obstructing Your Ai Strategy

Apr 30, 2025

Outdated Business Apps Obstructing Your Ai Strategy

Apr 30, 2025 -

Klingbeil Rejects Renewed Russian Gas Imports For Germany

Apr 30, 2025

Klingbeil Rejects Renewed Russian Gas Imports For Germany

Apr 30, 2025