Are High Stock Valuations Justified? BofA's Insight For Investors

Table of Contents

BofA's Key Arguments for Justified High Valuations

BofA's analysis suggests several factors that could support current, seemingly high, stock valuations. Let's delve into their key arguments:

Strong Corporate Earnings and Profitability

BofA's recent reports highlight robust corporate earnings and strong profitability across various sectors. Their analysts point to several key drivers:

- Increased Efficiency: Companies have streamlined operations, leading to improved margins and higher earnings.

- Strong Consumer Spending: Resilient consumer demand, despite inflationary pressures, fuels revenue growth for many businesses.

- Technological Advancements: Innovation across numerous industries is driving productivity and boosting bottom lines.

For example, BofA cites impressive earnings growth percentages in the technology sector (averaging X%), exceeding initial projections. Similarly, the consumer staples sector has shown remarkable resilience, with Y% earnings growth. These strong fundamentals, according to BofA, provide a solid foundation for higher stock valuations. Keywords: Corporate Earnings, Profitability, Earnings Growth, Sector Performance

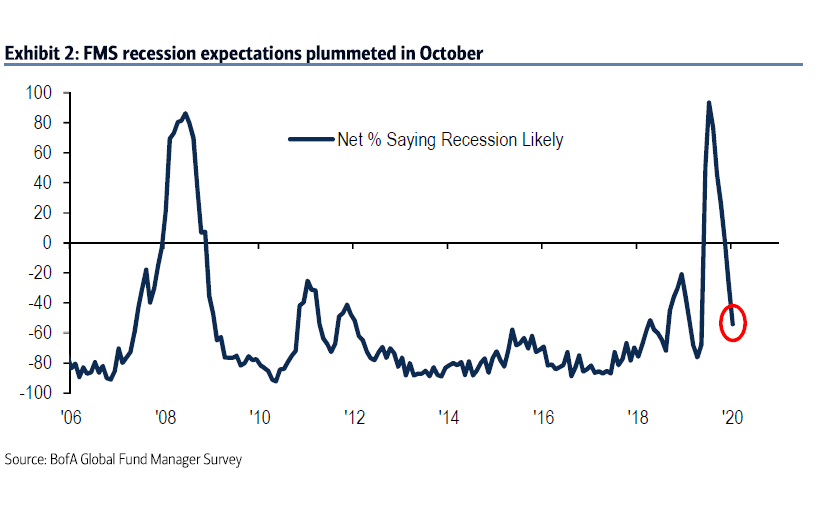

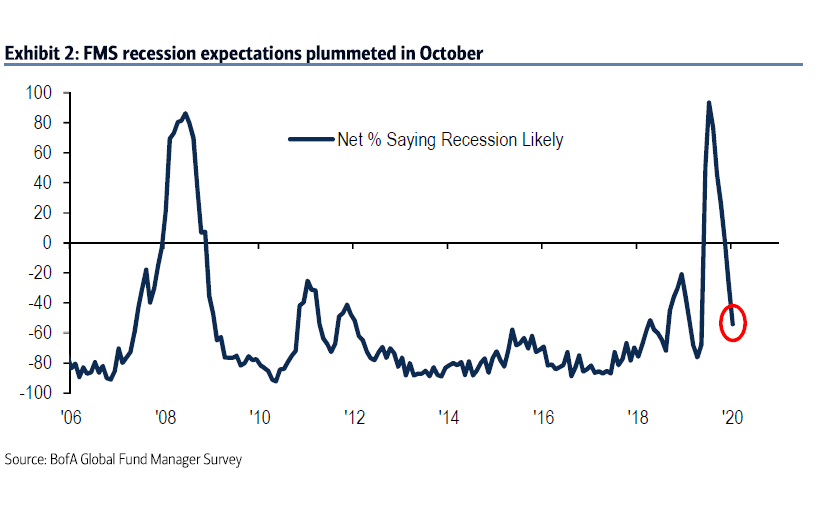

Low Interest Rates and Monetary Policy

Low interest rates significantly influence stock valuations. Lower discount rates, a direct consequence of low interest rates, make future cash flows more valuable, thereby inflating stock prices. BofA's perspective incorporates an analysis of future monetary policy, considering the potential for continued low rates or even further quantitative easing (QE) programs.

- Lower Discount Rates: Low interest rates reduce the cost of borrowing, encouraging investment and further fueling economic growth.

- Continued QE: The possibility of additional QE programs could inject more liquidity into the market, potentially pushing stock valuations even higher.

BofA's analysis acknowledges the potential impact of future interest rate hikes but suggests that the current low-rate environment remains a crucial factor supporting higher stock valuations. Keywords: Interest Rates, Monetary Policy, Quantitative Easing, Discount Rate

Technological Innovation and Growth Potential

BofA emphasizes the transformative impact of technological innovation on stock prices. They highlight the rapid growth of several sectors propelled by disruptive technologies:

- Artificial Intelligence (AI): The burgeoning AI sector is attracting significant investment, driving growth in related companies.

- Cloud Computing: The continued expansion of cloud computing services is creating new opportunities and boosting valuations.

- Biotechnology: Breakthroughs in biotechnology are fueling growth in the healthcare and pharmaceutical sectors.

