Australia Election 2024: Goldman Sachs On Labor Vs. Opposition Fiscal Policy

Table of Contents

Goldman Sachs, a globally influential economic forecaster, plays a significant role in shaping economic discourse. Their analysis of the Labor and Coalition's fiscal policies provides a valuable lens through which to understand the potential economic consequences of the upcoming election. This article will delve into Goldman Sachs’ assessment of both parties' plans, offering a comprehensive comparison to help voters navigate the complex economic landscape of the Australia Election 2024.

Goldman Sachs' Assessment of Labor's Fiscal Policy

Labor's Key Economic Promises

Labor's economic plan centers around increased government spending on key areas, aiming to boost economic growth and improve social outcomes. Their "Labor's budget" proposals include significant investments in:

- Infrastructure: Major investments in roads, railways, and public transport, aiming to stimulate job creation and improve productivity. Estimated cost: (Insert figures from Goldman Sachs report, if available).

- Healthcare: Expanded access to Medicare, including increased funding for hospitals and medical research. Estimated cost: (Insert figures from Goldman Sachs report, if available).

- Social Welfare: Enhanced social security payments and increased support for low-income families. Estimated cost: (Insert figures from Goldman Sachs report, if available).

Labor's economic plan also includes proposed tax changes, such as (Insert specific tax proposals and their estimated revenue impacts according to Goldman Sachs' analysis). Goldman Sachs' assessment of Labor's proposals considers the potential for increased economic activity spurred by government spending, while also analyzing the risks associated with increased national debt.

Goldman Sachs' Analysis of Labor's Debt and Deficit Projections

Goldman Sachs' analysis projects the impact of Labor's policies on Australia's national debt and budget deficit. Their key findings (according to their reports, insert data and charts if available) include:

- Projected increase in the national debt over the next (number) years.

- Potential impact on interest rates and inflation.

- Assessment of the long-term fiscal sustainability of Labor's plan.

The analysis also considers the potential impact on economic growth, highlighting both the stimulative effects of increased spending and the potential risks associated with higher debt levels.

Goldman Sachs' Assessment of the Coalition's Fiscal Policy

Coalition's Economic Platform

The Coalition's economic platform emphasizes fiscal responsibility and debt reduction. Their "Coalition's budget" focuses on:

- Targeted Spending: Prioritizing spending on essential services while maintaining fiscal discipline. Estimated cost: (Insert figures from Goldman Sachs report, if available).

- Tax Cuts: Proposals for income tax cuts to stimulate economic activity and encourage investment. Estimated cost and revenue impact: (Insert figures from Goldman Sachs report, if available).

- Debt Reduction Strategy: Implementation of strategies to reduce the national debt over the medium term.

Goldman Sachs' analysis assesses the potential economic consequences of the Coalition's proposals, considering the impact on economic growth, employment, and investor confidence.

Goldman Sachs' Analysis of the Coalition's Debt and Deficit Projections

Goldman Sachs' projections for the Coalition's impact on the national debt and budget deficit highlight:

- Projected trajectory of the national debt under the Coalition's plan.

- Assessment of the potential impact on credit ratings and investor confidence.

- Analysis of the Coalition's fiscal sustainability and its potential impact on future economic stability.

(Insert data and charts from Goldman Sachs’ reports, if available, to support these points). The analysis considers the potential benefits of fiscal restraint, while also acknowledging the potential drawbacks of slower economic growth.

Comparing Labor and Coalition Fiscal Policies: A Goldman Sachs Perspective

Key Differences in Approach

The fundamental difference between Labor and Coalition approaches lies in their budgetary priorities and risk tolerance.

- Spending Priorities: Labor prioritizes increased government spending on social programs and infrastructure, while the Coalition emphasizes fiscal restraint and targeted spending.

- Taxation Policies: Labor's proposals include potential tax increases to fund increased spending, while the Coalition favors tax cuts to stimulate the economy.

- Debt Management: Labor's approach involves potentially higher debt levels in the short term to achieve social and economic goals, whereas the Coalition prioritizes debt reduction.

Goldman Sachs' Overall Assessment and Predictions

Goldman Sachs' overall assessment considers both the potential benefits and risks of each party's fiscal plan. (Insert key conclusions from Goldman Sachs' reports, including projections for economic growth, employment, and inflation under each scenario). A balanced perspective highlights the strengths and weaknesses of each approach, allowing voters to make informed choices.

Conclusion: Making Informed Choices in the Australia Election 2024: Fiscal Policy Matters

Goldman Sachs' analysis of Labor and the Coalition's fiscal policies reveals significant differences in their approaches to managing the Australian economy. Understanding these differing approaches is crucial for voters as they consider the long-term economic consequences of each party's plans. The potential impacts on national debt, inflation, and economic growth are substantial, and informed choices are essential. Consult Goldman Sachs' reports and other reputable sources for more detailed information to make informed decisions in the upcoming Australia Election 2024. The future of Australia's fiscal policy depends on your vote.

