Are High Stock Valuations A Concern? BofA Weighs In.

Table of Contents

BofA's Stance on Current Market Valuations

BofA's recent reports and analyses haven't issued a blanket warning against investing due to high stock valuations. However, their approach is nuanced, reflecting the complexity of the situation. Reports from analysts like Savita Subramanian (mention specific analysts and reports if available with links to BofA research) often focus on specific metrics and sector-specific analyses rather than a generalized market prediction.

- Key arguments: BofA frequently highlights the importance of considering valuation metrics within their broader macroeconomic context. They acknowledge that current valuations are elevated compared to historical averages, but they also emphasize the influence of factors like low interest rates and robust (or recovering) corporate earnings. This leads to a more cautious, rather than overtly bearish, assessment.

- Metrics used: BofA employs a range of valuation metrics, including Price-to-Earnings ratios (P/E), Price-to-Sales ratios (P/S), and Price-to-Book ratios (P/B), but also incorporates qualitative factors like future earnings growth projections and industry trends.

- Caveats: BofA consistently cautions against simplistic interpretations of valuation metrics. Their analysis typically includes qualifications regarding the uncertainties inherent in economic forecasting and the potential for unexpected shocks to impact future earnings.

Factors Contributing to High Stock Valuations

Several macroeconomic factors contribute to the current environment of high stock valuations. Understanding these factors is crucial to assessing the risks and opportunities.

- Low interest rates: Historically low interest rates make borrowing cheaper for companies and make bonds less attractive compared to stocks, thereby driving investors towards equity markets and increasing demand, thus inflating prices.

- Strong corporate earnings: While corporate earnings growth has been uneven across sectors, strong performance in certain key areas has bolstered investor confidence and supported higher stock prices. However, future earnings growth projections are key factors in evaluating if current high valuations are justified.

- Investor sentiment: Positive investor sentiment, fueled by factors like technological advancements and government stimulus programs, can lead to a "fear of missing out" (FOMO) mentality, driving up demand and valuations regardless of underlying fundamentals.

- Technological advancements: Disruptive innovations and the growth of technology companies, often with high valuations and growth potential, have disproportionately contributed to the elevated market valuations in recent years.

Potential Risks Associated with High Stock Valuations

Despite the potential for growth, high stock valuations carry inherent risks:

- Market volatility: Highly valued markets are generally more susceptible to sharp corrections. A negative economic event or a shift in investor sentiment could trigger significant price drops.

- Overvaluation risk: If underlying fundamentals fail to justify current valuations, a significant market correction to bring valuations back to more sustainable levels is likely.

- Inflationary pressures: Rising inflation erodes the purchasing power of future earnings, potentially negatively impacting stock valuations if not offset by earnings growth.

- Geopolitical uncertainty: Global political instability and unforeseen events (like pandemics or trade wars) can create significant market uncertainty and volatility, impacting even well-valued companies.

BofA's Investment Recommendations (If Applicable)

While BofA doesn't offer specific stock picks publicly, their investment strategies often emphasize a balanced, diversified approach. (Note: Include specific recommendations if available from official BofA publications, linking to the source).

- Sector-specific advice: BofA may favor sectors less sensitive to interest rate changes or those demonstrating stronger future earnings potential in their research notes.

- Asset allocation: They typically advocate for a diversified portfolio, adjusting asset allocation based on risk tolerance and market conditions. They might suggest a shift towards less volatile investments, like bonds or alternative assets, if they perceive greater risk in the equity market.

- Risk management: BofA's approach consistently prioritizes prudent risk management strategies, including diversification and potentially hedging techniques to mitigate potential losses during market corrections.

Alternative Perspectives on High Stock Valuations

It's crucial to consider diverse perspectives. Not all analysts share BofA's cautiously optimistic view. Some believe the high valuations represent a significant bubble, predicting a substantial market correction. Others argue that technological innovation and low interest rates justify higher valuations.

- Differing opinions: Some analysts highlight the potential for a significant market correction, pointing to historical precedents and the disconnect between current valuations and fundamental economic indicators.

- Conflicting data: Different analysts may interpret the same data differently, leading to varying conclusions about the sustainability of high stock valuations. Some may focus on historical P/E ratios, while others may prioritize future earnings growth projections.

- Balanced view: Recognizing the range of viewpoints allows for a more informed and nuanced perspective on the current market dynamics.

