Bajaj Twins Weigh On Market: Sensex And Nifty 50 End Day Flat

Table of Contents

Bajaj Twins' Performance and its Market Impact

The performance of Bajaj Finance and Bajaj Auto significantly impacted the overall market sentiment on this particular trading day. While the Sensex and Nifty 50 showed minimal net change, the Bajaj twins experienced noticeable fluctuations. Bajaj Finance saw a slight dip of 1.5%, closing at ₹6,780, while Bajaj Auto experienced a more pronounced 2.2% drop, ending the day at ₹4,150. These fluctuations were notable given their substantial market capitalization and influence.

The reasons behind their underperformance are multifaceted. While no single event solely triggered the decline, a confluence of factors likely played a role. Analysts suggest that profit-booking after recent gains and concerns regarding the overall economic slowdown might have contributed to the sell-off. Further, sector-specific news related to the auto industry, potentially impacting Bajaj Auto's performance, might have created a negative ripple effect.

- Bajaj Finance: Closed at ₹6,780, a 1.5% decrease compared to the previous day's closing price. Trading volume was slightly higher than the average daily volume, indicating increased investor activity.

- Bajaj Auto: Ended the day at ₹4,150, representing a 2.2% decline. This drop was more pronounced than Bajaj Finance's, potentially reflecting specific concerns within the automobile sector.

- Significant Announcement: No major announcements or earnings reports were released by either company on this day, suggesting that market sentiment and broader economic concerns played a larger role in their price movements.

