Atkins Signals Major Changes To SEC Crypto Broker Regulations

Table of Contents

The Atkins Report and its Key Findings

The information discussed here stems from an internal Atkins report, details of which have been made public [Insert citation or source here – e.g., link to news article or official statement]. This report paints a picture of substantially more stringent SEC crypto regulation in the near future. The Atkins report highlights the SEC's growing concern over various aspects of cryptocurrency brokerage operations, leading to proposed changes that will significantly impact crypto broker compliance. Key findings include:

-

Increased scrutiny of custody practices: The SEC is expected to implement stricter rules surrounding the secure storage and management of client assets, demanding higher levels of transparency and security protocols. This means crypto brokerages will face increased audits and oversight related to their custody procedures.

-

New requirements for KYC/AML compliance: Expect more rigorous Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols. Brokerages will need to implement more robust systems to verify customer identities and track transactions, aiming to curb illicit activities within the crypto space.

-

Changes to reporting requirements for transactions: The SEC plans to mandate more detailed and frequent reporting of all transactions, providing greater oversight of the market’s activities. This includes stricter reporting of suspicious activity.

-

Clarification of "security" definitions impacting which cryptocurrencies fall under regulation: The SEC's definition of what constitutes a "security" is undergoing refinement. This clarification will significantly impact which cryptocurrencies are subject to their regulations, potentially leading to a re-evaluation of many currently available assets.

Impact on Crypto Brokerages – Preparing for Compliance

Adapting to these new SEC crypto regulations will present considerable challenges for crypto brokerages. The increased regulatory hurdles will necessitate substantial changes across operations. The potential for SEC enforcement actions against non-compliant firms is a major concern. This means crypto brokerage compliance is no longer optional but mandatory for survival. The key challenges include:

-

Upgrading existing systems to meet new requirements: Many brokerages will need to invest heavily in upgrading their technology infrastructure to meet the new KYC/AML and reporting standards.

-

Increased operational costs associated with compliance: The enhanced regulatory scrutiny will inevitably lead to increased operational costs, including legal fees, compliance software, and staffing.

-

Potential for legal challenges and fines for non-compliance: Brokerages failing to meet the new regulatory standards face substantial fines and potential legal battles.

-

Changes needed to business models and offerings: Some brokerages may need to alter their business models and offerings to remain compliant with the new regulations, possibly leading to limitations on certain cryptocurrencies or services.

The Role of Technology in Achieving Compliance

Fortunately, technology offers solutions. RegTech, specifically solutions focused on crypto compliance technology, plays a crucial role. Blockchain analytics, improved KYC/AML software, and secure custody solutions are essential for meeting the new standards.

-

Implementing robust KYC/AML systems: Automated KYC/AML systems can efficiently verify identities and flag suspicious transactions, reducing manual workload and improving accuracy.

-

Utilizing blockchain analytics for enhanced transaction monitoring: Blockchain analytics tools allow for better monitoring of transactions, helping identify and prevent fraudulent activities.

-

Employing secure custody solutions: Secure, institutional-grade custody solutions are crucial to protecting client assets and complying with the SEC's stricter custody requirements.

Implications for Investors – Increased Security vs. Limited Access

The Atkins Signals Major Changes to SEC Crypto Broker Regulations will have a profound impact on investors. While increased regulatory oversight contributes to crypto investor protection and potentially bolsters investor confidence, it also introduces limitations.

-

Increased confidence in regulated exchanges: Investors may gravitate towards regulated exchanges, perceiving them as safer and more reliable.

-

Potential for higher transaction fees: The increased costs of compliance for brokerages could lead to higher transaction fees for investors.

-

Reduced access to smaller or less regulated cryptocurrencies: The SEC's clarification on "security" definitions may restrict access to certain cryptocurrencies, potentially impacting investment diversification. The resulting market volatility will need careful navigation. This highlights the continuing regulatory uncertainty in the sector.

Conclusion: Navigating the New Landscape of SEC Crypto Broker Regulations

The Atkins report signals a significant shift in the landscape of SEC crypto broker regulations. The key takeaways are increased regulatory scrutiny, demanding higher compliance standards for brokerages and impacting investor access to certain crypto assets. Understanding the implications of Atkins' report on SEC crypto broker regulations is crucial for future success. Stay updated on the latest Atkins signals and SEC crypto broker regulations to navigate this changing environment effectively. Consult with legal and financial professionals to ensure full compliance with the new rules. Ignoring these changes could have serious consequences.

