Are High Stock Market Valuations A Concern? BofA Says No.

Table of Contents

BofA's Arguments Against High Valuation Concerns

BofA's optimistic outlook on high stock market valuations rests on several key pillars. They argue that a combination of factors justifies the current pricing, making elevated valuations less alarming than they might initially appear.

Low Interest Rates and Ample Liquidity

One primary argument supporting BofA's stance is the persistent environment of low interest rates and ample liquidity. Low interest rates reduce the cost of borrowing for companies, fueling investment and ultimately boosting earnings. This makes higher stock prices, seemingly driven by high valuations, more palatable. The continued implementation of quantitative easing (QE) and other liquidity measures by central banks has further contributed to this supportive market environment. BofA cites the continued low interest rate environment as a key factor in mitigating the risks associated with high valuations. Historically low borrowing costs make the higher price-to-earnings ratios (P/E) more sustainable than they might have been in periods of higher interest rates.

Strong Corporate Earnings Growth

BofA points to robust corporate earnings growth as a key justification for current stock market valuations. Data shows that many companies have exceeded earnings expectations, fueled by technological innovation, increased efficiency, and strategic industry consolidation. This strong earnings growth, in their view, supports the higher price tags currently assigned to stocks.

- Technology sector: This sector has consistently outperformed expectations, driving significant market gains.

- Consumer staples: Even amid inflationary pressures, consumer staples companies have shown remarkable resilience, maintaining strong earnings.

- Healthcare: Innovation and an aging global population continue to fuel growth in this sector.

These strong performers demonstrate that corporate profitability is not simply keeping pace with valuations, but actively exceeding them, suggesting a foundation for continued market strength.

Long-Term Growth Potential

BofA's optimism extends beyond current earnings; they see significant long-term growth potential underpinning current stock prices. Factors such as technological advancements (AI, automation), favorable demographic shifts in certain regions, and ongoing global economic trends (albeit with potential regional variations), all contribute to their bullish long-term outlook. From this perspective, current valuations are not considered excessive when viewed through the lens of future growth prospects.

Counterarguments and Potential Risks

While BofA presents a compelling case, it's crucial to acknowledge counterarguments and potential risks associated with high stock market valuations.

Valuation Metrics

Traditional valuation metrics, such as the price-to-earnings ratio (P/E ratio) and the cyclically adjusted price-to-earnings ratio (Shiller PE), undeniably show current valuations to be historically high. These metrics, however, have limitations. BofA might argue that applying historical valuation metrics to a drastically changed economic environment, characterized by low interest rates and technological disruption, is inappropriate. The very metrics used to evaluate past performance may not accurately predict future outcomes in a different economic landscape.

Inflationary Pressures

Inflation presents a significant risk. Rising inflation can erode corporate earnings, potentially squeezing profit margins and ultimately impacting stock valuations. Furthermore, rising interest rates, often a response to inflation, can dampen investor sentiment and lead to a market correction. While BofA's view remains optimistic, they must acknowledge these risks and their potential impact on market performance.

Geopolitical Risks

Geopolitical instability, including international conflicts, trade wars, and political uncertainty, poses an ever-present threat to global markets. These factors can introduce volatility and impact investor confidence, leading to market corrections irrespective of underlying valuations. BofA's assessment likely incorporates these risks, but their weighting in the overall analysis remains a key factor in their ultimate optimistic outlook.

Conclusion: Navigating High Stock Market Valuations: BofA's Perspective and Your Next Steps

BofA's argument against immediate concern over high stock market valuations rests on a combination of low interest rates, strong corporate earnings, and a bullish long-term growth outlook. While they acknowledge the risks presented by inflation, geopolitical events, and historically high valuation metrics, their assessment leans toward optimism.

However, investors should proceed with caution. High valuations always present some level of risk, and a balanced perspective is crucial. Conduct thorough research, understand your own risk tolerance, and diversify your portfolio. While BofA's perspective provides valuable insight into navigating high stock market valuations, it's vital to form your own informed opinion. Consider seeking professional financial advice tailored to your individual circumstances before making any significant investment decisions. Remember, understanding high stock market valuations and their implications is key to successful long-term investing.

