Bank Of Canada Interest Rate Cuts: The Impact Of Tariffs On Employment

Table of Contents

The Mechanism: How Tariffs Affect Employment

Tariffs, a key instrument in trade wars, significantly impact employment within the Canadian economy. Their imposition increases import costs for businesses, leading to several detrimental consequences. Higher input costs translate to higher prices for consumers, curbing consumer spending and potentially leading to reduced demand. This decrease in demand can force businesses to cut back on production, resulting in job losses or hiring freezes.

Simultaneously, tariffs negatively impact export competitiveness. When Canadian goods become more expensive in foreign markets due to increased input costs (resulting from tariffs on imported materials), exports decline. This decline directly affects export-oriented industries, leading to potential job losses and reduced business investment in those sectors. Further complicating the matter are supply chain disruptions. Tariffs can severely disrupt established supply chains, causing production delays and increased costs for businesses reliant on imported goods. This uncertainty surrounding tariffs discourages business investment and hiring, creating a climate of economic instability.

- Increased import costs reduce consumer purchasing power. This leads to a decrease in overall economic activity.

- Reduced export competitiveness leads to decreased sales and potential layoffs. Businesses struggle to maintain profitability in the face of reduced demand.

- Supply chain disruptions cause production delays and increased costs. This impacts productivity and profitability across various sectors.

- Uncertainty surrounding tariffs discourages business investment and hiring. Businesses are hesitant to expand or invest in new projects under conditions of economic uncertainty.