Featured Posts

-

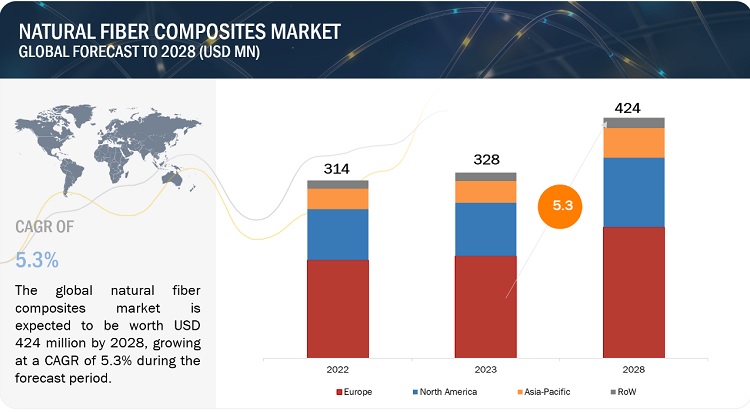

The Future Of Natural Fiber Composites A Market Forecast To 2029

May 13, 2025

The Future Of Natural Fiber Composites A Market Forecast To 2029

May 13, 2025 -

Prediksi Skor Ac Milan Vs Atalanta Head To Head Dan Susunan Pemain

May 13, 2025

Prediksi Skor Ac Milan Vs Atalanta Head To Head Dan Susunan Pemain

May 13, 2025 -

Possible Hamas Release Of Edan Alexander And Other Hostages At Ramadan

May 13, 2025

Possible Hamas Release Of Edan Alexander And Other Hostages At Ramadan

May 13, 2025 -

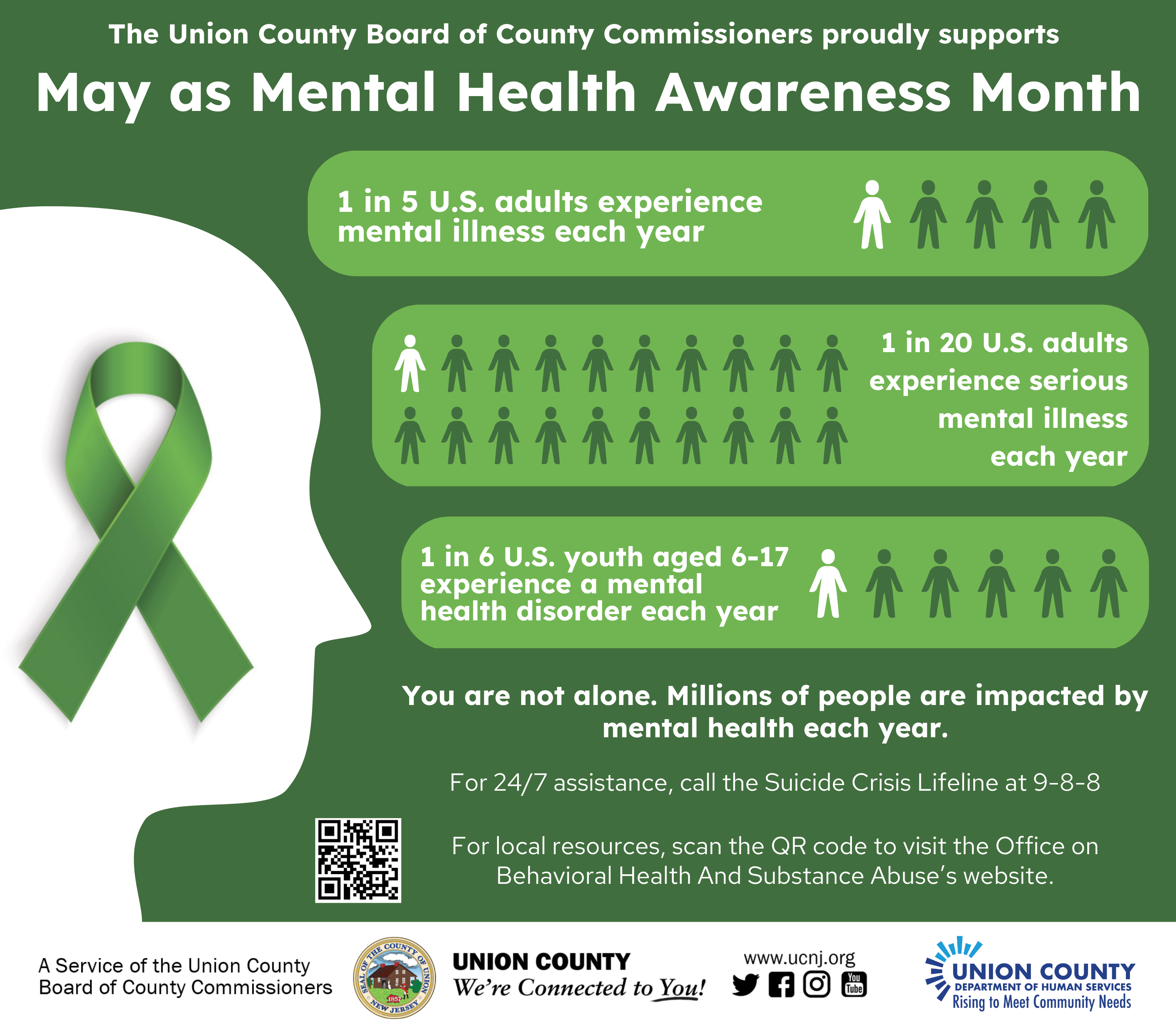

Didcot Dog Walks Supporting Mental Wellbeing This Mental Health Awareness Week

May 13, 2025

Didcot Dog Walks Supporting Mental Wellbeing This Mental Health Awareness Week

May 13, 2025 -

Ethan Slaters Impact On Elsbeth Season 2 Episode 17 A Breakdown

May 13, 2025

Ethan Slaters Impact On Elsbeth Season 2 Episode 17 A Breakdown

May 13, 2025