AT&T On Broadcom's VMware Acquisition: An Unacceptable 1,050% Price Surge

Table of Contents

AT&T's Stance Against the Broadcom-VMware Merger

AT&T has publicly voiced strong concerns about Broadcom's acquisition of VMware. Their official statement highlights anxieties about the potential for monopolistic practices and a significant reduction in competition within the crucial virtualization and cloud computing markets. AT&T argues that this merger could negatively impact consumers and businesses alike, leading to inflated prices, reduced choices, and stifled innovation.

Their specific concerns include:

- Loss of Innovation: Reduced competition could stifle innovation and slow the development of new technologies within the virtualization sector.

- Higher Prices for VMware Products and Services: A lack of competition allows Broadcom to increase prices for VMware's essential products and services, impacting businesses’ bottom lines.

- Potential for Reduced Quality of Service: A dominant player might prioritize profit over service quality, potentially leading to degraded performance and customer experience.

- Suppression of Technological Advancements: The merger could lead to the suppression of competing technologies and limit the choices available to consumers and businesses.

The 1050% Price Surge: An Unprecedented Increase

The VMware stock price increase following the acquisition announcement was nothing short of extraordinary. While precise figures may vary slightly depending on the timeframe considered, the magnitude of the surge is undeniable, representing a dramatic increase of approximately 1050% in a relatively short period. This unprecedented jump far surpasses typical increases seen in comparable tech acquisitions.

Several factors contributed to this dramatic price change:

- Market Speculation: Investors anticipated significant synergies and potential for increased profitability under Broadcom's ownership.

- Broadcom's Reputation: Broadcom’s history of successful acquisitions and integration boosted investor confidence.

- Demand for VMware Products: VMware holds a dominant position in the virtualization market, making its products highly sought after.

This dramatic price jump highlights the significant market impact and investor sentiment surrounding this high-profile merger. The question remains: is this price surge a reflection of genuine value, or a sign of potential market manipulation?

Regulatory Scrutiny and Antitrust Concerns

Broadcom's acquisition of VMware is likely to face intense regulatory scrutiny from bodies like the Federal Trade Commission (FTC) in the US and the European Commission in the EU. Antitrust concerns are paramount, given VMware's significant market share in virtualization and cloud computing. The potential for the creation of a monopoly, limiting choices and increasing prices for consumers and businesses, is a significant concern for regulators.

The regulatory landscape is complex, with past acquisitions offering both cautionary tales and precedents:

- Similar Acquisitions: Examining past mergers and acquisitions in the tech sector, particularly those involving dominant market players, can provide insights into potential regulatory outcomes.

- Potential Legal Challenges: There is a significant possibility of legal challenges to the acquisition from competitors and consumer advocacy groups.

- Potential Penalties for Anti-competitive Behavior: If found to be anti-competitive, Broadcom could face substantial fines and even be forced to divest parts of VMware.

The Future of VMware and the Impact on the Tech Industry

The long-term impact of the Broadcom-VMware merger on the technology industry is still unfolding. Several key areas will be affected:

- VMware's Product Roadmap: Changes to product development and strategic direction are anticipated, potentially influencing innovation and market competition.

- Impact on Competing Virtualization Technologies: Existing competitors will feel the pressure from a potentially dominant player, impacting their market share and future development.

- Influence on the Broader Cloud Computing Market: The merger's impact on the broader cloud computing landscape will be substantial, affecting pricing, innovation, and competition.

The acquisition's ultimate influence on consumers and businesses will depend largely on the regulatory response and Broadcom's post-merger strategies.

