Automakers Confused By Trump's Tariffs: Impact And Implications

Table of Contents

Increased Costs and Reduced Profit Margins

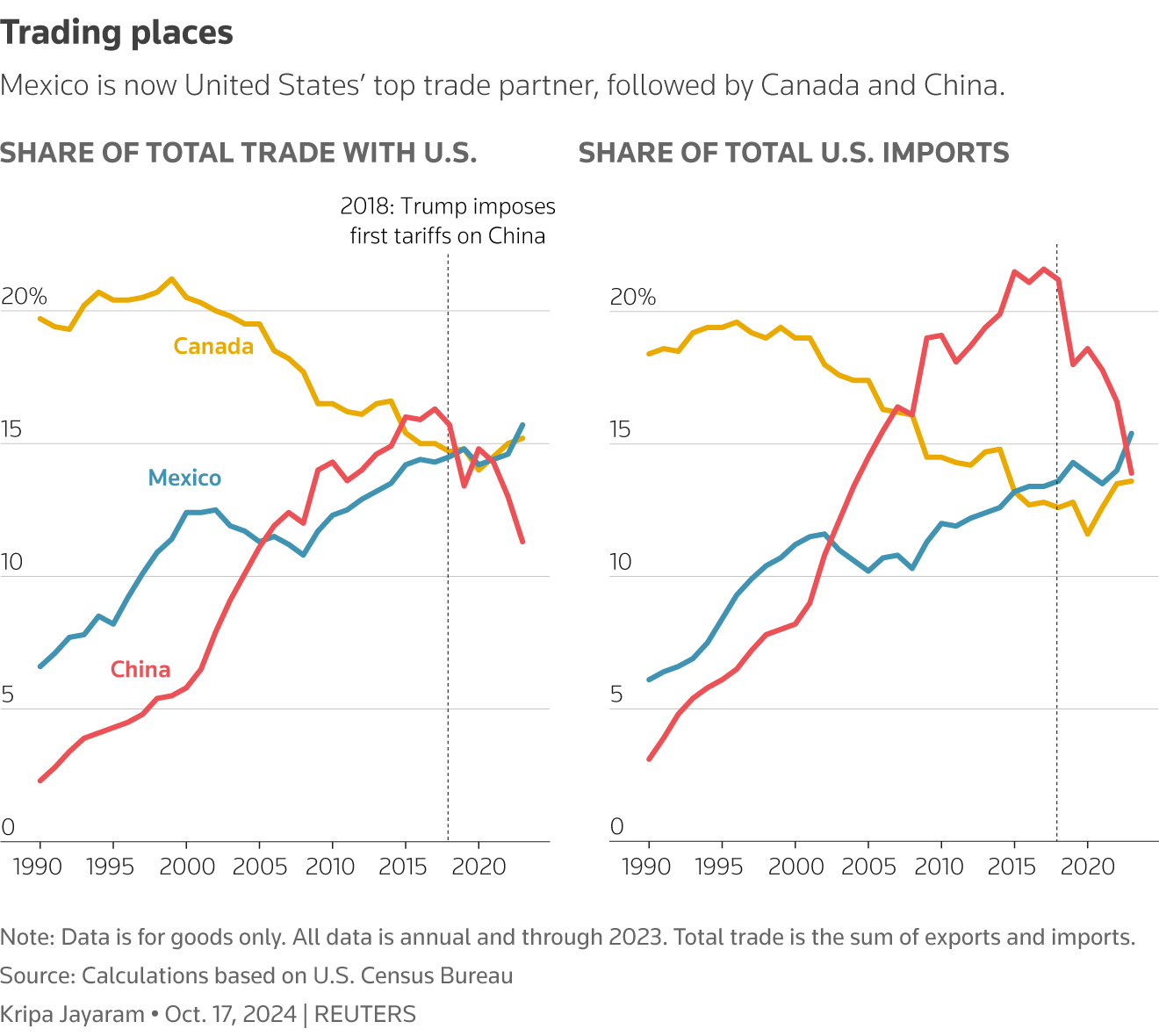

The immediate and most significant impact of Trump's tariffs on the auto industry was a substantial increase in production costs and a corresponding squeeze on profit margins. This was largely due to two key factors: the rising prices of imported parts and the disruption of global supply chains.

Rising Prices of Imported Parts

Tariffs on imported steel, aluminum, and other crucial components directly increased manufacturing costs for automakers. These tariffs, designed to protect domestic industries, inadvertently penalized automakers reliant on global supply chains. For example, the tariffs on steel significantly increased the cost of steel used in car bodies, frames, and various other parts. Similarly, aluminum tariffs affected components like engine blocks and wheels.

- Increased cost of production: Automakers faced higher expenses for every vehicle produced.

- Reduced competitiveness: Higher production costs made it difficult for US automakers to compete with foreign rivals who weren't subject to the same tariffs.

- Pressure to raise vehicle prices: To maintain profitability, many automakers were forced to pass these increased costs onto consumers through higher vehicle prices.

Impact on Supply Chains

The uncertainty surrounding the tariffs themselves added another layer of complexity. The ever-changing trade landscape forced automakers to scramble to find alternative suppliers, often at greater expense and with longer lead times. This disruption significantly impacted global supply chains, creating logistical nightmares.

- Delays in production: Finding new suppliers and navigating new logistical routes caused significant delays in production.

