Are High Stock Market Valuations A Cause For Concern? BofA Weighs In

Table of Contents

BofA's Stance on Current Market Valuations

BofA's stance on current market valuations is nuanced. While acknowledging the impressive gains and strong corporate earnings in certain sectors, they also express caution regarding the elevated price-to-earnings (P/E) ratios across many market segments. While specific reports and quotes may change over time, a recurring theme in their analyses often highlights the potential for a market correction in the future. They don't necessarily predict an imminent crash but rather underscore the inherent risks associated with investing in a market exhibiting such high valuations.

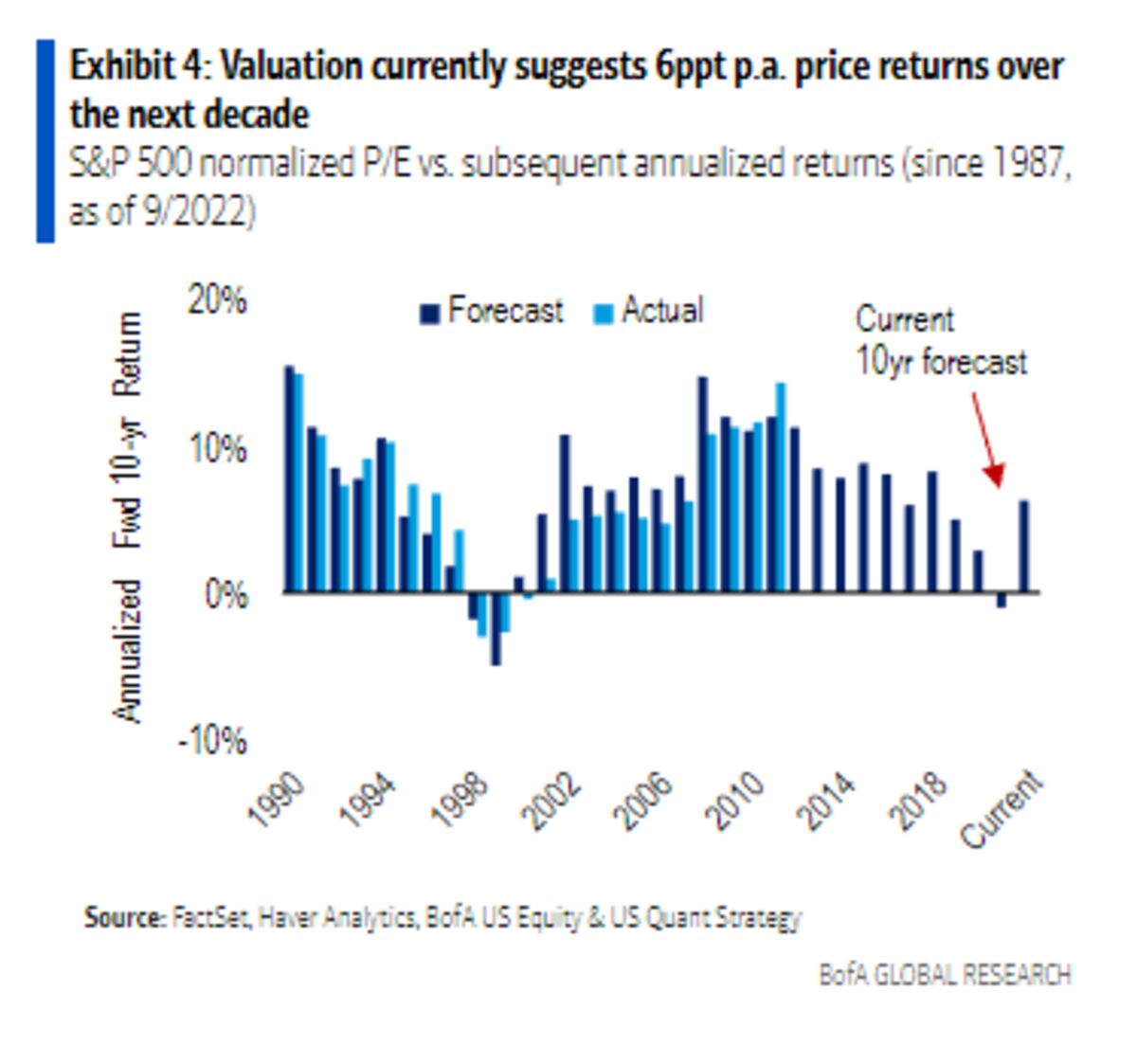

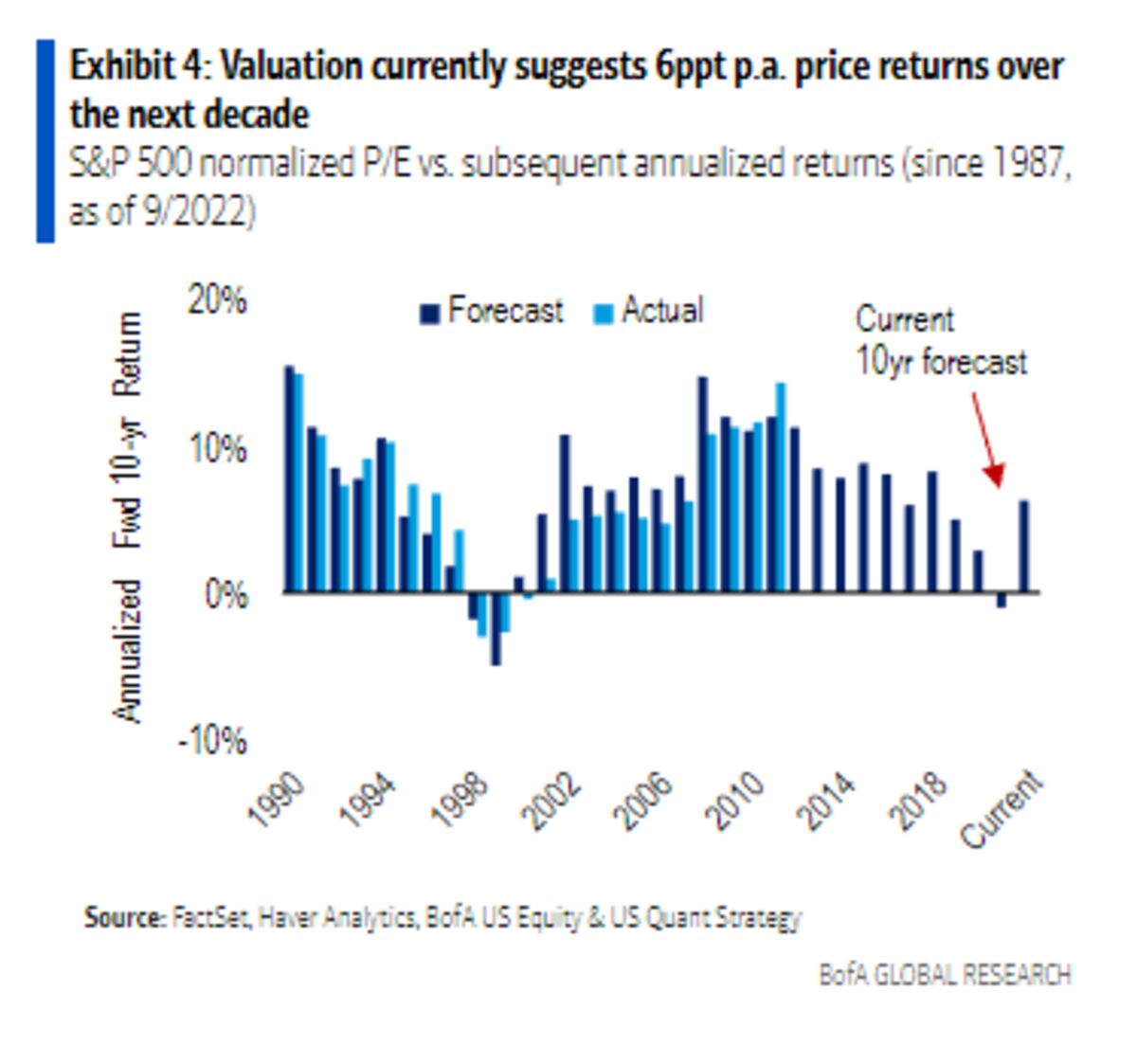

- Specific concerns raised by BofA: BofA often points to elevated P/E ratios compared to historical averages as a significant cause for concern, suggesting that current prices may not fully reflect underlying economic fundamentals. They may also highlight specific sectors with particularly high valuations, potentially indicating an overheated market segment.

- BofA's assessment of underlying economic factors: Their analyses usually consider macroeconomic factors, such as interest rate environments, inflation, and global economic growth, to provide context for the current valuations. A low interest rate environment often contributes to inflated asset prices, which is a concern BofA frequently addresses.

- Overvalued and Undervalued Sectors: BofA's research often identifies specific sectors that appear overvalued relative to their growth prospects and others that may be undervalued presenting potential investment opportunities. This analysis is usually a key component of their investment strategies and recommendations for their clients.

Factors Contributing to High Stock Market Valuations

Several interconnected factors contribute to the current climate of high stock market valuations. Understanding these is crucial for assessing the overall risk landscape.

- Low Interest Rates: Historically low interest rates globally make bonds less attractive, encouraging investors to seek higher returns in the stock market, thus driving up prices and valuations.

- Strong Corporate Earnings (in specific sectors): Robust corporate earnings, particularly within the technology and growth sectors, often justify higher valuations as investors anticipate future growth. However, BofA's research may also highlight earnings disparities across sectors and caution against investing solely based on current growth.