Conclusion: Addressing the Unacceptable VMware Price Surge

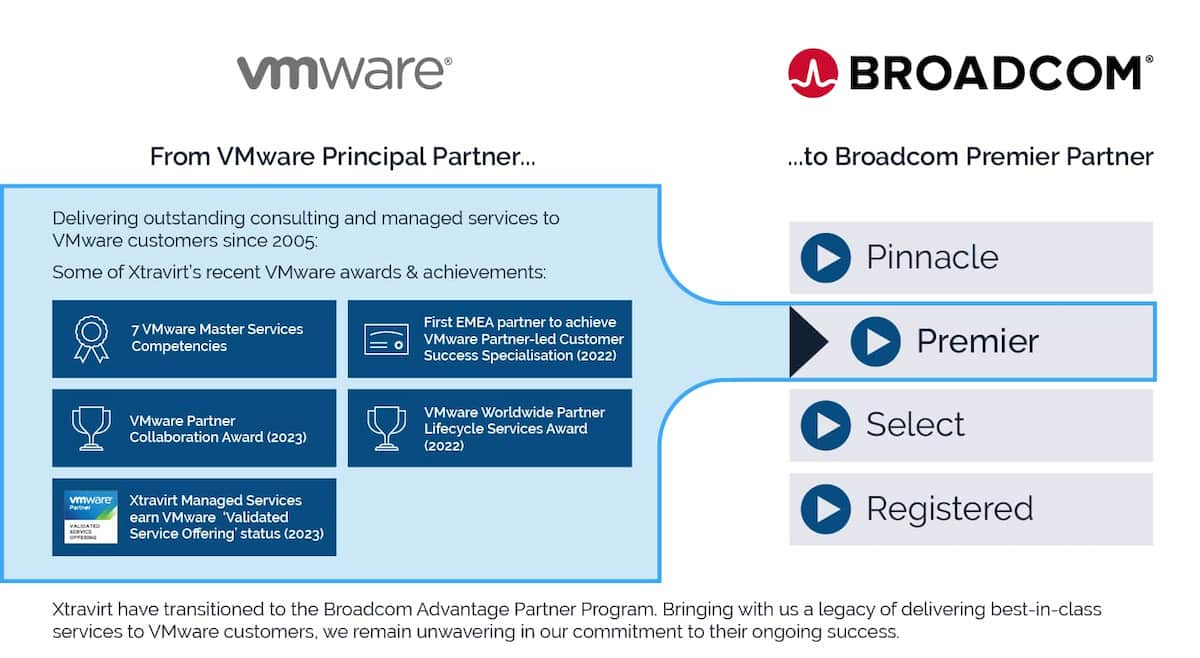

AT&T's concerns regarding the Broadcom-VMware deal, particularly the exorbitant 1050% price surge, highlight the potential for significant negative consequences for consumers and the broader tech industry. The unprecedented price increase raises serious questions about market competitiveness and the potential for monopolistic practices. The ongoing regulatory scrutiny of this acquisition will be crucial in determining the future of VMware and its impact on the tech landscape.

Stay informed about developments in the "AT&T on Broadcom's VMware Acquisition" situation and the ongoing regulatory review. Monitor news from the FTC, EU Commission, and other relevant regulatory bodies, as well as official statements from AT&T and Broadcom. The future of virtualization and cloud computing may well hinge on the outcome.

Featured Posts

-

Investigation Launched Into Plano Islamic Center Development By Texas Rangers At Gov Abbotts Behest

May 13, 2025

Investigation Launched Into Plano Islamic Center Development By Texas Rangers At Gov Abbotts Behest

May 13, 2025 -

Cremaschis Goal Lifts Inter Miami To Victory Over Crew

May 13, 2025

Cremaschis Goal Lifts Inter Miami To Victory Over Crew

May 13, 2025 -

Mc Kellen On Closeted Actors Its Silly

May 13, 2025

Mc Kellen On Closeted Actors Its Silly

May 13, 2025 -

Cremaschi Scores Winner As Inter Miami Triumphs In Cleveland

May 13, 2025

Cremaschi Scores Winner As Inter Miami Triumphs In Cleveland

May 13, 2025 -

Trump On Qatari Gift Plane A Controversial Decision

May 13, 2025

Trump On Qatari Gift Plane A Controversial Decision

May 13, 2025