Are We In A Recession? A Look At Investor Sentiment In The Stock Market

Table of Contents

Defining Recession and its Indicators

Before we analyze investor sentiment, it's crucial to understand what constitutes a recession.

The Technical Definition of a Recession

The most common definition of a recession is two consecutive quarters of negative growth in a country's Gross Domestic Product (GDP). GDP measures the total value of goods and services produced within a country's borders. A decline in GDP indicates a contraction in economic activity, a key characteristic of a recession.

Beyond GDP: Key Economic Indicators

While negative GDP growth is a significant indicator, other economic factors contribute to a more comprehensive understanding of recessionary pressures. These include:

-

Unemployment Rate: Rising unemployment often signifies a weakening economy. As businesses struggle, they reduce hiring and may even lay off employees, leading to increased unemployment claims. A sustained rise in unemployment is a strong warning sign of a potential recession.

-

Consumer Spending: Decreases in consumer spending indicate reduced economic activity. Consumer spending constitutes a significant portion of GDP, and a decline reflects reduced confidence and purchasing power among consumers. This can be a self-fulfilling prophecy, as reduced spending further weakens the economy.

-

Industrial Production: A decline in industrial production suggests reduced manufacturing and overall economic output. This indicator reflects the health of the manufacturing sector, a significant contributor to a nation's economic output. A drop in industrial production often precedes a broader economic slowdown.

-

Inflation: High and sustained inflation can contribute to economic instability and potential recession. While moderate inflation is generally acceptable, runaway inflation erodes purchasing power, increases uncertainty, and can lead to decreased investment and consumer spending.

The Limitations of Economic Indicators

It's important to remember that economic data is often lagging and can be subject to revision. Official recession declarations often come months or even quarters after the actual economic downturn begins. Furthermore, different indicators may send conflicting signals, making accurate prediction challenging.

Analyzing Investor Sentiment in the Stock Market

Investor sentiment plays a crucial role in predicting market trends and potential recessions. Understanding this sentiment can offer valuable insights beyond purely quantitative economic data.

What is Investor Sentiment?

Investor sentiment represents the collective mood and expectations of investors regarding the future of the stock market and the broader economy. It reflects the level of optimism or pessimism among investors concerning future economic growth, corporate profits, and market performance.

Measuring Investor Sentiment

Several methods are used to gauge investor sentiment:

-

Survey Data: Numerous surveys regularly poll investors' opinions and confidence levels. These surveys, while subjective, can offer valuable insights into the overall market mood. A consistently negative outlook often foreshadows market corrections.

-

Market Volatility (VIX): The VIX index, often referred to as the "fear gauge," measures market uncertainty and volatility. A rising VIX indicates increased fear and uncertainty among investors, often associated with a higher likelihood of a market downturn.

-

Stock Market Performance (Specific Sectors): Analyzing how different sectors of the stock market behave during periods of uncertainty provides insights into investor sentiment. For example, a flight to safety, where investors move funds into defensive sectors like consumer staples, indicates a pessimistic outlook.

-

Options Trading Activity (Put/Call Ratio): The ratio of put options (bets on price declines) to call options (bets on price increases) can signal investor pessimism or optimism. A high put/call ratio suggests increased fear and potential for a market correction.

Historical Correlation between Sentiment and Recessions

Historically, a sharp decline in investor sentiment, as measured by the indicators above, has often preceded or accompanied economic recessions. For example, the sharp drop in the stock market before the 2008 financial crisis was a clear indication of declining investor confidence and foreshadowed the subsequent recession.

Current Market Conditions and Investor Sentiment

Assessing the current economic climate requires analyzing the latest available data and interpreting current investor sentiment.

Current Economic Indicators

(This section should be updated with the most current data on GDP growth, unemployment rates, consumer spending, industrial production, and inflation.) For example: "As of [Date], the latest GDP figures show [Growth/Decline]..., while the unemployment rate stands at [Percentage]..."

Current Investor Sentiment

(This section should be updated with the most current data on investor sentiment indicators like the VIX index, survey data, sector performance, and put/call ratios.) For example: "The VIX index currently sits at [Number], indicating [Level of Volatility]... Survey data from [Source] shows [Percentage] of investors are pessimistic about the near-term future..."

Expert Opinions

(This section should include summaries of recent opinions from reputable economists and financial analysts on the likelihood of a recession. Include diverse opinions to offer a balanced perspective.)

Conclusion

Understanding whether we are heading towards a recession requires a multifaceted approach. We've examined the technical definition of a recession, key economic indicators beyond GDP, and various methods for gauging investor sentiment. Current data on [mention key indicators and investor sentiment] paints a picture of [summary of current situation - optimistic, pessimistic, uncertain]. However, it’s crucial to remember that economic forecasting is inherently uncertain.

Key Takeaway: While current indicators and investor sentiment [offer some clues/provide a mixed signal], the likelihood of a recession remains uncertain. Many factors influence economic cycles, and unexpected events can significantly impact the trajectory of the economy.