Featured Posts

-

Ashton Jeanty And The Denver Broncos A Super Bowl Contender In The Making

Apr 25, 2025

Ashton Jeanty And The Denver Broncos A Super Bowl Contender In The Making

Apr 25, 2025 -

Cassidy Hutchinsons Upcoming Memoir Insights Into The January 6th Hearings

Apr 25, 2025

Cassidy Hutchinsons Upcoming Memoir Insights Into The January 6th Hearings

Apr 25, 2025 -

Istanbul Un Kalbindeki Yenileme Abb Ve Anafartalar Caddesi Projesi

Apr 25, 2025

Istanbul Un Kalbindeki Yenileme Abb Ve Anafartalar Caddesi Projesi

Apr 25, 2025 -

Covid 19 Pandemic Lab Owner Admits To Falsifying Test Results

Apr 25, 2025

Covid 19 Pandemic Lab Owner Admits To Falsifying Test Results

Apr 25, 2025 -

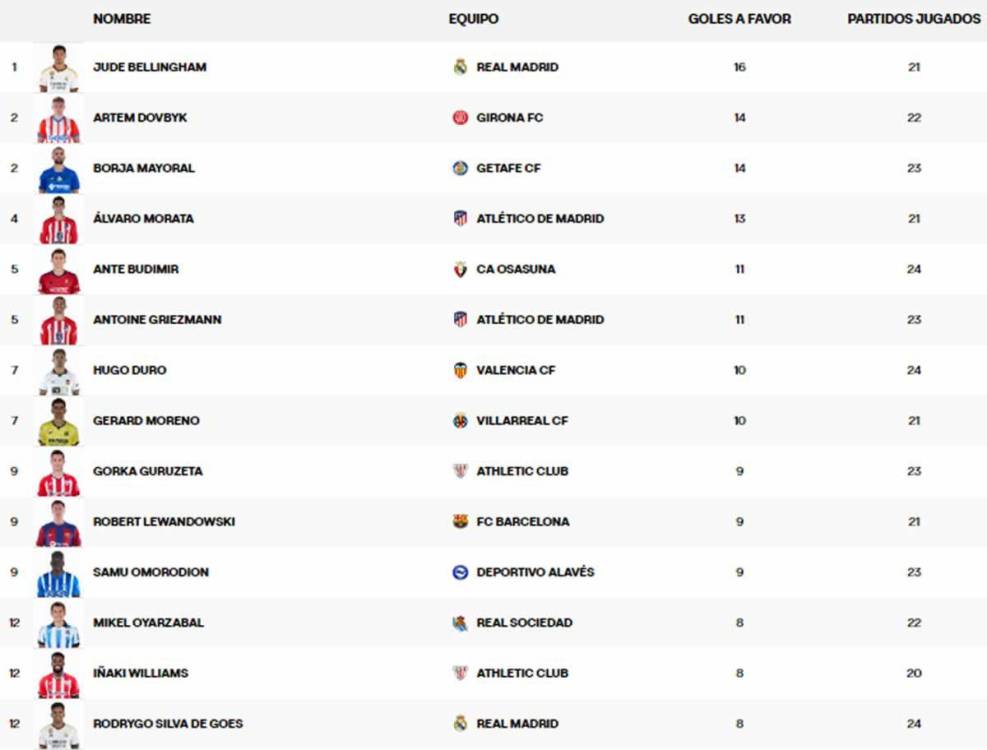

Bota De Oro 2024 25 Actualizacion De La Tabla De Goleadores

Apr 25, 2025

Bota De Oro 2024 25 Actualizacion De La Tabla De Goleadores

Apr 25, 2025

Latest Posts

-

3 Dias Para Comenzar Tu Entrenamiento De Boxeo En Edomex

Apr 30, 2025

3 Dias Para Comenzar Tu Entrenamiento De Boxeo En Edomex

Apr 30, 2025 -

10 2025 2

Apr 30, 2025

10 2025 2

Apr 30, 2025 -

Faltan 3 Dias Inscribete A Tus Clases De Boxeo En Edomex

Apr 30, 2025

Faltan 3 Dias Inscribete A Tus Clases De Boxeo En Edomex

Apr 30, 2025 -

10 2025

Apr 30, 2025

10 2025

Apr 30, 2025 -

Clases De Boxeo Edomex Inscribete Antes De Que Se Agoten Las Plazas 3 Dias

Apr 30, 2025

Clases De Boxeo Edomex Inscribete Antes De Que Se Agoten Las Plazas 3 Dias

Apr 30, 2025