The Bank of Canada's Response: Interest Rate Cuts as a Mitigation Strategy

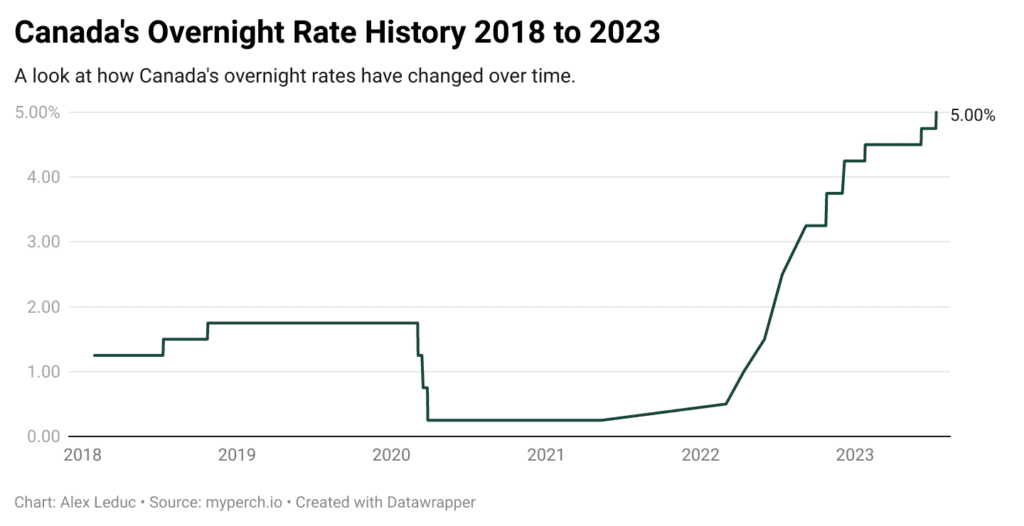

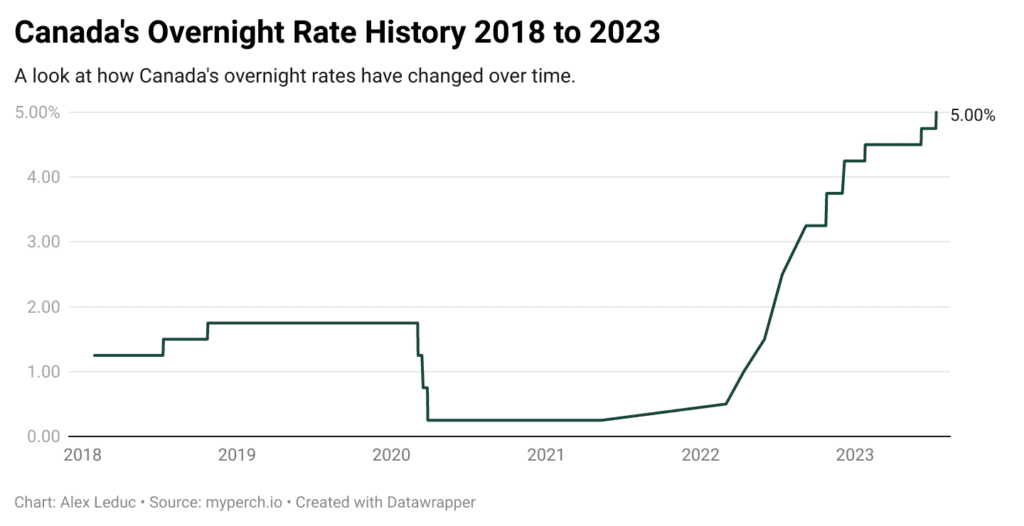

In response to economic downturns and the negative impacts of tariffs, the Bank of Canada utilizes interest rate cuts as a crucial tool of monetary policy. Lowering interest rates aims to stimulate the economy by encouraging borrowing and investment. Lower borrowing costs incentivize businesses to invest in expansion, creating jobs and boosting economic activity. Consumers, too, are encouraged to spend more, as borrowing becomes cheaper. This increased borrowing leads to higher consumer spending and increased business investment, potentially mitigating job losses caused by tariffs.

However, this approach isn't without its trade-offs. While stimulating the economy, the Bank of Canada must carefully manage inflation. Lower interest rates can fuel inflation if not carefully calibrated, potentially negating the benefits of increased economic activity. The delicate balance between stimulating growth and controlling inflation is a key challenge for the central bank.

- Lower interest rates incentivize borrowing and investment. This injection of capital into the economy can help counter the negative effects of tariffs.

- Increased borrowing can lead to higher consumer spending and business expansion. This boosts overall economic activity and potentially creates jobs.

- Stimulating the economy aims to mitigate job losses caused by tariffs. It's a crucial strategy to cushion the blow of trade disputes.

- The Bank of Canada must balance economic stimulus with inflation control. Finding the right balance is vital for maintaining long-term economic stability.

Effectiveness of Interest Rate Cuts in Counteracting Tariff Impacts

The effectiveness of interest rate cuts in mitigating the negative effects of tariffs on employment is a complex issue. While interest rate cuts can stimulate economic activity, their effectiveness in completely offsetting the impact of significant trade disruptions is debatable. The severity and duration of the tariff impacts are critical factors determining the success of this monetary policy approach. For example, interest rate cuts may not fully compensate for job losses in specific sectors particularly vulnerable to tariff impacts.

Furthermore, there are inherent time lags between interest rate cuts and their impact on employment. It takes time for businesses to adjust their investment strategies and for consumers to respond to changed borrowing costs. Lastly, inflationary pressures could limit the extent to which the Bank of Canada can lower interest rates. A sharp increase in inflation could counteract the positive effects of lower rates, making it a double-edged sword.

- The effectiveness depends on the severity and duration of the tariff impacts. Minor, short-term tariffs might be easily mitigated, while major, long-term tariffs pose a more significant challenge.

- Interest rate cuts may not fully compensate for job losses in specific sectors. Certain industries are more vulnerable to tariff impacts than others.

- Time lags exist between rate cuts and their impact on employment. It takes time for the effects of monetary policy to filter through the economy.

- Inflationary pressures could limit the extent of rate cuts. The Bank of Canada must balance economic stimulus with price stability.

Long-Term Economic Outlook and Employment Projections

The long-term economic outlook and its implications for Canadian employment depend on various interconnected factors extending beyond the immediate impact of tariffs and interest rate cuts. Long-term economic growth will rely on innovation, technological advancements, and successful adaptation to global economic trends. Reskilling and upskilling initiatives are essential for ensuring the Canadian workforce possesses the skills needed to thrive in a changing economic landscape.

Diversification of the Canadian economy is crucial to reduce vulnerability to future trade shocks. Over-reliance on specific sectors exposed to international trade disputes increases susceptibility to economic downturns. The future of work demands adaptation and investment in human capital. Ultimately, the long-term employment outlook hinges on successful navigation of trade disputes, strategic adaptation to global trends, and a commitment to fostering a resilient and diversified Canadian economy.

- Long-term economic growth will depend on factors beyond interest rates and tariffs. Technological advancements, innovation, and global market dynamics all play significant roles.

- Reskilling and upskilling initiatives are essential to adapt to changing economic conditions. Investing in workforce training and education is critical for future economic success.

- Diversification of the Canadian economy will reduce vulnerability to trade shocks. Reducing dependence on specific sectors exposed to trade disputes is paramount.

- The long-term employment outlook depends on resolving trade disputes and adapting to global trends. Proactive strategies are essential for long-term economic stability and job security.