Conclusion: Navigating the Landscape of High Stock Valuations

BofA's stance on high stock valuations reflects a balanced assessment of the current market conditions. While they acknowledge elevated valuations, their analysis suggests caution rather than outright alarm, emphasizing the need to consider the broader macroeconomic context and risk management strategies. Understanding high stock valuations requires careful consideration of both the potential rewards and the inherent risks. It's vital to conduct your own thorough research, consider professional financial advice tailored to your specific circumstances and risk tolerance, and assess your portfolio in light of high stock valuations before making any investment decisions. Remember to manage risks associated with high stock valuations effectively to achieve your long-term financial goals.

Featured Posts

-

12 Guests We D Love To See On A New York Knicks Roommates Show

Apr 26, 2025

12 Guests We D Love To See On A New York Knicks Roommates Show

Apr 26, 2025 -

T Mobiles 16 Million Data Breach Fine Three Years Of Security Failures

Apr 26, 2025

T Mobiles 16 Million Data Breach Fine Three Years Of Security Failures

Apr 26, 2025 -

Ryujinx Emulator Development Halted Nintendos Involvement Confirmed

Apr 26, 2025

Ryujinx Emulator Development Halted Nintendos Involvement Confirmed

Apr 26, 2025 -

Deion Sanders Shedeur Sanders A Top 3 Nfl Draft Pick Giants Rumors Swirl

Apr 26, 2025

Deion Sanders Shedeur Sanders A Top 3 Nfl Draft Pick Giants Rumors Swirl

Apr 26, 2025 -

Where To Invest A Guide To The Countrys Top Business Hotspots

Apr 26, 2025

Where To Invest A Guide To The Countrys Top Business Hotspots

Apr 26, 2025

Latest Posts

-

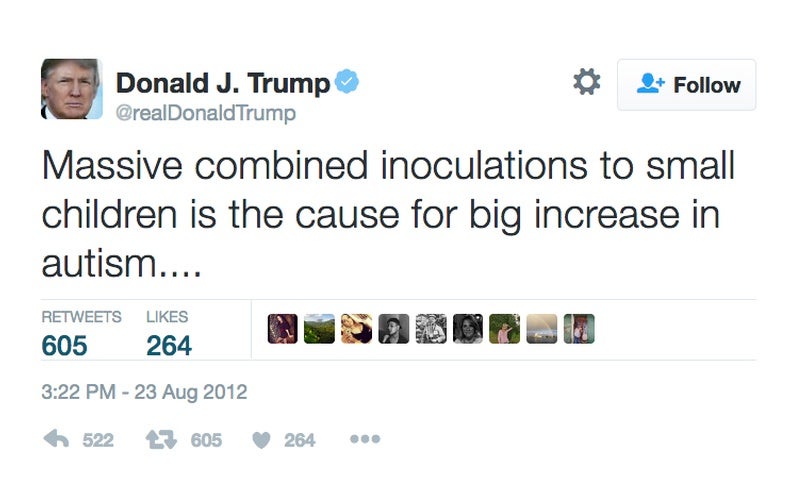

Concerns Raised Over Hhss Appointment Of Anti Vaccine Activist To Study Debunked Autism Vaccine Theories

Apr 27, 2025

Concerns Raised Over Hhss Appointment Of Anti Vaccine Activist To Study Debunked Autism Vaccine Theories

Apr 27, 2025 -

Hhs Under Fire For Selecting Anti Vaccine Advocate To Investigate Autism Vaccine Link

Apr 27, 2025

Hhs Under Fire For Selecting Anti Vaccine Advocate To Investigate Autism Vaccine Link

Apr 27, 2025 -

Hhss Controversial Choice Anti Vaccine Advocate To Examine Debunked Autism Vaccine Claims

Apr 27, 2025

Hhss Controversial Choice Anti Vaccine Advocate To Examine Debunked Autism Vaccine Claims

Apr 27, 2025 -

Anti Vaccine Activists Role In Hhs Autism Vaccine Review Raises Concerns

Apr 27, 2025

Anti Vaccine Activists Role In Hhs Autism Vaccine Review Raises Concerns

Apr 27, 2025 -

Hhs Investigation Into Debunked Autism Vaccine Link Sparks Outrage

Apr 27, 2025

Hhs Investigation Into Debunked Autism Vaccine Link Sparks Outrage

Apr 27, 2025