Australia's Opposition: $9 Billion Budget Improvement Pledge

Table of Contents

Key Areas Targeted for Budget Improvement

The opposition party aims to achieve this $9 billion budget improvement through a multi-pronged approach focusing on increased efficiency, targeted tax reforms, and a review of existing government programs. Their plan isn't simply about cutting spending; it emphasizes strategic reallocation of resources and maximizing returns on investment.

-

Increased efficiency in government spending: The opposition proposes a comprehensive review of government administrative processes, aiming to eliminate redundancies and streamline operations. They project savings of $2 billion through improved procurement practices and reduced bureaucratic overhead. (Source: Opposition Party Press Release, October 26, 2024)

-

Targeted tax reforms: A key element of their plan involves closing tax loopholes exploited by high-income earners and multinational corporations. This is projected to generate an additional $3 billion in revenue. Specific proposals include strengthening tax enforcement and addressing offshore tax avoidance schemes. (Source: Opposition Party Policy Document, Section 3.2, November 1, 2024)

-

Review and streamlining of existing government programs: The opposition plans to review the effectiveness of existing government programs, identifying areas where funding can be reallocated to more impactful initiatives. They estimate savings of $1 billion through the consolidation and elimination of overlapping programs. (Source: Independent Economic Analysis commissioned by the Opposition, November 15, 2024)

-

Increased focus on revenue generation through economic growth initiatives: The plan also includes measures to boost economic growth, leading to increased tax revenue. This involves investments in infrastructure projects and initiatives aimed at fostering innovation and entrepreneurship. The projected increase in revenue from this strategy is $3 billion. (Source: Opposition Party Economic Advisor Statement, November 22, 2024)

Impact on Essential Services

The proposed budget improvements have significant implications for essential services. While the opposition emphasizes efficiency gains, concerns remain about the potential impact on service delivery.

-

Healthcare: The opposition claims their plan will not reduce healthcare funding. They propose targeted investments in preventative care and improved access to mental health services. However, specific details regarding funding allocations remain limited.

-

Education: The opposition pledges to maintain funding for schools and universities while implementing reforms to improve educational outcomes. This includes investing in early childhood education and providing greater support for disadvantaged students. Further details on the specific budgetary allocation are expected.

-

Infrastructure: The opposition plans to invest heavily in infrastructure projects, focusing on public transport, renewable energy, and crucial road upgrades. This is presented as a key driver of economic growth and job creation. The proposed infrastructure investments are expected to stimulate economic activity and create employment opportunities.

Economic Implications and Forecasts

The opposition's budget improvement plan presents both opportunities and challenges for the Australian economy.

-

Impact on national debt and deficit: The opposition argues their plan will lead to a significant reduction in the national debt and deficit over the medium term. However, independent economists have called for more detailed analysis of the long-term fiscal sustainability of the plan.

-

Potential effects on inflation and interest rates: The economic impact of the proposed changes on inflation and interest rates is uncertain. Some economists predict a positive effect on economic growth leading to slight increases in inflation, while others caution against potential inflationary pressures from increased government spending on infrastructure.

-

Projected impact on economic growth and job creation: The opposition's plan emphasizes job creation through infrastructure investments and economic stimulus. The projected impact on job creation is considered a key aspect of their economic strategy and depends on successful implementation and economic conditions.

-

Analysis of the plan's long-term sustainability: Concerns remain regarding the long-term fiscal sustainability of the $9 billion improvement pledge. Critics argue that the projections may be overly optimistic and that a more in-depth analysis is needed to ensure the plan’s long-term viability.

Comparison with the Government's Budget

The opposition's $9 billion pledge contrasts sharply with the government's budget, which focuses on different priorities and approaches. The government emphasizes fiscal prudence and controlled spending, while the opposition prioritizes strategic investments in key sectors. A direct comparison reveals significant differences in spending priorities and approaches to fiscal management. A detailed analysis of both plans is essential to understanding their potential impacts on the Australian economy.

Conclusion

The opposition's ambitious plan to improve Australia's budget by $9 billion offers a compelling vision for the nation's financial future. Its focus on efficiency, targeted tax reforms, and strategic investments in essential services aims to achieve fiscal responsibility while simultaneously boosting economic growth. However, a thorough examination of the plan's long-term sustainability and potential impact on key services remains crucial. Learn more about the detailed proposals and their potential consequences by researching further into Australia's budget and the opposition's fiscal policy. Stay informed about the ongoing debates surrounding Australia's budget to make informed choices during the upcoming election. Engage in the conversation about Australia's budget and its future.