- Increased logistical costs: Shipping costs and other logistical expenses soared as companies adapted to the new trade environment.

- Difficulty securing reliable suppliers: The sudden shift in sourcing disrupted established relationships and created challenges in securing reliable and high-quality components.

Shifting Production and Investment Strategies

Faced with increased costs and supply chain disruptions, many automakers began reassessing their production and investment strategies. This led to a notable shift towards reshoring and nearshoring initiatives, along with a marked hesitation in new investments.

Reshoring and Nearshoring Initiatives

To mitigate the impact of tariffs and reduce reliance on foreign suppliers, several automakers started shifting production back to the United States (reshoring) or to neighboring countries (nearshoring). This involved significant capital expenditure and a reshaping of their global manufacturing footprint.

- Increased capital expenditure: Relocating production facilities requires substantial investment in new plants, equipment, and infrastructure.

- Job creation in some regions: Reshoring efforts created jobs in the US and other countries where production was relocated.

- Job losses in others: Conversely, the shift in production often led to job losses in countries where manufacturing was previously concentrated.

Investment Hesitation

The unpredictable nature of the tariff policies created an environment of uncertainty that discouraged investment in new factories, technologies, and research and development. This had a long-term impact on the growth and innovation capacity of the automotive sector.

- Reduced R&D spending: Companies became more cautious about committing resources to long-term projects in the face of unpredictable trade policies.

- Delayed technological advancements: Hesitation in investment slowed down the development and adoption of new automotive technologies.

- Negative impact on future competitiveness: The lack of investment in innovation potentially hampered the long-term competitiveness of the US auto industry.

Consumer Impact and Market Dynamics

The impact of Trump's tariffs wasn't confined to automakers; consumers felt the effects as well, experiencing higher vehicle prices and shifts in market dynamics.

Higher Vehicle Prices

As automakers passed on increased production costs, new and used vehicle prices rose, affecting consumer affordability. This slowdown in consumer spending had a ripple effect throughout the economy.

- Reduced consumer spending: Higher vehicle prices reduced consumer demand, leading to slower sales.

- Increased used car prices: The reduced supply of new vehicles also contributed to an increase in used car prices.

- Market slowdown: The combination of higher prices and reduced consumer demand resulted in a slowdown in the overall automotive market.

Competition and Market Share Shifts

The tariffs also impacted the competitive landscape, with some manufacturers benefiting while others suffered. This led to shifts in market share and changes in market leadership.

- Increased market share for some companies: Domestic automakers and those with more diversified supply chains may have gained a competitive advantage.

- Decreased market share for others: Automakers heavily reliant on imported parts were disproportionately affected.

- Changes in market leadership: The competitive landscape shifted as companies adapted differently to the new challenges.

Conclusion

Trump's tariffs presented a complex and unpredictable challenge to the automotive industry, leading to increased costs, supply chain disruptions, shifting production strategies, and ultimately affecting consumer affordability and market dynamics. The impact varied across different manufacturers, highlighting the vulnerability of global supply chains. Understanding the lasting implications of these past trade policies is crucial for navigating future economic uncertainty. Further research into the effects of trade policies on the automotive industry – analyzing Trump's tariffs, their ripple effects, and lessons learned – is essential for developing more resilient and adaptable strategies for automakers moving forward. The legacy of these tariffs continues to shape the automotive landscape, underscoring the need for informed decision-making in the face of future trade policy changes.

Featured Posts

-

Riot Fest Announces 2025 Lineup Featuring Green Day And Weezer

May 03, 2025

Riot Fest Announces 2025 Lineup Featuring Green Day And Weezer

May 03, 2025 -

Clayton Keller 500 Nhl Points And A Missouri Legacy

May 03, 2025

Clayton Keller 500 Nhl Points And A Missouri Legacy

May 03, 2025 -

T 50

May 03, 2025

T 50

May 03, 2025 -

Section 230 And Banned Chemicals Recent E Bay Legal Case

May 03, 2025

Section 230 And Banned Chemicals Recent E Bay Legal Case

May 03, 2025 -

Pandemic Fraud Lab Owner Convicted Of Falsifying Covid Test Results

May 03, 2025

Pandemic Fraud Lab Owner Convicted Of Falsifying Covid Test Results

May 03, 2025

Latest Posts

-

Investigation Reveals Credible Evidence Of Unlawful Harassment Against Rupert Lowe

May 03, 2025

Investigation Reveals Credible Evidence Of Unlawful Harassment Against Rupert Lowe

May 03, 2025 -

Robust Poll Data System Assuring Election Integrity Chief Election Commissioner Says

May 03, 2025

Robust Poll Data System Assuring Election Integrity Chief Election Commissioner Says

May 03, 2025 -

Credible Harassment Report Targets Ex Mp Rupert Lowe And Reform Shares

May 03, 2025

Credible Harassment Report Targets Ex Mp Rupert Lowe And Reform Shares

May 03, 2025 -

Reform Shares Ex Mp Rupert Lowe Faces Credible Harassment Allegations

May 03, 2025

Reform Shares Ex Mp Rupert Lowe Faces Credible Harassment Allegations

May 03, 2025 -

Investigation Launched Into Mp Rupert Lowes Conduct

May 03, 2025

Investigation Launched Into Mp Rupert Lowes Conduct

May 03, 2025