- Inflationary Pressures: Rising inflation can lead to increased investment in assets as a hedge against eroding purchasing power. However, this can also lead to inflated asset prices and ultimately contribute to a market correction.

- Geopolitical Events: Global political instability and geopolitical uncertainties can impact market sentiment and investment flows, contributing to both upward and downward pressure on valuations.

- Technological Advancements and Growth Stocks: The rapid growth of technology companies and the emergence of disruptive technologies consistently fuels investor interest, often pushing valuations to considerable heights for companies in this sector.

Potential Risks Associated with High Valuations

Investing in a market with high stock market valuations carries inherent risks.

- Increased Market Volatility: Highly valued markets are often more susceptible to sharp corrections, meaning significant and sudden price drops. This volatility increases the risk of substantial losses for investors.

- Risk of Capital Loss: Investors entering the market at peak valuations risk losing a significant portion of their capital if a correction occurs. The higher the entry point, the greater the potential loss.

- Historical Precedents: History is replete with examples of high valuations preceding market downturns. Analyzing these historical precedents helps understand the potential consequences of current high valuations. Understanding market bubbles and their eventual bursting is critical.

- Market Bubbles: The concept of a market bubble, where asset prices significantly exceed their intrinsic value due to speculative buying, is a key risk factor. BofA may highlight specific indicators that suggest the presence or potential formation of a market bubble.

BofA's Recommendations for Investors

BofA typically advises investors to take a cautious and diversified approach in a market characterized by high stock market valuations.

- Diversification Strategies: Spreading investments across various asset classes, sectors, and geographies is crucial to mitigate risk. This includes avoiding over-concentration in any single asset or sector.

- Asset Class Recommendations: BofA's recommendations may include diversifying beyond equities into asset classes such as bonds, real estate, or alternative investments to reduce overall portfolio volatility.

- Risk Tolerance Adjustment: Investors should assess their risk tolerance and adjust their portfolios accordingly. A conservative approach may be warranted in a highly valued market.

- Long-Term vs. Short-Term Strategies: BofA often emphasizes long-term investment horizons to weather short-term market fluctuations. Short-term trading in a volatile market can be particularly risky.

Conclusion: Navigating the Landscape of High Stock Market Valuations

BofA's analysis consistently highlights the potential risks associated with high stock market valuations, emphasizing the need for caution and diversification. The factors contributing to the current market situation – low interest rates, strong earnings in specific sectors, inflationary pressures, and geopolitical events – paint a complex picture that requires careful consideration. The potential for increased market volatility and capital loss is a significant concern. Therefore, BofA's recommendations for investors typically center around diversification, risk management, and a long-term investment strategy. Understanding and navigating high stock market valuations requires careful consideration. Review BofA's insights and develop a well-informed investment strategy today.

Featured Posts

-

Search Macon County Building Permits Online

Apr 26, 2025

Search Macon County Building Permits Online

Apr 26, 2025 -

Ryujinx Switch Emulator Shuts Down After Reported Nintendo Intervention

Apr 26, 2025

Ryujinx Switch Emulator Shuts Down After Reported Nintendo Intervention

Apr 26, 2025 -

Denmark Accuses Russia Of Spreading Disinformation About Greenland To Fuel Us Tensions

Apr 26, 2025

Denmark Accuses Russia Of Spreading Disinformation About Greenland To Fuel Us Tensions

Apr 26, 2025 -

Beyond Disney 7 Top Orlando Restaurants For 2025

Apr 26, 2025

Beyond Disney 7 Top Orlando Restaurants For 2025

Apr 26, 2025 -

Witkoff Trump Envoy Arrives In Moscow Interfax News

Apr 26, 2025

Witkoff Trump Envoy Arrives In Moscow Interfax News

Apr 26, 2025

Latest Posts

-

German Politics Crumbachs Resignation And Its Implications For The Spd

Apr 27, 2025

German Politics Crumbachs Resignation And Its Implications For The Spd

Apr 27, 2025 -

Bsw Leader Crumbachs Resignation Impact On The Spd Coalition

Apr 27, 2025

Bsw Leader Crumbachs Resignation Impact On The Spd Coalition

Apr 27, 2025 -

Concerns Raised Over Hhss Appointment Of Anti Vaccine Activist To Study Debunked Autism Vaccine Theories

Apr 27, 2025

Concerns Raised Over Hhss Appointment Of Anti Vaccine Activist To Study Debunked Autism Vaccine Theories

Apr 27, 2025 -

Hhs Under Fire For Selecting Anti Vaccine Advocate To Investigate Autism Vaccine Link

Apr 27, 2025

Hhs Under Fire For Selecting Anti Vaccine Advocate To Investigate Autism Vaccine Link

Apr 27, 2025 -

Hhss Controversial Choice Anti Vaccine Advocate To Examine Debunked Autism Vaccine Claims

Apr 27, 2025

Hhss Controversial Choice Anti Vaccine Advocate To Examine Debunked Autism Vaccine Claims

Apr 27, 2025