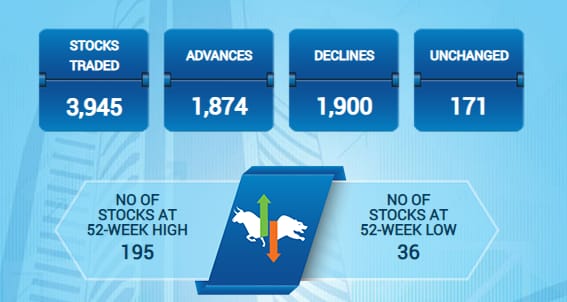

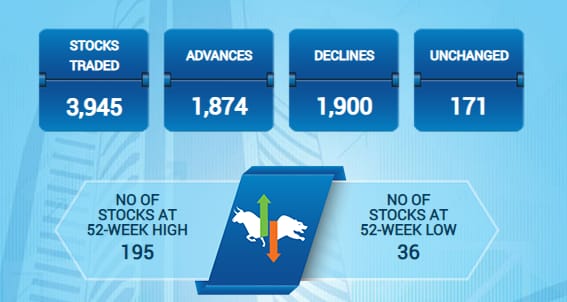

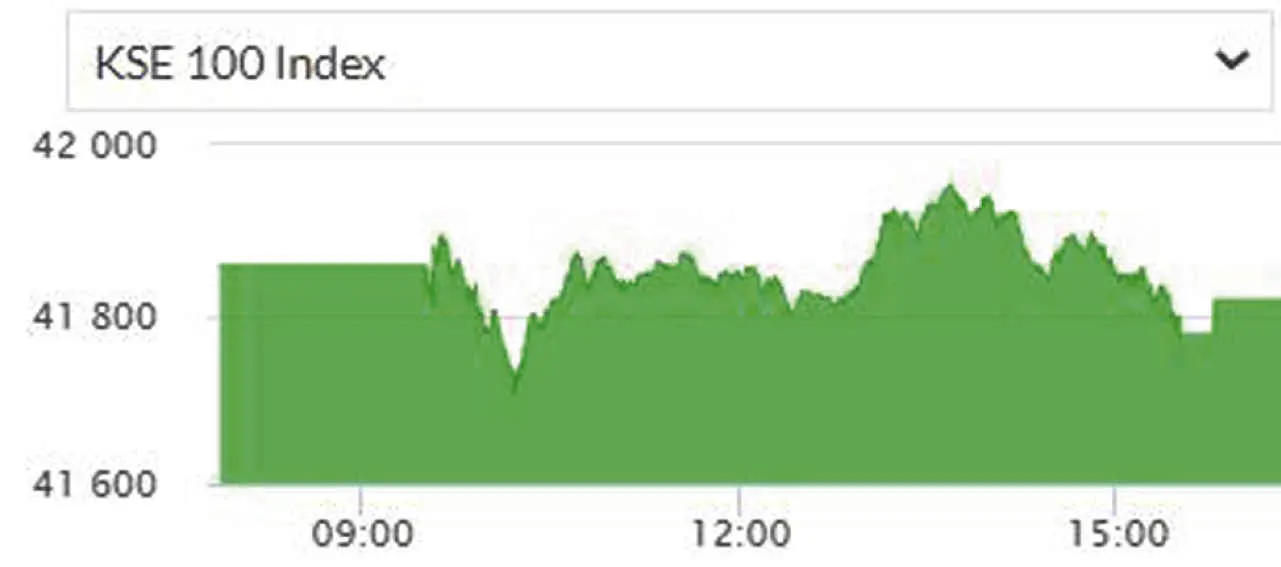

Broader Market Trends

While the Bajaj twins' performance played a notable role, the overall market exhibited mixed signals. Other key sectors showed varied performances. The IT sector experienced a modest increase, while the banking sector remained largely flat. The FMCG sector showed a slight dip. This mixed performance suggests that the overall market sentiment wasn't entirely negative, but the Bajaj twins' influence was substantial enough to prevent significant gains in the broader indices.

Global market trends also contributed to the muted performance. A slight dip in the US markets and continued concerns about global inflation created a sense of cautiousness among investors. This cautiousness, combined with the Bajaj twins' performance, prevented a stronger upward trend in the Indian market.

- Other Key Indices: The Bank Nifty index showed minimal change, while the Nifty IT index saw a slight increase.

- Global Impact: Concerns about rising interest rates in the US and slowing global growth contributed to investor hesitancy.

- Economic News: No major significant political or economic news directly impacted the market on this day, further emphasizing the importance of Bajaj twins' performance in the overall market sentiment.

Investor Sentiment and Market Volatility

Investor sentiment on the day was characterized by caution and uncertainty. The relatively flat performance of the Sensex and Nifty 50, despite positive performances in certain sectors, points to a degree of risk aversion. Profit-booking after recent gains in the market could also be a significant contributor to the observed flatness. Market volatility, as measured by the VIX (volatility index), remained relatively low, suggesting that while there were fluctuations, extreme volatility wasn't observed.

- VIX Index: The VIX index registered a reading of 12.5, indicating a relatively low level of market volatility.

- Investor Behavior: The trading volume for both Bajaj Finance and Bajaj Auto suggests increased investor activity, largely driven by selling pressure.

- Expert Opinions: Many market analysts attributed the flat performance to a combination of profit-booking and global uncertainties.

Future Outlook for Sensex and Nifty 50

The short-term outlook for the Sensex and Nifty 50 remains uncertain. While the market showed resilience in the face of the Bajaj twins' underperformance, continued global economic uncertainty and potential domestic factors could influence future market movements. The upcoming quarterly earnings reports of other major companies and the trajectory of global inflation will play a significant role in shaping investor sentiment.

- Analyst Predictions: Many analysts predict a sideways movement in the short term, with potential for upward movement contingent on positive global economic news and strong quarterly results from other leading companies.

- Potential Catalysts: Positive earnings reports from major companies, easing global inflation concerns, and positive government policy announcements could lead to a bullish market. Conversely, escalating global uncertainties or negative earnings could lead to further downward pressure.

- Economic Data Releases: Investors should closely watch for upcoming inflation data releases, both domestically and internationally, as these figures will strongly influence market sentiment.

Conclusion

The Indian stock market witnessed a relatively flat day, with the Sensex and Nifty 50 closing with minimal change. The performance of the Bajaj twins – Bajaj Finance and Bajaj Auto – played a significant role in this muted performance. A combination of profit-booking, sector-specific concerns, and global economic uncertainties contributed to the overall market sentiment. While other sectors showed mixed results, the impact of the Bajaj twins was substantial enough to keep the broader indices from experiencing significant gains. Understanding the influence of the Bajaj twins and other major players on the overall market sentiment and volatility is crucial for informed investment decisions.

Call to Action: Stay updated on the performance of Bajaj Twins and the Indian stock market by regularly checking our website for the latest analysis and insights on the Sensex, Nifty 50, and other key market indicators. Continue to monitor the Bajaj Twins' impact on the Sensex and Nifty 50 for informed investment decisions. Understand how the Bajaj twins weigh on the market and make smarter investment choices.