Featured Posts

-

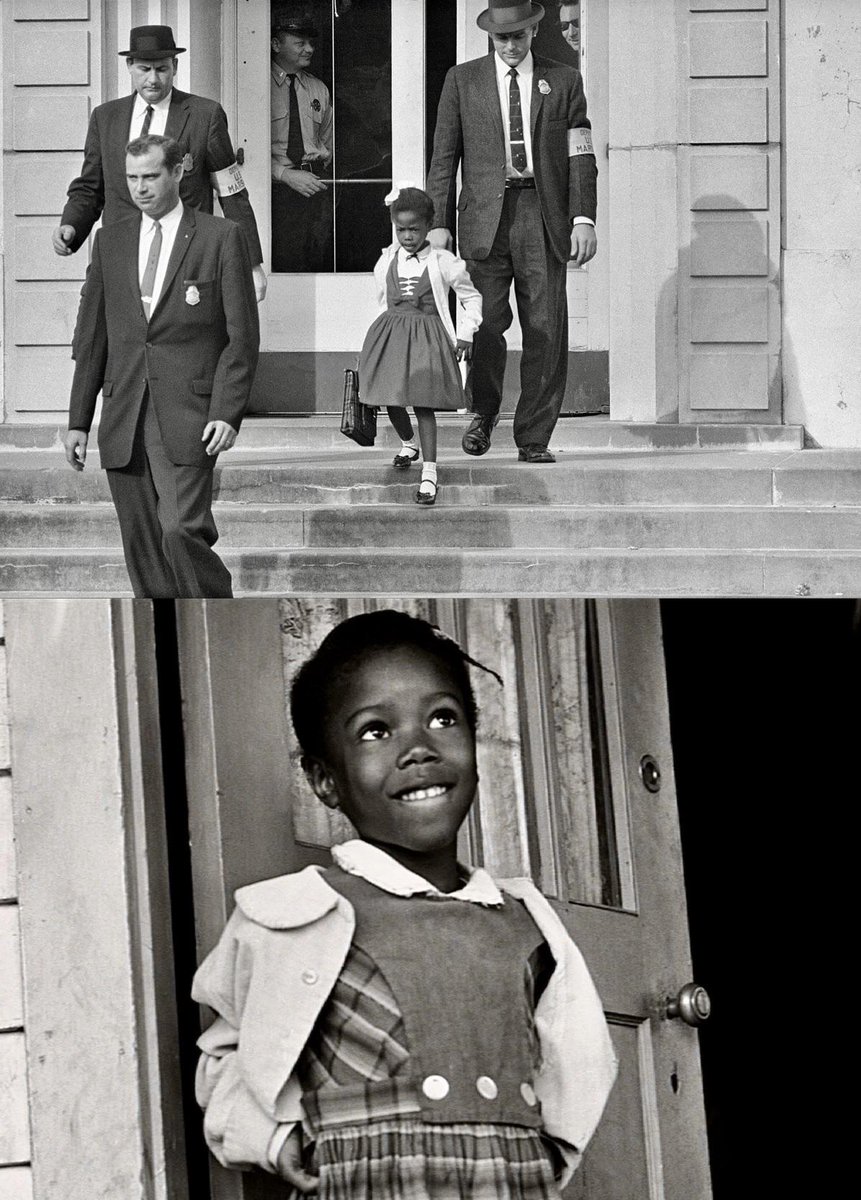

End Of An Era Justice Department Decision On Louisiana School Desegregation

May 02, 2025

End Of An Era Justice Department Decision On Louisiana School Desegregation

May 02, 2025 -

Top Agent Incentive Ponant Offers 1 500 Flight Credit For Paul Gauguin Sales

May 02, 2025

Top Agent Incentive Ponant Offers 1 500 Flight Credit For Paul Gauguin Sales

May 02, 2025 -

Channel 4 And Michael Sheen Face Accusations Over Million Pound Giveaway

May 02, 2025

Channel 4 And Michael Sheen Face Accusations Over Million Pound Giveaway

May 02, 2025 -

Trumps Tariffs A Judges Power Under Scrutiny

May 02, 2025

Trumps Tariffs A Judges Power Under Scrutiny

May 02, 2025 -

Como Escolher A Melhor Mini Camera Chaveiro Para Voce

May 02, 2025

Como Escolher A Melhor Mini Camera Chaveiro Para Voce

May 02, 2025

Latest Posts

-

This Country Insights Into Its People And Places

May 02, 2025

This Country Insights Into Its People And Places

May 02, 2025 -

The Radio 4 Mystery Why Robinson And Barnett No Longer Present Together

May 02, 2025

The Radio 4 Mystery Why Robinson And Barnett No Longer Present Together

May 02, 2025 -

Understanding This Country Politics Economy And Society

May 02, 2025

Understanding This Country Politics Economy And Society

May 02, 2025 -

Bbc Faces Unprecedented Crisis After 1bn Revenue Plunge

May 02, 2025

Bbc Faces Unprecedented Crisis After 1bn Revenue Plunge

May 02, 2025 -

Bbc Two Hd Newsround Schedule Episodes And More

May 02, 2025

Bbc Two Hd Newsround Schedule Episodes And More

May 02, 2025