Australia's Opposition Promises $9 Billion Budget Improvement

Table of Contents

Key Areas Targeted for Budget Savings

The opposition's $9 billion budget improvement plan hinges on a three-pronged strategy: significant spending cuts, innovative revenue generation, and a concerted effort to improve government efficiency and productivity.

Spending Cuts

The opposition has identified several areas ripe for spending cuts, emphasizing fiscal responsibility and a renewed focus on essential government services. These include:

- Reductions in administrative costs across government departments: A proposed 5% cut across all non-essential government departments is expected to yield approximately $2 billion in savings. This will involve streamlining bureaucratic processes and eliminating redundancies.

- Targeted cuts to specific programs: The opposition plans to review existing government programs, identifying those with minimal impact or demonstrably poor value for money. This targeted approach aims for approximately $3 billion in savings, with specific programs to be announced in the coming weeks. The party maintains these cuts will not affect essential services like healthcare and education.

- Review of government subsidies and grants: A comprehensive audit of existing subsidies and grants will identify areas where spending can be reduced without compromising vital social programs. The estimated savings from this review are projected to be around $1 billion.

Addressing concerns about potential negative impacts of these cuts, the opposition has pledged to protect essential services and carefully manage the transition to ensure minimal disruption to affected individuals and communities. Keywords: government spending, spending cuts, fiscal responsibility, austerity measures, public sector reform.

Increased Revenue Generation

Beyond spending cuts, the opposition aims to boost government revenue through a combination of strategic tax reforms and measures to close existing tax loopholes. Key initiatives include:

- Targeted tax reform for high-income earners: Proposals include adjustments to capital gains tax and adjustments to the top marginal tax rate to increase revenue from higher income individuals and corporations. The estimated increase from these reforms is $1.5 billion.

- Closing tax loopholes: The opposition plans to aggressively pursue tax avoidance and evasion through stricter enforcement and legislative changes to close existing loopholes. This is expected to generate an additional $1 billion.

- Review of Goods and Services Tax (GST): A thorough review of the GST system will focus on identifying areas for improvement in revenue collection and efficiency. Though specific changes are yet to be outlined, potential adjustments could yield an additional $500 million.

These measures aim for increased revenue generation while minimizing the impact on low and middle-income earners. Keywords: tax reform, revenue generation, tax policy, economic growth, fiscal sustainability.

Improved Efficiency and Productivity

The opposition recognizes the critical role of efficient and productive government operations in achieving fiscal sustainability. This includes:

- Streamlining government processes: A focus on digital transformation and automation of government services will reduce operational costs and improve service delivery.

- Investing in workforce training and development: Upgrading the skills and capabilities of the public sector workforce will increase productivity and efficiency.

- Modernizing IT infrastructure: Outdated IT systems will be upgraded to improve efficiency and reduce costs associated with maintenance and repairs.

These improvements are projected to yield approximately $500 million in savings through reduced operating costs and increased output. Keywords: government efficiency, public sector productivity, streamlining services, cost-cutting measures.

Economic Impact and Predictions

The opposition's $9 billion budget improvement plan is projected to have a significant positive impact on the Australian economy.

- Reduced national debt: The plan aims to decrease the national debt significantly, improving Australia's fiscal position and strengthening its credit rating.

- Improved credit rating: A more stable fiscal position is likely to lead to an improved credit rating, reducing borrowing costs for the government.

- Increased investor confidence: A credible plan for fiscal consolidation will boost investor confidence, potentially leading to increased investment and economic growth.

- Potential for GDP growth: While the direct impact on GDP growth is hard to quantify precisely, the projected improvements in the fiscal environment could contribute to a more positive economic outlook.

However, potential negative consequences, including the short-term impacts of spending cuts on specific sectors, need to be carefully managed. The opposition has committed to mitigating these risks through targeted support and transitional assistance programs. Keywords: economic impact, fiscal responsibility, debt reduction, economic growth, GDP growth, credit rating.

Public Response and Political Implications

Public and expert reactions to the opposition's budget proposal have been mixed. Some economists praise its ambition and potential for long-term fiscal stability, while others express concerns about the potential impact of spending cuts on specific sectors and vulnerable populations. The plan's political implications are significant, potentially shaping the upcoming election. Early polling suggests the proposal resonates with a segment of the electorate concerned about the nation's fiscal health. However, the opposition faces the challenge of convincing voters that its proposed spending cuts will not negatively affect essential services. Keywords: public opinion, political analysis, election prospects, political strategy, media coverage.

Conclusion: Analyzing Australia's Opposition's $9 Billion Budget Improvement Promise

The opposition's ambitious plan for a $9 billion Australian budget improvement offers a comprehensive approach, encompassing strategic spending cuts, increased revenue generation, and significant improvements to government efficiency. While the potential economic benefits are substantial, careful consideration must be given to potential negative consequences, particularly the impact of spending cuts on various sectors. The plan's political implications are significant and will likely play a major role in the upcoming election. To learn more about the specifics of the opposition's plan and form your own informed opinion, visit [link to opposition party's official website]. Understanding this proposal is crucial for every Australian concerned about the future of the Australian budget.

