Are High Stock Market Valuations A Concern? BofA Weighs In

Table of Contents

BofA's Valuation Metrics and Analysis

BofA employs a range of sophisticated valuation metrics to assess the health of the stock market. These include, but aren't limited to, the widely used Price-to-Earnings ratio (P/E), the cyclically adjusted price-to-earnings ratio (Shiller PE), and various other proprietary models that incorporate forward-looking estimates. Their analysis goes beyond simply comparing current valuations to historical averages. BofA meticulously considers current economic conditions, interest rate environments, and anticipated corporate earnings growth when interpreting these metrics. This holistic approach provides a more nuanced understanding of whether current valuations are truly excessive or justified by underlying fundamentals.

- BofA's findings: Recent BofA reports (specific report citations would be inserted here if available) may indicate that certain market sectors are trading at historically high P/E multiples, potentially suggesting overvaluation.

- Historical Comparison: A comparison of current P/E ratios to long-term historical averages can reveal whether valuations are significantly above or below their typical range. For example, if the current Shiller PE ratio is substantially higher than its historical average, it might signal a heightened risk of a market correction.

- Sectoral Analysis: BofA's research likely highlights specific sectors exhibiting signs of overvaluation (e.g., technology during certain periods) and others appearing undervalued (e.g., certain value stocks during periods of market pessimism).

Macroeconomic Factors Influencing Stock Market Valuations

Stock market valuations are not isolated entities; they are heavily influenced by macroeconomic factors. BofA incorporates these crucial elements into their valuation analysis. Their assessments consider the interconnectedness of various economic indicators and their potential impact on corporate profitability and investor sentiment.

- Rising Interest Rates: Higher interest rates generally increase borrowing costs for companies, potentially reducing future earnings and impacting stock prices. BofA's models incorporate projections for interest rate changes and their likely effect on discounted cash flow valuations.

- Inflation's Impact: Inflation erodes purchasing power and can negatively affect corporate earnings if companies cannot pass on rising costs to consumers. BofA analyzes inflation forecasts and their potential consequences for market valuations.

- Economic Slowdown: The prospect of an economic recession or slowdown significantly impacts investor sentiment and stock prices. BofA considers leading economic indicators and forecasts to gauge the probability and potential severity of an economic downturn and its implications for stock valuations. Geopolitical events are also factored in, since these can create uncertainty and impact investor confidence.

BofA's Recommendations and Investment Strategies

Based on their valuation analysis and macroeconomic outlook, BofA provides recommendations to investors. These recommendations might range from cautious optimism to outright warnings depending on their assessment of the risks involved.

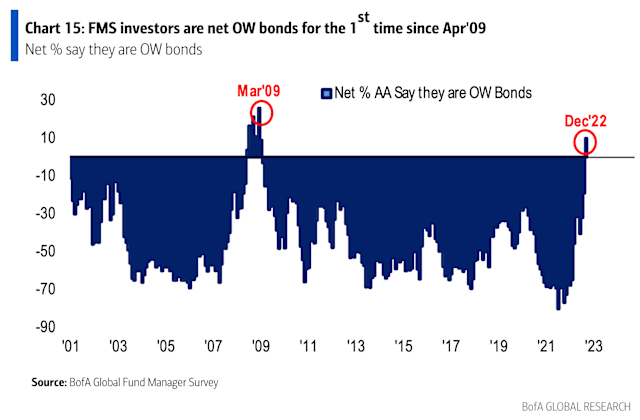

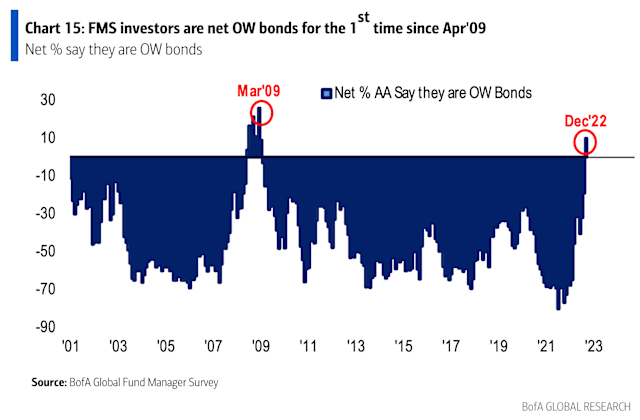

- Investment Strategies: BofA might suggest a shift towards more defensive investment strategies during periods of high valuations, focusing on lower-risk assets like high-quality bonds. In other scenarios, they may recommend a more selective approach, focusing on undervalued companies within specific sectors. Value investing and growth investing strategies may be favoured depending on market dynamics.