Featured Posts

-

Understanding The Pakistan Stock Exchange Outage And Market Instability

May 09, 2025

Understanding The Pakistan Stock Exchange Outage And Market Instability

May 09, 2025 -

Les Mis Cast Considers Protest Over Trumps Kennedy Center Performance

May 09, 2025

Les Mis Cast Considers Protest Over Trumps Kennedy Center Performance

May 09, 2025 -

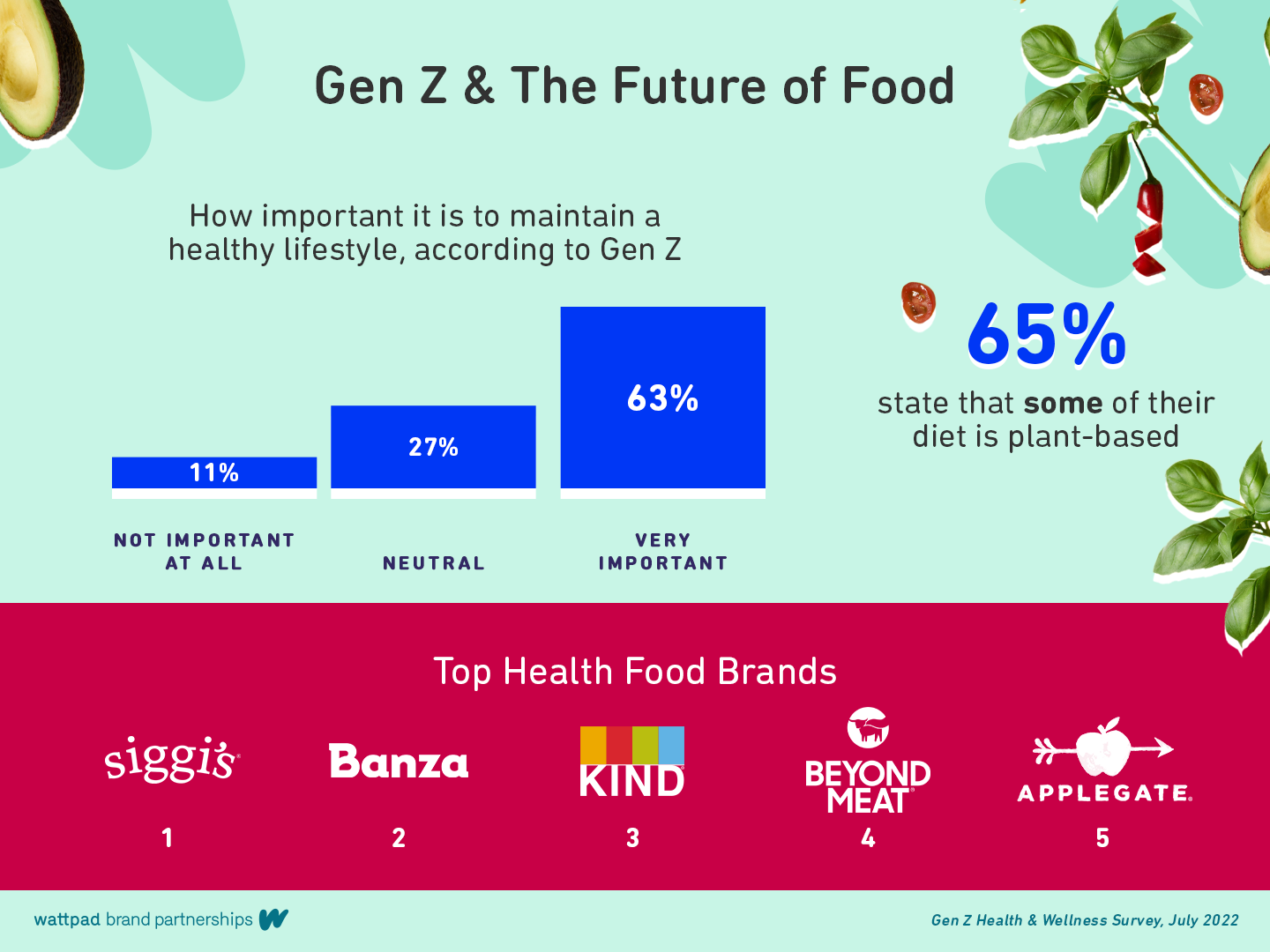

Android Vs I Phone Gen Zs Smartphone Preferences And The Impact Of Design

May 09, 2025

Android Vs I Phone Gen Zs Smartphone Preferences And The Impact Of Design

May 09, 2025 -

R5 1078 2025

May 09, 2025

R5 1078 2025

May 09, 2025 -

Rio Ferdinands Champions League Winner Prediction Arsenal Or Psg

May 09, 2025

Rio Ferdinands Champions League Winner Prediction Arsenal Or Psg

May 09, 2025