Conclusion

The interplay between Bank of Canada interest rate cuts, tariffs, and Canadian employment is complex and multifaceted. Tariffs negatively impact employment by increasing costs, reducing competitiveness, and disrupting supply chains. The Bank of Canada responds with interest rate cuts to stimulate economic activity and mitigate job losses. However, the effectiveness of these cuts is limited and depends on various factors, including the severity and duration of tariff impacts. The long-term economic outlook necessitates proactive measures such as workforce retraining, economic diversification, and a commitment to resolving trade disputes.

To stay informed about the impacts of these economic forces, stay updated on Bank of Canada interest rate cuts and monitor the impact of tariffs on employment. Further research into the specific effects of tariffs on various sectors of the Canadian economy is crucial. Engage in discussions about the role of monetary policy in mitigating the effects of trade disputes on employment. Understanding this interplay between monetary policy and trade is vital for navigating the challenges ahead and ensuring a strong and resilient Canadian economy.

Featured Posts

-

Mlb Speedway Classic At Bristol Manfreds Outlook On Fan Numbers

May 11, 2025

Mlb Speedway Classic At Bristol Manfreds Outlook On Fan Numbers

May 11, 2025 -

Impact Of Jurickson Profars 80 Game Ped Suspension On The Season

May 11, 2025

Impact Of Jurickson Profars 80 Game Ped Suspension On The Season

May 11, 2025 -

Zane Dentons Current Baseball Team A Look At His Post Tennessee Career

May 11, 2025

Zane Dentons Current Baseball Team A Look At His Post Tennessee Career

May 11, 2025 -

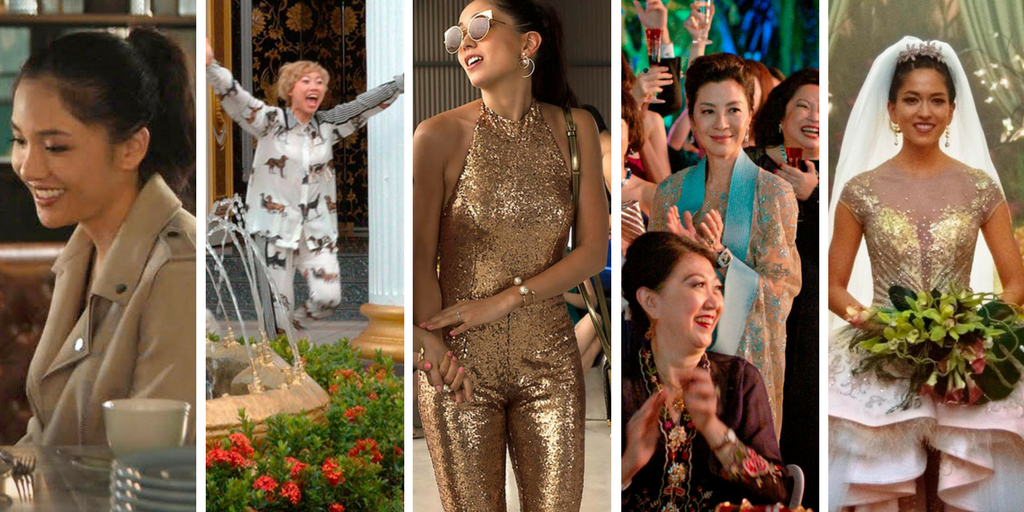

Crazy Rich Asians Tv Show What We Know So Far

May 11, 2025

Crazy Rich Asians Tv Show What We Know So Far

May 11, 2025 -

Rising Sea Levels Catastrophe For Coastal Communities

May 11, 2025

Rising Sea Levels Catastrophe For Coastal Communities

May 11, 2025

Latest Posts

-

Is A Crazy Rich Asians Tv Series In The Works Jon M Chu Offers Insights

May 11, 2025

Is A Crazy Rich Asians Tv Series In The Works Jon M Chu Offers Insights

May 11, 2025 -

Crazy Rich Asians Tv Series Director Jon M Chus Latest Update

May 11, 2025

Crazy Rich Asians Tv Series Director Jon M Chus Latest Update

May 11, 2025 -

Is A Crazy Rich Asians Tv Show Really In Development Everything We Know

May 11, 2025

Is A Crazy Rich Asians Tv Show Really In Development Everything We Know

May 11, 2025 -

Max Greenlights Crazy Rich Asians Tv Series Adaptation

May 11, 2025

Max Greenlights Crazy Rich Asians Tv Series Adaptation

May 11, 2025 -

Jon M Chu On A Potential Crazy Rich Asians Tv Series

May 11, 2025

Jon M Chu On A Potential Crazy Rich Asians Tv Series

May 11, 2025