- Sector/Asset Class Recommendations: BofA's recommendations often specify which sectors or asset classes are better positioned to weather market challenges or potentially outperform in the given environment.

- Risk Management: Regardless of their specific recommendations, BofA always emphasizes the importance of risk management. This often involves diversification, appropriate asset allocation, and a clear understanding of one's own risk tolerance.

Alternative Perspectives and Counterarguments

While BofA's perspective is influential, it's crucial to acknowledge alternative views on high stock market valuations.

- Justification for High Valuations: Some analysts might argue that current valuations are justified by factors like persistently low interest rates, consistently strong corporate earnings, or significant technological advancements that drive future growth. These factors can support higher price-to-earnings multiples.

- Counterarguments to BofA's Concerns: Critics might argue that BofA's analysis may be overly cautious or that it doesn't adequately account for certain positive economic developments.

- Other Financial Institutions' Opinions: It's beneficial to consider the perspectives of other prominent financial institutions, comparing their assessments and recommendations to those of BofA to gain a more balanced understanding.

Navigating High Stock Market Valuations – BofA's Insights and Your Next Steps

BofA's analysis of high stock market valuations provides valuable insight but shouldn't be taken as gospel. Their key findings often highlight potential risks associated with elevated valuations, urging caution and a thorough understanding of macroeconomic factors. They may recommend strategies to mitigate potential losses or capitalize on opportunities within a volatile market.

Understanding valuation metrics like the P/E ratio and the Shiller PE ratio, along with their relationship to macroeconomic conditions such as inflation and interest rates, is paramount when making investment decisions. Remember, BofA's perspective offers a valuable viewpoint, but independent research and consultation with a financial advisor are crucial for developing a well-informed investment strategy tailored to your risk tolerance and financial objectives. Don't blindly follow any single assessment; thoroughly research the implications of high stock market valuations and build a robust investment plan that aligns with your own goals.

Featured Posts

-

S And P 500 Volatility Strategies For Managing Downside Risk

Apr 30, 2025

S And P 500 Volatility Strategies For Managing Downside Risk

Apr 30, 2025 -

Yankees Salvage Series Finale With 5 1 Win Over Guardians Rodon Shines

Apr 30, 2025

Yankees Salvage Series Finale With 5 1 Win Over Guardians Rodon Shines

Apr 30, 2025 -

10th Straight Win For Cavaliers Hunter Scores 32 Points In Overtime Thriller Against Blazers

Apr 30, 2025

10th Straight Win For Cavaliers Hunter Scores 32 Points In Overtime Thriller Against Blazers

Apr 30, 2025 -

Navy Jet Falls Overboard 60 Million Loss Confirmed Investigation Launched

Apr 30, 2025

Navy Jet Falls Overboard 60 Million Loss Confirmed Investigation Launched

Apr 30, 2025 -

The Case Of The Missing Mexican Activist A Tragic Conclusion

Apr 30, 2025

The Case Of The Missing Mexican Activist A Tragic Conclusion

Apr 30, 2025

Latest Posts

-

Can Celtic Maintain Momentum Crucial Homestand In Championship Battle

Apr 30, 2025

Can Celtic Maintain Momentum Crucial Homestand In Championship Battle

Apr 30, 2025 -

Celtic Championship Race Heats Up Homestand Will Define Contenders

Apr 30, 2025

Celtic Championship Race Heats Up Homestand Will Define Contenders

Apr 30, 2025 -

Indiana Pacers Vs Cleveland Cavaliers Full Schedule Viewing Details And Expert Predictions

Apr 30, 2025

Indiana Pacers Vs Cleveland Cavaliers Full Schedule Viewing Details And Expert Predictions

Apr 30, 2025 -

10th Straight Win For Cavaliers Hunter Scores 32 Points In Overtime Thriller Against Blazers

Apr 30, 2025

10th Straight Win For Cavaliers Hunter Scores 32 Points In Overtime Thriller Against Blazers

Apr 30, 2025 -

Tough Tests Ahead Celtic Face Star Studded Homestand In Championship Push

Apr 30, 2025

Tough Tests Ahead Celtic Face Star Studded Homestand In Championship Push

Apr 30, 2025