Bank Of Canada Interest Rate Outlook: Job Losses And The Potential For Further Cuts

Table of Contents

The Impact of Rising Unemployment on the Canadian Economy

The recent surge in unemployment across Canada is a significant concern. Job losses have been particularly acute in sectors like hospitality, tourism, and retail, impacting thousands of Canadians. This rise in unemployment has a direct correlation with several key economic indicators. The relationship between unemployment and inflation is complex; typically, high unemployment leads to lower inflation due to reduced consumer demand. However, the current situation is nuanced, with supply chain disruptions and other factors potentially influencing inflation independently of unemployment.

The decreased employment translates directly into reduced consumer spending, a major driver of economic growth. With less disposable income, consumers are likely to curtail spending on non-essential goods and services, further dampening economic activity. This creates a vicious cycle where reduced consumer spending leads to further job losses and slower economic growth.

- Statistics on job losses across different sectors: Recent reports indicate a loss of X jobs in the hospitality sector, Y jobs in retail, and Z jobs in manufacturing (replace X, Y, Z with actual statistics).

- Analysis of consumer confidence indicators: Consumer confidence indices have shown a decline, reflecting the uncertainty surrounding employment and economic prospects.

- GDP growth projections considering unemployment: Economists predict a slowdown in GDP growth for the next quarter, largely due to the impact of rising unemployment.

Bank of Canada's Current Monetary Policy Stance

The Bank of Canada currently holds its key interest rate at [insert current interest rate]%. Their primary monetary policy tools include adjusting this key rate, influencing borrowing costs for banks and, consequently, consumers and businesses. The Bank's mandate is to maintain price stability and promote sustainable economic growth. Their current inflation target is [insert current inflation target]%. However, recent economic data suggests inflation may be [higher/lower] than targeted.

- Key statements from recent Bank of Canada announcements: The Bank has recently expressed [summarize key statements from recent announcements, e.g., concerns about unemployment, cautious optimism regarding economic recovery, etc.].

- Summary of the Governor's press conferences and statements: The Governor has highlighted [summarize key points from press conferences, focusing on interest rate decisions and economic outlook].

- Analysis of the Bank's inflation forecasts: The Bank's latest inflation forecasts indicate [summarize the Bank's inflation predictions and any potential deviation from the target].

Analyzing the Likelihood of Further Interest Rate Cuts

The Bank of Canada's decision regarding further interest rate cuts will depend on a complex interplay of factors. Inflation, economic growth, and unemployment are all crucial elements in their assessment. While rising unemployment strongly suggests a need for stimulus, the Bank must also consider the potential risks associated with further rate cuts, such as fueling inflation or potentially weakening the Canadian dollar.

The pros of further cuts include boosting economic activity through lower borrowing costs and encouraging investment. However, the cons include the risk of increased inflation if demand outpaces supply, and potentially creating asset bubbles in the housing market.

- Potential scenarios for future interest rate changes: Scenario 1: Further cuts if unemployment remains high and inflation stays low. Scenario 2: No further cuts if inflation rises unexpectedly. Scenario 3: Targeted measures instead of broad rate cuts.

- Expert opinions and market forecasts: Many economists believe [summarize expert opinions and market forecasts regarding potential interest rate changes].

- Analysis of the risks associated with further cuts (e.g., inflation): A significant risk is that further rate cuts could exacerbate inflationary pressures, particularly if supply chain disruptions persist.

Potential Alternatives to Interest Rate Cuts

Beyond interest rate cuts, the Bank of Canada has other policy options to stimulate the economy. These could include quantitative easing (QE), where the Bank injects liquidity into the market by purchasing government bonds. Furthermore, fiscal policy, implemented by the federal government, can play a significant role. Government spending on infrastructure projects or direct financial aid to individuals and businesses could provide economic support.

- Examples of quantitative easing or other non-traditional monetary policies: The Bank could consider targeted QE, focusing on specific sectors affected by job losses.

- Government fiscal policy and its potential impact: Government stimulus packages can effectively counter the negative effects of high unemployment and boost economic activity.

Conclusion: Understanding the Bank of Canada Interest Rate Outlook and its Implications

The Bank of Canada interest rate outlook is deeply intertwined with the current economic reality, particularly the impact of rising unemployment. While further interest rate cuts remain a possibility, the Bank will carefully weigh the risks and benefits, considering inflation, economic growth, and overall market stability. Understanding this complex interplay is crucial for both individuals and businesses to make informed financial decisions. We might see a scenario where targeted support measures are prioritized over broad interest rate reductions.

For individuals, this might mean reviewing personal financial plans and potentially adjusting savings strategies based on the predicted interest rate trajectory. Businesses need to monitor the economic climate closely and adapt their investment strategies accordingly. Staying informed about the Bank of Canada interest rate outlook is paramount. Regularly check the Bank of Canada's website for official announcements, and follow reputable economic news sources for expert analysis. Stay informed to navigate this evolving economic landscape effectively.