Featured Posts

-

The Economic Reality Of Offshore Wind Are They Too Expensive

May 03, 2025

The Economic Reality Of Offshore Wind Are They Too Expensive

May 03, 2025 -

Winning Lotto Numbers Wednesday 16th April 2025

May 03, 2025

Winning Lotto Numbers Wednesday 16th April 2025

May 03, 2025 -

Christmas Voucher Glitch On Play Station Sony Issues Credit To Users

May 03, 2025

Christmas Voucher Glitch On Play Station Sony Issues Credit To Users

May 03, 2025 -

Tencent Confirms Valorant Mobile Development Analysis Of Recent Leaks

May 03, 2025

Tencent Confirms Valorant Mobile Development Analysis Of Recent Leaks

May 03, 2025 -

Nigel Farages Reform Uk Facing A Political Crisis Five Key Issues

May 03, 2025

Nigel Farages Reform Uk Facing A Political Crisis Five Key Issues

May 03, 2025

Latest Posts

-

Open Ai Unveils Streamlined Voice Assistant Development At 2024 Event

May 04, 2025

Open Ai Unveils Streamlined Voice Assistant Development At 2024 Event

May 04, 2025 -

Revolutionizing Voice Assistant Development Open Ais New Tools

May 04, 2025

Revolutionizing Voice Assistant Development Open Ais New Tools

May 04, 2025 -

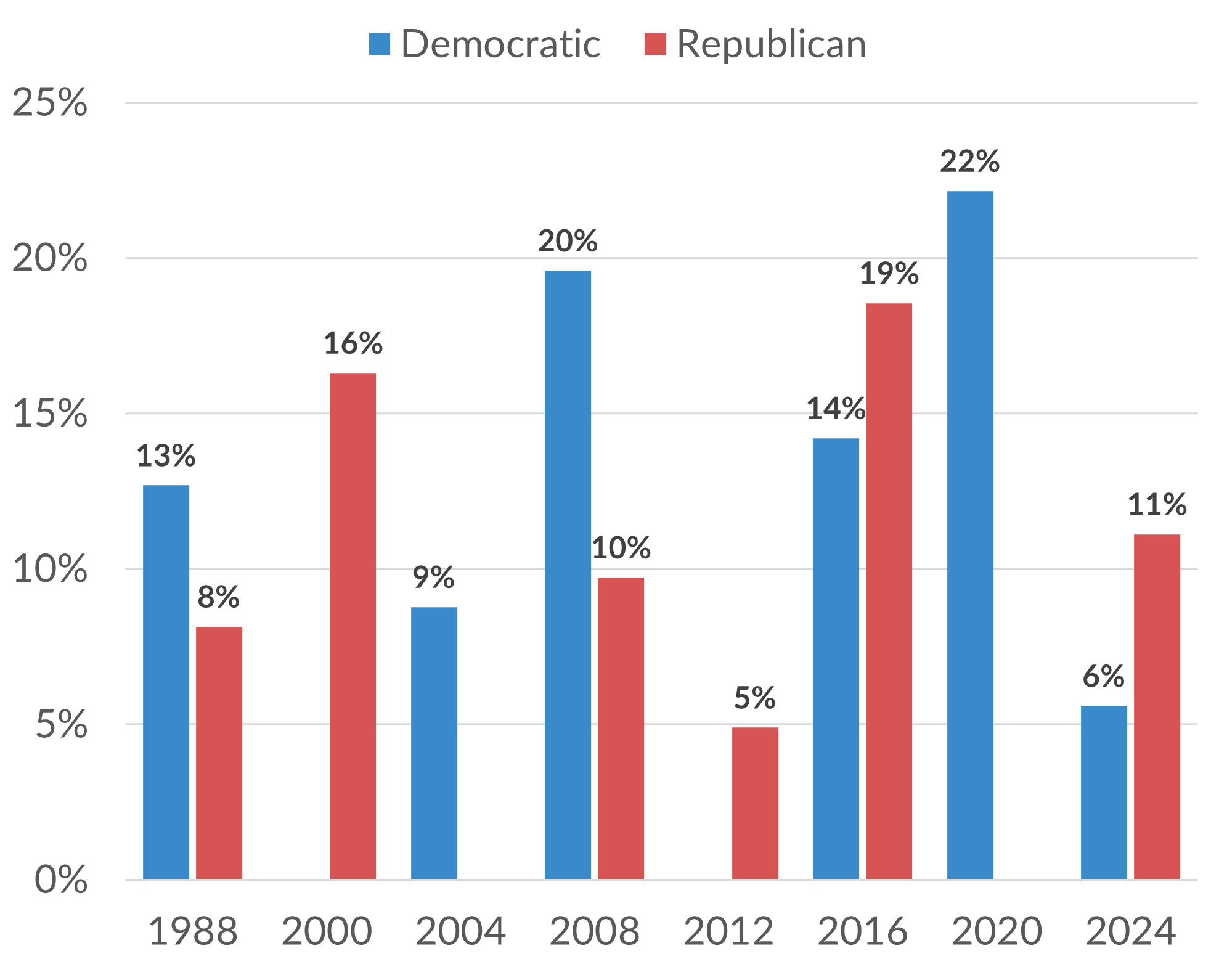

Singapores Elections Assessing Voter Turnout And Political Participation

May 04, 2025

Singapores Elections Assessing Voter Turnout And Political Participation

May 04, 2025 -

Open Ais 2024 Event Easier Voice Assistant Creation

May 04, 2025

Open Ais 2024 Event Easier Voice Assistant Creation

May 04, 2025 -

Is Change Coming To Singapore The Significance Of The Next General Election

May 04, 2025

Is Change Coming To Singapore The Significance Of The Next General Election

May 04, 2025