Call to Action: Stay vigilant and continue monitoring key economic indicators and investor sentiment to better navigate the potential challenges of a looming recession. Reputable financial news sources and economic data websites offer valuable information to help you stay informed. Regularly reviewing these resources will allow you to make more informed financial decisions.

Featured Posts

-

Daughters Cryptic Remarks About Ashton Kutcher Spark Controversy

May 06, 2025

Daughters Cryptic Remarks About Ashton Kutcher Spark Controversy

May 06, 2025 -

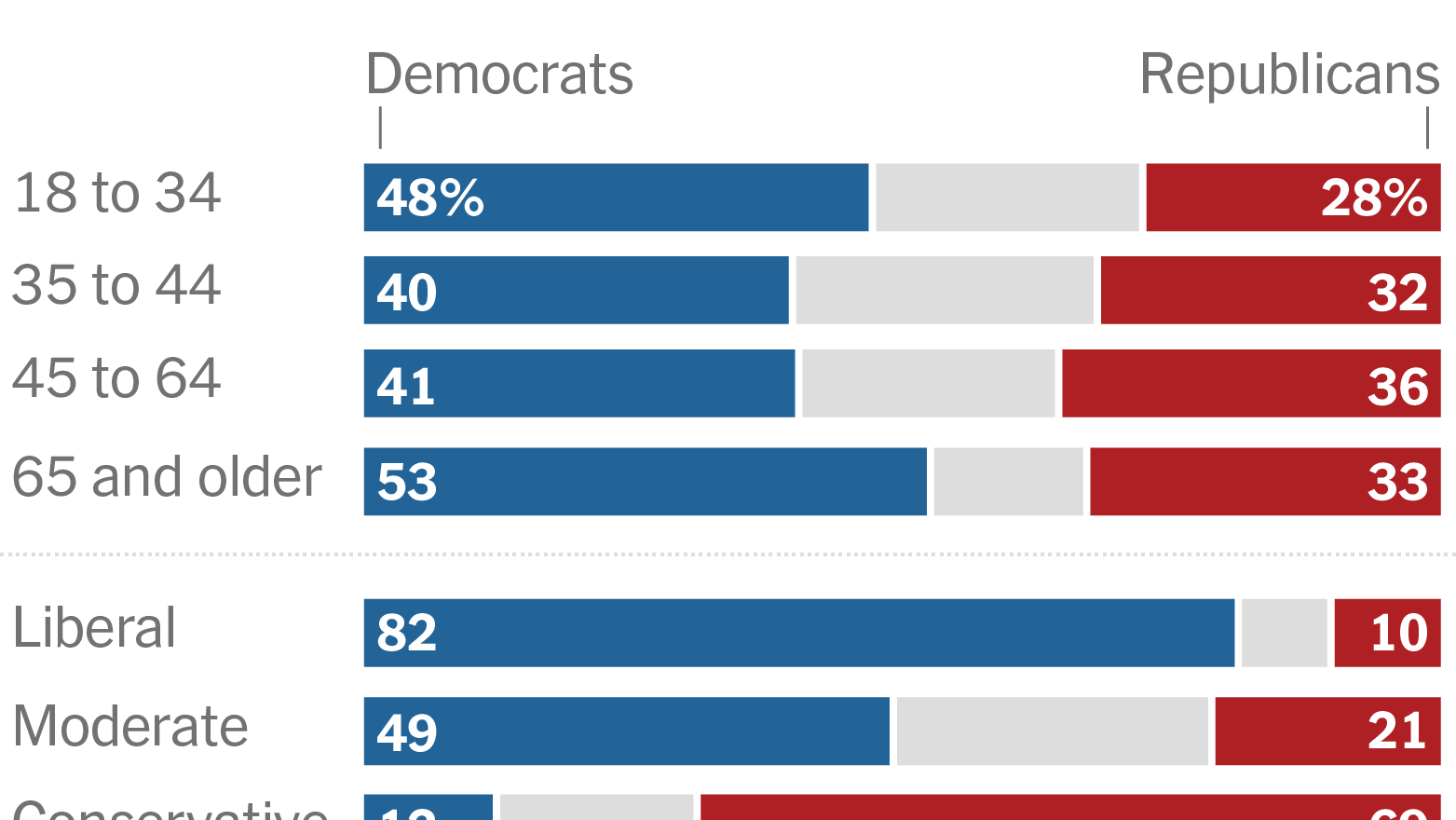

House Democrats Divided Public Clash Highlights Generational Shift

May 06, 2025

House Democrats Divided Public Clash Highlights Generational Shift

May 06, 2025 -

Is Sabrina Carpenter The Next Fortnite Festival Headliner New Leak Points To Yes

May 06, 2025

Is Sabrina Carpenter The Next Fortnite Festival Headliner New Leak Points To Yes

May 06, 2025 -

Line Of Duty Comeback Martin Compston Offers A Cryptic Update

May 06, 2025

Line Of Duty Comeback Martin Compston Offers A Cryptic Update

May 06, 2025 -

Polska I Handel Trotylem Rzut Oka Na Nowe Zamowienie

May 06, 2025

Polska I Handel Trotylem Rzut Oka Na Nowe Zamowienie

May 06, 2025