BofA’s analysis suggests that the potential for future growth driven by these innovations justifies, at least partially, the current high valuations of growth stocks. Keywords: Technological Innovation, Growth Stocks, Disruptive Technologies, Future Growth

BofA's Concerns Regarding High Stock Valuations

While acknowledging the positive factors, BofA also highlights potential risks and concerns associated with the current high stock valuations:

Potential for Market Correction

BofA's analysis includes a cautious assessment of market risks and the potential for a correction. Several factors could trigger a downturn:

- Inflationary Pressures: Persistently high inflation could lead to interest rate hikes, negatively impacting stock valuations.

- Geopolitical Instability: Uncertainties related to global conflicts or political tensions can create market volatility.

- Overvaluation in Certain Sectors: Specific sectors may be overvalued relative to their fundamentals, making them vulnerable to corrections.

BofA warns investors to remain vigilant and prepare for potential market volatility. Keywords: Market Correction, Market Risk, Stock Market Volatility, Bear Market

Valuation Metrics and Potential Overvaluation

BofA uses various valuation metrics, such as the P/E ratio and PEG ratio, to assess potential overvaluation. Their analysis shows that while some sectors are justified by strong fundamentals, others may be showing signs of overvaluation when compared to historical averages and industry benchmarks.

- High P/E Ratios: Elevated P/E ratios in certain sectors raise concerns about potential overvaluation.

- Comparison to Historical Averages: Comparing current valuations to historical averages provides context and helps identify potential discrepancies.

Understanding these metrics is crucial for investors to make informed decisions. Keywords: P/E Ratio, PEG Ratio, Valuation Metrics, Market Capitalization, Overvalued Stocks

Geopolitical and Macroeconomic Risks

BofA's comprehensive analysis includes an assessment of macroeconomic factors and geopolitical risks:

- Inflationary Pressures: Sustained inflation could erode corporate profits and negatively impact stock valuations.

- Global Trade Tensions: Escalating trade disputes or protectionist policies can disrupt global supply chains and harm economic growth.

- Interest Rate Hikes: Aggressive interest rate hikes by central banks to curb inflation could trigger a market downturn.

These factors introduce uncertainty and could negatively impact stock valuations. Keywords: Geopolitical Risk, Macroeconomic Factors, Inflation, Global Trade

Navigating High Stock Valuations: Actionable Insights from BofA

BofA's analysis presents a nuanced picture. While strong corporate earnings and low interest rates support current high valuations, potential risks, including market corrections and macroeconomic uncertainties, warrant caution. The key takeaway is the need for a balanced and diversified investment strategy.

Based on BofA's insights, investors should:

- Diversify their portfolios: Reduce risk by investing across different sectors and asset classes.

- Conduct thorough due diligence: Carefully analyze individual companies before investing, focusing on fundamentals and valuation metrics.

- Monitor market trends: Stay informed about macroeconomic developments and geopolitical events that could impact stock valuations.

To effectively navigate the complexities of high stock valuations, investors should delve deeper into BofA's research and reports. Analyzing stock valuations requires careful consideration of multiple factors, and understanding the nuances of assessing stock valuation risk is critical for successful investing in the current market. By combining BofA's insights with your own thorough research, you can develop a well-informed investment strategy tailored to your risk tolerance and financial goals.

Featured Posts

-

Boating Competition In Arizona Speedboats Dramatic Airborne Flip

Apr 29, 2025

Boating Competition In Arizona Speedboats Dramatic Airborne Flip

Apr 29, 2025 -

Antlaq Fealyat Fn Abwzby Fy 19 Nwfmbr Dlyl Shaml

Apr 29, 2025

Antlaq Fealyat Fn Abwzby Fy 19 Nwfmbr Dlyl Shaml

Apr 29, 2025 -

Post Roe America How Otc Birth Control Changes The Game

Apr 29, 2025

Post Roe America How Otc Birth Control Changes The Game

Apr 29, 2025 -

Minnesota Snow Plow Name Winners Announced

Apr 29, 2025

Minnesota Snow Plow Name Winners Announced

Apr 29, 2025 -

Empty Chicago Office Buildings A Look At The Zombie Property Phenomenon

Apr 29, 2025

Empty Chicago Office Buildings A Look At The Zombie Property Phenomenon

Apr 29, 2025

Latest Posts

-

Is The One Plus 13 R Worth Buying A Comprehensive Review

Apr 29, 2025

Is The One Plus 13 R Worth Buying A Comprehensive Review

Apr 29, 2025 -

Ohio Train Disaster Long Term Impact Of Lingering Toxic Chemicals On Buildings

Apr 29, 2025

Ohio Train Disaster Long Term Impact Of Lingering Toxic Chemicals On Buildings

Apr 29, 2025 -

One Plus 13 R Review A Practical Assessment

Apr 29, 2025

One Plus 13 R Review A Practical Assessment

Apr 29, 2025 -

Months After Ohio Derailment Toxic Chemical Traces Persist In Structures

Apr 29, 2025

Months After Ohio Derailment Toxic Chemical Traces Persist In Structures

Apr 29, 2025 -

One Plus 13 R Vs Pixel 7a In Depth Comparison And Review

Apr 29, 2025

One Plus 13 R Vs Pixel 7a In Depth Comparison And Review

Apr 29, 2025