Featured Posts

-

Who Are These People A Look Back At April 1999

Apr 25, 2025

Who Are These People A Look Back At April 1999

Apr 25, 2025 -

Chinas Impact On Luxury Car Sales The Bmw And Porsche Case Study

Apr 25, 2025

Chinas Impact On Luxury Car Sales The Bmw And Porsche Case Study

Apr 25, 2025 -

Nestle Nesn Revenue Growth A Closer Look At Coffee And Cocoa

Apr 25, 2025

Nestle Nesn Revenue Growth A Closer Look At Coffee And Cocoa

Apr 25, 2025 -

Declutter Your Makeup The Ultimate Guide To Choosing The Right Organiser

Apr 25, 2025

Declutter Your Makeup The Ultimate Guide To Choosing The Right Organiser

Apr 25, 2025 -

Oklahoma City Parks Your Spring Break Destination

Apr 25, 2025

Oklahoma City Parks Your Spring Break Destination

Apr 25, 2025

Latest Posts

-

Louisvilles Shelter In Place Order A Time For Remembrance And Safety

Apr 30, 2025

Louisvilles Shelter In Place Order A Time For Remembrance And Safety

Apr 30, 2025 -

Shelter In Place Louisville Community Reflects On Past Tragedy During Emergency

Apr 30, 2025

Shelter In Place Louisville Community Reflects On Past Tragedy During Emergency

Apr 30, 2025 -

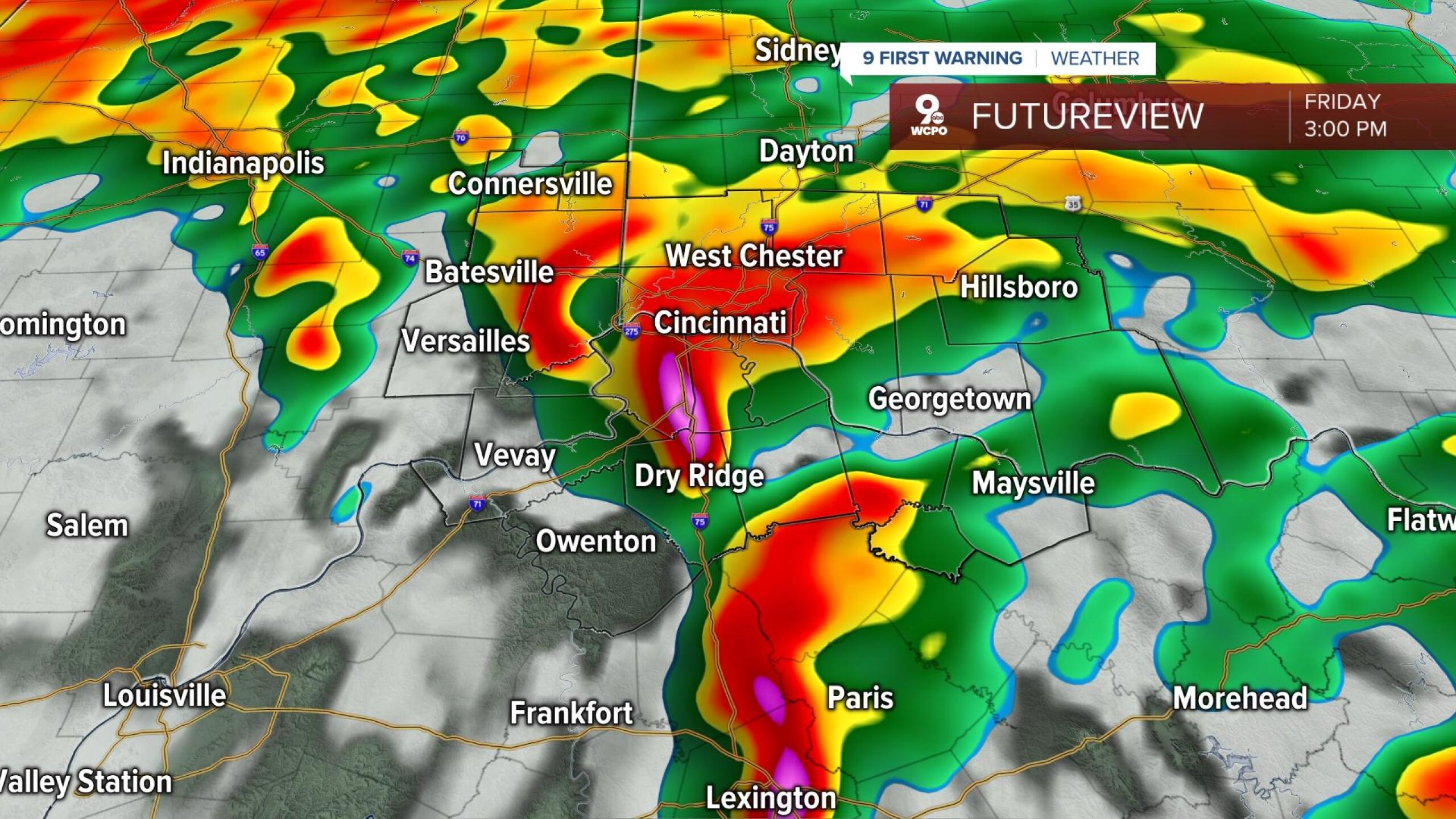

Heavy Rain And Flooding Prompt State Of Emergency Declaration In Kentucky

Apr 30, 2025

Heavy Rain And Flooding Prompt State Of Emergency Declaration In Kentucky

Apr 30, 2025 -

Louisville Mail Delivery Issues Unions Positive Outlook

Apr 30, 2025

Louisville Mail Delivery Issues Unions Positive Outlook

Apr 30, 2025 -

Understanding The Delays In Kentuckys Post Storm Damage Assessments

Apr 30, 2025

Understanding The Delays In Kentuckys Post Storm Damage Assessments

Apr 30, 2025