Featured Posts

-

Lids I Barnli Obezbedi A Premierligashki Fudbal

May 13, 2025

Lids I Barnli Obezbedi A Premierligashki Fudbal

May 13, 2025 -

The Next Generation Of Xr Ai Powered Platforms And The Emerging Market

May 13, 2025

The Next Generation Of Xr Ai Powered Platforms And The Emerging Market

May 13, 2025 -

Oregon Tournament Deja Kellys Leadership Crucial For Texas

May 13, 2025

Oregon Tournament Deja Kellys Leadership Crucial For Texas

May 13, 2025 -

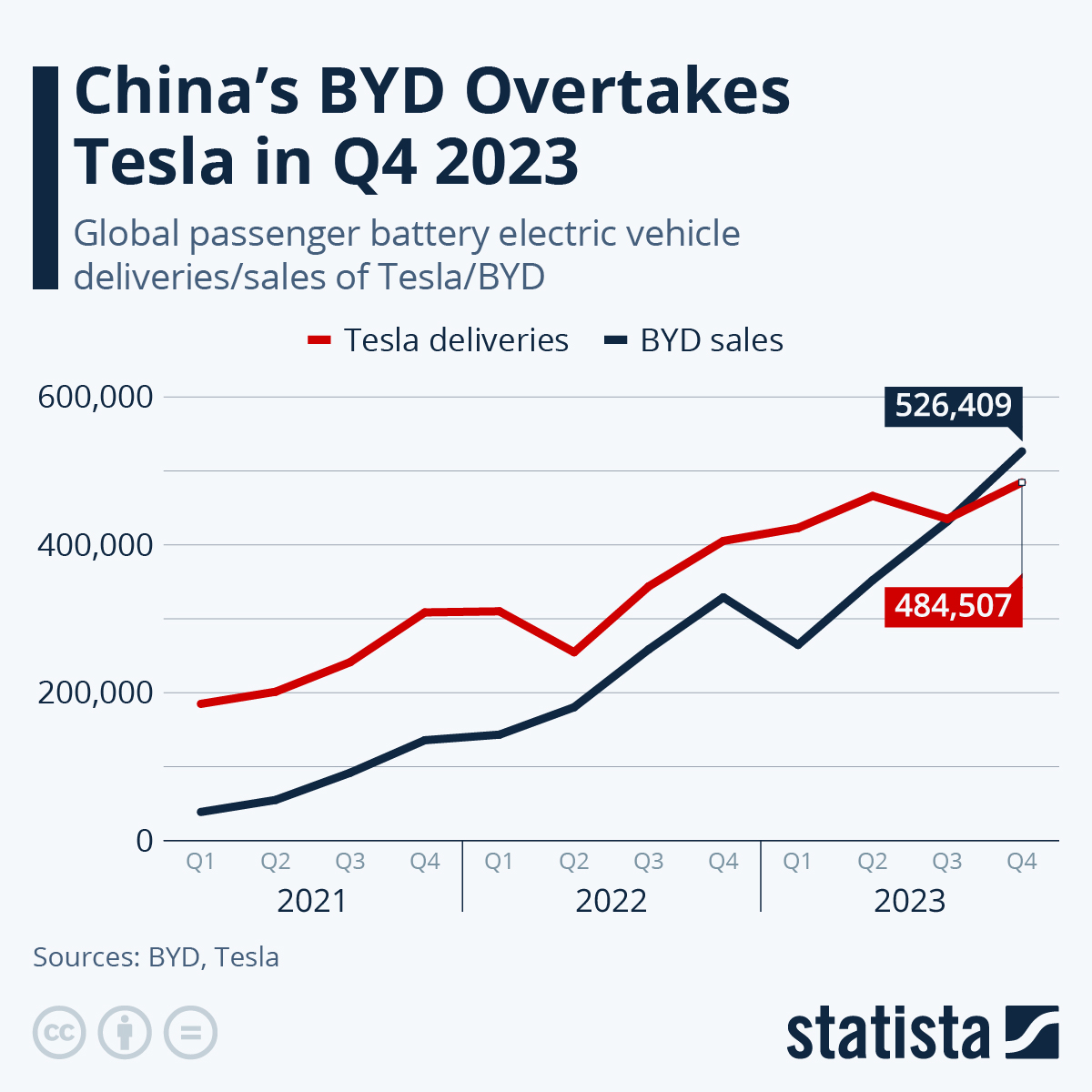

Chinas Byd Sets Sights On Global Domination 2030 Sales Projections

May 13, 2025

Chinas Byd Sets Sights On Global Domination 2030 Sales Projections

May 13, 2025 -

Planning A Fun Filled Spring Break For The Whole Family

May 13, 2025

Planning A Fun Filled Spring Break For The Whole Family

May 13, 2025